A study on Canadian freelancers in 2018: more clients, more countries, more costs

In today’s increasingly digital world, more than 1 in 4 people in Canada are choosing to freelance – and with millennials continuing to enter the workforce, the numbers are on the rise.

We surveyed 500 Canadian freelancers to learn about how they find working with clients abroad. The findings are clear – more clients and global experienced is welcomed, but there are challenges around getting paid in foreign currencies.

Some may be intimidated to work across borders.

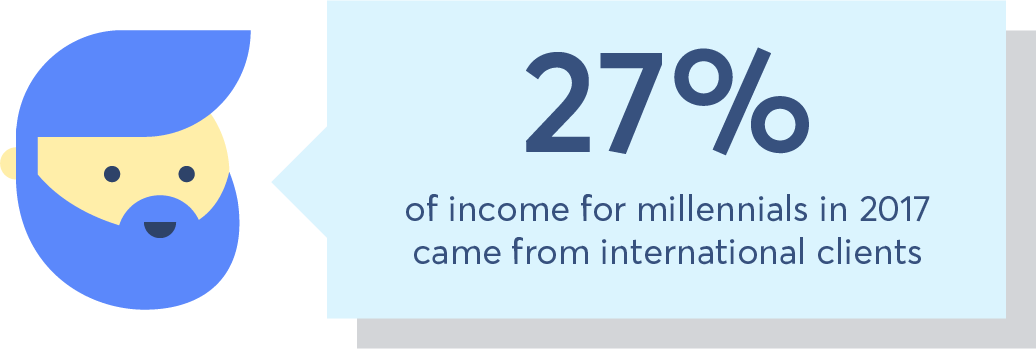

On average, 18% of freelancers’ 2017 income came from international clients; the average amount being $1,821.

Millennials earned a larger percentage of their 2017 income from international clients (27%), but freelancers aged 35-54 earned more in dollars ($2,005 on average).

Some freelancers see the potential in international clients, but don’t pursue them because of language barriers (28%), lack of familiarity with other markets (26%), and the fear that processing international payments will be too complicated (18%).

"Where’s my money?" The common issue of unpaid invoices.

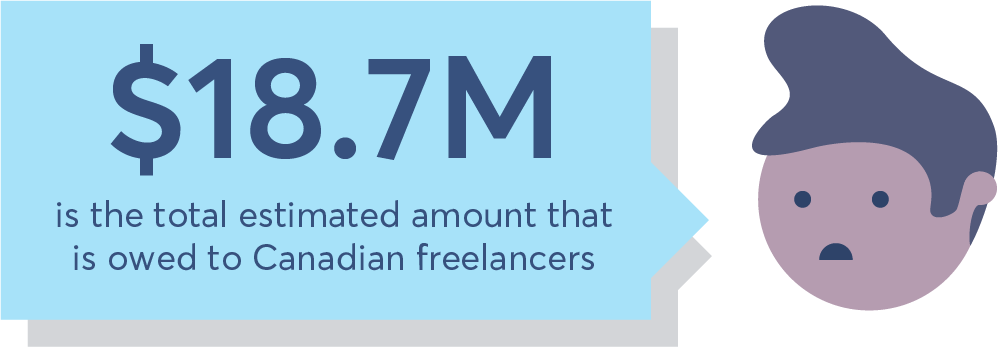

Famously, one of the toughest things about being a freelancer is getting paid. 50% had at least one unpaid invoice at the end of 2017, and the average freelancer was owed $1,701.80.

If we apply these figures to the Canadian freelancer population as a whole, that's around around $18.7 million still owed at the end of 2017.*

Millennial freelancers aged 18-34 were 18% more likely than those aged 35-54 to have outstanding payments, and 89% more likely than those over 55 years old.

Don't lose out when you're paid.

Working internationally may expand your client base, but if you're not careful, you could lose money on each paycheck. That’s because banks and services like PayPal can charge big fees to receive foreign currencies, and may use unfriendly exchange rates.

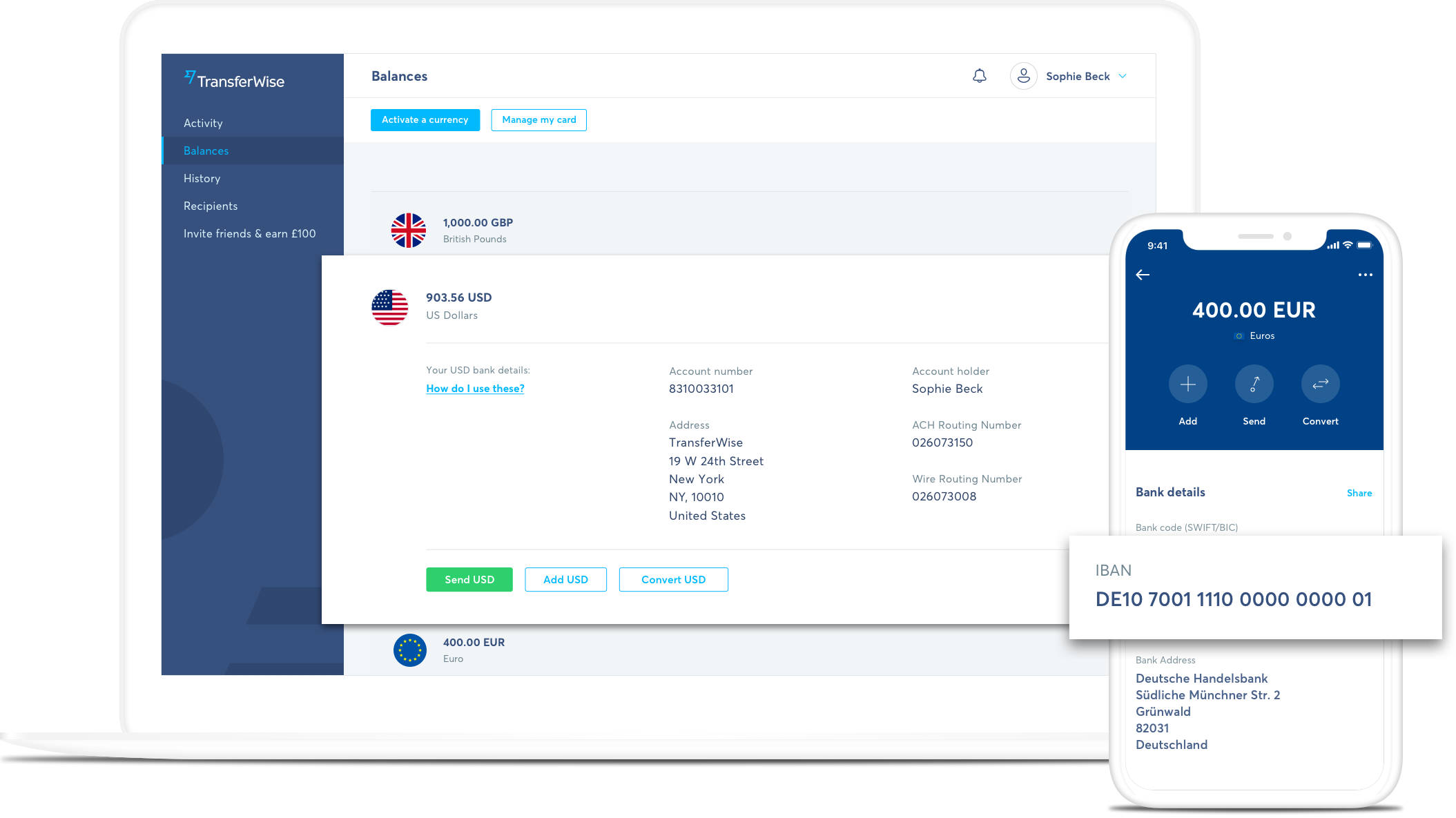

The Wise borderless account is a great payment alternative. It's a multi-currency account that comes with your own bank account details for US, European, UK, and Australian accounts. This means you can receive payments in multiple currencies for free.

You can also hold up to 29 currencies in the account, and easily convert between them with the real exchange rate. Find out more here