How to open a foreign currency account in the US

Wondering how to open a foreign currency account in the US? Struggling to find information? Read on to find out what you need.

There are many online bank accounts available with different fees, rewards, and features. This can make it tough to choose which one to use.

This guide will introduce some of the best online bank accounts and help you decide which one is best for you.

Before we start, a word – let’s talk about an alternative to banks, which could help you cover your banking needs.

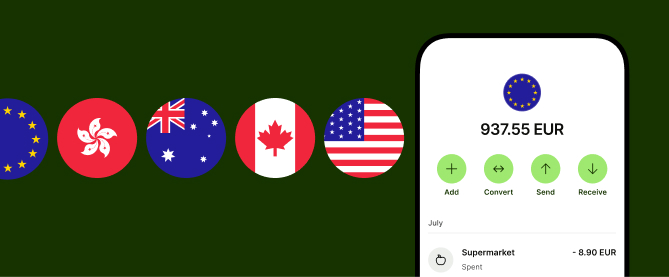

Wise is not a bank, but rather a money services business (MSB) that allows you to send money overseas and manage funds held in different currencies.

You can easily open and manage a Wise Account online, in just a few steps. There’s no minimum balance requirement and no monthly fees. You’ll also get the following features:

There’s even a handy Wise app, so you can manage everything from your phone.

Please see Terms of Use for your region or visit Wise Fees & Pricing for the most up-to-date pricing and fee information

The choice of which bank is best comes down to what you need from an account.

Each bank offers different benefits and features and will suit different customers. It can be helpful to work out what you need from an account and choose the one that best matches this.

| Top 10 summary |

|---|

| Useful for | Fees and APY¹ |

|---|---|

|

|

Axos is an online bank that opened in 2000. The Axos Rewards Checking account has one of the highest APY of the online bank accounts here.

There are also no monthly fees, overdraft fees, or ATM usage fees (and Axos will rebate fees for any domestic ATM). But there is a minimum $50 deposit to open the account.

| 🔍 You can see more details about Axos, the Rewards Checking account, and other accounts in our detailed Axos Bank review. |

|---|

| Useful for | Fees and APY² |

|---|---|

|

|

Varo Bank is a relatively new online bank, founded in 2015. The Varo Online Checking account offers no fees, with no minimum balance requirement. It uses the Allpoint ATM network with a large ATM network in the US and overseas.

The Varo account comes with a linked savings account which offers an APY of up to 3% for balances under $5,000.

| 🔍 Read more about this and other Varo accounts in our full Varo Bank review. |

|---|

| Useful for | Fees and APY³ |

|---|---|

|

|

Ally Bank is another relatively new internet bank, started in 2009. Its Interest Checking account is a good standard no-fee option, but notably, it charges for overdraft use.

Ally Bank uses the Allpoint ATM network in the US and overseas, but goes one step further with a rebate of up to $10 per month for ATM usage outside this.

| 🔍 Read more in our Ally Bank review. |

|---|

| Useful for | Fees and APY⁴ |

|---|---|

|

|

Discover is an older bank (established in 1985) that offers online accounts. It does also have one physical branch.

The standard Discover Checking Account has no monthly fee but does not pay interest. Discover does offer an online savings account at 4% APY though⁴.

Standout features are US ATM access – with a network of 60,000 locations. It also offers a debit card with 1% cashback on purchases (up to $30 per month).

| 🔍 You can read more in our full Discover review. |

|---|

| Useful for | Fees and APY⁵ |

|---|---|

|

|

Chime is a mobile-only online bank. It offers a standard account with no fees. There is also no interest payment – although it does have a linked savings account with the option to automatically transfer funds.

Chime offers fee-free access to a $200 overdraft facility with no minimum deposit requirements.

For ATM access, Chime uses the MoneyPass and Visa Plus Alliance (and allows access at $2.50 to other ATMs).

| Useful for | Fees and APY |

|---|---|

|

|

Capital One provides an online 360 Checking Account. This is a good option for a bank moving online, with some interest paid and no account fees or minimum payments required. Overdraft fees can add up, though.

For ATMs use you can use Capital One ATMs (these allow check deposits as well), and the Allpoint ATM network.

| 🔍 If you plan to use Capital One abroad, then it's also worth reading up on the foreign transaction fees. |

|---|

| Useful for | Fees and APY⁶ |

|---|---|

|

|

NBKC is a regional Kansas City bank, but online accounts are available nationwide. It offers some of the lowest fees out of the banks featured here, whilst still paying interest.

The account also has good ATM access. It uses the MoneyPass network (with 34,000 locations), but will also cover up to $12 per month of other ATM fees.

As a regional bank, customer service is more limited than with larger online banks. Live chat for example is only available during normal weekday banking hours.

| Useful for | Fees and APY⁷ |

|---|---|

|

|

Chase is a well-known bank, and its Total Checking account is a good option for those wanting to combine an online account with branch access.

Fees can be high if you do not make regular payments to keep the fee-free use.

| 🔍 If you plan to use Chase internationally, it's also worth knowing the Chase debit international fees. |

|---|

| Useful for | Fees and APY⁸ |

|---|---|

|

|

PNC is a regional bank, with over 2,000 branches in the Northeast, South, and Midwest. It offers a good option for those in these areas.

Outside these areas, you can use ATMs (it has a network of 18,000).

Choosing an online account over a bank branch account can bring many benefits. You should get overall lower costs and higher returns.

There are limitations, but these can be minimized with consideration of the best account and what you need.

There are plenty of things to consider when looking at an online account. Choosing the ‘best’ account depends on what features you will make the most use of.

As online banks typically do not offer branch access (although some do have partners for this), ATMs are an important consideration.

All these accounts offer ATM access, but the availability of ATMs varies widely.

Banks use different ATM networks, which can be stronger in some areas. Some accounts offer rebates for even wider use beyond these networks.

It's a good idea to consider which network is best for you when choosing an online bank.

Online banks generally offer low fees and good interest rates, but these can often vary widely. There may be promotional higher rates on offer or cashback from card purchases that can boost returns.

Without branch access, you will need to use telephone or online chat features for queries and customer service. Check what channels are used, and what the opening times are.

Many banks offer a range of other accounts, such as savings accounts or certificates of deposit. This is particularly useful if you have larger balances that you want to keep in the same place and earn better returns.

While online banks usually offer lower fees, there will still be charges for some services. Overdraft fees are one important example – some banks allow a certain level of free overdraft use, while others charge.

International fees are another. If you regularly make international transfers or payments, fees can be high.

Like all banks, online-only banks should also be registered and insured.

Make sure any you choose is insured by the Federal Deposit Insurance Corporation (FDIC), which will provide cover in the event of bank failure. Or for credit unions, look for National Credit Union Administration cover.

Most online accounts have high fees, and exchange rate markups for conversions and payments overseas.

If you send money abroad regularly, consider a Wise Account. Wise allows low-cost foreign transfers and offers the Wise debit card for overseas use.

Sources:

All sources checked 20 June 2023

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Wondering how to open a foreign currency account in the US? Struggling to find information? Read on to find out what you need.

Considering closing your foreign bank account? Discover the tax implications, benefits, and steps involved in making this decision. Learn more here.

Learn how to close your ADCB account from abroad with this comprehensive guide. Discover the steps, required documents, and tips for a smooth process.

Learn how to close your UAE bank account from abroad with this comprehensive guide. Discover the steps, required documents, and tips for a smooth process.

Learn how to close your AIB bank account from abroad with this comprehensive guide. Discover the steps, required documents, and tips for a smooth process.

Learn how to close your Emirates NBD account from abroad with this comprehensive guide. Discover the steps, required documents, and tips for a smooth process.