How to buy FIFA World Cup 26™ tickets: Step-by-step guide

Guide on how to buy world cup tickets 2026: official sales, signup tips & tricks, resale safety, and key dates to secure seats.

When it comes to making international bank transfers, there’s a lot of information to take in. Every bank has its own slightly different processes, requirements and fees.

In this guide, we’ll take a look at how to transfer money from BB&T to another bank overseas. This includes info on BB&T international wire transfer fees, exchange rates and more.

We’ll even show you an alternative which could save you money - the Wise Account. But more on that later.

| 💡 Disclaimer: BB&T merged with SunTrust to become Truist Bank in 2019. If you’re a BB&T customer, it’s likely that your account will be transitioned over to Truist, if it hasn’t already. This means some of the information here may now be out of date, and you’ll need to check with Truist for the latest fees and terms for making international wire transfers. |

|---|

Unfortunately, it isn’t free to make a BB&T personal wire transfer. There’s an upfront fee to pay, and you’ll also need to account to any exchange rate markup.

Banks often add a margin to the exchange rate, which is on average a spread of an additional 4-6%. In addition, there are normally 1-3 intermediary and recipient banks who also charge fees.

Those costs can add up. Fast.

To make sure you really know what you’re getting, compare the exchange rate you’re being offered with an online currency converter to find out how much your international transfer is really costing you.

| BB&T international transfers | Regular fees¹ |

|---|---|

| Incoming international transfer | $18 |

| Outgoing international transfer | $65 |

| Additional fees may apply | See Additional Fees section below |

Sending or receiving international transfers in a different currency means that, somewhere along the line, the currency needs to be converted. This can be done by either at the recipient bank or one of the intermediary banks, for example.

When BB&T converts your money, they say the exchange rate may fluctuate between the time you start a transfer and the time it’s completed.²

That means the person receiving the transfer will see less money arriving in their account, because of the markup the bank keeps on the conversion.

BB&T exchange rates are available on its website, along with the option to subscribe to a mailing list to receive a daily foreign exchange rate update. If BB&T is doing the conversion, you can use an online currency converter to compare its rates to the mid-market rate.

Before you get ready to transfer money, make sure to double-check with BB&T’s customer support whether your account is eligible for setting up international wires.

International transfers can sometimes come with other fees, especially if you need to recall or trace a transfer. Here are some of the BB&T transfer fees you need to know about:

| BB&T international transfer | Additional fees¹ |

|---|---|

| Stop/recall international payment | $30 |

| Amendment of an international payment | $20 |

| Tracing of an international payment | $20 |

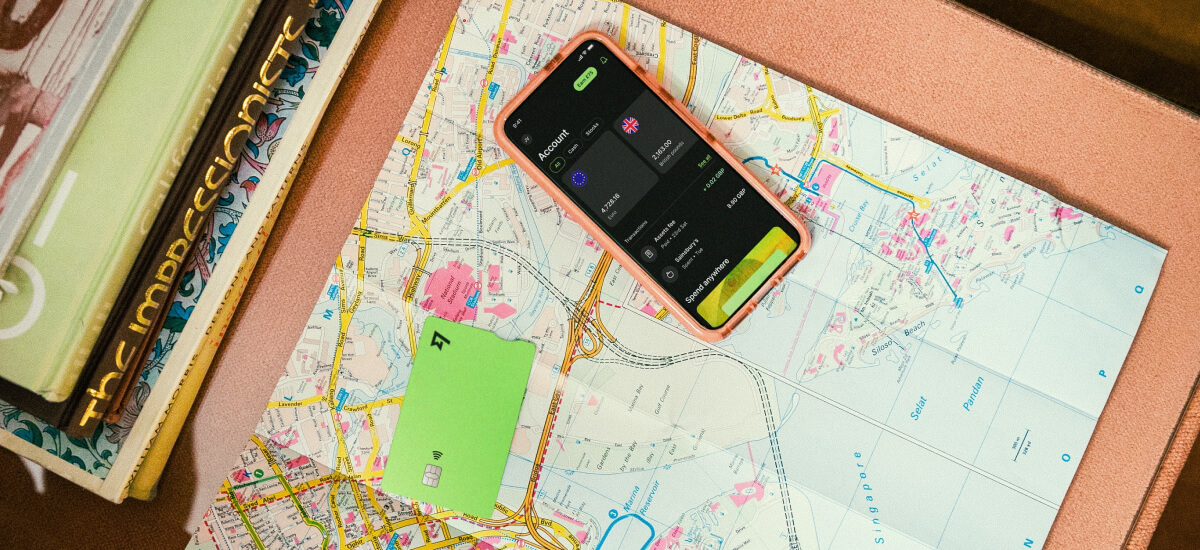

If you’d prefer to swerve those high bank fees and exchange rate mark-ups, send money with Wise instead.

With Wise, you can send money all over the world for low, transparent fees³. What’s more, you’ll always get the mid-market exchange rate. There are no mark-ups, hidden costs or subscription charges.

Open a Wise Account online, and you can manage your money in 50+ currencies at once. You can also receive international transfers using your own account details for major currencies.

BB&T offers a number of ways to transfer money internationally:

As it’s not clear from their website whether international wires can be made from all personal bank accounts, make sure to double-check with BB&T beforehand.

Here’s how to wire money with BB&T using online banking:

BB&T usually processes international wire transfers in real time, provided you initiate the transfer before the cut-off time of 5pm ET on a business day⁴.

If you submit your transfer after that time, or on a weekend or bank holiday, it will be processed the next business day⁴.

Keep in mind that after BB&T has processed the transfer in their system, it also has to be processed by any intermediary banks that are involved, as well as the recipient’s bank.

The time it takes to process your transfer can vary depending on the country and bank you’re sending to.

Still have questions about how to transfer money to another person's account with BB&T? Get in touch with BB&T’s customer support team.

Phone numbers and email addresses will vary by location, though, so check online before getting in touch.

After reading this guide, you should have all the information you need to use BB&T to transfer money to another account overseas.

We’ve covered BB&T foreign transaction fees, exchange rates and how to set up a payment.

As we’ve discovered, though, sending money internationally with a traditional bank like BB&T isn’t always the cheapest option. You could save a bundle by going for a cheaper alternative like Wise, where transfers are secure, quick and convenient too.

Sources checked on 9 November 2022

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Guide on how to buy world cup tickets 2026: official sales, signup tips & tricks, resale safety, and key dates to secure seats.

Interested in Remitly Flex? Find out everything you need to know, including key features, costs, and limits.

Read on for everything you need to know about sending and receiving international wire transfers with Abound.

Receiving a large international wire transfer in the US? Here's a guide on the fees, time, and what you should give to your sender overseas.

Read on for everything you need to know about sending and receiving international transfers with GCash.

Read on for everything you need to know about sending and receiving international wire transfers with Remit2Any.