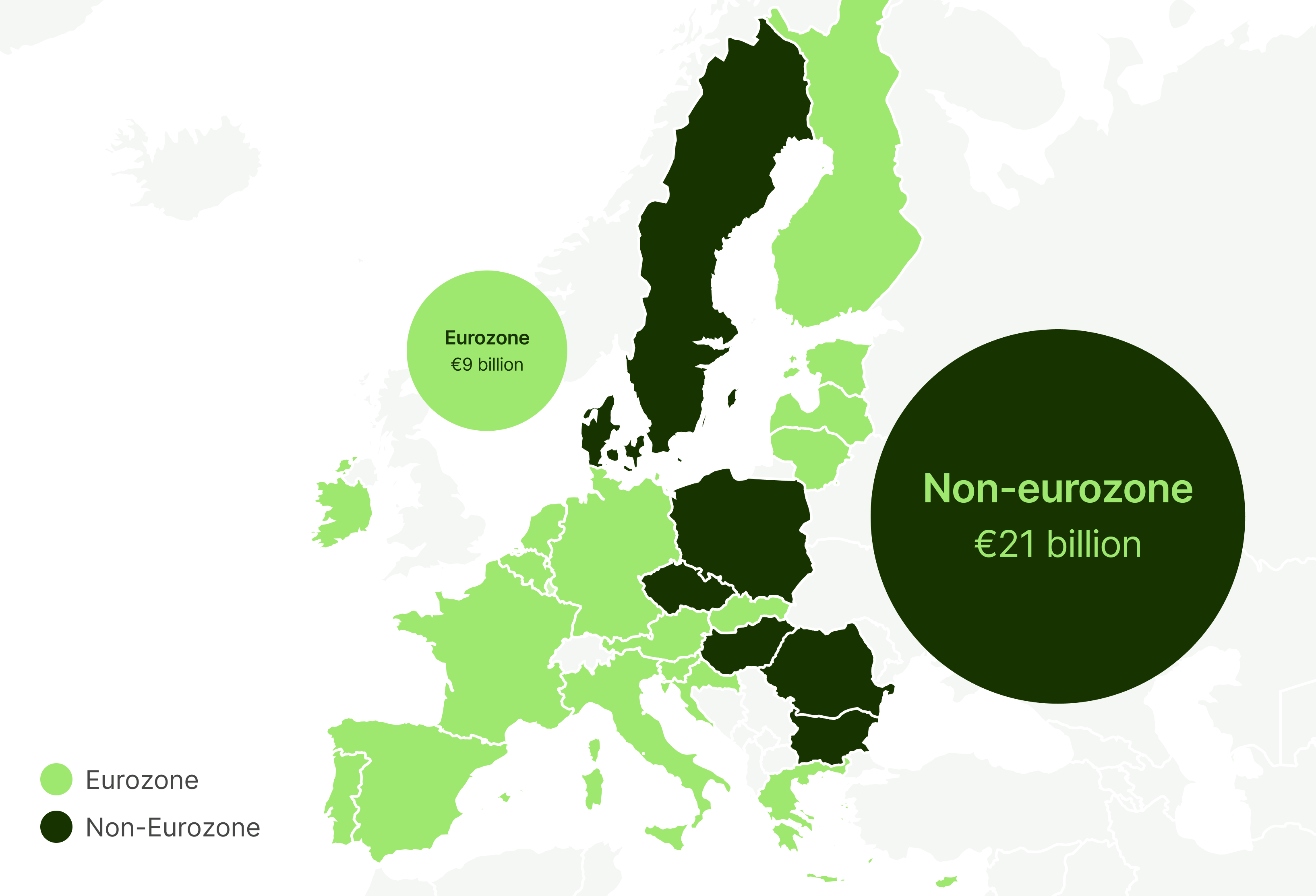

The EU has a €30 billion hidden fees problem

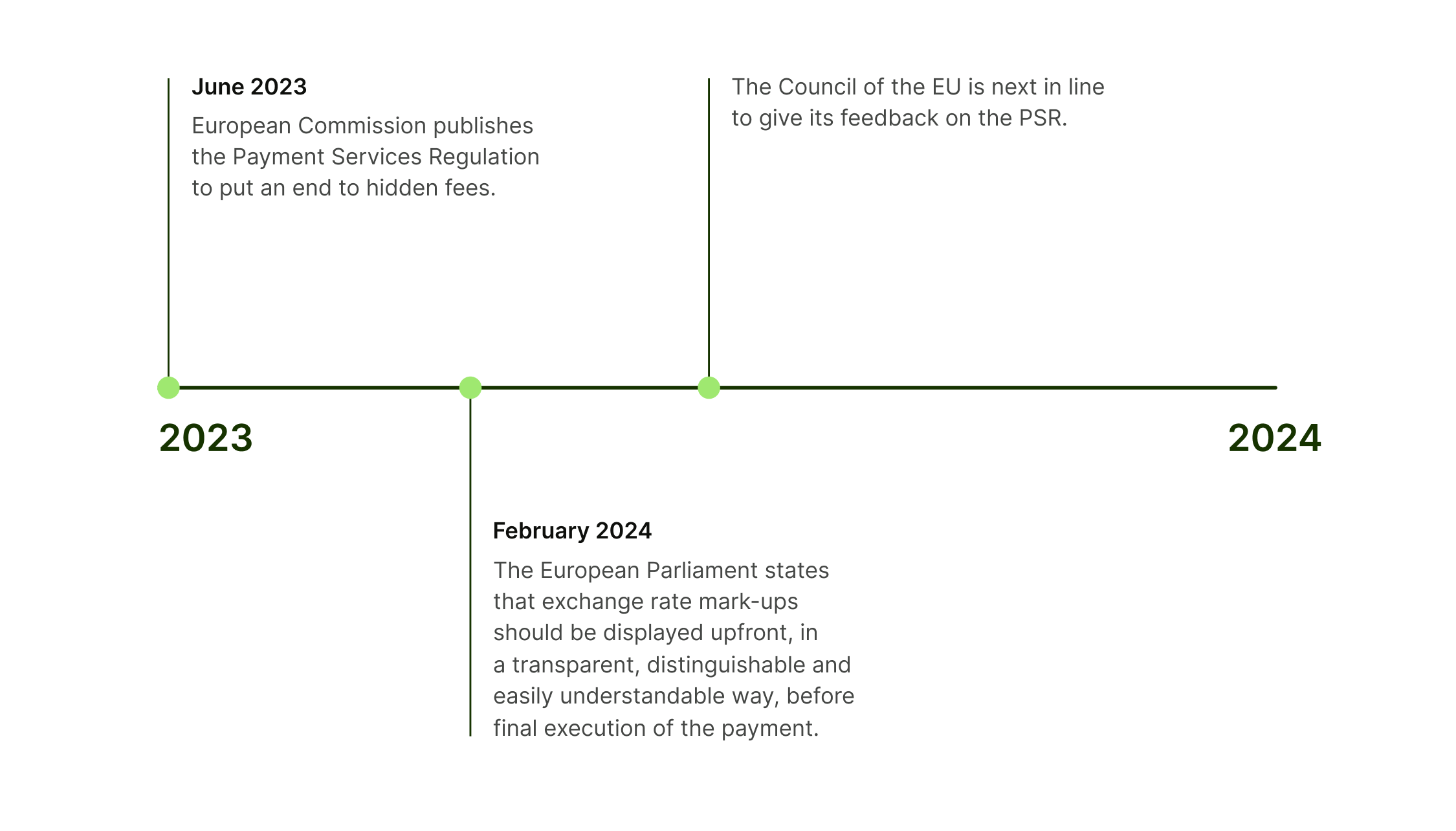

Hidden fees in international payments are not new. They’ve been banned by law since 2020 for cross-border payments within the EU.

Yet they remain a problem that cost people and businesses in the European Union a whopping €30 billion in 2023 alone.

For European consumers, that’s money that could have been used for daily spending, savings or investment, especially during a time of high inflation.

For the EU’s small and medium-sized businesses — who are hit the hardest by hidden fees — that’s money that could have gone to hiring, product investment, marketing or rainy day savings.

Yet they remain a problem that cost people and businesses in the European Union a whopping €30 billion in 2023 alone.

For European consumers, that’s money that could have been used for daily spending, savings or investment, especially during a time of high inflation.

For the EU’s small and medium-sized businesses — who are hit the hardest by hidden fees — that’s money that could have gone to hiring, product investment, marketing or rainy day savings.