What is the 90 day rule on Airbnb?

What is the 90 day rule on Airbnb? Learn all about rules and restrictions for using your London-based property to make passive income with short-term rentals.

If you receive a check, you won’t be able to cash it in until you endorse it.

Endorsing in this context means signing the back of the check. If you don’t endorse a check, the bank won’t be able to process it.

There are different ways to endorse a check depending on how the check has been written and what you plan to do with it.

This post will explore all three endorsement methods and talk you through how to use each to process your check.

| 💡 Next time you need to send or receive money, avoid confusing processes and try Wise. You can easily transfer, convert and manage your money in just a few clicks. |

|---|

With online transfers becoming increasingly popular, it’s understandable if you don’t know how to cash a check.

So, what is the correct way to endorse a check?

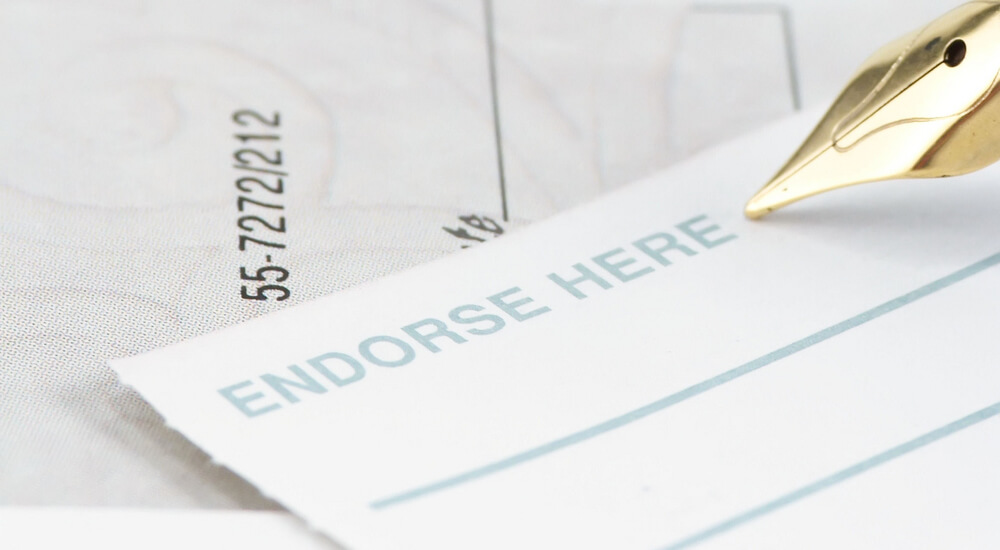

First, find the endorsement area on the back of the check. You will see the words ‘endorse check here’ in capital letters and a line with a blank space above it. This is the line you want to sign to endorse the check.

Before you pen your signature, double-check that the name on the front of the check matches the signature on the back. It’s also important to use either a blue or black pen for the signature.

Check that all the details on the check are correct and that the check is valid.

Go over your bank’s guidelines to be sure that you’re endorsing the check correctly.

Typically, the person receiving the check will need to endorse it. Of course, the person writing the check will need to sign it too, but their signature will go on the front of the check.

But what if the check is made out to you and other recipients?

If this is the case, every payee will have to sign the back of the check to endorse it correctly.

For businesses, the only person who can endorse a check is the company’s owner, unless another employee has been authorized to manage the business finances.

The reason check endorsements exist is to protect the money of the payer and ensure the intended recipient collects it.

You can think of it like signing for parcels and packages that you receive, except in this case, it’s money you’re collecting.

The moment you sign the back of the check, you give your bank the green light to collect and process the payment.

It is possible to sign a check over to someone else, but it’s often ill-advised.

You can do it, though, and here’s how:

Bear in mind that some banks won’t allow you to sign a check over to someone else, due to fraud concerns.

The three ways to process a check are blank, restrictive, and special endorsements.

If you want to endorse a check quickly, all you have to do is sign above the line on the back of the check and leave it at that.

This is known as a blank endorsement.

While this might be the fastest and most convenient way to endorse a check, it can be a risky method too. It’s recommended that you only endorse a check this way if you’re close to your bank and plan on depositing it shortly.

With a restrictive endorsement, you have control over which bank account the check ends up in.

To do a restrictive endorsement, sign the back as usual, but also write your account number and something along the lines of ‘For deposit only to account XXX.’

That way, there’s less risk of the money falling into the hands of someone else.

A special (third party) endorsement is one in which you sign the check money off to a third party.

To do so, you must write ‘Pay to the order of (recipient’s name)’ and then sign the check on the back as normal.

Yes, there is a way to deposit a check without endorsing it.

If you decide to do so, you’ll need to check with your bank first to make sure it’s possible. If it is, then this can be a way to hide your identity and process the check anonymously.

Your details won’t show up on images of the processed check online, so there’s no risk of giving away your account number or signature.

You can also endorse a check using your mobile phone if you’d prefer.

The best way to do this is to follow the instructions provided by your bank’s app, as they may vary from one another. You will typically be required to take a photo of the check.

Usually, if you endorse a check via mobile, you will have to do a restrictive endorsement. Be sure to write ‘For mobile deposit only’ in the endorsement area, so that the bank knows what type of endorsement it is.

If you don’t include a phrase to this effect, a bank can reject the endorsement attempt.

It’s important if you’re doing a mobile endorsement to check that all the details are correct before you hit ‘send.’

Sending and receiving checks can be a headache and one that’s easy to avoid.

Wise allows users to easily and securely send money online or through the Wise app, often in a matter of seconds.

Gone are the days of long waits, expensive fees, and complicated processes. If you want to send and receive money without the usual frustrations associated with checks, give Wise a go.

Register for free and start saving 💰

| 🤓 More useful articles you’ll love |

|---|

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

What is the 90 day rule on Airbnb? Learn all about rules and restrictions for using your London-based property to make passive income with short-term rentals.

Have a look at our guide that covers how to manage your Airbnb remotely, from automating the check-in process all the way to handling local regulations.

How much do Airbnb property managers charge? Here's an in-depth overview to find out all about the management fees and charges that might arise.

How to report Airbnb income on tax return? This guide will tell you all about reporting your rental income for both domestic and international properties.

Get a full overview of the best Airbnb tax software systems that will help you easily track and manage expenses for your rental property.

How much is Airbnb tax for American hosts? Take a look at our in-depth guide on this topic and simplify your taxation process while staying compliant.