Small Business Guide to Handling Late Payments in the UK

Learn the most effective ways to handle and prevent late payments as a small business based in the U. Our guide covers all of the main things you need to know.

If you’re setting up a new business, you might be considering using PayPal UK Business to get paid, either by invoicing clients, taking payment online through your website, or even in person using a PayPal Here card reader.

Before you get started though, it pays to look at the process involved, particularly how to receive money on PayPal to ensure you get paid. As well as understanding the processes, you also need to be clear on the costs, particularly when it comes to overseas transactions with PayPal UK Business international fees. You may find a better deal with a specialist in international money transfers, such as Wise Business.

This guide will outline the steps for how to get paid via PayPal and also give you the lowdown on the benefits of a Wise International Business account.

If you want to use PayPal to receive payments from your clients, there are a few steps to take to get you started.

Confirm your email address, linked bank account and business information

Start getting paid online and in person through PayPal invoice and PayPal here card reader

You can upgrade your PayPal personal account to a business account if you’re a sole trader — but if you’re operating any other type of business you’ll need to open a new business account.¹

To upgrade your personal account, click on the Settings tab, and select Upgrade to a business account. Enter all your information and follow the on-screen steps.

If you need to set up a new PayPal business account, you can go to the PayPal UK Business website listed as source 2 at the end of this article.²

As part of the verification process for receiving payments on PayPal, you might have to give some further information, including confirming your email address and bank account. Whether or not this is needed depends on how your account was initially set up.

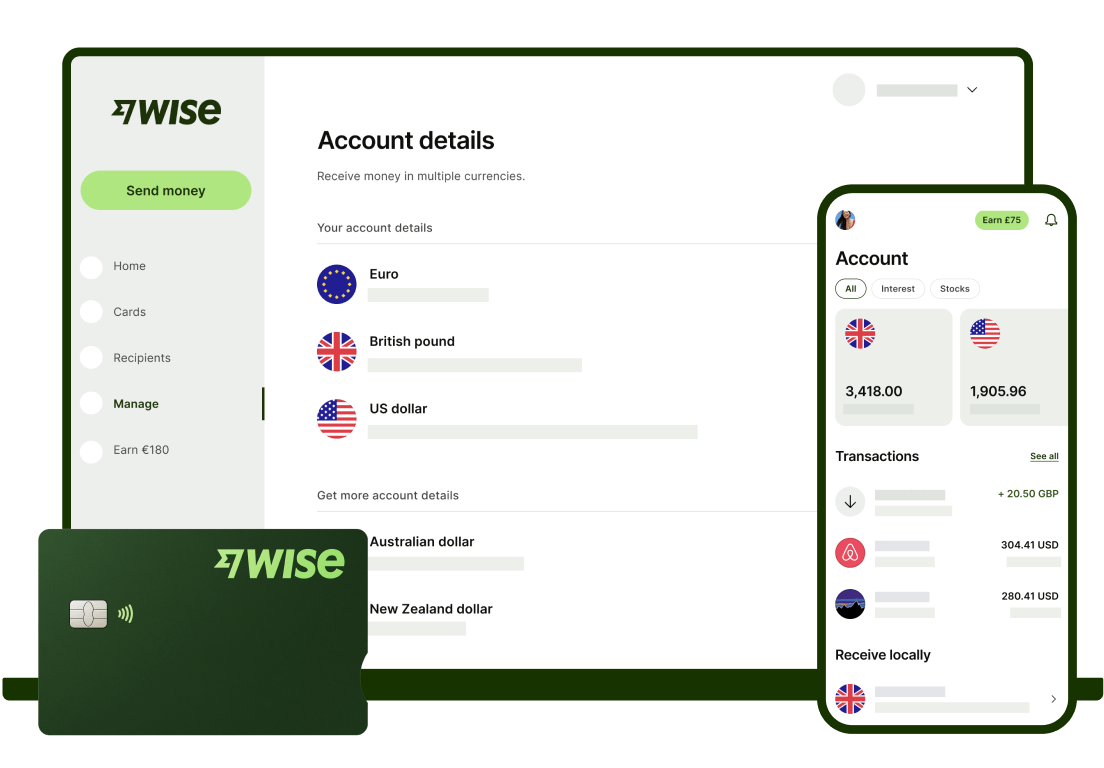

Get a multi-currency account with Wise Business 🚀

PayPal offers a range of different options to accept payments, depending on the type of business you run. There are different costs associated with different options — make sure you’re clear on the PayPal fees before you decide what’s best for your business.

There are several ways to receive payments via PayPal. Here, we'll give you the lowdown on how the different methods work so you can choose which one works best for you.

If you’re wondering how to get paid on PayPal quickly and easily, a good option is to set up a PayPal button to your website. PayPal offers a shareable link or button³ for you to accept payments for a single service or item. You can copy the simple code to add the button to your website yourself.

As your business grows, you may want to choose an ecommerce platform⁴ to enable your business to sell products or services online. Such platforms offer various features that enable you to manage the front and back end of your online store. These include product catalogue management, customer contact points, such as live chat and stock management tools. Payment gateway integrations enable you to make and receive payments securely and quickly. Many ecommerce providers have order fulfilment functionality too.

You can also choose from big name hosted platforms, such as Shopify and Wix. They are called hosted providers as they let you host your online store on their servers. Generally, they also provide user-friendly templates and drag-and-drop facilities for you to set up your online store with minimum fuss.

Self-hosted ecommerce platforms require you to host your site on your own server. However, they offer wider possibilities with being able to customise your online store. Examples include Magento and OpenCart.

A PayPal Here or point of sale card reader⁵ is a convenient way to receive PayPal payments if you trade in person. You can accept contactless payments using chip and PIN credit and debit cards. You can also pair your smartphone or tablet with your card reader using Bluetooth.

One way to help you get paid faster on PayPal is by sending your customers an invoice. If you don’t deal with a large number of transactions every day, you may prefer to create a custom invoice to send to your clients. These are a great way to help you get paid faster.

In many instances, once the customer has made payment, the money is deposited in your PayPal wallet within just a few minutes. However, there are some fee structures and payment methods you may choose which will delay access to your customers’ funds for 1-2 business days.⁷

But after the money is available, you can then withdraw the cash to your bank account, which takes a further couple of hours usually and is a manual process.

There are fees to use PayPal to receive payments. These vary depending on how you choose to use PayPal, and the volume and type of payments you’re receiving. Check out our PayPal fees Calculator for more information about the fees.

If you’re using your PayPal UK Business account to take payment from customers and clients then you’ll struggle to avoid the PayPal fees. If you’re used to sending invoices, or your clients and customers can easily send you a local bank transfer in regions like the UK, the US, the Eurozone, Australia, and Asia, why not consider a Wise Business account?

Here are some of the great features you can unlock with a Wise Business account.

Get started with Wise Business 🚀

Sources used in this article

Sources last checked Apr 11, 2024

Disclaimer: The UK Wise Business pricing structure is changing with effect from 26/11/2025 date. Receiving money, direct debits and getting paid features are not available with the Essential Plan which you can open for free. Pay a one-time set up fee of £50 to unlock Advanced features including account details to receive payments in 22+ currencies or 8+ currencies for non-swift payments. You’ll also get access to our invoice generating tool, payment links, QuickPay QR codes and the ability to set up direct debits all within one account. Please check our website for the latest pricing information.

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Learn the most effective ways to handle and prevent late payments as a small business based in the U. Our guide covers all of the main things you need to know.

Learn how to do invoice reconciliation the right way and key things to note to help your business in the UK in our quick guide.

Learn how automation and AI can sharpen your company's competitive edge in accounts payable by boosting efficiency, ensuring timely vendor payments, and more.

Learn about the corporate tax system in Austria, its current rates, how to pay your dues and stay compliant, and best practices.

Learn about the corporate tax system in Botswana, its current rates, how to pay your dues and stay compliant, and best practices.

Learn about the corporate tax system in Chile, its current rates, how to pay your dues and stay compliant, and best practices.