We're not a bank — we're the world's most international account

We believe in radical transparency

Wise is not a bank. We're a financial technology company building the world's most international account. We're regulated by the Financial Conduct Authority (FCA) in the UK as an authorised electronic money institution, and by other financial regulatory bodies around the world.

We're building an account for people living and working all over the world to access their money from other countries, just like a local. And we believe in radical transparency, so we want to make sure that anything we say can be backed up by clear, transparent data.

We wanted to share how we validated consumers' understanding of what an 'international account' means to them. And how we compared our account to leading competitors in the market.

So we surveyed consumers around the world

We ran surveys with consumers all over the world — in Australia, Brazil, Germany, UK, and U.S.. We excluded any existing Wise customers to make sure we had a fair, unbiased view. We asked them a series of questions around different financial products. These included: ‘Borderless account’, ‘International account’, and ‘Multi-currency account’.

We learnt that ‘International account’ had the clearest consumer understanding as a financial product to be used in multiple countries, not just multiple currencies, with money transfer as a key feature of the account — which is the product we're building for Wise customers.

Next, we ran a second survey to ask which features customers most associated with an ‘International account’. We learnt the top four most associated features for consumers were consistent across all markets:

- Money transfers 24%

- Multi-currency debit card 18%

- Currency balances 13%

- Bank details to receive currencies 12%

Then we hired a third party researcher to compare us to international accounts around the world

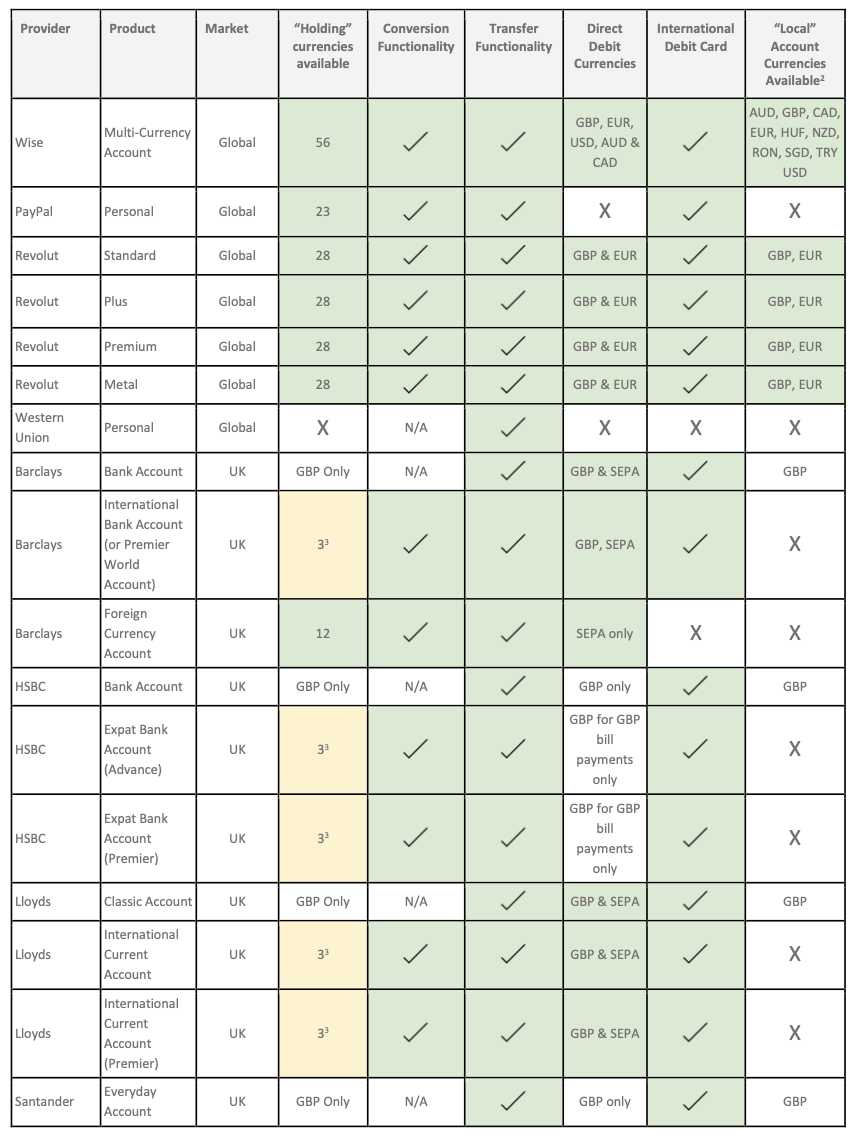

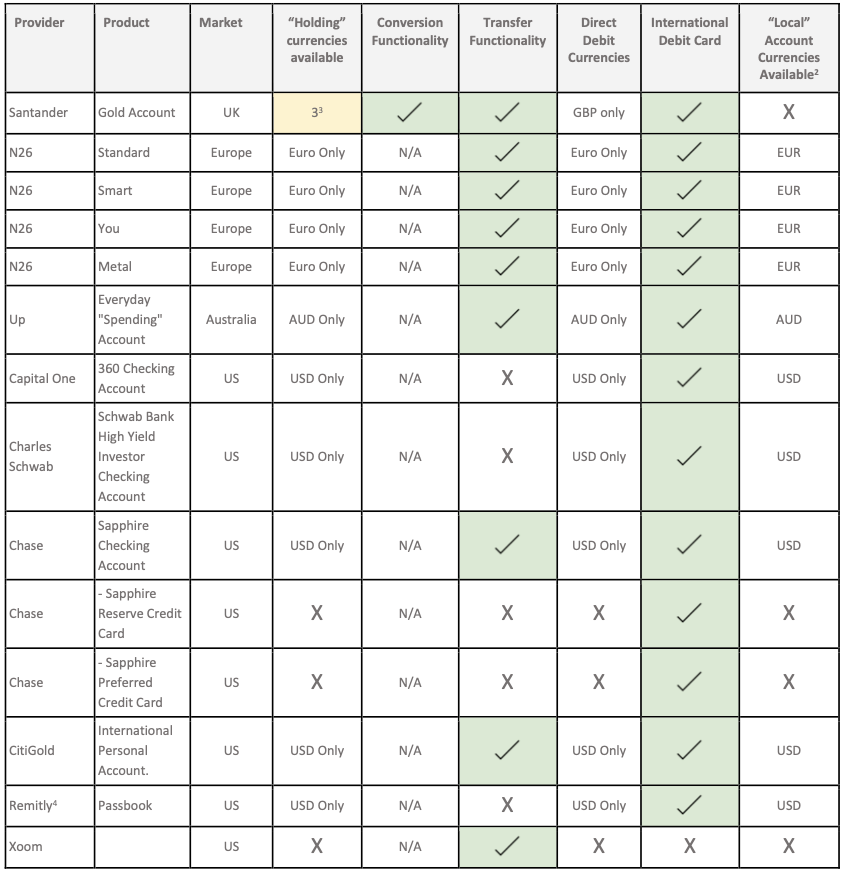

We hired an independent researcher to conduct this research in June 2021. They did this by reviewing all the following competitors publicly published information, and by verifying details by contacting their customer service teams.

To establish whether or not we were the 'most international account', the criteria used for the research included the most strongly associated consumer features for the account itself, validated by our original research, plus the broadest international coverage, i.e. the most number of countries and currencies consumers could use these features in. The independent researcher advised including additional criteria to assess consumer value of each account, as well as coverage, for fairness.

We identified competitors to include in the research by combining products our existing customers use / have used, organic search results for ‘international account’, and additional recommendations by the researcher to ensure fair coverage.

The final criteria included:

- Money transfers: ability to transfer money from the account to a recipient account + number of supported currencies

- Conversion: ability to convert money between currencies in a single account

- Multi-currency debit card: ability to order a debit card connected to the account that can be used to spend overseas + number of supported spending currencies

- Currency balances: ability to hold money within the account in separate nominated currencies + number of supported currencies

- Bank details to receive currencies: ability to get unique allocated bank account details (e.g. IBAN / account number and sort code) + number of supported bank details

Research summary: "Wise offers the most comprehensive international coverage from a single account"

Based on the overall evaluation, the third party researcher concluded: “Having reviewed all the products within the scope, Wise offers the most comprehensive international coverage from a single account.”

Stand out proof points included:

- 10 “local” accounts, with 5 offering direct debit functionality (Local account functionality was defined as allowing payments to be received a s domestic transfer as opposed to an international transfer)

- 56 currencies overall supporting balance conversion, and international transfers

- Both a physical and virtual debit card accepted globally, supported by Visa or Mastercard

- No other brand currently offers this breadth of coverage

Here's the data

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.