Outsourcing to Romania: Clear Guide & Top Tips for US Businesses

Outsource to Romania with confidence. Discover the benefits, costs, and practical steps for US businesses.

In 2020, it was estimated that mobile POS payments totalled $2 trillion USD - which accounted for 30% of the total global transaction value of digital payments that year.¹

Having a reliable payment processor to offer payment gateways, as well as a merchant account to accept the received funds, is crucial for the success of your business.

Adyen payment processing and Stripe are two payment processors who also offer integrated merchant account functionality. In this article, the two providers will be put head-to-head for an in-depth Adyen vs Stripe comparison.

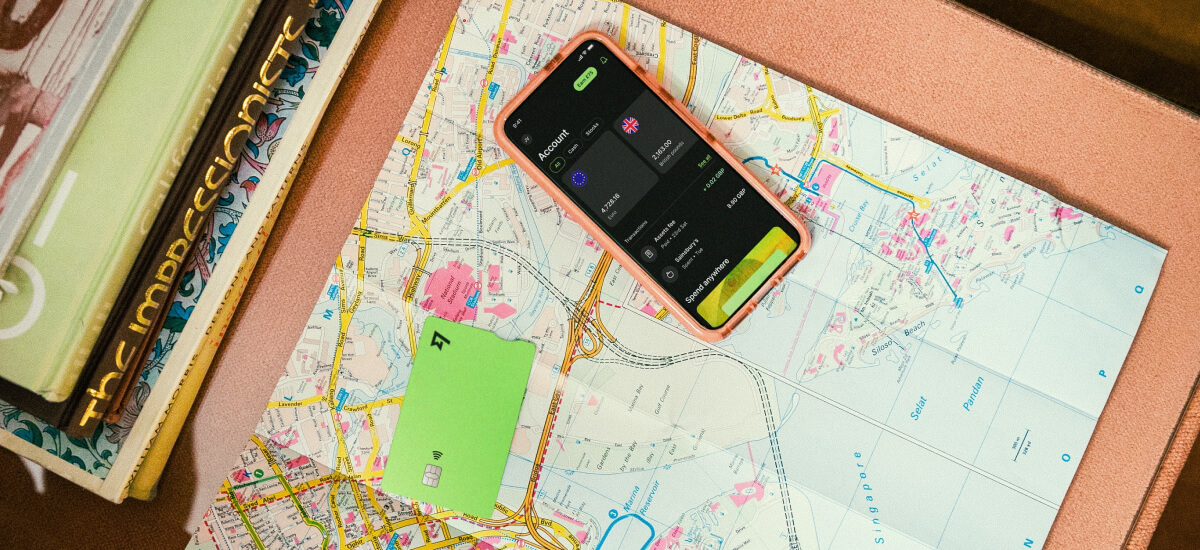

Both Adyen and Stripe support multiple currencies and are available in a variety of countries. Similarly, if you’re looking to go global conveniently, then a Wise Business account can help you out.

| With Wise Business, you can send money to over 70+ countries and hold more than 50+ currencies in your multi-currency account. You’ll also have access to the mid-market exchange rate, free of hidden fees, when sending money abroad. |

|---|

Learn more about Wise Business

Here’s a short overview of the main features of Stripe vs Adyen.

| Adyen | Stripe | |

|---|---|---|

| Availability | Available in 37 countries, supports 37 currencies² ³ | Available in 47 countries, supports 135+ currencies ⁴ ⁵ |

| Standout feature(s) | Omnichannel, unified commerce solution, simplifying control of revenue flows and financial management. Both a payment processor and merchant account provider | Payment processor with merchant account functionality, giving you developer access to its APIs. Stripe Billing offers the option of recurring payments and invoicing, avoiding the need for third-party providers |

| Transaction fees | Interchange ++ pricing (processing fee and payment method fee combined) ⁶ | 2.9% + $0.30 (online) 2.7% + $0.05 (in-person) ⁷ |

| Merchant account | Individual merchant accounts given to businesses after application is approved. Option for multiple and sub-merchant accounts | No application process required; Stripe is a merchant aggregator, giving you the functionality of a merchant account without ownership over a sole account |

| API | Customizable APIs for a range of services, from online payments to POS solutions | High customizable APIs, giving you developer access to Stripe’s functionality |

| Security | RevenueProtect builds risk profiles and databases to protect against fraud. Encryption, 3D authentication and industry specific risk management tools available ⁸ ⁹ ¹⁰ | Radar system utilises the information of partner services to prevent fraud. Certified as a PCI Service Provider Level 1 ¹¹ |

| Card | Adyen Issuing offers a variety of cards for your specific business type ¹² | Stripe corporate card available, with physical and virtual cards ¹³ ¹⁴ |

| Mobile app | Available for both Apple and Android ¹⁵ ¹⁶ | Available for both Apple and Android ¹⁷ |

Both providers share very similar functions. But there are some notable differences between Adyen vs Stripe, making them suited to different types of businesses.

Stripe is best suited to businesses looking for quick access to a payment processing solution and merchant account, without the long-winded application and approval process.

It also gives businesses a lot of flexibility in customizing their own APIs, making it an attractive option for start-ups and tech companies.

On the other hand, Adyen payment processing is a great solution for businesses with a high volume of transactions, who want the benefits that come with ownership of a merchant account, as well as revenue optimization and protection tools.

Adyen is also useful for businesses looking for better financial management, as it offers users multiple merchant accounts, as well as sub-merchant accounts.

Similarly, Adyen offers a range of PCI compliant POS solutions, that are suitable for a wide variety of businesses.

| Find the best online business bank account for your own business with the help of this review. Choosing the right option shouldn’t be time consuming. |

|---|

Adyen is both a merchant account provider and payment processor, who works with a wide range of companies, from Spotify to eBay. ¹⁸ Here’s an overview of Adyen’s pros and cons.

| Pros of Adyen | Cons of Adyen |

|---|---|

Stripe is a financial services company that provides payment processing solutions as well as Application Programming Interfaces (API) for ecommerce and online businesses.

Stripe supports millions of companies, from Amazon and Google, to new startups.¹⁹ Here’s an overview of the pros and cons of Stripe.

| Pros of Stripe | Cons of Stripe |

|---|---|

| |

Let’s now take a look at the features of Adyen vs Stripe.

Payment methods

Adyen supports a wide range of payment methods, giving your customers flexibility in terms of how they can pay. At the time of writing, these methods are accepted for Adyen payments in the US:

| Adyen payment methods | |

|---|---|

| | |

Just as with Stripe, Adyen has payment methods available for a wide range of countries which can be found on the Adyen pricing page.

Adyen payment processing also supports refunds for ACH Direct Debit, Afterpay, Clearpay and Mastercard. Additionally, recurring payments can be configured, allowing for subscriptions and one-click checkout portals.¹⁹

API

Adyen offers customizable APIs for online payments, POS solutions, plugins and platforms.

You can use Adyen’s API Explorer to test and learn more about its API system. ²⁰

Merchant account

A merchant account allows your business to accept card payments. Adyen comes with the advantages of allowing your business to open multiple merchant accounts.

This is a real benefit if your business accepts transactions from several different countries, as you can have a dedicated merchant account for each country, easing financial management.

Additionally, Adyen provides sub-merchant accounts for third parties, such as contractors and suppliers, further simplifying your payment solution and platform. ²¹

| As an international business it's important to have a business account that supports multiple currencies worldwide. Withdraw from your merchant account to an international business account - such as Wise. |

|---|

Get your multi-currency account today

Unified commerce

Adyen’s unified commerce solution allows your business to connect offline and online payments, making for a smoother customer experience. ²²

Adyen payments can be accepted in-store, in-app and online, with real-time reporting allowing your business to gain greater customer insights and adapt its operations and processes accordingly.

The ability to track and analyze patterns in customer data enables your business to offer a more customer-oriented service, generating company loyalty.

POS solutions

The Adyen payment processing POS solution enables your business to accept payments from multiple countries.

The POS solution changes its user interface to each individual region, by automatically detecting the language and related currency.

This makes the payment solution ideal for businesses with an international scope, as it automatically adapts to the given region, further enticing potential customers.

| 💡 Did you know? |

|---|

| As an international business expanding internationally, product localization can play a huge part in your success when entering another country's market. Part of localization is offering your products and services in the local language. |

POS solutions offered by Adyen are fully customizable and also PCI compliant. Additionally, with the help of analysis and terminal fleet management tools, in which all information is stored in a single place, your business gains a greater overview, and consequently better control, of its operations.

Available POS terminals from Adyen at the time of writing are:

Invoicing

Adyen gives your company a monthly payment processing invoice. This invoice includes all of the payment processing costs for all merchant accounts linked to a single legal entity.

That means you will receive separate invoices for any merchant accounts linked with different legal entities. ²⁴

| 📚 Read more about Invoicing |

|---|

Payment methods

Stripe supports multiple global methods of payment, allowing your customers to pay by their preferred method. Available US payment methods at the time of writing are:

| Stripe payment methods | |

|---|---|

| |

On top of this, Stripe currently supports 135 currencies across 47 countries, allowing your business to expand further into international markets.

API

Stripe’s APIs are very attractive for all types of businesses looking for flexibility and customizability.

Stripe has APIs for many aspects of its operations, from accepting payments and sending invoices to managing subscriptions.

Merchant account

Stripe is what is known as a merchant aggregator. A merchant aggregator combines the functions of a payment processor and merchant account provider into one.

Your funds, along with those of many other merchants, are essentially aggregated into accounts belonging to Stripe; as compared to that of a traditional merchant account, where you are the sole owner. The benefit of this is that the sign-up process is much quicker and easier, meaning you can get going instantly. ²⁶

| 💡 Merchant account vs payment gateway |

|---|

| Merchant account and payment gateways are related business tools they have different functionalities. While a payment gateway is a consumer interface allowing for the collection of card data, a merchant account enables businesses to receive the funds from these card transactions. |

POS solutions

Stripe Terminal is a POS solution allowing you to unify your offline and online commerce channels, simplifying management of your payment stack.

You can build a unique in-person checkout terminal and scale it with ease via drop-shipped new hardware and the remote configuration of card readers, among many other fleet management tools and features.

Similarly, customized email receipts and reader splash screens allow you to create the POS terminal suited to your business. Pre-certified card readers supporting contactless payments and end-to-end encryption further ease the process of creating your perfect POS solution.²⁴ ²⁷ Card readers come at the cost of $59 per unit.²⁸

Invoicing

Stripe allows you to create customizable invoices for recurring and one-off payments.

You can customize the invoice based on the customer, and tailor it to your specific brand. In addition to this, you can also set up email reminders for overdue invoices. ²⁹

Billing and accounting

Stripe’s billing API provides you with a highly flexible system to suit multiple types of billing, and can be integrated with existing mobile apps, CRM systems and websites.

Stripe Billing API supports the following billing systems:

Stripe Billing is highly adaptable to your businesses needs, and new changes are quick to be integrated and offered to your customers.

Stripe also has a host of partners to integrate services with. Companies such as Xero offer the chance to integrate accounting services with your business, making for simple and smooth financial management.³⁰

| 💡 Did you know? You can also add your Wise Business account to Xero and QuickBooks for bank feeds. |

|---|

Here’s an overview of Adyen vs Stripe charges.

| Adyen fees⁶ | Stripe charges⁷ ²⁸ | |

|---|---|---|

| Debit and credit card transaction fee | $0.12 + interchange++ | 2.9% + $0.30 (online) 2.7% + $0.05 (in-person) |

| ACH Direct Debit fee | $0.12 + $0.25 | 0.8%, capped at $5.00 for standard settlements 1.2% for two day settlements $1.50 per instant bank account validation |

| Apple Pay and Google Pay fee | $0.12 + defined by card used | 2.9% + $0.30 |

| Alipay fee | $0.12 + 3% | 2.9% + $0.30 |

| Afterpay fee | $0.12 + 4.99% + $ 0.30 (for US and Canada) | 6% + 30¢ |

| Klarna fee | $0.12 + 4.29% + $ 0.30(for US and Canada) | 5.99% + 30¢ (pay in 4 installments) 2.99% + 30¢ (pay with financing) |

For the most part, Adyen is free of fees. With Adyen, you won’t pay any setup fees, closure fees, integration fees or monthly fees.

The only Adyen fee you’ll have to pay is a transaction fee.

The transaction fee is composed of a fixed processing fee of $0.12 USD and a variable payment method fee. This is known as the interchange ++ model, and comes with the benefit of making transaction fees fully transparent.

Additionally, Adyen also has a minimum monthly invoice, the cost of which can vary depending on your business and industry.⁶

For the most up to date fees, it is best to check Adyen’s pricing page.

Stripe’s fee system varies depending on what software and which integrations you opt to use.

For Stripe’s Integrated payment system, they charge 2.9% + $0.30 USD per card transaction. For in-person card transactions at Stripe POS terminals, this changes to 2.7% + $0.05 USD per transaction.

Stripe also supports international payments, charging 1% + $0.30 USD per transaction with international cards. An additional 1% charge is applied if currency conversion is required.

Additionally, Stripe comes with the option of card issuing, charging $0.10 USD per virtual card and $3 USD per physical card.

Similarly, Stripe offers customized payment packages for businesses with high value transactions, large payment volumes and/or unique business models.

Stripe encourages prospective users to reach out to them to form a customized pricing package tailored to their business model and needs.²⁸ ⁷

Let’s take a look at the availability of Adyen vs Stripe.

Adyen is available in 37 countries worldwide, inclusive of the United States. Here’s an overview.

| Adyen countries | |

|---|---|

| Austria | Belgium |

| Bulgaria | Croatia |

| Cyprus | Czech Republic |

| Denmark | Estonia |

| Finland | France |

| Germany | Greece |

| Hungary | Ireland |

| Italy | Latvia |

| Liechtenstein | Lithuania |

| Luxembourg | Malta |

| Netherlands | Norway |

| Portugal | Romania |

| Slovakia | Slovenia |

| Spain | Sweden |

| Switzerland | United Kingdom |

| Australia | New Zealand |

| Singapore | Canada |

| United States | Brazil |

| Poland |

Stripe is available to users in 47 countries, including the United States. Check out this table for a quick overview of Stripe countries.

| Stripe countries | |

|---|---|

| Australia | Brazil |

| Austria | Belgium |

| Luxembourg | Latvia |

| Malaysia | Lithuania |

| Malta | Mexico |

| Bulgaria | Canada |

| Czech Republic | Norway |

| Cyprus | New Zealand |

| Croatia | Netherlands |

| Romania | Poland |

| Sweden | Portugal |

| Spain | Singapore |

| Slovenia | Slovakia |

| India | United Kingdom |

| Finland | Hong Kong |

| Estonia | Hungary |

| Greece | United States |

| Germany | United Arab Emirates |

| France | Japan |

| Denmark | Italy |

| Ireland | Philippines |

| Indonesia | Liechtenstein |

| Thailand | Gibraltar |

| Switzerland³ |

| If you’re looking to expand your operations to even more countries, then Wise Business may be the service for you. With Wise Business, you can send to 80 countries and over 50+ currencies. |

|---|

Let’s now compare the security and risk management features of Adyen vs Stripe.

Adyen’s risk management system uses RevenueProtect to prevent fraud, as well as help with chargebacks and disputes. Every transaction is subject to a risk evaluation, based on customizable risk settings.

Stripe is certified to PCI Service Provider Level 1. ¹¹ This is the highest achievable PCI security level in the industry, meaning Stripe’s security standards are industry leading.

Given the amount of businesses Stripe supports, its Radar system processes billions in payments annually. So much so, that the chance of it receiving a payment from a card already stored on the Stripe network is 89%.

This means it has a high chance of recognising fraudulent payments. Similarly, via partnerships with other financial services, Stripe utilises third-party information to further enhance their own risk profiles.

The use of checkout tools also allows Stripe to track the customer path, increasing the likelihood of fraud recognition.¹¹

Both Adyen and Stripe offer their own mobile apps.

Adyen has a mobile app available for both Apple and Android.

The app allows users to accept debit and credit card payments via Maestro, American Express, Visa, V PAY and MasterCard, with the promise of other payment methods to come.¹⁵ ¹⁶

Stripe offers its users a mobile dashboard app for both Apple and Android, which is available only for Direct and Standard accounts.

The Stripe mobile dashboard app allows you to view and create payments, customers, payouts, refunds, as well as to search for specific customers or transactions.

The Stripe app is also protected by two-factor authentication.¹⁷

Both Adyen and Stripe offer cards for your business. Let’s take a closer look at these card issuing schemes.

Adyen Issuing offers virtual and physical cards for your business.

The Adyen card issuing program allows you to gain better insights into transaction data, manage corporate funds with card-control settings and authorization tools, and benefit from real-time reporting.

The Adyen card issuing scheme also allows flexible card types for specific business industries, such as travel and online marketplace businesses. These cards can be issued to your partner services and customers, avoiding the need for a third-party card issuer.

The Stripe corporate card allows your employees to handle company finances and grow your credit line alongside your business.

Stripe Issuing allows virtual cards to be issued in minutes, with the option of physical cards existing too, and cards can be branded with your company’s logo.

You’ll also earn 1.5% cash back on every corporate card payment, while simultaneously enjoying no foreign transaction fees, late fees or annual fees. ¹³ ¹⁴

Stripe and Adyen are both providers for expanding your business. You can also make international business management easy by joining the other 200K businesses using Wise Business.

Manage your finances in one place using the Wise Business multi-currency account.

Get access to local account details - like Routing Numbers, Sort Codes and IBANs - and receive payments on time.

Connect Stripe to Wise and withdraw seamlessly from your merchant account into your Wise Business account.

Send and receive money internationally at the mid-market exchange rate, free of hidden fees - saving you up to 19x more than when using Paypal.

Signing up to Wise Business allows access to BatchTransfer which you can use to pay multiple invoices in one go.

Open your Wise Business account now

Sources:All sources checked 10 May 2022

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Outsource to Romania with confidence. Discover the benefits, costs, and practical steps for US businesses.

In this US guide to buying commercial property in Singapore, navigate the process, costs, and unlock foreign investment opportunities with expert insights.

Discover the most secure and convenient online payment methods for your business.

Learn the essentials of how to invest in commercial property in the UK as a US investor.

Compare Mollie vs Stripe to find the best payment gateway for your business. Our guide covers fees, features, and integrations to help make the right choice.

Find out how to open an IBAN account with our step-by-step guide. Understand the requirements, benefits, and best practices.