Outsourcing to Romania: Clear Guide & Top Tips for US Businesses

Outsource to Romania with confidence. Discover the benefits, costs, and practical steps for US businesses.

| This piece has been written in collaboration with Esther Friedberg Karp, an esteemed bookkeeper and QuickBooks ProAdvisor. |

|---|

Financial statements are a key analysis tool used by businesses, investors, creditors, and others to evaluate the financial performance of a business.

Understanding the differences between the balance sheet vs income statement (as well as their uses) plays a huge role in understanding and assessing the financial health of a business.

Research has found that businesses that practice strong financial management, such as analyzing financial statements, tend to have better financial health overall.¹

According to recent statistics, businesses with poor financial management are less likely to survive, with over 50% of businesses failing within five years of starting.²

Financial statements like a balance sheet and income statement - as well as a cash flow statement - are crucial for analyzing a company’s financial performance.

They can provide insight into the value of a business and its profitability to help the business forecast and plan for the future, avoid financial distress, and improve operations.

Get your free Wise business templates

| Table of contents |

|---|

| Key differences | Balance sheet | Income statement |

|---|---|---|

| Usage | Helps to understand a company’s liabilities and whether it is liquid enough to pay its financial obligations | Provides insight on a company’s profitability versus its expenses and how a business is performing |

| Reported items | Includes assets, liabilities, and equity | Includes revenue, cost of goods sold, and expenses to understand profit and loss |

| Timing | Looks at a specific time point | Looks at a period of time |

| Metrics | Assets, liabilities, and equity are compared to one another to understand how liquid a business is | Looking at the distribution gross profit, operating income, and net income |

| Creditors | Looking at whether to extend more credit to a business based on its current balance | Used to understand whether a business is sufficiently profitable enough to pay back its debts |

To better understand the difference between the balance sheet and the income statement, let’s look at each one in more detail.

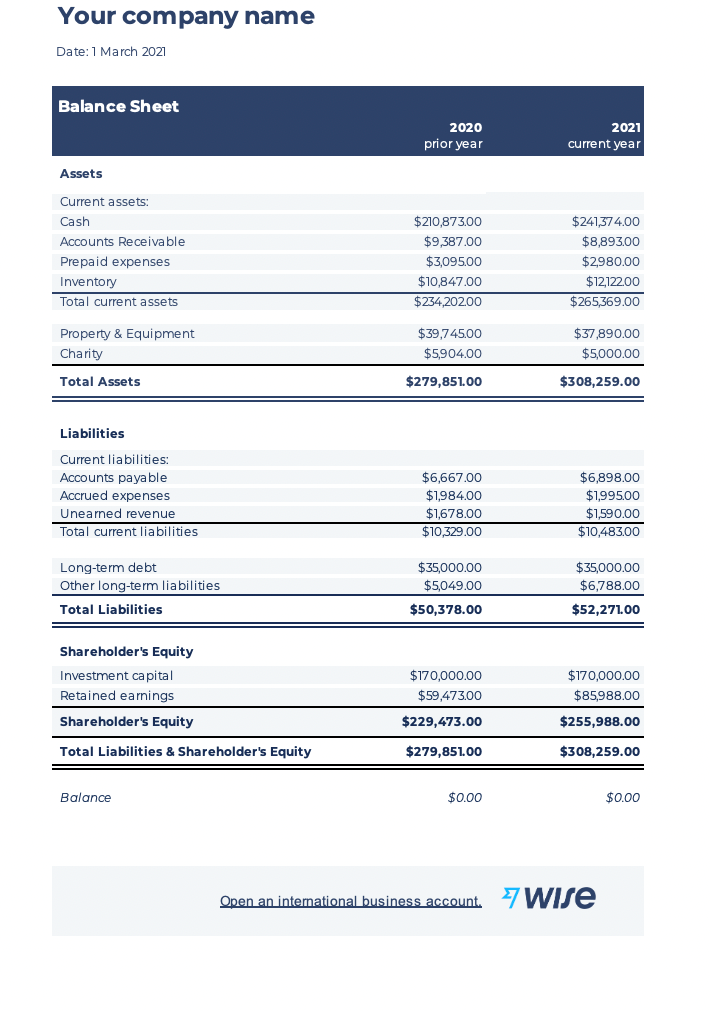

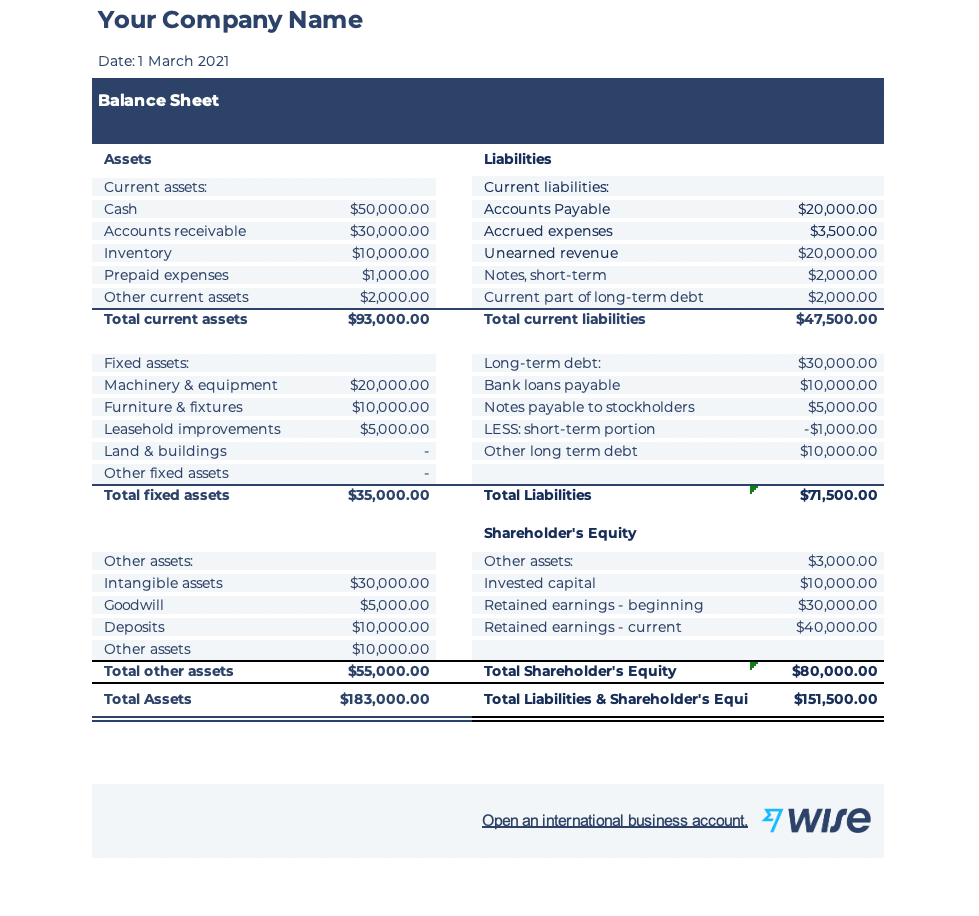

A balance sheet is a financial statement used to understand a company’s assets and equity versus its liabilities.

It’s used to understand how much a company owes versus how much it owns. Balance sheets are useful to gain insight into a company’s value and whether it is liquid enough to pay off its debts.

Let’s look at a balance sheet example to understand what is included and pinpoint some of the differences between an income statement and a balance sheet.

In the examples below, you can see a simple balance sheet and a bit more comprehensive balance sheet.

The simple balance sheet is useful for getting a quick snapshot of company assets and equity versus its debts and financial obligations.

The balance sheet below is better if you’d like a deeper look at business financial health.

This template is more comprehensive so that you can understand the split among assets, liabilities, and equity in more detail.

Get your balance sheet template today

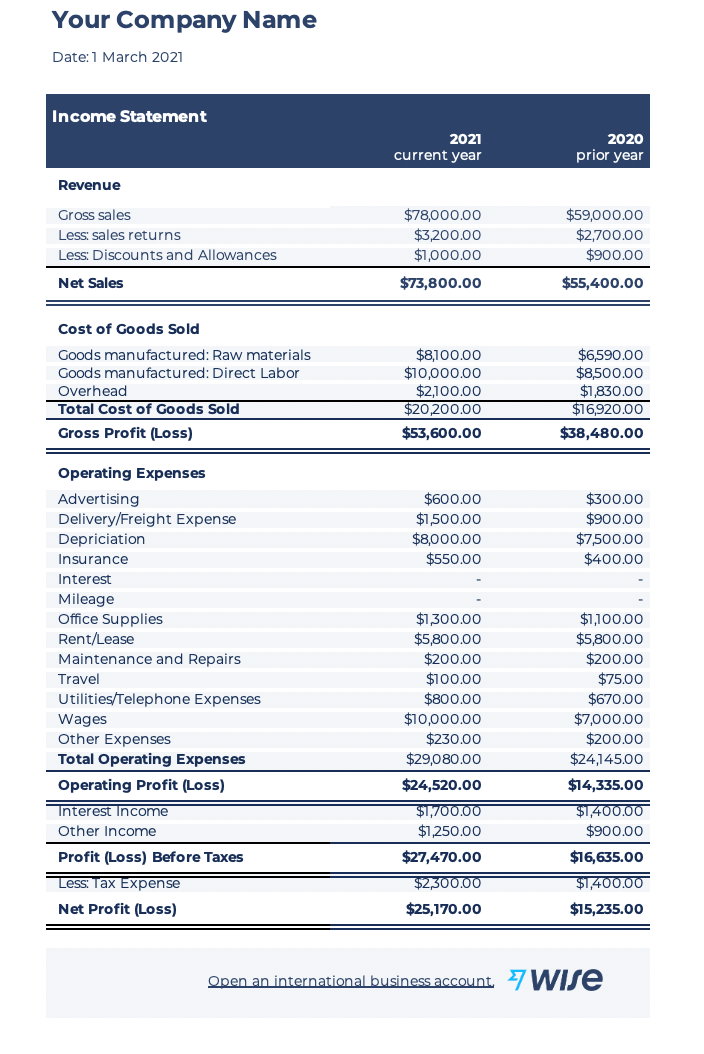

An income statement, otherwise known as a “profit and loss” or “P&L,” is a summary of a company’s income/revenue, cost of goods sold, and expenses.

All is contributing to the “bottom line,” which is either a profit or loss.

It’s used to look at company revenues compared to its various costs and expenses and ultimately the profit margins a company is reporting.

An income statement is useful for understanding how much a company makes versus how much it spends.

In the income statement example below, you can see a detailed breakdown across business areas.

The income statement looks at revenue, cost of goods sold, expenses, and tax obligations.

This way, it’s easy to see how much profit a business earns compared to its production costs and how much the business is spending on operations.

Get your income statement template today

When it comes to income statement vs. balance sheet, it’s very important to look at them together with other financial statements such as a cash flow statement.

In isolation, each financial statement only shows one part of the picture. Looking at all of the financial statements together provides a holistic view of your business’s health and performance.

Creditors usually look at financial statements such as balance sheet, income statement, and cash flow statement together when deciding whether to extend credit.

Therefore, financial statements such as a balance sheet and income statement for public companies must be reported as part of the 10-K filed with the U.S. Securities and Exchange Commission (SEC).³

Together, the statements show:

As you can see, analyzing the statements together provides deeper insight into financial health and performance.

Consistent monitoring and analysis can help uncover financial distress before it severely impacts the business.

In addition, using the financial statements, businesses can strategically plan growth and expansion while also identifying ways to cut down expenses and boost profits.

|

|

International businesses have an extra layer of complexity. Therefore, owners and other stakeholders need to understand the effect of international activities on their company’s financial health.

The income statement must show revenues and expenses, even those in other currencies, expressed in the home or operating currency of the company.

Certain accounting software can produce an income statement split by area of operation or other ways of splitting the business pie.

This can shine a light on areas where profitability is compromised or low, and lead management to make strategic changes in the company’s business model to address them (such as price changes).

The balance sheet expresses the company’s assets, liabilities, and equity at a particular point in time, and the equity includes the fiscal year-to-date net income from the income statement.

In an international/multi-currency environment, this means indicating where bank balances (even foreign ones, expressed in the home currency) are low, and where payables and receivables in various currencies are as well.

If more information is required about any particular account such as accounts receivable, special reports can be produced to spell out the details.

Also, it’s important to work with a company that minimizes bank charges and offers the most advantageous exchange rates to maximize the company’s bottom line.

That same company should make international payments as seamless as possible so that everyone gets paid in their desired currency as quickly as possible.

On top of the financial statement templates (which are pretty useful and can help you keep an eye on your business finances), Wise can help with a lot more.

Using Wise, you can easily manage international payments with your multi-currency account in more than 50 currencies - all in one place!

Get account details in 10 currencies, including IBAN, sort code, and more to get paid like a local.

With Wise, you can make the invoicing and payment process for customers easier and gain competitive mid-market rates when converting currency.

| 💡 Did you know? |

|---|

| Wise did some research, comparing their business prices to PayPal’s. The research was carried out between 6 Janaury 2021 and 14 January 2021. |

| |

Sources

All sources checked 28 December 2021

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Outsource to Romania with confidence. Discover the benefits, costs, and practical steps for US businesses.

In this US guide to buying commercial property in Singapore, navigate the process, costs, and unlock foreign investment opportunities with expert insights.

Discover the most secure and convenient online payment methods for your business.

Learn the essentials of how to invest in commercial property in the UK as a US investor.

Compare Mollie vs Stripe to find the best payment gateway for your business. Our guide covers fees, features, and integrations to help make the right choice.

Find out how to open an IBAN account with our step-by-step guide. Understand the requirements, benefits, and best practices.