2018 hidden fees roundup

When you use Wise to send money to a different country, you can check the exchange rate that we quote you against that of Reuters, which is the same as the one you can find on Google. This rate is known as the mid-market rate, and we use it because we want to be transparent with the amount we’re charging you.

Essentially, if you used the mid-market rate to exchange money, you would be getting exactly the equivalent value of the amount you’re sending in the currency you’re sending to. As we are providing a service at Wise, we charge what we think is a fair, an up front fee that covers the cost of the exchange, along with some margin that we reinvest into our product.

However, most banks and money transfer providers don’t exchange your money using the mid-market rate. They alter the rate in a way that is favorable to themselves. The difference between the two rates represents a hidden fee that you don’t realize you're being charged.

This hidden fee is the exact reason that we decided to start developing the price comparison tool. We wanted to normalize the idea of being able to see what you pay upfront; and show how our competitors charge for money transfers. Specifically, our aim is to show that there's usually a markup in the exchange rate, and that even promises of a “zero commission/fee” transfer are still likely to entail a significant hidden fee on your transfer.

So, as we near the end of 2018, we (the Comparison team) thought it would be a good time to look back and see the extent to which our competitors have been charging hidden fees over the year. Here’s a brief summary of three routes in the form of league tables.

All the tables are generated using data that we’ve gathered for the comparison tool during 2018.

Go straight to:

Sending 1000 GBP to EUR

| Name | Average hidden fee (£) |

|---|---|

| Wise | 0.00 |

| Western Union | 2.11 |

| WorldRemit | 10.76 |

| Nationwide | 21.47 |

| RBS | 22.49 |

| NatWest | 22.56 |

| Barclays | 26.82 |

| Lloyds | 32.24 |

| HSBC | 37.72 |

With almost a 4% markup on the mid-market rate, HSBC ranks last. This means that 37 GBP of the 1000 pounds you send is essentially charged as a hidden fee. That doesn’t include the upfront commission they charge for their service, which in this case is around 4 GBP.

Western Union do offer a relatively good rate, and in fact, are not charging a fee for bank transfers, but don’t let them fool you that it’s totally free:

They’re still charging you 2.10 GBP on average, for making an international transfer to a bank account, which is a very good price (hint: its cheaper than Wise) So why not just be open about it?

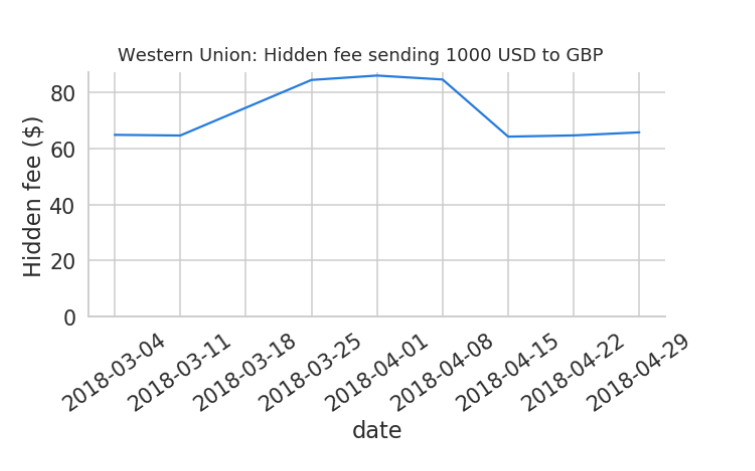

The problem with hiding the fee in the exchange rate is that it allows companies to change pricing at will, without people realizing it.

And as you can see above, Western Union can, and does, do this sort of thing. In this case, it’s a nice 20USD increase in the hidden fee, just in time for Easter. (Route: 1000 USD to GBP).

Sending 1000 EUR to GBP

| Name | Average hidden fee (€) |

|---|---|

| Wise | 0.00 |

| WorldRemit | 10.16 |

| LaCaixa | 21.27 |

| Sabadell | 23.16 |

| BBVA | 34.57 |

| Western Union | 44.15 |

While Western Union supply an incredibly cheap service for sending GBP, they charge an extortionate amount for sending EUR to GBP. That’s 21x more expensive to move 1000 EUR to GBP than 1000 GBP to EUR.

Sending 1000 GBP to USD

| Name | Average hidden fee (£) |

|---|---|

| Wise | 0.00 |

| Western Union | 2.67 |

| WorldRemit | 10.53 |

| Nationwide | 21.55 |

| RBS | 22.14 |

| NatWest | 22.32 |

| Barclays | 26.79 |

| Lloyds | 32.21 |

| HSBC | 38.11 |

| PayPal | 38.49 |

In general, the cheapest and most competitive routes are those with GBP as the source currency - and GBP>USD is no exception. However, what is of note here is that a non-bank has the most extreme markup of any of the providers that are present. It’s because of providers like Paypal, which have a very high (and also very volatile) hidden fee, that we began building the price comparison tool in the first place.

There's progress on this front, however, as the EU has recently passed a law that will force banks and money transfer providers to disclose exactly how much they're charging you for an international money transfer. But until that law comes into action, we will diligently work to show you how much you're really being charged to send money across borders.

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.