How to buy FIFA World Cup 26™ tickets: Step-by-step guide

Guide on how to buy world cup tickets 2026: official sales, signup tips & tricks, resale safety, and key dates to secure seats.

Checks were previously the most common way to make payments. While checks are still being used today, in the digital era, faster and more convenient methods are also available. One example is Wise, which is a cheap and transparent way of sending money overseas. It takes no time to open an account, and you could save up to 7x compared to regular financial institutions.

In this article, we’ll show you the basics of writing a check. While it’s fairly simple to fill out a check, there are some things to watch out for. So let’s begin!

| 📝 Table of contents |

|---|

Here’s how you fill out a check.

1. First, fill in the date. This will be written in the top right corner of the check.

2. Next, write down the name of the recipient. This is supposed to go on the line next to the words “Pay to the order of”.

3. Now, fill in the amount in numerical format. You’ll find this box next to the dollar sign. To avoid fraud, make sure to leave no blank space in the box – so no third party can change the amount of dollars and cents you’d like to pay. To prevent this, it is a good idea to put horizontal lines in the box before and after the number.

4. Your next step is fill in the dollar amount in words. Just like the numerical format, make sure that nobody can change the amount. A good tip is to write the amount as far to the left as you can.

5. There is also a memo section that can be used. This isn’t vital, but it can be useful if there’s a specific reason you are paying the check. So, it’s a good idea to use the memo line to remind you why you wrote the check. Plus, it will allow you to balance your books much easier at a later date.

6. Finally, you need to sign the check. All you have to do, is to just sign your name on the line in the bottom right corner of the check.

| ⚠️ It should also be noted, that if you want to write cents on a check, you have to present that it in fractional format. So, if you were filling in a check for $300.50, it would be written as 'three hundred dollars and 50/100'. |

|---|

To make sure the money arrives safely to the payee, we’ve collected some tips and tricks for you about check writing:

Print everything. Writing in cursive might look pleasing to the eye, but it can also sometimes be hard to read. This is especially the case where things move quickly in a bank. By printing your writing, it will look clearer, reducing the chance that an error happens.

Never give out blank checks. Even if you fully trust the person you are giving it to, it could be very problematic if they lose it, or it gets stolen. Always fill in everything to make sure you’re fully protected.

Make sure you check your checks (pun intended!). Keep checking until you are absolutely sure that you have all the details correct such as the date, recipient and the amount.

Get your signature the same every time. Practice if you need to, just make sure to do it before writing the check – instead of doing it on the check.

Don’t forget to track the payment in your check register.

| To minimize the chance for fraud and make sure the money gets to the recipient in a fast and transparent way, a great option can be something completely digital such as Wise. You can send money abroad fast with a small fee and the mid-market rate and save up to 7x compared with regular banks. Plus, it takes just a few minutes to get a free account. |

|---|

Get a Wise account in minutes ⏱

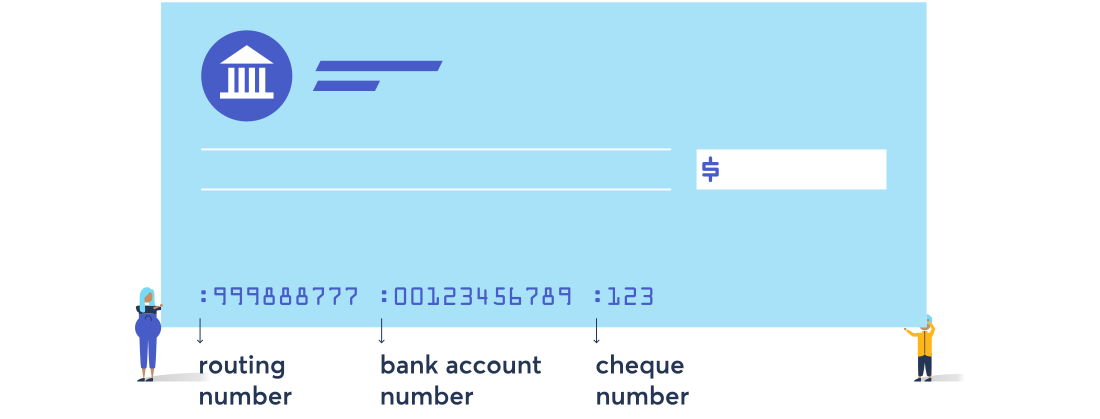

When you’re filling out a check, you’ll notice three number sequences at the bottom of the check – see our check example above! While you don’t have to know what these are when learning how to write checks, it’s still important to be aware of these numbers as it will help you spot if someone is trying to pass off a fraudulent check.

Routing numbers are the first 9 numbers that you will see at the bottom of the check, which acts as an identification number for your bank: each bank has their own unique routing number. You can always check the routing number of your bank, if in doubt.

The account numbers are the numbers immediately to the right of the routing numbers, and it’s the number for your bank account.

If you need more information about the difference between routing vs account numbers, we also got you covered.

The check number is the number that identifies how many checks have been issued. This can be located at both the top right and the bottom right of the check itself.

It’s actually quite simple to write a check once you’re used to it. Just remember to fill in every section of the check in full and always check details like the date, payee, amount and your signature. Also, keep in mind to write the cents for the written version of the amount. Once you have perfected the above tips, then writing a check will be a cakewalk.

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Guide on how to buy world cup tickets 2026: official sales, signup tips & tricks, resale safety, and key dates to secure seats.

Interested in Remitly Flex? Find out everything you need to know, including key features, costs, and limits.

Read on for everything you need to know about sending and receiving international wire transfers with Abound.

Receiving a large international wire transfer in the US? Here's a guide on the fees, time, and what you should give to your sender overseas.

Read on for everything you need to know about sending and receiving international transfers with GCash.

Read on for everything you need to know about sending and receiving international wire transfers with Remit2Any.