UK Price Comparison Research 2024

An independent research team compared Wise to six UK bank accounts, as well as Monzo, Starling, Revolut, PayPal, Xoom, Western Union and Post Office. They...

Back in January, we wrote a (kind of) hopeful blog about CBPR2 – a new EU regulation that would force banks and other financial services to disclose exactly what it costs for you to send money abroad.

The year is 2020, and money — like people — should be able to move around the world, without borders. As the world becomes more connected, services like banking should fundamentally support that change, by making moving money as fast, cheap and convenient as can be.

So, when this new regulation promised to force banks and brokers to show all those fees they’d been sneaking into bad exchange rates for decades, we got quite excited.

It’s baffling that regulators have allowed this to happen for this long. But the EU had listened, and hidden fees for European cross-border payments were finally due to disappear on the 19th of April.

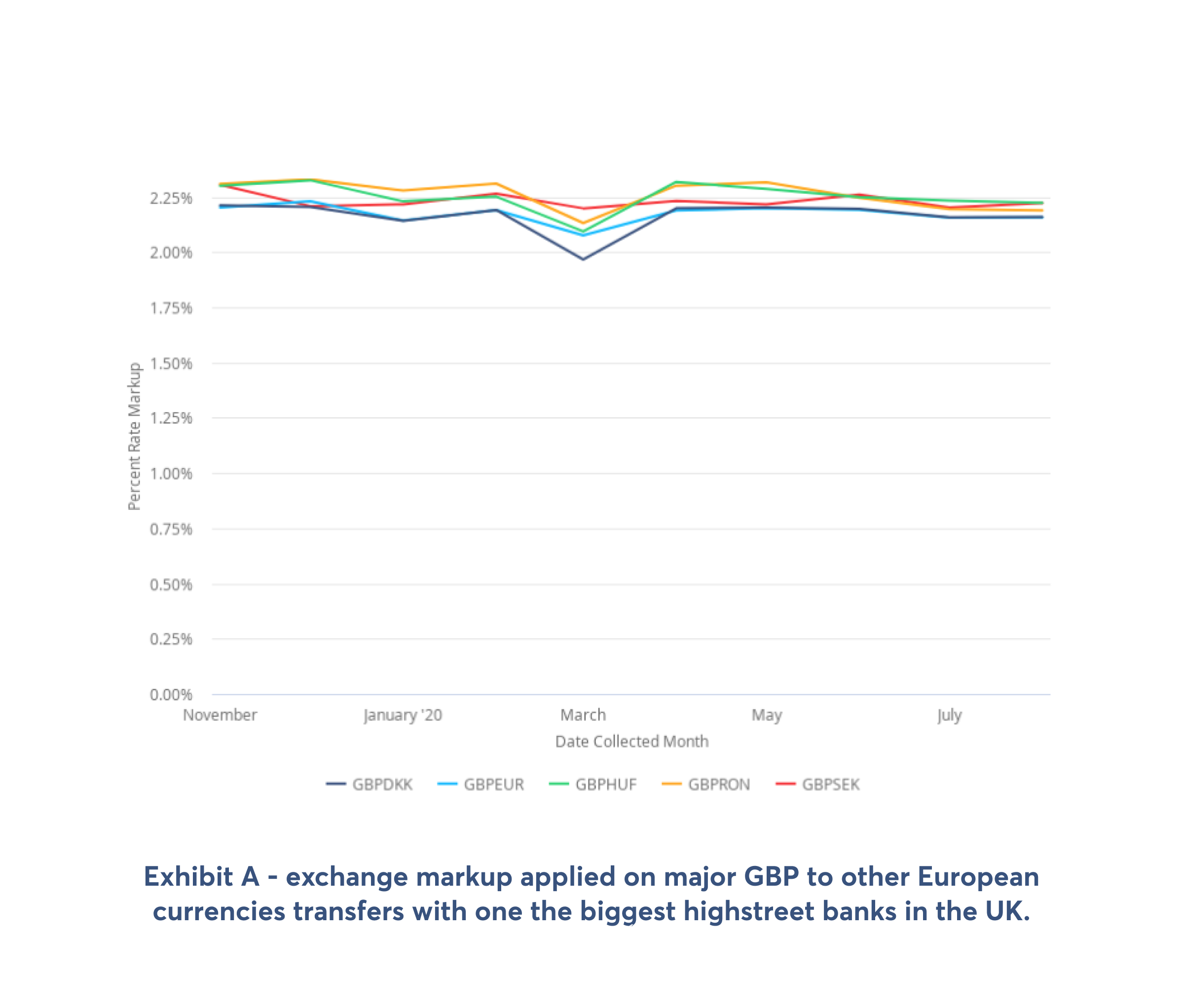

We’re writing this blog, to you, in September 2020. And news flash: hidden fees (and other dodgy FX schemes) are still very much a thing. (See exhibit A)

Let’s go backwards to May, when we wrote a slightly less hopeful blog. Using COVID-19 as a pretext, banks and other industry players asked for a delay to implement this new layer of transparency — one month before the deadline, when they’d known about the new rules for 2 years. The European Commision accepted their plea.

On top of that, the language of the law is just vague enough and leaves a little wiggle room. What does this mean? Banks and brokers could technically respect the letter of the law, but not the spirit of the law. They decide how, when and which version to implement.

i.e. chances are high that consumers will end up without the transparency they deserve.

The worst part is that the regulation explicitly lays out the new transparency rules for card payments. But because the language for bank transfers leaves room for interpretation, some providers will keep hiding their fees when you make an international bank transfer. They are technically required to show the total cost for both card payments and international transfers, but they will use vague language to their advantage.

Nope, we don’t get it either.

We’re no patrol squad but transparency has always been part of our mission. The main reason Wise exists is because banks hide fees in bad exchange rates –– the same problem CBPR2 was meant to solve.

In this investigation, we’ve found out two things:

Markups haven’t gone away: these are new rules, but they apply to the same old banks. Doing right by customers isn’t incentive enough for the financial industry to disclose exactly what they’re charging you.

Banks are still hiding the true costs of sending money abroad and are using their own (inflated) rate and not the real exchange rate, without telling you what that is.

In fact, some of them are even charging you more since the beginning of the pandemic (more info to follow).

Tooltips are the new hidden fees.

Even though these providers tell you the cost of sending money, they don’t actually want you to find out and hide all the info you need behind a tooltip.

For that reason, over the next month, we’ll be posting information about what we, as a team, of the dodgy practices banks decide to continue perpetrating; and the new tricks used to get money out of consumers.

Most importantly, more than letting you know how and who is doing this, we’ll do our best to teach everyone we can to spot these hidden fees and tooltips so that you always know what’s the best provider for your transfer.

We know banks and other providers can be sneaky, and will continue to be for as long they are allowed to. To stop it, we need to make it illegal for them to deceive customers.

The first step is to make your friends and family aware of the issue. The second, is to help log a collective complaint against big (sneaky) banks.

And call it out on social media, by adding the hashtag #banksaresneaky.

Check whether your bank or provider is doing something similar. And spread the word on social media: tweet the screengrab of the rate they provided you for your international transfer vs the mid-market rate You can check what’s the real exchange rate on a reliable third party (XE, Google or even Transferwise).

Don’t forget to tag the bank and Wise. And add #banksaresneaky to your post if you can fit the characters in.

Make a formal complaint and ask your bank to put things right

If you really want banks to stop hiding their fees from you, ask them to be more transparent. You can usually find the right place to log a complaint in your bank quite easily in their Contacts or Complaints page.

We’ve written a template that you can use to make things easier:

Dear Sir/ Madam,

I am writing to formally complain with regards to the pricing that was displayed on my recent international transaction from [currency you’re sending from] to [currency you’re sending to] on [date].

Upon checking, it is clear that there was a charge embedded in the exchange rate - as the mid market rate on the day was not the rate applied to the transaction. According to the FCA, this ‘exchange rate margin’ should be considered a charge and disclosed to me prior to the initiation of a transaction to help me compare providers and understand what I am paying.

Furthermore, new regulations (the Cross Border Payments Regulation II) have come into force in the UK. These regulations require that total cost is disclosed to your customers upfront, including the exchange rate margin.

As a result, I believe your pricing display is deliberately misleading to consumers like myself.

I hereby request that it is made clear to consumers such as myself the difference between the mid market rate and the rate you apply, as well as any upfront fees, displayed as either a percentage charge or as one single amount e.g £3 before we make a transaction online or on mobile. I do not believe the costs were clearly presented, as intended by new legislation and the regulator, and I was not offered a fair opportunity to shop around.

Kind regards,

XXX

To take things further you can also complain to the Financial Ombudsman Service, after you’ve received a response from your bank. Here’s how you can do it.

To find out more, and join the fight, click here.

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

An independent research team compared Wise to six UK bank accounts, as well as Monzo, Starling, Revolut, PayPal, Xoom, Western Union and Post Office. They...

A dedicated comparison research team in Wise compared Wise to four India bank accounts. They found that we’re on average 1x cheaper to send ₹9,000 abroad....

In the UK, our research found that it’s up to 87% cheaper to spend with a Wise card abroad, compared to high street banks, if you’re spending £1000. High...

Detailed research by Wise reveals substantial savings compared to Singapore banks and services like Instarem, Revolut, and Youtrip by EZ link.

Discover how Wise compares to 5 major Japanese banks and Revolut, offering savings of up to 6x on international transactions.

Discover how Wise compares to major banks and money transfer services, saving you up to 4x on international transactions.