Where to get a money order: 5 options for you

Looking to buy a money order near you? Read on to discover five available options, including your post office, bank or credit union, and convenience store.

Moving to Singapore? Catherine Treyz, writer and American abroad, breaks down 5 important tips that will help set you up for financial success.

One of just a few city-states in the world, Singapore has a tropical climate year-round, 4 official languages (including English), and is known among international foodies for Michelin star earning food stalls (and a chewing gum ban).

Sarah Shumate, who used to live in Singapore, tells Wise:

“Singapore is a great place to base yourself if you're looking to travel around Southeast Asia and also want to live in a fun, dynamic city with plenty of ‘western’ comforts. Singapore has it all - beautiful neighborhoods, reliable public transport, excellent healthcare, exciting nightlife, and plenty of events, shopping, and restaurants to keep you busy on weekends.”

The city-state also has a wealth of greenery and, well, money. But just because Singapore is a wealthy place, that doesn’t mean that Americans living there should be relaxed with their spending. Here are 5 financial tips for your time in Singapore:

Surrounded by the luxury of Singapore and duped by the affordability of aforementioned food stalls, it’s understandably easy for one to forget to budget.

But, as the cost of living in Singapore is quite high, consider this your gentle reminder. While living in Singapore, it’s still important to budget for necessary expenses, long-term savings/investments, and more.

The Singaporean government has a website called MoneySense that aims to help Singapore residents manage — and understand — their finances. MoneySmart is a popular financial blog that also lines up what residents need to do to maintain or improve their financial situations. Both websites are just a couple of what appears to be many Singaporean websites focused on budgeting.

If you don’t already have one, you will likely you’ll want to look into getting a local bank while living in Singapore.

When doing so, it’s important to acknowledge your situation — like are you freelance or a salaried employee — in order to make the right decision for you. Different banks, like in the States, will have different offerings regarding ATM withdrawals and interest rates.

DBS Bank, UOB, and Citibank appear to be popular for expats and Singaporeans alike, with the first two having ATMs and locations in many locations.

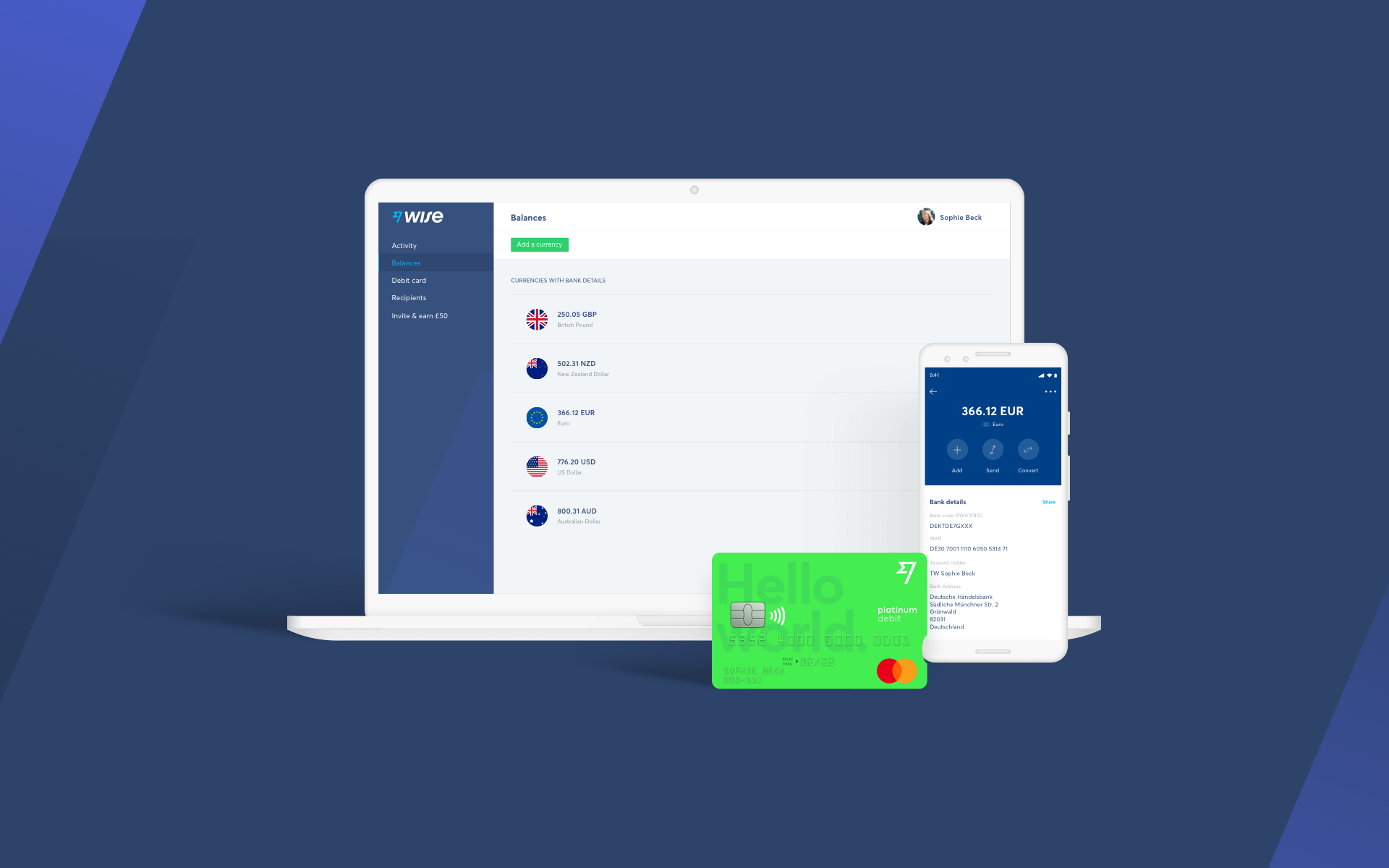

It is almost inevitable that you will need to dip into your American savings while in Singapore — that’s where Wise can help.

With just a few clicks, Wise provides an affordable alternative to traditional bank transfers — and your money often arrives in less time than a cross-Pacific flight takes. Wise also eliminates the hidden fees that are notoriously associated with traditional bank or wire transfers.

Additionally, Wise now provides the Wise account that allow account holders to receive and convert currencies in one spot, which may be helpful if, for example, you’re a freelancer and invoice international clients. You can also create and send your invoices by using our invoice generator, or the downloadable free invoice template in Google Docs or Google Sheets, Word, PDF or Excel.

While there are certain mechanisms in place that seek to limit double taxation, it is still highly advised to speak with professionals on tax matters.

With the introduction of the Foreign Account Tax Compliance Act (FATCA), US citizens and Green Card holders living in Singapore must file taxes to both American and Singapore authorities. Speaking with a tax professional in the States, Singapore, or both, will help you manage your taxes properly. If you don’t file your foreign income with the US, there’s the risk of racking up expensive penalties.

You read that right. In Singapore, food stalls at hawker centres sell not just cheap food, but delicious cheap food.

Restaurants in Singapore can still be pricey, but the hawker centers and markets offer great alternatives. Sarah Shumate tells Wise:

“If you're not the type who enjoys cooking at home, I suggest you get familiar with your local hawker center. Eating out in Singapore, particularly if you enjoy a drink or two with dinner, can get prohibitively expensive over time. If you stick to local hawker stalls, though, you can save a load of cash AND discover an endless array of delicious dishes to try. Our personal favorite is Newton Food Centre, but to be perfectly honest, we've never had a bad experience at any of the hawker centers in Singapore, so get out there and try a few until you find your favorite!”

Also, there are a few useful apps and guides to help individuals better save on food. Look at Tap for More, for example, which uses a point systems at select stores.

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Looking to buy a money order near you? Read on to discover five available options, including your post office, bank or credit union, and convenience store.

Here’s everything you need to know about sending money orders with H-E-B. We cover fees and costs, limits, and how to fill one out. Read on to learn more.

Here’s everything you need to know about sending money orders with CVS. We cover fees and costs, limits, and how to fill one out. Read on to learn more.

Torn between XE and OFX? Read our guide and compare your options

Torn between XE and OFX? Read our guide and compare your options

Everything you need to know about OFX's transfer limits