December fee review — here’s what’s changed

See the full summary of the December 2025 fee review. Find out how specific adjustments affect the cost of transfers on a range of routes.

Back in April 2023, we launched the USD interest feature for our US customers. Today, we’re excited to expand this offering to additional currencies: GBP and EUR.

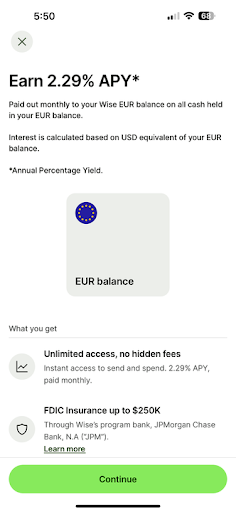

Eligible US customers with a Wise Account are now able to opt-in to earn interest on GBP balances at 3.22% APY and EUR balances at 2.29% APY¹, while continuing to earn interest on USD balances at 4.85% APY (a new, higher rate!).

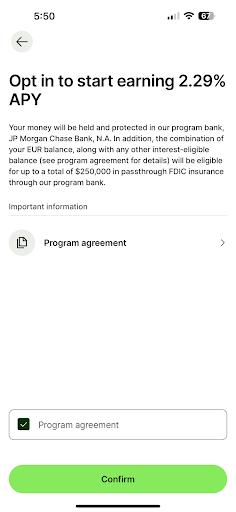

Customers who opt-in to receive interest on GBP, EUR or USD balances will be eligible for passthrough FDIC insurance up to $250,000 through Wise’s program bank, JPMorgan Chase Bank, N.A². This $250,000 includes all balances of USD, GBP and EUR combined and held with Wise and opted into the feature.

How this feature works

Interest for GBP and EUR balances is accrued daily and paid monthly. It is calculated based on the USD equivalent of these balances. Wise will convert GBP and EUR balances of customers who opt-in to the feature into USD; after opting in to our interest feature, customer funds will accrue interest at the provided rate depending on their balance’s currency.

When this interest is paid out, these funds are converted back to GBP or EUR, and customers will see these amounts reflected for their respective balance. All conversions of currencies will be done at the mid-market rate.

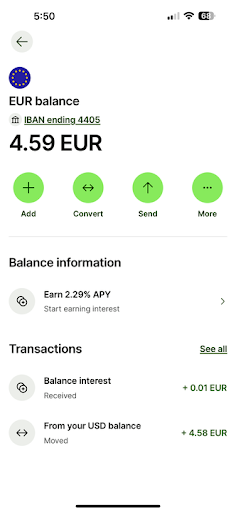

Check out the images and video below to see how this works in action:

|  |  |  |

The opt-in process

Opting in to this feature is easy — all you need to do is open the Wise app or website, go to your GBP or EUR balance, and select “Earn Interest.” As part of this process, you will need to verify your SSN or EIN to be eligible (and for tax purposes) and will need to opt in each balance separately. You can then use your account as normal, all while earning interest on your GBP, EUR, and USD balances.

Business customers are also eligible to opt-in for the GBP and EUR interest features. As many small businesses look to maximize their global operations, this new feature is a great option.

What’s next for interest in the US

These interest features align to our mission of transparency in the finance services industry. We continue to believe the interest our customers’ money is making should be passed back to them when possible. And we’re glad to see our customers agree with us — 50% of USD balances held by US accounts are currently accruing interest.

At Wise, we will continue to focus on providing easy, convenient and versatile options for you to manage your money internationally. We look forward to building more products and features that meet your needs.

The interest rate offered for USD, GBP and EUR balances may change and if this happens it will be communicated to customers directly. If you have further questions, please check out our FAQ here and find out more about the feature here.

Please note the interest feature is not currently available to New York and Alaska customers.

¹ Annual Percentage Yield (APY) - rates shown are true as of 01/01/2024. See_ Program Agreement for details.

² The current Program Bank is JPMorgan Chase Bank, N.A., see Appendix 1 of the_ Program Agreement for the most updated list of Program Bank(s). Eligible customers must opt in to the interest feature. Participants will have the balance of their USD funds held in their Wise Account “swept” into a Federal Deposit Insurance Corporation (“FDIC”) insured interest-bearing account at one or more participating banks (each, a “Program Bank”) that will hold and pay interest on the deposit funds. For a complete list of Program Banks, please see Appendix 1 of the Program Agreement. For more information on FDIC insurance coverage, please visit www.FDIC.gov. Customers are responsible for monitoring their total assets at each of the Program Banks to determine the extent of available FDIC insurance coverage in accordance with FDIC rules. The Program is not intended to be a long-term investment option, checking or savings account, investment contract or security.

For customers opted in to receive interest on EUR and GBP balances, the FDIC passthrough insurance provided by our program bank is for up to the equivalent of $250,000 in total for your USD, EUR and GBP combined balance amounts (collectively, the "Eligible Balances").

See the full summary of the December 2025 fee review. Find out how specific adjustments affect the cost of transfers on a range of routes.

This new test feature from Google will make transparent and convenient international payments more accessible in the U.S.

From time to time, you might make a purchase with your Wise card and run into an issue — maybe something you bought didn’t arrive, wasn’t as described, or you...

Our mission is to lower the cost of moving money across borders. And since we started 13 years ago, we’ve made good progress, particularly over the past...

We're thrilled to announce that Wise has officially launched in Mexico, revolutionizing the traditional landscape of international money transfers. With this...

Study abroad rates in the US have been on the rise following a sharp decline during the pandemic. As more American college students seek out new experiences...