Building a profitable and sustainable business: A review from Matt (CFO)

Our mission is to create the best way to move and manage money around the world. We have a relentless focus on solving the problems facing our customers whilst building a sustainable and profitable business to support this mission.

In doing this, and in particular, bringing transparency and fairness into how we price our products, we’ve found a common ground of creating massive value for our customers and also for our shareholders.

Today, the majority of customers come to us to make cross-border payments. So that’s what customers pay us the most fees for, and hence from a finance perspective, how we earn the majority of our revenue.

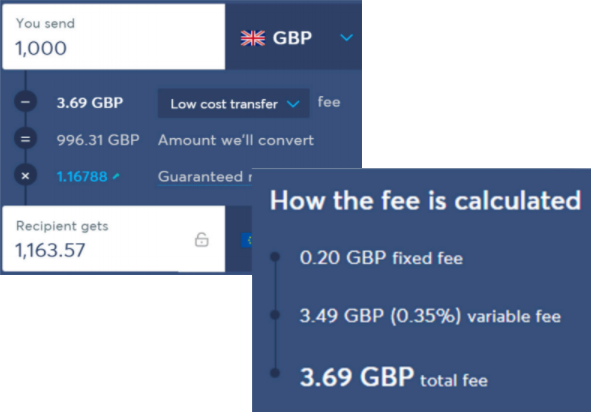

The fees we charge for a payment are always transparent. If you make a transfer on our platform for £1,000 to euros today, this is what you see:

We charge £3.69. That’s broken up into a fixed fee of £0.20 and variable fee of £3.49. What you see is what you pay, and also the revenue that we recognise. There are no spreads or hidden fees in these payments.

We earn revenue from personal customers and business customers. Active customers are customers who’ve made a cross-border payment in the relevant period, whether that’s via Wise Transfer or via their Wise Account. So our revenue is a function of the (1) number of active customers, (2) the volume per active customer, and (3) the fees we receive (or our “take-rate” as we call it).

In the year ended 31 March 2021 (FY2021), we had 5.7 million active personal customers and 305,000 active business customers. And both segments are growing rapidly vs prior year; with personal growing at 27% and business growing at 58%.

Whilst customers typically join us for our low and transparent prices, they continue using us as our price, speed, convenience and coverage is an order of magnitude better than alternatives. As a result, the average annual volume per active customer remained stable at around £9,100.

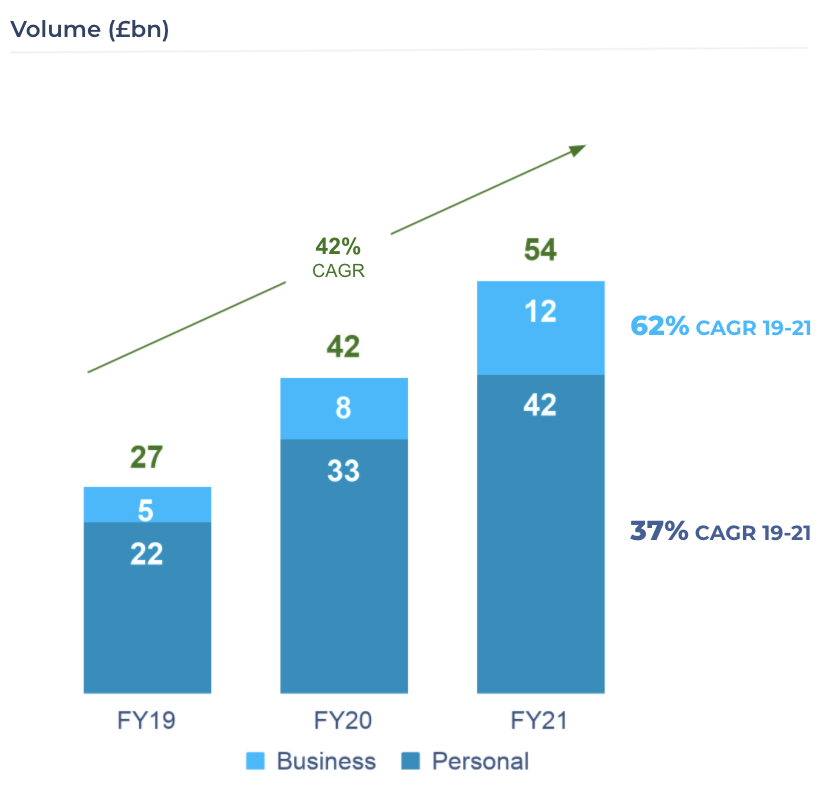

We processed £54.4 billion in cross-border payments in FY2021, which was a 30% increase vs FY2020.

This volume growth has driven our revenue growth, which as stated earlier is a function of the volume our customers move and also of the prices we charge our customers. If you were sending £1,000 to euros six years ago, it would have cost you £5. It costs £3.69 today. We’ve cut the price by more than a quarter. And at the same time, we’ve turned from a loss-making business into a profitable, cash generating business.

But so far we’ve only talked about the fees paid by our customers on cross-border payments. Overall we have seen our take rate increase in recent years. This is thanks to the launch of the Wise Account, which has seen customers also use Wise to make payments in their local currency, for which we charge a fee, and also spend on their Wise debit card, for which we earn some interchange income. In the year ended 31 March 2021 we saw this take rate increase from 0.73% of volume to 0.77%.

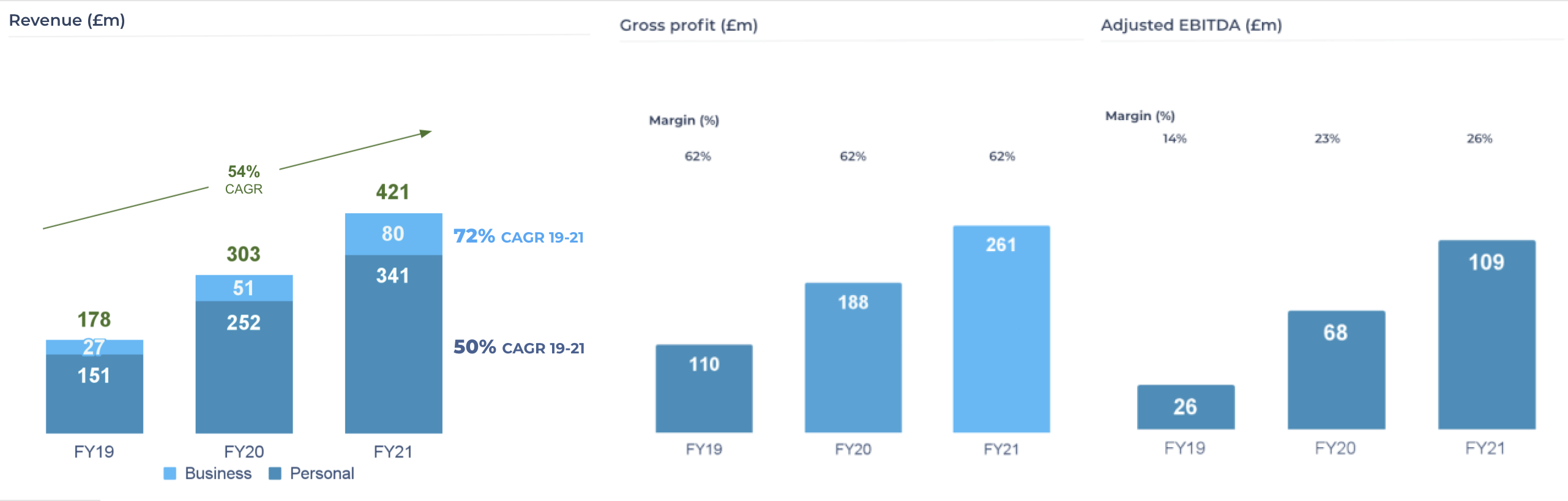

So in the last financial year, we generated £421.0 million in revenue, which was a 39% increase vs the previous financial year.

On that revenue of £421.0 million, we have a 62% gross margin. This means it turned into £260.5 million of gross profit in the last year. And that margin has been very steady over time.

This growth in gross profit, largely driven by volume growth, means we have more cash that we can invest back into our customers. And whenever we build better customer experiences, it drives more volume and more scale. This means we get to a lower unit cost and even more capacity to invest.

We have three ways of reinvesting those gross margins.

We invest in marketing. Although two-thirds of our customers join us through recommendations, we also invest in marketing to reach new customers, but only if this pays back sustainably. This drives more customers to our platform, which in turn drives more volume and scale, and lowers our unit costs.

We invest in our platform. We invest heavily in our engineering teams, and in launching new features and products. This drives a better customer experience, more word of mouth referrals, and also lowers our unit costs.

And of course, we also re-invest in sustainably lowering prices for our customers.

In the year ended 31 March 2021, administrative expenses increased 29% year over year to £217.5 million, but were in fact lower than planned due to cautious hiring in the face of initial uncertainty at the onset of the pandemic, combined with a reduction in spend on certain items (e.g. travel). This resulted in a higher than planned Adjusted EBITDA margin of 26% (2020: 23%) which corresponds to £108.7 million of Adjusted EBITDA (2020: £68.2 million).

Our profit before tax for the year was £41.1 million (2020: £20.4 million). We’re incredibly proud that this is our fifth consecutive year of profitability.

We’ve got over £4 billion of cash-type balances. Importantly this includes £3.7 billion of Wise Account customer deposits, which we keep safeguarded and readily available. But this also includes £286.1 million of our “own cash”, and this cash balance is increasing thanks to the cash generating qualities of the business we’ve built.

In summary, our growth has been fuelled by building products and features that customers love and recommend. We re-invest our margins into improving our product and customer experience, marketing to help spread the word, and sustainably lowering prices.

Our focus on our mission will not change as we continue to grow and scale, and neither will our focus on building a strong, sustainable and cash-generating business that is best placed to address the evolving needs of our customers.

We’ve just got started, and have a long way to go.

Onwards.

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.