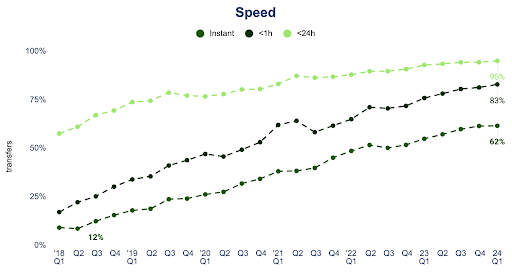

Q1 2024 Mission Update: Speed

We're happy to say that instant transfers are up 1% from last quarter to 62%.* We've made a few improvements to speed this quarter which have contributed to this, and to the overall speed of all transfers on Wise.

Speed

We improved the speed of payouts via the Swift network, which meant that by the end of Q1 almost 80% of transfers were paid out in under 30 minutes, compared to less than 10% in November. We did this by processing our payments more frequently.

International payouts to Australian dollars are now instant to a number of banks, including to Westpac and ANZ. This is possible because the local network in Australia, New Payments Platform (NPP), now accepts instant international payouts. This means that 57% of transfers are paid out instantly, compared to 40% last quarter. We'll see instant transfers continue to increase as more large banks connect to the NPP network.

We're also now routing all transfers under 40,000 Turkish lira through Turkey's FAST payment system which can process transfer payouts instantly 24/7, which means that 80% of transfers are paid out in less than an hour, compared to 55% last quarter.

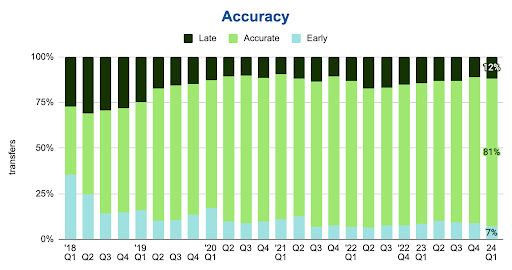

Accuracy

We track the accuracy of our transfer arrival estimates as ‘Early’, ‘On time’ or ‘Late. In Q1, the number of transfers we estimated would arrive early reduced by 2%, and the number of late transfers increased by 1%. Overall 81% of transfers arrived when we estimated they would.

Delays were mainly caused by failures when paying out in our Asian currencies (Indian rupees (INR), Malaysian ringgit (MYR), Sri Lankan rupee (LKR) and Chinese yuan (CNY), and paying out in Kenyan shilling (KES).

CNY was particularly affected by Lunar New Year holidays. Where banks are closed we can't pay out transfers, which means fewer transfers could be instant in this period.

In INR, we’re currently investigating an issue which caused a delay when we were submitting instructions to our payout partners to send customers' transfers. This affected the overall payout speeds.

We also continue to see issues when trying to pay out a large amount of transfers instantly at the same time, as we can't screen them for financial crime indicators quickly enough. We've reported on this several times before, and continue to work on fixes to allow us to process more transfers at scale.

However, we did have some accuracy wins. If we encounter a failure, we’ve increased the number of times we retry sending payouts over the UK's FPS payment network from every 15 minutes to every minute. This has decreased the average delay time to under 5 minutes.

We improved our estimates for paying out business to business transfers in China, which means accuracy has improved 3.5x.

Additionally, in the Nordics, we've updated our payout rules to make them more accurate, which has improved the number of transfers arriving on time by up to 20%. Now all Nordic currencies have a payout accuracy of 90% or more.

Finally, we've improved the reliability of our payout co-ordinator (the service we use to manage transfer payouts), which will reduce the number of instant transfers getting delayed by allowing us to parallelise the actions we take to payout a transfer rather than going through them sequentially, to prevent slower checks delaying other actions. It's also helped to increase the overall stability of our payouts. As a result, we should see more instant transfers and fewer delays.

*Transaction speed claimed depends on individual circumstances and may not be available for all transactions.