Ryt Bank vs GXBank 2026: Which Digital Bank is Best for Your Ringgit?

A guide on Ryt vs GXBank and which is the best digital bank for 2026. Find out who wins on interest and how Wise can help you no matter which bank you pick.

Looking for a smart multi-currency card and account to help you manage your finances across currencies? Whether you’re planning to travel, need to hold, receive and spend in foreign currencies, or just love to shop online with foreign retailers, there’s a perfect fit out there for you.

Here in Malaysia, great multi-currency card and account options include MAE by Maybank¹, BigPay² and Wise. But which suits you best? Join us as we explore MAE vs BigPay vs Wise, looking at what these providers offer, and how they compare.

| Table of contents |

|---|

A multi-currency card works in a similar way to your regular debit or credit card for payments and withdrawals. The key difference is that multi-currency cards have been designed to make it easier and more flexible to spend foreign currencies, often offering neat features like low cost currency conversion and international transfers, as well as day to day spending.

Each of the providers we’re looking at - MAE, BigPay and Wise - offers a great multi-currency card for Malaysian citizens and residents. However, they’re all different, so which one suits you best might depend on how you’re planning on using it.

So what is the difference between the MAE card vs BigPay vs Wise? We’ll get into the detail about each provider in just a moment - but first let’s split them out in a head to head feature comparison.

| MAE | BigPay | Wise | |

|---|---|---|---|

| Eligibility | Malaysian residents | Malaysian citizens or Malaysian permanent residents or foreigners legitimately residing or gainfully employed | Personal and business customers, in most countries around the world |

| Currencies available to hold and exchange | MYR only | MYR only (for BigPay Malaysia card holders) | 40+ currencies including MYR |

| Maintenance fees | 8 MYR annual fee to get MAE card³ | No maintenance fee but you’ll need 20 MYR to open the account - this is yours to spend later⁵ One off 20 MYR fee to get a card⁹ | No maintenance fee One off 13.7 MYR fee to get a card⁷ |

| ATM fees | Free at Maybank ATMS 1 MYR at MEPS ATMs 12 MYR at Plus ATMs | 6 MYR locally⁶ 10 MYR internationally | 2 withdrawals to 1,000 MYR/month free⁹ 5 MYR + 1.75% after that |

| Foreign transaction fee | Can vary based on transaction type - QR code payments include an exchange rate margin, for example | Up to 1% + network fee | None If you don’t hold the currency you need you can convert with low fees from 0.77% |

| Fees to send money overseas | Send from the MAE app to Cambodia for 10 MYR⁴ Other transfers processed using the Maybank2u online banking service | Up to 22 MYR based on destination | Low fees from 0.77% |

| Other features | Budgeting and expense management features Easy ways to spend with local merchants in-app | Budgeting features Available in both Malaysia and Singapore | Send payments to 70+ countries Local account details for 8+ currencies |

Pricing/fees: Please see Terms of Use for your region or visit Wise Fees & Pricing for the most up to date pricing and fee information

MAE is Maybank’s app based e-wallet and card, which allows you to hold MYR and spend or withdraw internationally. To apply for MAE you’ll need to be a Malaysian resident, but if you’re eligible you’ll be able to get everything set up in-app easily enough.

Add funds to MAE or link to another Maybank account for automatic top ups, and get budgeting and expense tools, ways to save on your own or in a group, options to request payments from other MAE users and more⁸.

| Pros ✅ | Cons ❌ |

|---|---|

|

|

Want to learn more about MAE and how to apply? Get the full MAE by Maybank review here.

BigPay is a popular e-wallet in both Malaysia and Singapore, which comes with a linked physical and virtual card. You’ll be able to hold MYR only, but can use your card to spend and withdraw internationally, and can also send payments overseas to select countries.

When you spend with your card you can earn AirAsia points, and there’s no need to tell BigPay you’re travelling - your card is already set up for international use automatically.

| Pros ✅ | Cons ❌ |

|---|---|

|

|

Learn more in our full BigPay Malaysia review.

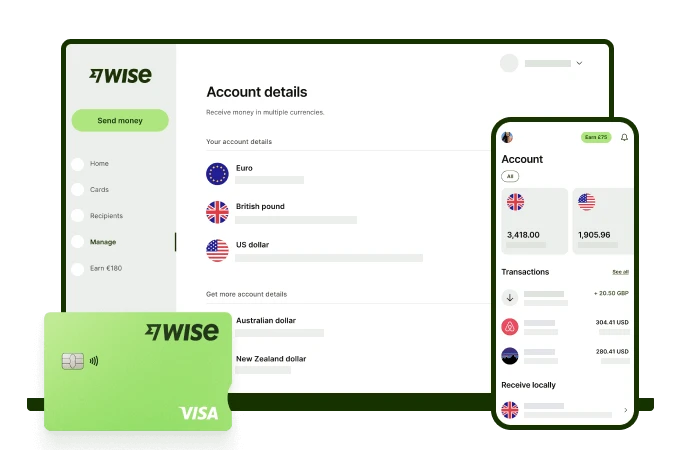

If you’re looking for a bit more from your e-wallet and multi-currency card, Wise might suit you. You’ll be able to hold 40+ currencies, and get local bank details to receive fee free (except USD wire transfers) payments in up to 10 currencies, including MYR. Order a Wise card, and it’s free to spend any currency you hold. If you don’t have the currency you need, you’ll get the mid-market exchange rate and low conversion fees from 0.43%.

The Wise account and international card comes with all you need to spend, send, and receive payments in foreign currencies. Make payments - fast - to 70+ countries, spend in 150+ countries, and get paid in up to 10 currencies fee free like a local. Once you have a balance in your account you can switch to any of the supported 40+ currencies with the mid-market rate and low, transparent fees - to withdraw back to your regular MYR account, or ready for the next time you head abroad.

| Pros ✅ | Cons ❌ |

|---|---|

|

|

Pricing/fees: Please see Terms of Use for your region or visit Wise Fees & Pricing for the most up to date pricing and fee information

What you pay to use your multi-currency card is important. Keeping costs down means you have more money to enjoy. Here’s how MAE vs BigPay vs Wise compares across costs and fees:

| MAE | BigPay | Wise | |

|---|---|---|---|

| Fees to get a card | 8 MYR annual fee | One off 20 MYR fee | One off 13.7 MYR fee |

| Opening deposit requirement | None required | 20 MYR | None required |

| Top up fees | No fee to top up in MYR | 1 MYR + 2% for cash top ups Up to 1% for credit card top ups | Free to add funds in 8+ currencies with local bank details |

| ATM fees | Free at Maybank ATMS 1 MYR at MEPS ATMs 12 MYR at Plus ATMs | 6 MYR locally 10 MYR internationally | 2 withdrawals to 1,000 MYR/month free⁹ 5 MYR + 1.75% after that |

| Foreign transaction fee | Can vary based on transaction type - QR code payments include an exchange rate margin, for example | Up to 1% + network fee | None If you don’t hold the currency you need you can convert with low fees from 0.77% |

| Fees to send money overseas | Send from the MAE app to Cambodia for 10 MYR Other transfers processed using the Maybank2u online banking service | Up to 22 MYR based on destination | Low fees from 0.77% |

Pricing/fees: Please see Terms of Use for your region or visit Wise Fees & Pricing for the most up to date pricing and fee information

If you want a multi-currency card to help you cut the costs of spending in foreign currencies, you’ll also need to understand how the exchange rate used to convert your MYR to the currency you need is set.

Wise uses the mid-market exchange rate to convert between currencies - whether that’s when you spend with your card, send a payment or switch between balances in your Wise account. The mid-market rate is the one banks and currency conversion services get when they buy foreign currency on global markets - and the rate you’ll usually find on Google.

Check out the real-time rates and fees for your transfer here:

If you’re spending with either MAE or BigPay you might find you’ll pay a currency conversion fee or foreign transaction fee when you spend overseas.

BigPay’s fees are set at up to 1%, plus network charges. That means the exchange rate you get can include some extra charges - making it trickier to see exactly what you’re paying when you transact internationally.

MAE might also add a fee to the exchange rate that’s used for your overseas spending. That depends on the transaction type, so you’ll need to check the details in-app before you spend, to make sure you’re clear on the rates available.

All three providers - MAE, BigPay and Wise - have their own great features.

If you’re already a Maybank customer, getting MAE can be convenient as you’ll be able to link your existing MYR Maybank account to MAE for automatic top ups. There are also useful budgeting and expense management tools - but you could find you’re paying extra fees when you’re overseas, including foreign transaction fees and higher ATM withdrawal charges.

BigPay is set up for international use automatically, which is handy. You’ll get a physical and virtual card, which makes it easy to spend and withdraw around the world - plus you can send international payments to select countries and regions. One downside of BigPay is that you can only hold MYR, which means fees apply when you spend overseas, including BigPay’s cost of up to 1% and any charges added by the network.

If you’re looking for a multi-currency account and card with a real international leaning, Wise might be the one for you. Hold 40+ currencies, use your card in 150+ countries, and get local bank details to get paid fee free in 8+ currencies. That means you can do more with your Wise account and card - plus you’ll benefit from Wise’s low fees, and get the mid-market exchange rate every time you need to convert from one currency to another. Easy.

Sources:

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

A guide on Ryt vs GXBank and which is the best digital bank for 2026. Find out who wins on interest and how Wise can help you no matter which bank you pick.

Is Ryt Bank Malaysia’s best digital bank? Read our 2026 review on Save Pockets, AI bill payments, and the zero-fee Ryt Card.

Is Wise cheaper than a Malaysian credit card in 2026? We break down hidden bank fees vs Wise’s mid-market rates to help you stretch your Ringgit.

Transferring money from Malaysia? Compare Wise vs Western Union fees and exchange rates for 2026. See which provider is cheaper for your next transfer now.

Compare Wise vs GXBank to stretch your Ringgit. Earn interest with GXBank savings, but use Wise to avoid FX fees.

Maybank Grab Card 2026 Guide: Is it still worth it? Here's a review of the 5x GrabCoins benefit, the zero annual fee status, and more.