The best international account comparison

Managing finances in different countries is tricky. Whether you’re looking to send money, get paid, hold balances or spend overseas, this article will help you decide which option is best for you.

If you live, work, or have family internationally, it can be hard to find a good way to manage your money.

Here, we’ll compare five UK providers, to explain how different types of international accounts vary and help you decide which one works for you. This article will look at a range of providers, to show how they vary — the international accounts for 2 banks, Western Union, Starling, and Wise.

We’ll compare the features they offer, their pricing, speed, and ease-of-use.

Remember, it's important to use this article as a starting point, and carry out your own research to make sure you're choosing the best option for you and that none of the information below has changed since publication.

1. The most complete international account

First, let’s compare which account has the most features designed specifically for international usage.

| Barclays | Lloyds | Western Union | Starling Bank | Wise | |

|---|---|---|---|---|---|

| Send money | ✅ To 60 countries | ✅ | ✅ To 200 countries | ✅ To 38 countries | ✅ To 80 countries |

| Local bank details in different currencies | ✅ 12 currencies | ✅ 3 currencies | ❌ | ✅ 2 currencies | ✅ 11 currencies |

| Multi-currency balances | ✅ 12 currencies | ✅ 3 currencies | ❌ | ✅ 2 currencies | ✅ 55 currencies |

| Multi-currency debit card | ❌ | ❌ | ❌ | ✅ | ✅ |

| Business account | ✅ | ✅ | ✅ | ✅ | ✅ |

| Direct debits | ✅ | ✅ | ❌ | ✅ | ✅ |

| Cash transfers | ❌ | ❌ | ✅ | ❌ | ❌ |

The Wise account offers the most complete set of features: local bank details in 11 currencies so you can get paid from abroad, balances in 55 currencies, and money transfers to 80 countries. It also lets you issue direct debits and comes with a debit card that lets you spend overseas.

Starling offers local bank details in 2 currencies, and its debit card lets you spend abroad. However, it doesn’t let you receive money into your account from different currencies.

Western Union is the only option for sending cash, but it doesn’t offer any other features for consumers. Its business account, however, includes balances.

The Lloyds International Account and Barclays International Account offer accounts in 3 and 12 currencies, respectively.

2. The cheapest way to send and receive money

Monthly fees

The Lloyds International Account includes a £7.50 monthly fee. The Barclays International Account charges a £40 fee if your account value goes below £25,000.

Exchange rates

There are two components to an international transaction: the stated fee and the exchange rate mark-up.

It’s often hard to work out how much the exchange rate costs. However, this is generally the largest part of the cost — it can be 3-5% of the amount you send, depending on which currencies you’re converting and the amount you’re sending.

Here are the fees for a £5,000 transfer to dollars.¹

As you can see, the upfront fee costs are deceptive. Despite Wise and Starling appearing to have the highest fees, they are the cheapest overall. That’s because they use the real, mid-market exchange rate — instead of using a rate with a mark-up.

Despite advertising free international transfers, Lloyds is the most expensive option on this list because its exchange rate includes a 3.57% mark-up. Their free domestic account uses the same rate, but charges an additional £9.50 per international transfer.

It’s crucial to compare exchange rates before sending money. These rates can fluctuate and will depend on the amount and route you’re sending. You should compare the rate you’re offered with the one you see on Google. Click here to compare for yourself.

Receiving fees

The local bank details in Wise’s account mean that you pay no fee to receive payments from abroad except for US wires.

Lloyds allows you to receive money for free. Barclays charges £6 to receive any non-sterling currency.

Starling only allows foreign deposits between euros and pounds, for which it charges a 2% fee. Western Union doesn’t offer this service.

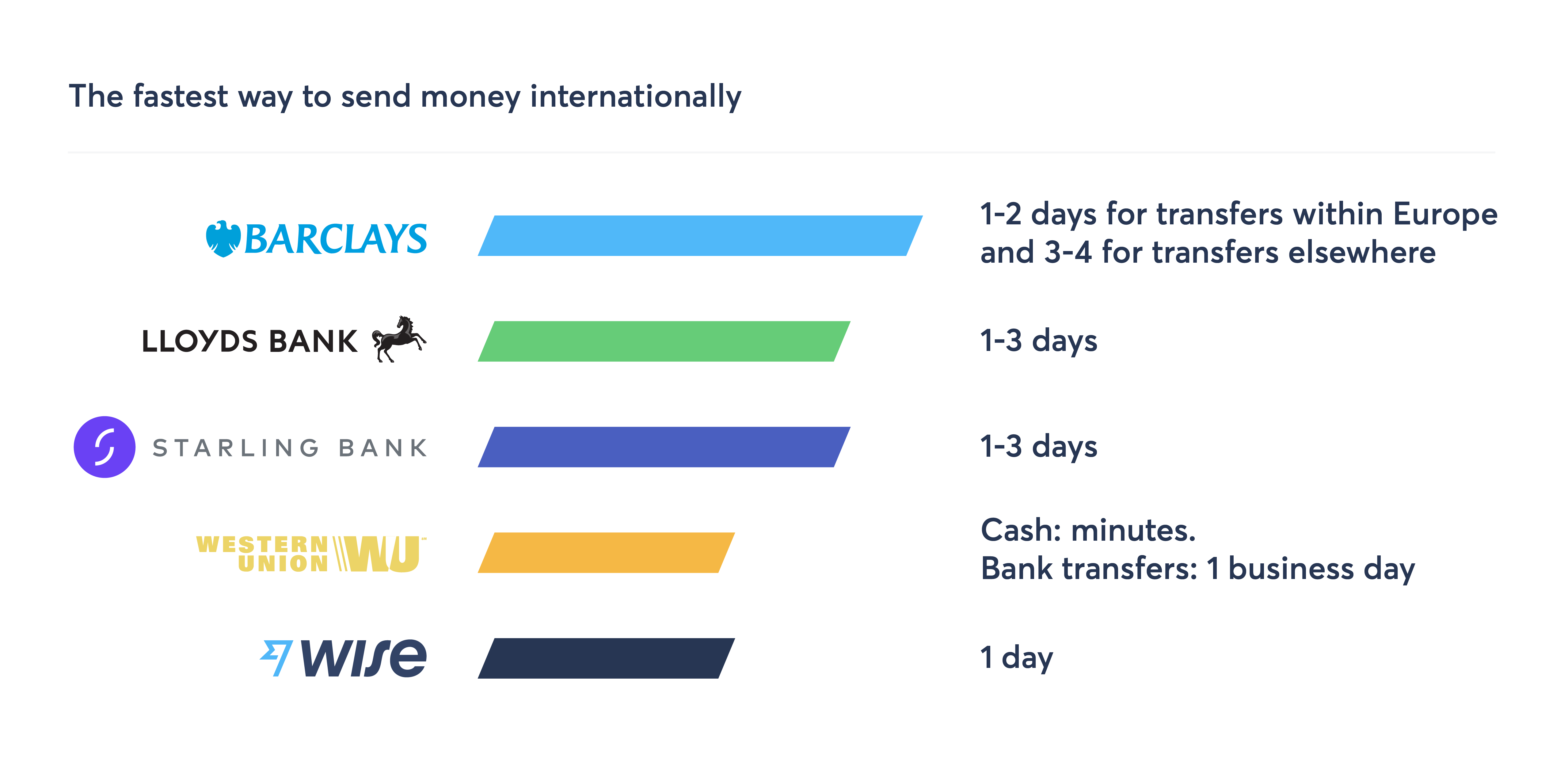

3. The fastest money transfer option

While domestic banking in the UK is typically speedy, transferring internationally can be slower. Here's how long it takes each provider to send money between the UK and Europe.

Western Union’s cash option is the fastest way of sending money. For bank transfers, Wise is the fastest. It completes 75% of its transfers on the same day and 25% are instant.

It’s common for providers to show different time estimates depending on where you’re sending money. It's crucial to prepare in advance and check well in advance of sending, since delivery estimates vary for all providers across different routes and times of day.

4. The most convenient option

First, let’s compare how much each provider lets you send and then how easy they are to use.

Transfer limits

| Transfer limits | |

|---|---|

| Barclays | £100,000 per day |

| Lloyds | £10,000 per transfer; £30,000 per day |

| Starling | £10,000 per transfer; £25,000 per day |

| Western Union | £50,000 per day |

| Wise | £1 million per transfer |

Ease of use

All of the providers allow you to manage your account through their app or website.

Wise's app lets you hold balances in 55 currencies, and send, top up and convert between them — all in one account. You can freeze your debit card in one click if you lose it, and you receive payment notifications to keep track of your spending. It also has the highest daily transfer limits, putting you in greater control of your money.

Barclays also lets you manage your balances in its website or app. However, you will need to add and maintain a balance of at least £25,000 or pay a £40 monthly fee. Lloyds requires you to speak with a relationship manager to set up an international account, and you will then have to log into your UK account and your currency accounts separately.

1. Rates taken at 14.36 on 13th May 2021. To compare today's rates, click here.

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.