How to Open a Maybank Saving Account Online in 2026

Thinking of opening a Maybank savings account online? Check out our 2026 guide on how to do so, from the easiest MAE app steps to hidden fees!

A foreign currency or multi-currency account can be helpful if you get paid in foreign currencies, or if you need to make international payments often. Multi-currency accounts can also be handy for people who travel a lot or love to shop online with overseas retailers, and those who want to diversify investments by holding foreign currencies.

This guide to the Hong Leong Bank foreign currency account covers all you need to know about eligibility, account options and the HLB exchange rate you’ll access. We'll also introduce the Wise account, a handy companion to make your money go further with low, transparent fees.

| Table of contents |

|---|

Foreign currency or multi-currency accounts let customers hold one or more foreign currencies, and can be used to make one off or regular payments, to get paid in an international currency, or to invest.

Hong Leong Bank offers two foreign currency account options for personal customers:

You can hold 10 foreign currencies in the current account for day to day spending such as remitting money overseas to support a family member, getting paid by an overseas employer, or paying international bills. Currencies available include:

- US dollar

- Canadian dollar

- Australian dollar

- British pound

- Chinese renminbi

- Euro

- Hong Kong dollar

- Japanese yen

- New Zealand dollar

- Singapore dollar

Minimum opening deposits apply, which can vary by currency. If you hold a USD balance you’ll need to deposit at least 1,000 USD, while HKD accounts can be opened with a 10,000 HKD initial deposit, for example.

The Foreign Currency Fixed Deposit Account is aimed more at people who are looking to invest and hold foreign currencies, rather than for day to day spending. The same range of currencies - and the same minimum deposit requirements - are in place, but with this account you can hold funds for a fixed term to earn a higher interest amount. If you need to withdraw a payment before the end of the fixed term, penalties may apply. More on the Hong Leong Bank interest rate later.

Let’s take a closer look at the fees and interest rates available for both HLB foreign currency account options.

If you want to hold foreign currencies to earn interest you’ll probably want to choose the fixed deposit account option. Although theoretically interest is payable on the day to day foreign currency current account, at the time of research, the interest payable is 0.0% across all currencies, reflecting global markets. However, these rates may change over time, so it’s worth keeping an eye on.

If you’re able to lock away your foreign currency balance in a fixed deposit (FD) account, you’ll be able to earn interest which varies by currency and based on how long you keep it in the account. The Hong Leong Bank FD rate at the time of writing ranges from 0.0% for EUR and JPY deposits, to 0.45% for 12 month holdings of USD, and 1.15% returns on a 12 month term for CNY.

There are also a few associated fees it’s worth knowing about:

| Fee type | Hong Leong Bank foreign currency account cost³ |

|---|---|

| Transaction fee | 10 MYR Depending on the transaction type other costs such as commissions, postage or cable charges may also apply |

| Service charge | 30 MYR every 6 months |

| Early withdrawal penalty | If you withdraw from a FD account early you may pay penalty fees and lose interest accrued |

Using a multi-currency account can mean you avoid the need to exchange currency unnecessarily. If you get paid in a foreign currency you can hold it in your HLB foreign currency account until you next need to send money in that currency. That avoids unnecessary double conversion fees, and can help you manage fluctuations in the exchange rate.

If you know you’re going to need a foreign currency for a future payment you can also buy and hold the funds when the exchange rates are favourable. However, it’s important to note that the HLB exchange rate⁴ includes a markup on the mid-market exchange rate. This can push up the overall cost of currency exchange and means you may be able to find a better deal with a specialist provider.

Ready to get started? Let’s look at how to open your Hong Leong Bank foreign currency account.

To open your HLB multi currency account you must:

- Already have an account with HLB

- Be a Malaysian citizen, permanent resident, or foreigner with valid documentation

v* Be over 18 years old

It’s possible to open your MYR current or savings account online or in a branch, but you’ll then need to visit a branch to open your foreign currency account.

To open your HLB foreign currency account you’ll need to select the right account type for your needs and get in touch with HLB in branch, online or by phone. A member of the customer service team can talk you through the documents you need to provide and how to activate your account, based on your specific needs.

Select the account you are interested in, on the HLB website, and tap I’m interested to get started.

Hong Leong Bank contact details:

Phone number for all banking inquiries: 03 7626 8899 (open 9am to 6pm)

You can also contact HLB via social media or online chat on their website.

Let’s summarise some of the pros and cons of the HLB foreign currency accounts.

| Pros | Cons |

|---|---|

|

|

The Hong Leong Bank foreign currency account does have some great benefits - especially if you prefer to manage your money via a bank branch. However, if you’re looking for a cheaper and more flexible option you might be better off with a Wise sccount.

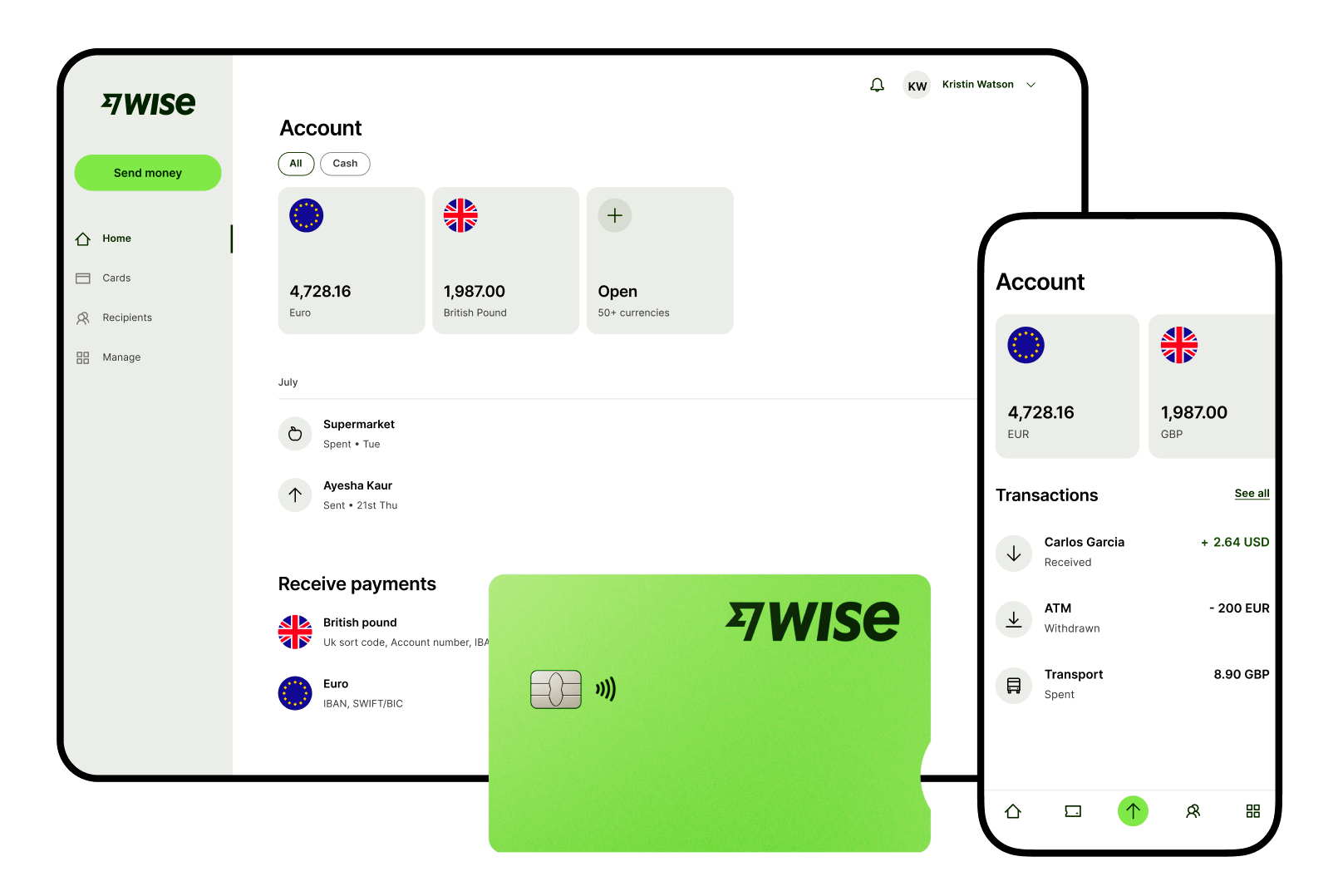

The Wise account is an easy way to hold and exchange 40+ currencies, including MYR, USD, GBP, and more. All you need to do is create a free account to get started.

With Wise, you can exchange currencies at the mid-market rate each time, with low, transparent conversion fees from 0.77% and absolutely no markups. Plus, you can order a linked Wise card for convenient spending without any foreign transaction fees, and up to 2 free ATM withdrawals to the value of 1,000 MYR when you're overseas. You'll even get 8+ local account details to get paid conveniently to your Wise account in MYR and a selection of other major global currencies.

Sending money or making payments abroad? Wise also offers fast, low cost transfers to 140+ countries - you can track your transfer in your account and your recipient will also be notified when a transfer reaches them.

Sources

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Thinking of opening a Maybank savings account online? Check out our 2026 guide on how to do so, from the easiest MAE app steps to hidden fees!

Is Ryt Bank's interest really worth it for Malaysians? Compare the benefits and see how using Wise alongside your account can help you avoid hidden fees.

Can you open a Public Bank account online? See which steps you can do from home, why a branch visit is likely, and how Wise offers a digital alternative.

A guide on Ryt vs GXBank and which is the best digital bank for 2026. Find out who wins on interest and how Wise can help you no matter which bank you pick.

Is Ryt Bank Malaysia’s best digital bank? Read our 2026 review on Save Pockets, AI bill payments, and the zero-fee Ryt Card.

Compare Wise vs GXBank to stretch your Ringgit. Earn interest with GXBank savings, but use Wise to avoid FX fees.