Modernising cross-border payments with domestic rails

Discover why agile partnerships are trumping complex, costly global payments infrastructure builds for banks like yours.

If you’re new to self employment, or if you need to complete a self assessment for the first time you might have questions about the process from HMRC.

There are plenty of ways to pay self assessment tax - you’ll need your UTR Number, but once you’ve found that you can pay your tax bill online or in person pretty easily.

Paying on time is important to avoid extra costs and penalties - and so you can generate a SA 302 statement of earnings, which is needed for things like accessing a business loan or mortgage.

Join us as we walk through how to pay self assessment tax - including making your payments from a Wise Business account.

💡Learn more about Wise Business

You’ll need to pay self assessment tax by the UK government deadline to avoid penalties and interest fees. If you file a late return up to 3 months after the deadline, the penalty is £100 plus accrued interest1.

The penalty can increase for late payment, and for filing more than 3 months after the deadline. There’s a tool on the UK government website to calculate the late payment penalty you may need to pay2. To avoid this, make sure you pay self assessment online or by post by the deadlines:

Wondering how to pay self assessment tax online? The good news is that you can pay self assessment by debit card or get the details needed for paying self assessment by Bacs, CHAPs and similar digital methods.

Alternatively you can pay by cheque, although bear in mind that this takes longer. You can also pay in person at a bank or building society. Let’s walk through the ways to pay self assessment tax online and by post, one by one so you can pick the right one for you.

You can pay your self assessment tax conveniently from your bank3. You’ll also be able to pay self assessment tax through a Wise Business account, which can be handy if you use Wise to take low cost international payments for your company.

To pay with your bank you just need to:

Get started with Wise Business 🚀

You can also choose to pay self assessment through CHAPS, Bacs and Faster Payments4. The process for all 3 payment types is the same, but check if your own bank charges different fees for these services as that may make one a more attractive option for you. Bacs payments can take 3 days to arrive, while CHAPS and Faster Payments should arrive on the same day.

Your self assessment tax bill will give you the bank account details you’ll need to pay into. If you do not have a bill, or you’re not sure, you can pay into either:

OR

If you’re paying from an account which is overseas, you’ll have to pay into one of the following accounts:

OR

You’ll be able to pay self assessment tax through debit or corporate card and it’ll be processed either on the same day or the following day depending on the time you initiate it5.

You’ll need to:

If you want to pay self assessment tax through direct debit6 you can do so - but bear in mind it’ll take 5 working days to set up a new direct debit, or 3 days if you’ve previously used this payment method.

You can set up weekly or monthly direct debits as part of a budgeting plan, or you can make an annual payment if you’d prefer. You’ll need to find your UTR and use this, followed by the letter K as the reference you use when you create your direct debit with your bank or building society.

Finally, you’ll have the option to pay self assessment tax through the post by sending a cheque7. Make your cheque payable to ‘HM Revenue and Customs only’.

The mailing address you need is:

Direct

BX5 5BD

You do not need to include a street name, city name or PO box with this address, and you’ll need to allow 3 working days for your payment to reach HMRC.

Yes, if you can't pay your self-assessment tax in full, you can set up a Time to Pay Arrangement with HMRC, which lets you pay in installments. Contact HMRC as soon as possible to discuss your options.

If you miss the deadline for payment you can face interest and penalties, starting at £100 for late submissions and increasing depending on how overdue your payment is.

Use your Unique Taxpayer Reference (UTR) followed by the letter ‘K’. Ensure this is correct to avoid payment delays.

| Read more about What is a UTR number and hot to find yours |

|---|

You can check your payment status by logging into your HMRC online account. Payments typically show within 3 working days.

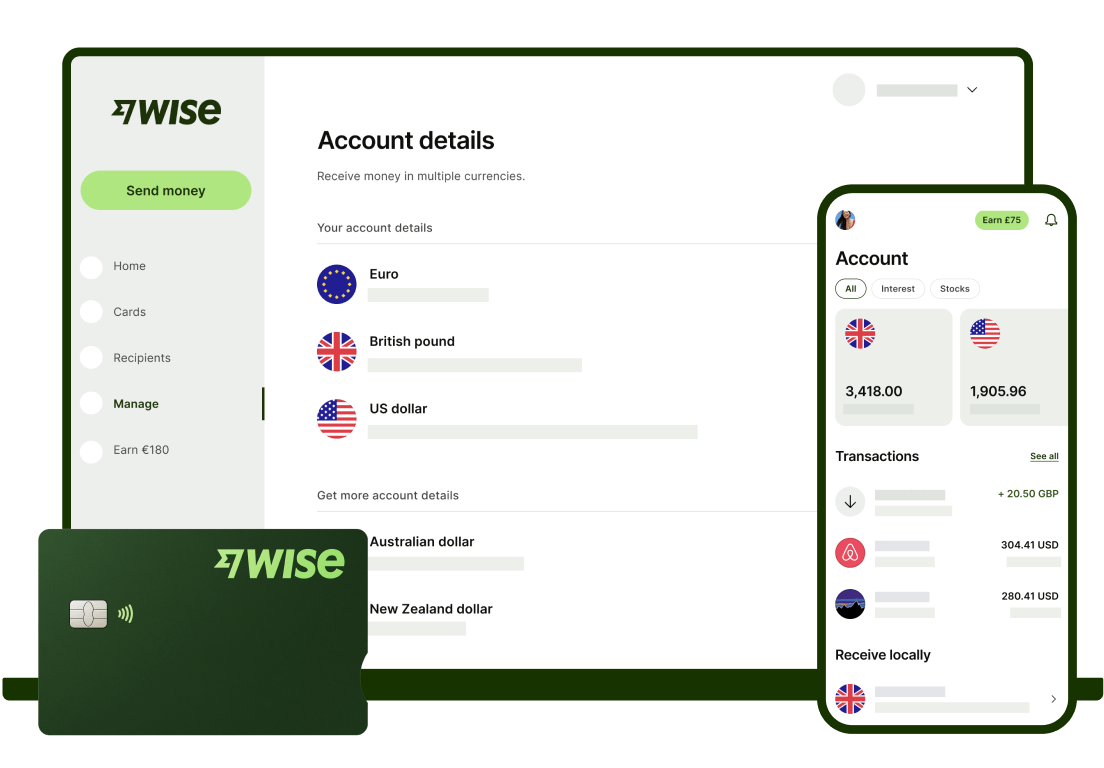

While you’re thinking about the most efficient ways to organise your business finances, check out Wise Business for smart multi-currency account options which allow you to pay and get paid globally.

You’ll be able to hold a balance in currencies, send payments to countries, and get local bank details to receive payments yourself in a selection of foreign currencies, using low cost transfer methods.

That makes it easier for customers from around the world to pay you - and you can also use your local bank details to get paid through PSPs like Stripe and marketplaces like Amazon.

Once you have a balance in a foreign currency you can hold it in your Wise Business account to make payments later, withdraw it to another bank account, or convert it to the currency of your choice with the mid-market exchange rate and low fees from 0.43%.

Get started with Wise Business 🚀

Use this guide to figure out the most convenient way to pay your self assessment tax - and remember to take a look at Wise Business as well, as a simple and straightforward way to pay and get paid internationally.

Sources used in this article:

Sources last checked on December 30, 2024

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Discover why agile partnerships are trumping complex, costly global payments infrastructure builds for banks like yours.

Can you use Payoneer in Nigeria? Find out here in our essential guide for UK businesses, covering everything you need to know.

Can you use Payoneer in the UK? Find out here in our essential guide for UK businesses, covering everything you need to know.

Can you use Payoneer in Argentina? Find out here in our essential guide for UK businesses, covering everything you need to know.

Can you use Payoneer in Türkiye? Find out here in our essential guide for UK businesses, covering everything you need to know.

Can you use Payoneer in Israel? Find out here in our essential guide for UK businesses, covering everything you need to know.