How to make money online and from home: For beginners, students and more (MY)

Learn more about how to make money online in Malaysia through platforms like YouTube, TikTok, and more.

Not sure about the difference between a charge card and a credit card? While both can be handy for convenient spending in person and online, they do work differently in some important ways.

Before you pick the right card - or cards - for your needs, read our full guide on charge card vs credit card so you can work out which suits you the best. We'll also introduce the Wise account, a handy companion to make your money go further with low, transparent fees.

A charge card is a payment card which allows you to make purchases online and in person, with a monthly bill which you must settle in full by the due date. You might find that with a charge card there’s not an upper spending limit set, so you can use the card as often as you wish for purchases, as long as you’re able to make a full repayment when your bill comes in.

Charge cards are different to both credit cards and debit cards. All of these different spending card types have their own advantages and disadvantages, though, so it’s worth considering each of them when deciding which may work for you. We’ll dive into the detail of charge card vs credit card a little later to help you compare.

In Malaysia the primary issuer of charge cards is Maybank. Maybank issues 3 different charge cards, all on the American Express network¹:

- American Express Card

- American Express Gold Card

- The Platinum Card

It’s worth noting that these cards come with minimum salary requirements and may have fairly hefty annual fees. Depending on which card you pick though, you’ll also get a range of perks and benefits which may mean that the costs are worthwhile. The Platinum Card² for example has a minimum annual income requirement of 190,000 MYR/year, and an annual fee of 3,250 MYR for up to 5 cards. You’ll unlock a range of luxury benefits, but you’ll have to repay your bill in full monthly, or face a penalty fee³.

Now that yoy know what a charge card is, there are a few things which are similar between charge cards and credit cards:

The way you use a charge card day to day is similar to the way you’d use a credit card. However, there are a couple of important differences:

Here’s a head to head run through of the key features of both charge cards and credit cards:

| Charge card | Credit card | |

|---|---|---|

| Options available | Few options available | Widely available |

| Spending limits | May not be subject to limits | Limits apply based on your credit history and the card type |

| Eligibility and fees | May be subject to strict eligibility including minimum earning requirements Annual fees can be high | Broad range of eligibility options and annual charges, including cards with no annual fee |

| Repayment plan | Pay back in full every month | Pay back a minimum every month - the remainder can be rolled over for future repayment (charges and interest apply) |

| Penalties | Late payment penalties are likely to apply | Late payment penalties are likely to apply |

Both credit cards and charge cards have their own advantages and disadvantages, which can make them more suited to different customer needs. If you’re not sure where you land in the credit card vs charge card debate, here’s a quick summary of some important pros and cons of each.

| Pros | Cons | |

|---|---|---|

| Credit card |

|

|

| Charge card |

|

|

Whether a credit card or charge card is right for you will depend a lot on your personal preferences and how you like to manage your money.

If you’re confident that you can clear your bills every month, a charge card can offer more flexible limits and some great perks. This is especially so if you’re willing to pay a higher annual fee to unlock more benefits with a card like the Maybank Platinum Card. However, there’s not a huge number of banks which issue charge cards in Malaysia so you’ll have a limited choice compared to credit cards.

On the other hand, a credit card might suit you better if you’d like to spread the cost of purchases over a few months and don’t mind paying interest for this facility. There are many credit cards on the market, so the chances are that you’ll be able to find one which has benefits you’d value, with a balance of cost and convenience that suits your needs.

No matter whether you pick a charge card or a credit card, there will be some fees involved, so it’s important to read through the card terms and conditions carefully before you sign on the dotted line. Look out for penalty costs and charges, as well as transaction fees such as extra costs when you spend in foreign currencies. Or, pick a specialist card whenever you need to spend internationally, to drive down the costs of currency conversion - more on that next.

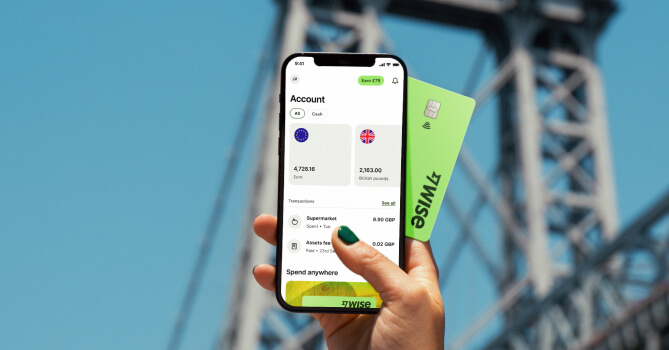

The Wise card lets you spend in 40+ currencies at the mid-market rate including CNY, JPY, GBP, and SGD so you know you'll be getting a great deal in over 150+ countries. Simply create a free Wise account, order a card and top-up MYR to get started.

Virtual cards are free and can be added to your Google or Apple Pay wallet, while a physical Wise card can be ordered for a low fee of 13.7 MYR. Having a physical Wise card allows you to make chip and pin payments, as well as two free ATM withdrawals to the value of 1,000 MYR each month, before low fees start.

While abroad, you can choose to spend with directly in MYR and let auto-conversion do the trick, or convert to your desired currency with your Wise account. Either way, you’ll get the exchange rate you see on Google, with low, transparent fees from 0.77%.

Sources:

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Learn more about how to make money online in Malaysia through platforms like YouTube, TikTok, and more.

Learn more about the RHB Multi Currency Debit card in Malaysia, including benefits, requirements, fees and whether it’s worth getting.

We compared the top Affin Bank cards in Malaysia. Whether you’re looking for points, fees or rewards on travel spend, find out which credit card is for you.

Learn more about Revolut and Wise, including exchange rate comparisons, and whether the product can be used in Malaysia,

Want to know how much transaction fees you’re paying when using your Malaysian credit card overseas? Learn more about the types of fees and how to avoid them.

Learn more about the Maybank World Elite Mastercard in Malaysia, including benefits, requirements, fees and whether it’s worth getting.