How to Open a Maybank Saving Account Online in 2026

Thinking of opening a Maybank savings account online? Check out our 2026 guide on how to do so, from the easiest MAE app steps to hidden fees!

Multi-currency or foreign currency accounts can be helpful for people who send and receive foreign currency payments, travel often, or want to diversify their investments. Public Bank offers a couple of options for foreign currency accounts, including a current account for day to day transactions and a fixed deposit account to get a higher rate of interest.

This guide introduces all you need to know about Public Bank foreign currency account options, including fees and interest rates and how exchange rates are applied. We'll also introduce the Wise account, a handy companion to make your money go further with low, transparent fees.

| Table of contents |

|---|

Foreign currency accounts, or multi-currency accounts allow customers to hold one or more foreign currencies. Depending on the account type you may be able to convert between currencies within the account, receive payments from overseas, make cash withdrawals and send money internationally.

Foreign currency accounts are particularly useful if you send and receive payments from overseas. Get paid in a foreign currency and hold the balance until you need it next, with no pressure to switch bank to MYR immediately. Or, wait until the exchange rate looks good, buy the foreign currency you need and hold it in your account ready for making payments or spending as you travel.

Different foreign currency accounts have different features and fees - and may use different exchange rates too. Let’s look at how the foreign currency accounts from Public Bank work.

The Public Bank Foreign Currency Current Account is available in the following currencies¹:

- New Zealand dollar (NZD)

- Australian dollar (AUD)

- British pounds (GBP)

- US dollar (USD)

- Euro (EUR)

- Japanese yen (JPY)

- Hong Kong dollar (HKD)

- Swiss franc (CHF)

- Singapore dollar (SGD)

- Thai baht (THB)

- Chinese renminbi (CNY)

- Canadian dollar (CAD)

Accounts are available for both individuals and businesses - although it’s also worth noting that placements of CNY for businesses can be made for trade related purposes only. A minimum deposit of 1,000 USD or the currency equivalent is required to open the account, and interest is calculated daily and paid monthly in the currency of the account. More on the interest rates available a little later.

If you want to hold foreign currency as an investment, or if you have funds you’re willing to lock away for a period to get a better interest rate, a fixed deposit account may suit you. In a fixed deposit account you’ll make a currency placement and then won’t be able to access it for a pre-agreed period of time. You’ll usually earn a better interest rate compared to a regular savings account, but if you need to withdraw your funds early there will be a penalty to pay.

Public Bank Foreign Currency Fixed Deposit Accounts are available to individuals and businesses and can be denominated in²:

- New Zealand dollar (NZD)

- Australian dollar (AUD)

- British pounds (GBP)

- US dollar (USD)

- Euro (EUR)

- Japanese yen (JPY)

- Hong Kong dollar (HKD)

- Swiss franc (CHF)

- Singapore dollar (SGD)

- Thai baht (THB)

- Chinese renminbi (CNY)

- Canadian dollar (CAD)

As with the current account option, CNY placements for businesses are only allowed for trade purposes.

The minimum deposit for this account type is 10,000 MYR or the currency equivalent for each currency you want to hold. Placements can be made for 1 to 12 months and interest is paid upon maturity in the currency of the account.

Before choosing a foreign currency account you’ll want to know the costs involved with opening and operating your account, and how much interest you may earn. Let’s take a look.

Interest rates in both Public Bank foreign currency accounts are determined by the currency involved. The current account pays a relatively low level of interest, on a monthly basis while the fixed deposit account may provide ways to boost your interest if you lock your money away for a fixed period.

Here are the rates available at the time of research from the Public Bank Foreigh Currency Current Account³:

| Currency | Public Bank Foreign Currency Current Account interest rate |

|---|---|

| USD | 1.07% |

| GBP | 0.96% |

| AUD | 0.87% |

| EUR | 0.43% |

| HKD | 0.00% |

| NZD | 0.72% |

| CNY | 0.13% |

| CAD | 0.58% |

| SGD | 0.34% |

| JPY | 0.01% |

| CHF | 0.00% |

| THB | 0.05% |

*Correct at time of research - 17 August 2025

And as a comparison, here’s how much you may earn if you opt for a Public Bank Foreign Currency Fixed Deposit Account, split by currency and placement length⁴:

| Currency | 1 month | 3 months | 6 months | 12 months |

|---|---|---|---|---|

| USD | 4.25% | 4.30% | 4.05% | 3.75% |

| GBP | 3.90% | 4.05% | 3.90% | 3.70% |

| AUD | 3.50% | 3.60% | 3.40% | 3.20% |

| SGD | 1.50% | 1.55% | 1.35% | 1.25% |

| JPY | 0.20% | 0.25% | 0.20% | 0.05% |

| EUR | 1.80% | 2.00% | 1.80% | 1.70% |

| HKD | 0.50% | 1.35% | 1.80% | 2.05% |

| NZD | 2.90% | 3.00% | 2.85% | 2.70% |

| CAD | 2.50% | 2.60% | 2.40% | 2.30% |

| CNY | 0.55% | 0.60% | 0.65% | 1.00% |

| CHF | 0.00% | 0.00% | 0.00% | 0.00% |

| THB | 0.30% | 0.35% | 0.40% | 0.50% |

*Correct at time of research - 17 August 2025

Maintenance and transaction charges apply to the Public Bank Foreign Currency Current Account. A couple of fees may also apply to the Fixed Deposit account option, and if you need to withdraw your money early from a fixed term agreement you may also lose interest you’ve accrued.

Here are the key Public Bank Foreign Currency Current Account fees⁵:

| Service type | Public Bank Foreign Currency Current Account fee |

|---|---|

| Maintenance fee | 30 MYR or the currency equivalent per annum |

| Transaction charge (individual customers including sole proprietors and partnerships) | Transaction charge varies by the currency involved. For CNY transactions, sole proprietors and partnerships are considered to be non-individual customers:

|

| Transaction charge (non- individual customer) | 4 USD or MYR equivalent per transaction |

And there are the key costs associated with the Public Bank Foreign Currency Fixed Deposit account⁶:

| Service type | Public Bank Foreign Currency Fixed Deposit Account fee |

|---|---|

| Lost receipt | 5 MYR service charge + 10 MYR stamp duty |

| Request for statement | 2 MYR per page |

If you need to convert your funds from a foreign currency to MYR - or vice versa - you’ll want to check the Public Bank’s exchange rate. Banks typically offer a different rate depending on whether you’re buying or selling a currency, and the different service you need - like buying notes or sending a telegraphic transfer for example. Check out the Public Bank exchange rates online or in your local branch to see what’s on offer⁷.

When you have found out the rate that’ll be applied to your transaction, it pays to compare it to the mid-market exchange rate, which you can find on Google. The mid-market exchange rate is the rate banks get when they buy and sell foreign currency on wholesale markets. However, it’s not usually the rate they offer customers. Instead, they add a markup or margin to their retail rates - which is an extra fee but it’s tricky to spot.

Compare the Public Bank rate with the mid-market rate to see if an extra fee has been added in here. If it has you might be better off with a currency exchange service or foreign currency account which doesn’t add a markup to rates - like the Wise account. More on that later.

To open your Public Bank foreign currency account you’ll need to visit your local branch. A member of staff will help you decide which account is most suited to your needs, and confirm the documents you need to proceed. Contact details can be found on Public Bank's website under "Contact".

Here’s a summary of some of the pros and cons of the 2 different Public Bank foreign currency account options:

| Account | Pros | Cons |

|---|---|---|

| Public Bank Foreign Currency Current Account |

|

|

| Public Bank Foreign Currency Fixed Deposit Account |

|

|

If you’re looking for a more flexible foreign currency account with no minimum balance and low fees, read on for more about the Wise account.

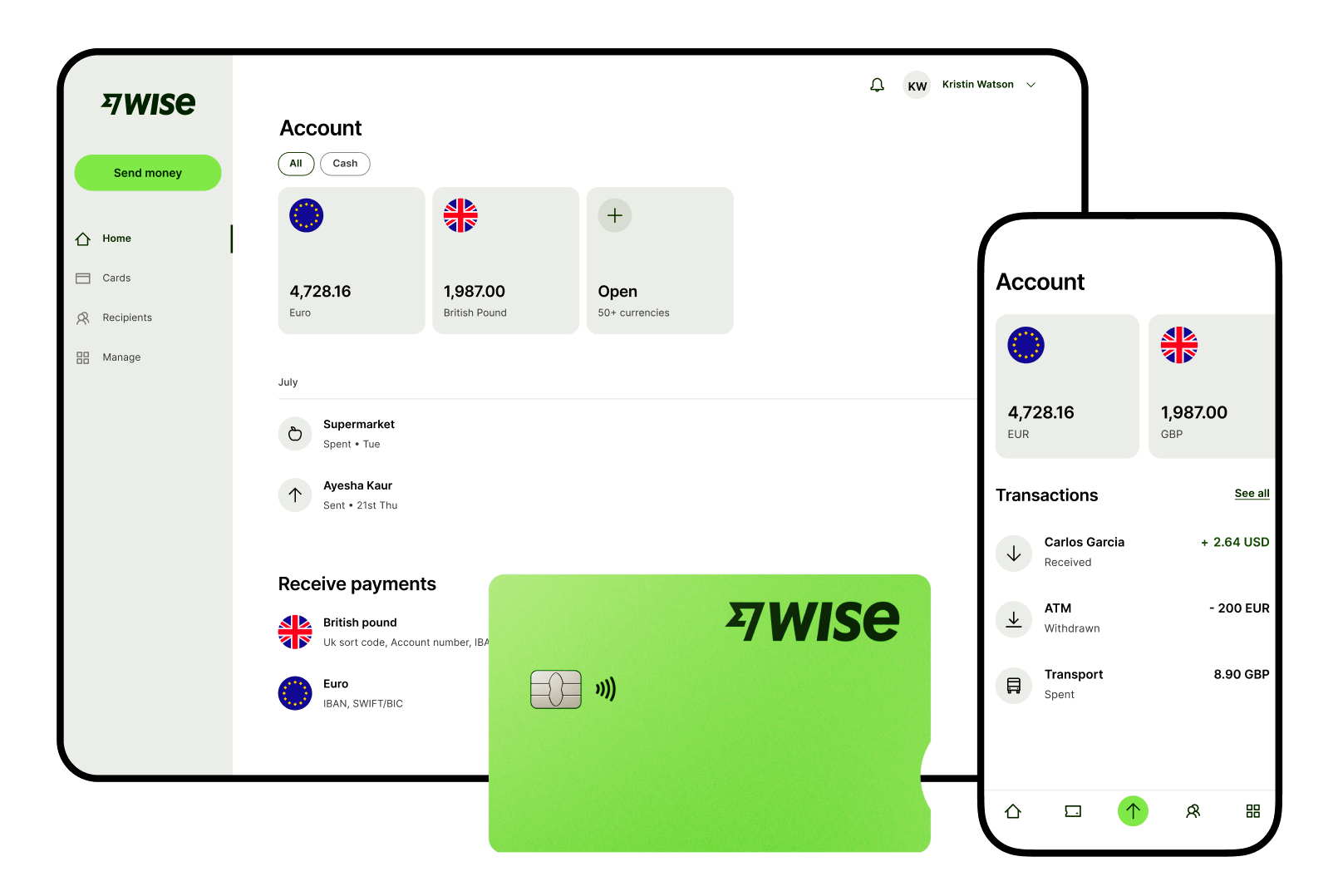

The Wise account is an easy way to hold and exchange 40+ currencies, including MYR, USD, GBP, and more. All you need to do is create a free account to get started.

With Wise, you can exchange currencies at the mid-market rate each time, with low, transparent conversion fees from 0.77% and absolutely no markups. Plus, you can order a linked Wise card for convenient spending without any foreign transaction fees, and up to 2 free ATM withdrawals to the value of 1,000 MYR when you're overseas. You'll even get 8+ local account details to get paid conveniently to your Wise account in MYR and a selection of other major global currencies.

Sending money or making payments abroad? Wise also offers fast, low cost transfers to 140+ countries - you can track your transfer in your account and your recipient will also be notified when a transfer reaches them.

Sources

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Thinking of opening a Maybank savings account online? Check out our 2026 guide on how to do so, from the easiest MAE app steps to hidden fees!

Is Ryt Bank's interest really worth it for Malaysians? Compare the benefits and see how using Wise alongside your account can help you avoid hidden fees.

Can you open a Public Bank account online? See which steps you can do from home, why a branch visit is likely, and how Wise offers a digital alternative.

A guide on Ryt vs GXBank and which is the best digital bank for 2026. Find out who wins on interest and how Wise can help you no matter which bank you pick.

Is Ryt Bank Malaysia’s best digital bank? Read our 2026 review on Save Pockets, AI bill payments, and the zero-fee Ryt Card.

Compare Wise vs GXBank to stretch your Ringgit. Earn interest with GXBank savings, but use Wise to avoid FX fees.