How to Open a Maybank Saving Account Online in 2026

Thinking of opening a Maybank savings account online? Check out our 2026 guide on how to do so, from the easiest MAE app steps to hidden fees!

Having a multi-currency account can help you to cut down the costs of holding and spending foreign currencies. With the RHB multi-currency account, you can hold, convert and spend all 33 currencies without foreign transaction fees using your linked RHB debit card. You’ll be able to choose between the RHB foreign currency account for education and employment, or as an individual investment account.

This guide covers all you need to know about the RHB multi-currency account, including availability, eligibility, and who it’s aimed at. We'll also introduce the Wise account, a handy companion to make your money go further with low, transparent fees.

Multi-currency accounts - which are also sometimes called foreign-currency accounts - allow customers to hold, exchange, and spend one or more foreign currencies. This can be really helpful if you or a family member live, work, or study abroad, or even if you just love to travel.

You can use a multi-currency account to buy and hold currencies you use often when exchange rates are good. That can help you minimise the risk of losses because of changes in currency exchange rates.

Let’s take an in-depth look at the RHB multi-currency account features and how the account works.

You can hold 33 currencies in the RHB multi-currency account, and convert between them using the RHB exchange rate whenever you need to. Preferential rates may apply when you spend with your linked debit card.

Here are the currencies you can handle with your RHB foreign currency account:

|

|

You can choose to hold your foreign currencies in an easy-access interest-bearing account or lock the money away in a term deposit to access a higher interest rate. Term deposit options run from one week to one year, to suit different customer needs.

Get an RHB debit card linked to your account to transact in MYR and 33 foreign currencies.

If you hold the currency you need in your account, you won’t need to pay a foreign transaction fee when you spend or withdraw from your account. Otherwise, a 1% foreign transaction fee may apply to spending using your RHB debit card. A preferential exchange rate is used for card spending.

You can convert currencies instantly online or in an RHB branch, which lets you buy and sell currencies when the rates are in your favour. This can minimise the risk of losing out because the exchange rate changes. You’ll also get a preferential rate when you spend internationally using the RHB debit card.

However, it’s important to note that the RHB exchange rate includes a markup added to the mid-market rate. That’s an extra fee and can make it harder to see exactly what you’re paying for currency conversion.

Using a currency exchange rate markup is extremely common - but not all providers choose to use a markup. The Wise account offers exchange that uses the mid-market exchange rate with no markups and no hidden fees. That can mean you get better value when you exchange, send, or spend foreign currencies with Wise. More on that later.

✍️ Sign up for a free account now

Let’s look at the costs involved in opening and operating an RHB multi-currency account. We’ll compare these fees to the costs of using a Wise account to offer a bit of context, and help you see which would be cheaper for your needs.

| Service | RHB⁴ | Wise |

|---|---|---|

| Open account | Free | Free |

| Get local bank details for 9 foreign currencies | Not available | Free |

| Multi-Currency Visa Debit Card issuance fee | 20 MYR | 13.70 MYR |

| Minimum initial call deposit | 200 USD or its equivalent | None |

| Minimum fixed term deposit | 2,000 USD or its equivalent | None |

| Currency exchange | Exchange rate includes a markup | Mid-market exchange rate and low, transparent fees |

| ATM withdrawals | RHB ATM withdrawal - free Local MEPS - 1 MYR Foreign NEPS - 1 MYR Visa/Mastercard network - 12 MYR | Free for 2 withdrawals/month, to the value of 1,000 MYR 5 MYR/withdrawal + 1.75% after that |

| Foreign transaction fee | 1% | None |

There are 2 different RHB multi-currency account options: the Individual Export Proceeds Account and the Individual Investment Account.

The Individual Export Proceeds Account is aimed at people who are exporting physical goods and are receiving overseas currency proceeds. This account is available for Malaysian residents and non-residents alike. The RHB Individual Investment Account allows people to retain investments from abroad and invest in foreign currency by converting MYR or borrowing from licensed onshore banks. Let’s walk through who’s eligible to open an RHB account and how to get started.

RHB foreign currency accounts are available to:

To open a multi-currency account with RHB, you’ll also need an MYR checking or savings account. Some RHB checking accounts can be opened entirely online - but the process and paperwork needed may vary a little depending on the account type you choose.

Once you have your MYR account up and running, you’ll need the following to open your multi-currency account:

Call RHB or head into a local branch to double-check the exact paperwork and process that applies to your situation before you get started.

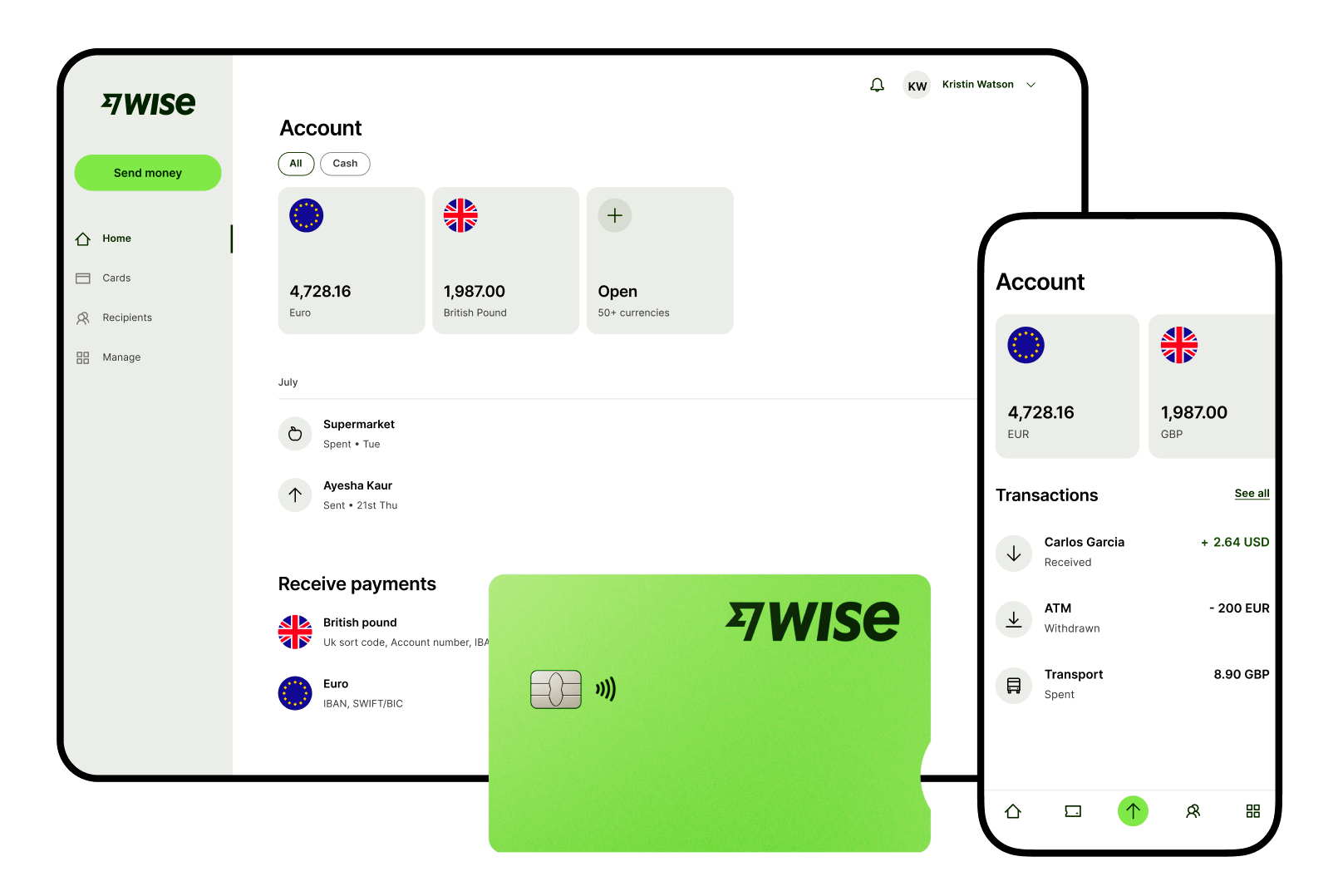

The Wise account is an easy way to hold and exchange 40+ currencies, including MYR, USD, GBP, and more. All you need to do is create a free account to get started.

With Wise, you can exchange currencies at the mid-market rate each time, with low, transparent conversion fees from 0.77% and absolutely no markups. Plus, you can order a linked Wise card for convenient spending without any foreign transaction fees, and up to 2 free ATM withdrawals to the value of 1,000 MYR when you're overseas. You'll even get 8+ local account details to get paid conveniently to your Wise account in MYR and a selection of other major global currencies.

Sending money or making payments abroad? Wise also offers fast, low cost transfers to 140+ countries - you can track your transfer in your account and your recipient will also be notified when a transfer reaches them.

RHB’s multi-currency account lets customers hold and exchange 33 currencies, and spend on all currencies with a linked debit card. Customers must hold an opening deposit of the equivalent of 200 USD for easy access accounts or 2,000 USD for term deposits. You can access instant currency conversion when you need it, online or in branch. However, exchange rates do include a markup that pushes up costs and makes it harder to see what you’re really paying for your transactions.

Compare the RHB Multi-currency account with the Wise account - a modern, low-cost alternative which uses the real mid-market exchange rate to help you save whenever you send, spend, or convert currencies. Decide for yourself which account suits your needs the best to get the most out of your international money movements.

Sources:

1.RHB Multi Currecy account

2.RHB Multi Currency debit card

3.RHB Multi Curency deposit

4.RHB account product disclosure

5.RHB Multi Currency pricing

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Thinking of opening a Maybank savings account online? Check out our 2026 guide on how to do so, from the easiest MAE app steps to hidden fees!

Is Ryt Bank's interest really worth it for Malaysians? Compare the benefits and see how using Wise alongside your account can help you avoid hidden fees.

Can you open a Public Bank account online? See which steps you can do from home, why a branch visit is likely, and how Wise offers a digital alternative.

A guide on Ryt vs GXBank and which is the best digital bank for 2026. Find out who wins on interest and how Wise can help you no matter which bank you pick.

Is Ryt Bank Malaysia’s best digital bank? Read our 2026 review on Save Pockets, AI bill payments, and the zero-fee Ryt Card.

Compare Wise vs GXBank to stretch your Ringgit. Earn interest with GXBank savings, but use Wise to avoid FX fees.