How to buy FIFA World Cup 26™ tickets: Step-by-step guide

Guide on how to buy world cup tickets 2026: official sales, signup tips & tricks, resale safety, and key dates to secure seats.

Before making a transaction, it’s important to understand the key information needed to ensure funds go to the right place. US financial institutions require both a routing number and an account number to identify customers and finalize transactions.

This article will explain the difference between routing vs. account number. It’ll also introduce one alternative you can use to send money abroad, from Wise. With Wise, you can save up to 3x when sending internationally, with transparent fees.

Let’s clear things up and break down the main differences between the two.

Many financial institutions identify routing numbers based on the purpose of the transaction, so they may have a few different names like:

It all means the same thing. A routing number is the nine-digit identification number assigned by the ABA, and they’re specific to each financial institution.¹ Think of them as an address to a bank.

The Federal Reserve Routing System assigns the first four digits to the bank or credit union. Until 2019, the numbers represented the physical location of the bank. If your bank has a new number, this is no longer the case.²

The next four numbers represent the routing Federal Reserve Bank, processing center, and district.

The final (9th) number is the total of a checksum test from the first eight numbers. If the ninth number doesn’t equal the result of the algorithm, then the transaction or check is flagged. In this situation, the Federal Reserve processes the transaction manually.³

Some banks may have multiple routing numbers due to their size—think about large operations like US Bank, Capital One or Wells Fargo.

But don’t worry! No bank may have more than 10 routing numbers, so it isn’t difficult to find the one associated with your personal bank or credit union.

There are many options to help find your bank’s routing number:

Wise has a comprehensive list to help find the routing number for most major U.S. banks. Click ‘find your routing number’ at the top of the page.

Banks provide key account information—like account and routing numbers—through their online portal. Login to your account to find the number.

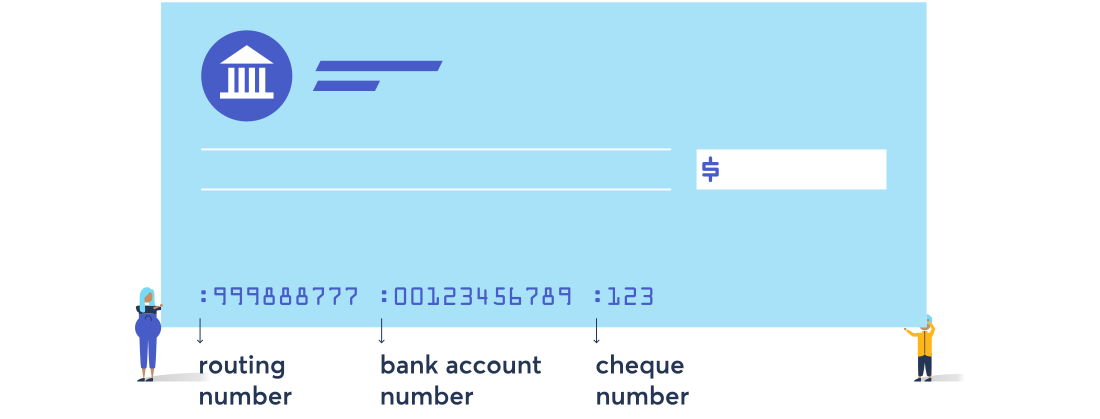

If you have bank-issued checks, the routing number on a check is located at the bottom and on the left side—the first nine numbers.

The Federal Reserve’s Official Site has a routing number directory.

If you’re using a Wise account for an ACH transfer, these are our routing numbers.

While routing numbers identify financial institutions, account numbers are unique to the account holder. Think of them as an identification much like a passport or driver’s license number.

Each account number is made up of eight to twelve digits and/or letters and is different for every account. So, a checking account and a savings account for an individual at a bank will be different, but the routing number—in most cases—will remain the same.⁴

There are many options to locate an account number:

Log in to the account through an online portal. A bank’s web system will have a link to locate an account number once you’re securely logged in.

Again, if you have bank-issued checks, the account number on a check is located at the bottom of the check and is the middle set of numbers. The sequence of numbers of a paper check is: the routing number, the account number, and the check number.

Check a monthly statement for the account number. Though many banks may hide half or all but the last four digits on the statement, some banks still print the entire number.

If all else fails, visit or call the bank. With proper identification, any bank will tell you the number for your account.

A great alternative to send money abroad is Wise. It can be faster and cheaper than a wire transfer, and there’s no need for SWIFT or BIC codes. Sending money online with Wise lets you send money at the mid-market exchange rate and avoid exchange rate markup charges.

To save on fees, you can also use your bank’s routing number and account number to add funds to a Wise Multi-currency Account. With your Wise Multi-Currency Card, you can spend money or use an ATM in the local currency and avoid Dynamic Currency Conversion fees from foreign banks. There’s no annual card fee, and you’ll always get the mid-market exchange rate!

Please see Terms of Use for your region or visit Wise Fees & Pricing for the most up to date pricing and fee information.

Sources:

All sources checked on 16 February 2021

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Guide on how to buy world cup tickets 2026: official sales, signup tips & tricks, resale safety, and key dates to secure seats.

Interested in Remitly Flex? Find out everything you need to know, including key features, costs, and limits.

Read on for everything you need to know about sending and receiving international wire transfers with Abound.

Receiving a large international wire transfer in the US? Here's a guide on the fees, time, and what you should give to your sender overseas.

Read on for everything you need to know about sending and receiving international transfers with GCash.

Read on for everything you need to know about sending and receiving international wire transfers with Remit2Any.