How to pay Atome using GCash : Step-by-step guide for Filipinos

Wondering how to pay for your Atome bill using GCash? Learn more about how to make payments for your Atome card and more.

If you bank with BDO1 but like to spend with GCash2 you may be wondering how to send money from BDO to GCash to get your money where you need it. Or, maybe you need to send a payment from your BDO account to someone else and they’ve asked you to deposit the funds to GCash instead of a bank. Sending a BDO to GCash transfer is pretty easy to do, and your money may be available pretty much instantly.

We’ll look at how to send a BDO payment step by step, as well as the BDO to GCash transfer fee you need to consider. Read on to learn all there is to know about how to transfer money from BDO to GCash for convenient spending.

| Table of contents |

|---|

BDO offers several different ways to send money, either to another account in your own name, to a bank or e wallet account in someone else’s name,or for cash collection through partner organisations3.

If you’re sending a payment from BDO to GCash it’ll be processed as an Instapay transaction. This sort of payment is known as a cash in from a local bank4 - this is what you’ll need to look out for on GCash if you’re setting up this transfer for yourself.

This guide walks through how to send money from BDO to GCash, with a quick look at the cash remittance options available as an alternative.

To send a payment from BDO to GCash you’ll need an eligible BDO account. If you’re sending your payment digitally - the most convenient option - you’ll need to have set up your BDO digital banking, including setting an online PIN or using your phone’s biometrics.

It’s also worth taking a moment to get your GCash account fully verified. Or, if you’re sending to someone else’s GCash account, it’s worth asking them to make sure their account is properly verified. This is because the GCash incoming payment limits for an unverified account are very low, at 5,000 PHP5. If your payment causes the recipient to exceed their monthly limit, the money may be returned to you.

It’s easy to verify a GCash account by simply uploading an image of a government ID document like your passport or National ID. Other documents are also accepted, including HDMF (Pag-Ibig Loyalty Plus), a valid driver's licence or a Philippine Postal ID6.

When you send money from BDO to GCash you’ll follow online prompts to make sure you enter all of the details required to process your payment successfully. Generally, this will include:

If any other details are needed for your specific transfer, you’ll be notified on screen when you work through the payment instruction form.

| 👀 Looking for a smart, low-cost way to send or receive remittances? Learn more about how to use Wise in the Philippines |

|---|

Sign up for a free Wise account

The easiest and most convenient way to send a payment from BDO to GCash is to do so online or in app, avoiding the need to head out to a BDO branch to arrange the transfer. Here’s how to send your BDO payment to a GCash wallet, online or in the BDO app:

You can also send money from BDO for cash pick up, through the BDO remittance service7. In this case you’ll need to visit one of the BDO partner organisations, which include counters at WalterMart and SM Supermalls. Cash pick up service payments have a higher fee compared to sending a digital payment which is received in a GCash wallet. The payment delivery time is also slower, taking 24 hours compared to the digital transfer solution which can arrive instantly.

The process for sending money from BDO to GCash shouldn't be too difficult to navigate - whether you’re sending money to someone else, or from a BDO account in your own name to your GCash account. Let’s look at another few important points to make sure your payment goes through smoothly.

A BDO to GCash transfer is arranged through Instapay, and should arrive instantly in the recipient’s GCash account.

There’s a charge from BDO when you arrange a transfer from your account to a GCash wallet. The fee depends on the way you set up your transfer - but usually the cheapest options are for digital payments. These are also more convenient than heading to a bank branch to arrange your transfer in person. Here are the BDO transfer fees based on different transfer methods:

There’s a minimum transfer amount of 100 PHO, and a maximum daily transfer limit of 50,000 PHP when you send money with BDO.

If you’re sending money for cash collection instead of to a GCash wallet, there’s a fee of 100 PHP - 150 PHP depending on the BDO partner you use to set up your transfer.

If you’re sending money from BDO to GCash the chances are that it’ll be a PHP balance, sent to GCash in PHP. However, if there’s a need for currency conversion at any stage - when you receive the payment to BDO in the first place for example, or if the recipient intends to spend the funds overseas, you need to know about the exchange rate which applies.

Generally, exchange rates offered by banks like BDO will include a markup. That means that there’s a fee added to the mid-market rate which you would find on Google or using a currency converter tool. This is already built into the exchange rate you're quoted by the bank, which means it's hard to figure out the exact fee you’re paying - particularly as markups can be variable depending on the currency and transaction type.

If you need to receive payments from abroad - or if you’re sending money from overseas back to the Philippines - it’s important to know that the costs of your transfer can include fees added to the exchange rate, as well as any quoted transfer chargers. An alternative is to use a non-bank provider which offers the mid-market rate, with low, transparent fees8 - like Wise. We’ll look at what Wise does and how they may be able to help, next.

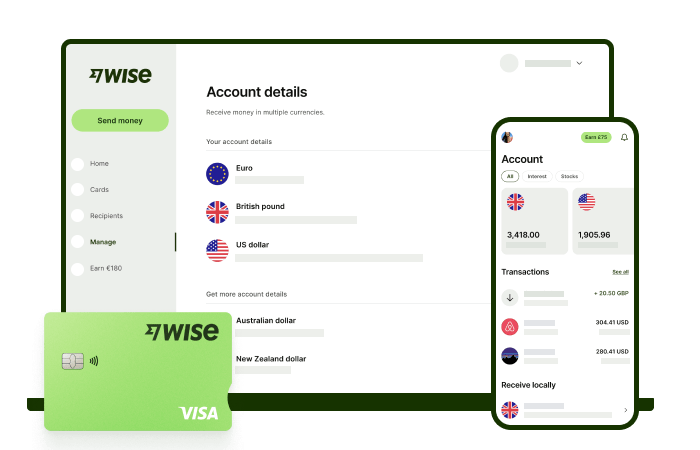

Take a look at Wise as a perfect solution if you need to manage your money or make payments in foreign currencies.

Wise international money transfers can be set up online or within the Wise app with low fees from 0.57% and the mid-market rate, to over 140+ countries. There’s no markup added to the exchange rate that’s used to convert your currency, which makes it easier to see exactly what you're paying for a transfer, and what the recipient will get in the end. Just transfer the amount indicated in PHP and let Wise do the rest.

To make sending foreign currency even easier, create a free Wise account, and you'll be able to manage and convert your money in PHP and 40+ other currencies. You'll get the same great rates, and be able to track your transfers all from one place. You can also get 8+ local account details to be able to receive money in PHP, USD, GBP, and more.

Consider using Wise the next time you need to send money to GCash in the Philippines, and see if you can save.

| This content incorporates publicly available data points from as part of research and comparative analysis conducted as of 4 November 2024. The information and insights provided are for informational and illustrative purposes only and may not reflect the most current data. Readers are advised to independently verify and cross-check the information before making any decisions or proceeding further. |

|---|

Sources:

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Wondering how to pay for your Atome bill using GCash? Learn more about how to make payments for your Atome card and more.

Need to send money from Paypal to GoTyme? Our 2025 guide covers the step-by-step online transfer process, fees, and processing times.

Learn how to transfer money from GCash to Wise with our detailed guide. We cover fees, processing times, verification steps, and account requirements.

Sending money from Japan to the Philippines? Learn how to transfer from SBI Remit to GCash with our guide, covering fees, exchange rates, and transfer times.

Learn how to transfer money from the eCebuana app to GCash. We cover the step-by-step process, transfer fees, and how long it takes.

Need to send money from RCBC to GCash? Our guide covers the step-by-step online transfer, fees, and processing times.