How to Open a Maybank Saving Account Online in 2026

Thinking of opening a Maybank savings account online? Check out our 2026 guide on how to do so, from the easiest MAE app steps to hidden fees!

Visa payWave Malaysia lets you make contactless payments with your payWave card or your smartphone, watch, or even fitness tracker, if you activate payWave mobile. That means fast, secure payments when you’re in a store, restaurant or on public transport - and if you link your payWave debit card to an enabled device, you can even leave your wallet at home.

This guide covers all you need to know - including:

PayWave¹ is Visa’s contactless payment service. With contactless payments you can pay merchants in person by simply tapping your payWave enabled debit card - or your phone or similar device if you’ve chosen to use payWave mobile payments². There’s no need to hand over your card - making this a safe way to pay. And there’s usually no need to enter your PIN - making it fast, too.

Paying using contactless technology has a number of big benefits - but one of the biggest is precisely the fact it’s contactless. As the global pandemic made us all very aware of how often we may accidentally share our germs by touching the same surfaces as others, contactless payments became more popular with consumers and merchants alike.

Contactless payments can improve basic hygiene when you’re out and about by reducing the amount of contact with payment terminals and so on - but they’re also a very secure way to pay. Visa payWave cards have all the same layers of security your normal Visa card would - plus added peace of mind from the fact your card or phone won’t even need to leave your hand while you complete the transaction.

You can use payWave contactless payments anywhere you see the contactless logo.

This means you can pay with your contactless enabled Visa card by tapping it on the merchant’s payment terminal, or you can use your phone or other device instead if you’ve linked your contactless card to a mobile wallet like Apple Pay.

Smart devices including watches, fitness trackers and more can all be used to make contactless payWave payments, for convenient spending wherever you happen to be.

PayWave is already supported by huge numbers of merchants across Malaysia - there’s a listing on the Visa website⁴ but the easiest thing to do is to look out for the contactless logo when you’re in a store. It’s usually displayed prominently near the checkout - after all, contactless payments are good for merchants too, so they’ll want to encourage customers to adopt payWave payments whenever they can.

To unlock contactless payments with payWave you’ll first need an eligible card. You might well find your bank issues payWave enabled cards, but even if it doesn’t, there are some great online providers which can help you get a contactless card which comes with a whole host of benefits. We’ll look at some of the most popular cards for contactless payment in Malaysia in a moment.

Once you have your card, you may need to activate it before you can use it for contactless transactions. This will usually mean you need to make a single payment or cash withdrawal using your PIN number. This transaction can be with any merchant or ATM, for any value - it’s simply intended to demonstrate that the card is in the hands of the account holder, by proving it’s being used by someone who also knows the account PIN.

That said, the exact way you activate your payWave Malaysia card may vary based on the specific card - check with your card issuer if you’re unsure.

There are plenty of cards you can choose from in Malaysia if you want to pay with payWave for easy contactless and mobile transactions. Some - like the MayBank Visa Platinum - are issued by major banks; while others like the BigPay card and the Wise card, are issued by specialist services which can offer many of the features of bank cards, with a few extras thrown in as well.

To give an idea of how each of these popular payWave Malaysia cards match up, here’s a comparison of key features.

| MayBank Visa Platinum debit card⁵ | BigPay card⁷ | Wise card | |

|---|---|---|---|

| Supports payWave? | Yes | Yes | Yes |

| Ongoing charges | 8 MYR annual fee⁶ | No maintenance fee⁸ | No maintenance fee |

| Currencies available | MYR | MYR | MYR and 40+ other currencies |

| ATM fee | 1 MYR for out of network domestic withdrawals 12 MYR for international withdrawals | 6 MYR for domestic withdrawals 10 MYR for international withdrawals | Free for 2 withdrawals a month, to the value of 1,000 MYR 5 MYR + 1.75% after that |

| Currency conversion fee | From 1% | 1% + network charges | Currency conversion from 0.41% based on the real exchange rate |

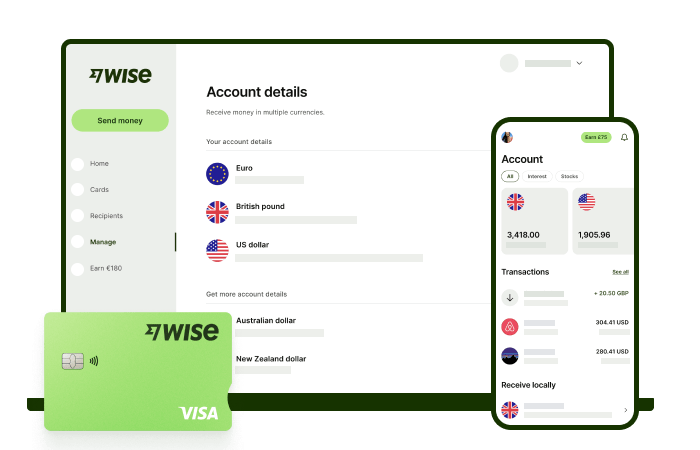

If you’re looking for a contactless card which lets you do more both at home and abroad, the Wise international debit card might be the one for you. You can open a Wise account for free online, and order a linked international card for just 13.70 MYR.

Wise accounts are perfect for anyone living an international lifestyle, with the option to hold and exchange 40+ currencies, receive payments like a local from 30+ countries, and send money to 80+ countries. With your card you can also spend all over the world with the real mid-market exchange rate - and make local cash withdrawals from 2.3 million ATMs.

Tap to use your Wise card wherever you see the contactless logo - or add your card to payWave to transact from your smart device wherever in the world you are.

There’s no minimum balance, no monthly fee, and just low, transparent charges for the services you need. See how much you can save with the Wise account and card, today.

Start saving money with Wise 🚀

PayWave from Visa offers contactless payment technology you can use to tap and pay in stores, restaurants and on public transport. You can also link your payWave card to a mobile wallet to make payments from your smartphone, watch or fitness tracker - and leave your wallet at home.

Contactless payments are extremely well supported across Malaysia and beyond. If you’ve not got a payWave card yet, check out the Wise international debit card as a simple way to tap and pay at home and abroad, with the real exchange rate and low fees that can beat the banks.

You can usually just tap and go if you’re making a purchase of 250 MYR or less. For higher value transactions you may need to tap and then enter your PIN as an added security measure.

It’s worth knowing that there may also be a debit card contactless limit imposed by your own bank. If you’re not sure how to increase your payWave limit you’ll usually find the answers easily by logging into your online banking.

PayWave is a Visa technology, and so not supported by MasterCards. However, MasterCard has its own MasterCard Contactless system⁹, which also allows card holders to tap to pay, and add their cards to mobile wallets.

Sources checked on 30.08.2022

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Thinking of opening a Maybank savings account online? Check out our 2026 guide on how to do so, from the easiest MAE app steps to hidden fees!

Is the Maybank KrisFlyer Platinum actually worth it for 2026? Here's a breakdown of lounge access, miles rate, and how to save on foreign transactions.

Is Ryt Bank's interest really worth it for Malaysians? Compare the benefits and see how using Wise alongside your account can help you avoid hidden fees.

A guide to Maybank PayWave activation. We explain the 2026 security cooling period, contactless limits, and how to use Wise to avoid bank fees abroad.

Can you open a Public Bank account online? See which steps you can do from home, why a branch visit is likely, and how Wise offers a digital alternative.

A guide on Ryt vs GXBank and which is the best digital bank for 2026. Find out who wins on interest and how Wise can help you no matter which bank you pick.