How to pay Atome using GCash : Step-by-step guide for Filipinos

Wondering how to pay for your Atome bill using GCash? Learn more about how to make payments for your Atome card and more.

Both Maya1 (formerly PayMaya) and GCash2 are very popular e wallets in the Philippines which allow users to manage their money using little more than a smartphone. Both offer great features and services, with an intuitive interface and - in most cases - low fees.

But are they compatible? Can you make a GCash to Maya transfer and if so, how to send GCash to PayMaya in the cheapest, easiest way? This guide has you covered, including a full step by step guide and a look at the GCash to Maya transfer fee you should know about.

| Table of contents |

|---|

If you want to know how to transfer GCash to PayMaya you’re in the right place. Luckily enough, the process is easy and can be fast too - as long as both the sender and recipient have eligible accounts. There’s a fee to pay to GCash, but if the transfer fails, the full payment including the charge, should be credited back to the sender’s account3.

Before you start with GCash to Maya payments, it’s worth checking your account is properly set up and verified, and also getting all of the information you need from the recipient to make a safe transfer. Read on for all you need to know.

Before you send a GCash to PayMaya transfer, it’s a good idea to make sure that both you as sender, and the recipient, have verified accounts with the provider. While you may be able to send a GCash to Maya transfer without completing verification, your options are very limited - making this the ideal time to upgrade your account by adding a few documents. Here’s what to do.

If you’re a Filipino over 18, including overseas workers, you can get verified with GCash by snapping a photo of a government issued ID and uploading it. Documents which are accepted include4:

- National ID (Card Type)

- National ID (Paper Type) / Digital National ID

- Passport

- HDMF (Pag-Ibig Loyalty Plus)

- Driver's License

- Philippine Postal ID

- PRC ID

- UMID

- SSS ID

You’ll also need to take a selfie and add a bit of information to your account to get a fully verified account with GCash. It’s worth getting verified with GCash if you intend to send payments, because an unverified account is likely to have a 5,000 PHP outgoing payment limit every month. If you need more than this you can get verified to let you send up to 100,000 PHP a month, or take a few extra steps to increase your wallet limit to 500,000 PHP if you’re using the service very regularly5.

Maya also has options to upgrade to an account with a higher wallet limit and more features. This may be a smart move for your recipient, and it’s also a very simple job. Like with GCash you’ll just need to add an image of some ID documents and then record a quick video selfie to prove you’re really who you say you are6. This then increases the flexibility of your Maya account and could open the door to new features.

Before you can send a payment from GCash to Maya you’ll need to make sure you have the recipient’s details correctly. While GCash may refund a payment which fails, they’re not likely to give you your money back if you simply use an incorrect phone number and send the money to the wrong recipient.

So - to send a GCash to Maya transfer, make sure you check your recipient’s Maya account details. Usually this is the 11 digit phone number they used to register with Maya in the first place.7

| 👀 Looking for a smart, low-cost way to send or receive remittances? Learn more about how to use Wise in the Philippines |

|---|

Sign up for a free Wise account

Once you and your recipient have checked that your e wallet accounts are in order, you can start your GCash to PayMaya transfer. Here’s what you need to do:

You’re almost there. To make sure your GCash to Maya payment goes through OK let's look at a few final pointers.

The length of time it takes for your GCash to Maya transfer to arrive depends a bit on how the transfer is set up and processed. If you’re sending money using InstaPay the funds may be instantly available. Where PESONet payments are selected, the delivery time could be the same business day or the day after, depending on the time of day when the transaction is confirmed.

If you’re unsure about the payment delivery time, you can track your transfer in the GCash app.

When you send a payment with GCash to a digital wallet like Maya there’s usually a 15 PHP fee to pay. There’s no fee for the recipient to pay to Maya8.

If currency conversion is needed at any point in the transaction - when loading funds to GCash for example, or when sending to Maya, you’ll need to know the conversion rate that will be applied. Exchange rates are set by the provider which processes the currency conversion, and can often include a fee known as a markup.

This fee is common, but it’s hard to spot because it’ll be added into the rate you’re quoted rather than being split out as a separate line on your bill. To see if a conversion charge has been added, you’ll need to take the exchange rate you’re quoted and then compare it to the mid-market rate you can get from Google. The difference here is likely the markup - and it can mean the recipient gets less than expected in the end.

If you need to send or receive international payments in PHP, you might like to take a look at Wise which has fast, low cost transfers which can be sent to banks in the Philippines and around the world - and wallets like GCash and Maya, too.

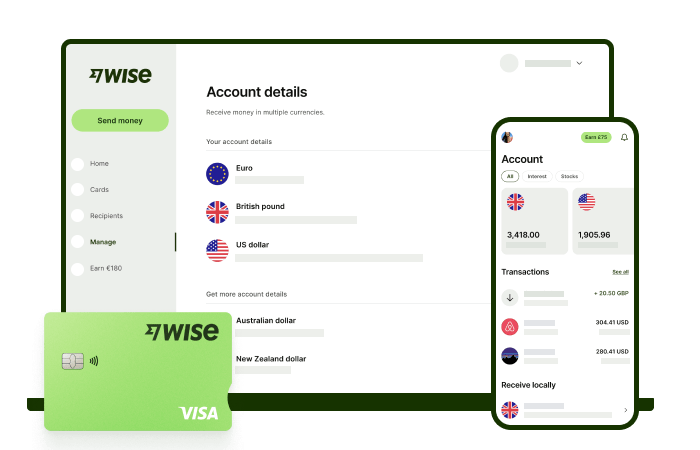

Wise international money transfers are set up online or in app. Wise international money transfers can be set up online or within the Wise app with low fees from 0.57% and the mid-market rate, to over 140+ countries. There’s no markup added to the exchange rate that’s used to convert your currency, which makes it easier to see exactly what you're paying for a transfer, and what the recipient will get in the end. Just transfer the amount indicated in PHP and let Wise do the rest.

To make sending foreign currency even easier, create a free Wise account, and you'll be able to manage and convert your money in PHP and 40+ other currencies. You'll get the same great rates, and be able to track your transfers all from one place. You can also get 8+ local account details to be able to receive money in PHP, USD, GBP, and more.

| This content incorporates publicly available data points from as part of research and comparative analysis conducted as of 4 November 2024. The information and insights provided are for informational and illustrative purposes only and may not reflect the most current data. Readers are advised to independently verify and cross-check the information before making any decisions or proceeding further. |

|---|

Sources:

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Wondering how to pay for your Atome bill using GCash? Learn more about how to make payments for your Atome card and more.

Need to send money from Paypal to GoTyme? Our 2025 guide covers the step-by-step online transfer process, fees, and processing times.

Learn how to transfer money from GCash to Wise with our detailed guide. We cover fees, processing times, verification steps, and account requirements.

Sending money from Japan to the Philippines? Learn how to transfer from SBI Remit to GCash with our guide, covering fees, exchange rates, and transfer times.

Learn how to transfer money from the eCebuana app to GCash. We cover the step-by-step process, transfer fees, and how long it takes.

Need to send money from RCBC to GCash? Our guide covers the step-by-step online transfer, fees, and processing times.