Are you paying more than you think with Revolut?

At first, Revolut might look like the cheaper option. Dig a little deeper and it turns out Wise could offer the better deal. How do Wise and Revolut differ?...

One thing you should know about us: we care about transparency. That’s because we navigate a minefield of an industry that is the exact opposite. And it’s what we were born to do — challenge the status quo. (For more context, read Kristo’s appreciation moment for HSBC).

In any case, this lack of transparency allows banks to keep resisting change that will make finance — and moving money around the world — much faster, cheaper, and fairer.

That’s why we’ve been banging on about the new Cross Border Payments Regulation (CBPR2). A new set of rules which would force banks to disclose what it costs for you to send money across Europe. But so far, banks have persistently ignored and dodged them.

So we’re campaigning to enforce the rules in the way they were intended. Part of that means first looking into how transparent banks and other money transfer providers are right now — based on the following criteria:

The exchange rate used vs the real exchange rate

Disclosure (and visibility) of the mid-market rate

Disclosure (and clarity) of how much extra you’re paying

Next up is Lloyds.

In Lloyds’s own words:

“The banking market is in the midst of a major transformation with growing competitive, regulatory and operational challenges.

Today more than ever, financial institutions need to provide comprehensive, cost-effective and robust services to their customers, supported with reporting transparency and world-class processing capabilities.” (Lloyds Banking Group FX monthly magazine, September 2010)

It’s been 10 years since a talented copywriter at Lloyds wrote that transparency statement.

Have they stayed true to their words? Not really.

It’s hard to understand how international finance really works because banks purposefully blur the lines between exchange rates, commission (the upfront fee), and markups.

Lloyds isn’t an exception. Let’s have a look at this international transfer from a Lloyds bank account to a German one.

To your right: the quote of how much you’d get for your £1000 in €. To your left: how much you’d get according to Google. In this case, Lloyds states that the exchange rate is 1.0557. Google says it’s 1.094.

Why are they different? Lloyds uses a dynamic rate in which they embed a markup. That’s where their profit is. And Google’s rate is the real mid-market rate, i.e. the rate your bank should have used.

What does this mean? Let’s do some basic maths:

And...

€1,094.6- €1,055.7 = €38.91

What’s that €38.91? Lloyds pulling the good old hidden fees trick on you, and putting exactly 3.9% of your cash in their pockets.

So, the verdict so far: Lloyds isn’t transparent, because it hides a pretty hefty fee in their terrible exchange rate.

Seeing the mid-market rate is important because it gives you the reference point of how much your transfer should be worth.

In previous blogs, we’ve seen that banks sometimes get creative with how they refer to their exchange rates by using euphemisms such as “HSBC exchange live rate” (whatever that is).

But this is where Lloyds is... special.

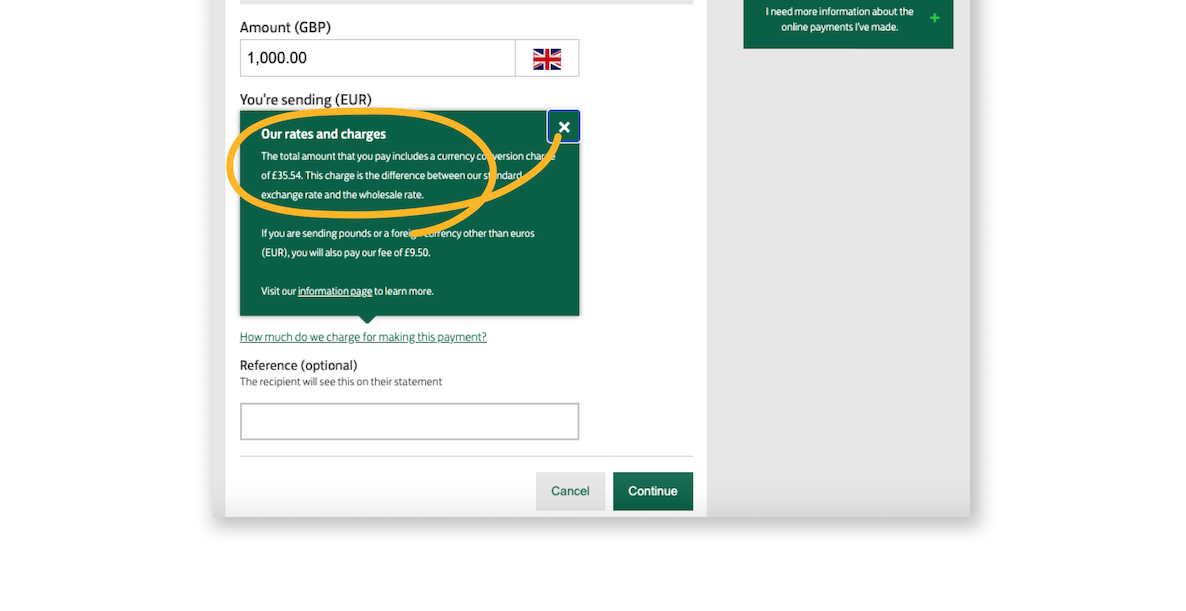

You’d need to be eagle eyed, but under the blue table in the image below you can see in tiny small print “How much do we charge for making this payment”.

Here, in case you’ve missed it:

Click on it, and a green box pops up –– a tool tip which reveals the total amount paid includes “a currency conversion charge of £35.54”. Which they say is “the difference between our standard exchange rate and the wholesale rate”.

Hmm...

This is problematic for more than couple of reasons:

You’d need to be eagle-eyed to spot a tooltip that tells you their exchange rate isn’t real (and hides a hefty fee of 3.9% of the value you’re sending).

*€1,094.6- €1,055.7 = €38.91 which isn’t always £35.54. Using the wrong exchange rate again, are we? ;)

At no point do they show the mid-market rate.

So it’s a no on this category, too.

Ok, Lloyds does hide fees and charges customers a hefty markup. But what it does do is disclose how much extra it’s charging you. And that is:

So, yes, Lloyds is better than most banks. They deserve one (short) round of applause for building a mechanism that shows the true cost.

But people shouldn’t have to try this hard to find out. Tooltips are a pretty sneaky mechanism to disguise profit margins. It’s a very grey line, comparable to fairtrade claims for products with massive and untraceable supply chains; organic beauty & care labels disguising in latin very chemical (potentially explosive) ingredients; T&Cs where you may be signing your soul away – or just how natural Fanta flavours really are.

Get our point?

It’s hidden behind a hyperlink or tooltip, so it’s still an abuse of customers’ trust.

Especially when you consider that on Lloyds’ public website they claim this:

Verdict: it’s a conundrum. We recognise that Lloyds is in fact far better than most high street banks in terms of disclosing how much extra they charge customers. Even though it’s definitely cheeky to hide costs behind tooltips.

Lloyds are playing the same old game, with new tricks. So, we give them a half point. For effort.

It’d be wrong for us not to recognise that Lloyds fares better than many other banks included in our transparency campaign. It’s a step in the right direction.

However, they still apply a pretty loose understanding of the rules.

And, by resorting to these new tricks to hide costs, they’re still doing wrong by their customers.

This is another example of how we're concerned about legislation like CBPR2. Without clear rules and clear deadlines, banks and providers will continue to hide the total cost from you and pocket any profits.

There are more banks being sneaky out there

Change is coming — but unless we call out the biggest offenders of CBPR2 dodgers, banks will never be transparent. So help us make transparency the norm.

What can you do?

Are you a Lloyds customer? Write a complaint to them - here’s how.

Still upset ? Complain to the FOS - here’s how.

Want to make this public? Screenshot your hidden fee in and tweet it with the #banksaresneaky hashtag - and we’ll make sure the world sees it!

Interested in making finance fairer? Join the fight here.

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

At first, Revolut might look like the cheaper option. Dig a little deeper and it turns out Wise could offer the better deal. How do Wise and Revolut differ?...

An independent research team compared Wise to six UK bank accounts, as well as Monzo, Starling, Revolut, PayPal, Xoom, Western Union and Post Office. They...

A dedicated comparison research team in Wise compared Wise to four India bank accounts. They found that we’re on average 1x cheaper to send ₹9,000 abroad....

In the UK, our research found that it’s up to 87% cheaper to spend with a Wise card abroad, compared to high street banks, if you’re spending £1000. High...

Detailed research by Wise reveals substantial savings compared to Singapore banks and services like Instarem, Revolut, and Youtrip by EZ link.

Discover how Wise compares to 5 major Japanese banks and Revolut, offering savings of up to 6x on international transactions.