Best Digital Banks in Malaysia comparison

Find out which are the best digital banks in Malaysia and how they compare.

This guide to the best banks in Malaysia for 2025 will walk through some key points about the major bank brands here in Malaysia. We’ll look at important criteria for choosing the right bank for you, including the account types available, bank size and number of branches.

To help you save money when banking across borders, we will also touch on a smart way to cut international payment fees, using Wise.

If you're an expat in Malaysia, you might need to send money abroad regularly.

A crucial thing to remember when sending money abroad is to always check exchange rates. The true cost of an international transaction isn’t just the upfront transfer fees. If you get hit by a bad exchange rate, you could find you’re paying more than you think to send a payment internationally.

Wise makes it easy to compare the costs, rates and how much your recipient will get in the end, so you can see which service is best for you. Just enter the details of the transfer into the comparison tool to get an instant, no obligation quote from Wise, with a live comparison of some major Malaysian banks so you can see which is cheapest.

You can check more banks’ telegraphic transfer fees here.

Send money abroad with the mid-market exchange rate💡

If you’re looking for a bank in Malaysia, you have plenty of choice. There are some strong local banks, banks with a regional presence, and global banking giants all operating in Malaysia. Each has its own features and benefits - so choosing the right one for you will require some research.

Our Malaysia bank ranking covers bank features and fees here in Malaysia, starting out with Maybank which was recently ranked top bank in Malaysia in a global survey¹. HSBC and Standard Chartered also ranked highly on this list, which had all of the biggest global banking brands featured. Let’s dive into our look at the best banks in Malaysia 2024.

Maybank is Malaysia’s largest bank, operating throughout the country and broader region.

|

|---|

Maybank2u is Maybank’s online banking system, which provides a convenient and reliable way for customers to engage and manage their money. With Maybank you can also open accounts - including savings accounts - online. You can budget, make cashless payments, access Shariah compliant features and more, through Maybanks’ MAE.

Maybank also has some great specialist accounts including a range of saving accounts.

Check out more about the best savings accounts in Malaysia 📖

While Malaysia is a fairly small market for the enormous Standard chartered, Forbes found it the 2nd best bank in Malaysia in 2024.

|

|---|

Customers can access standard and Islamic account products, investments, credit cards, loans and a full suite of services. Premium banking options are available for high wealth individuals, as well as business and corporate banking services.

HSBC is one of the best known global banking brands, with a strong presence in Malaysia and around the South East Asia region. In fact, HSBC has had a footprint in Malaysia since 1884.

|

|---|

HSBC has a long history in Malaysia. Back in the early 1980s, it was HSBC which introduced the first ATM to the country, and HSBC was a front runner in bringing electronic banking to Malaysia too. These days, you can access a broad range of products and services for personal and business customers, online, in branches and via your mobile.

RHB operates for both private and commercial customers, with a full range of banking and investment products.

|

|---|

RHB is one of the largest financial services groups in Malaysia, with strong online and mobile banking options to make life more convenient for customers. You can apply for some accounts online, and manage your money on the move through your preferred device.

Bank Islam is a pioneer of Islamic banking in Malaysia, and ranks 5th best bank in the country according to Forbes.

|

|---|

Bank Islam offers personal, corporate and business banking in Malaysia, including deposit and investment accounts, cards and more.

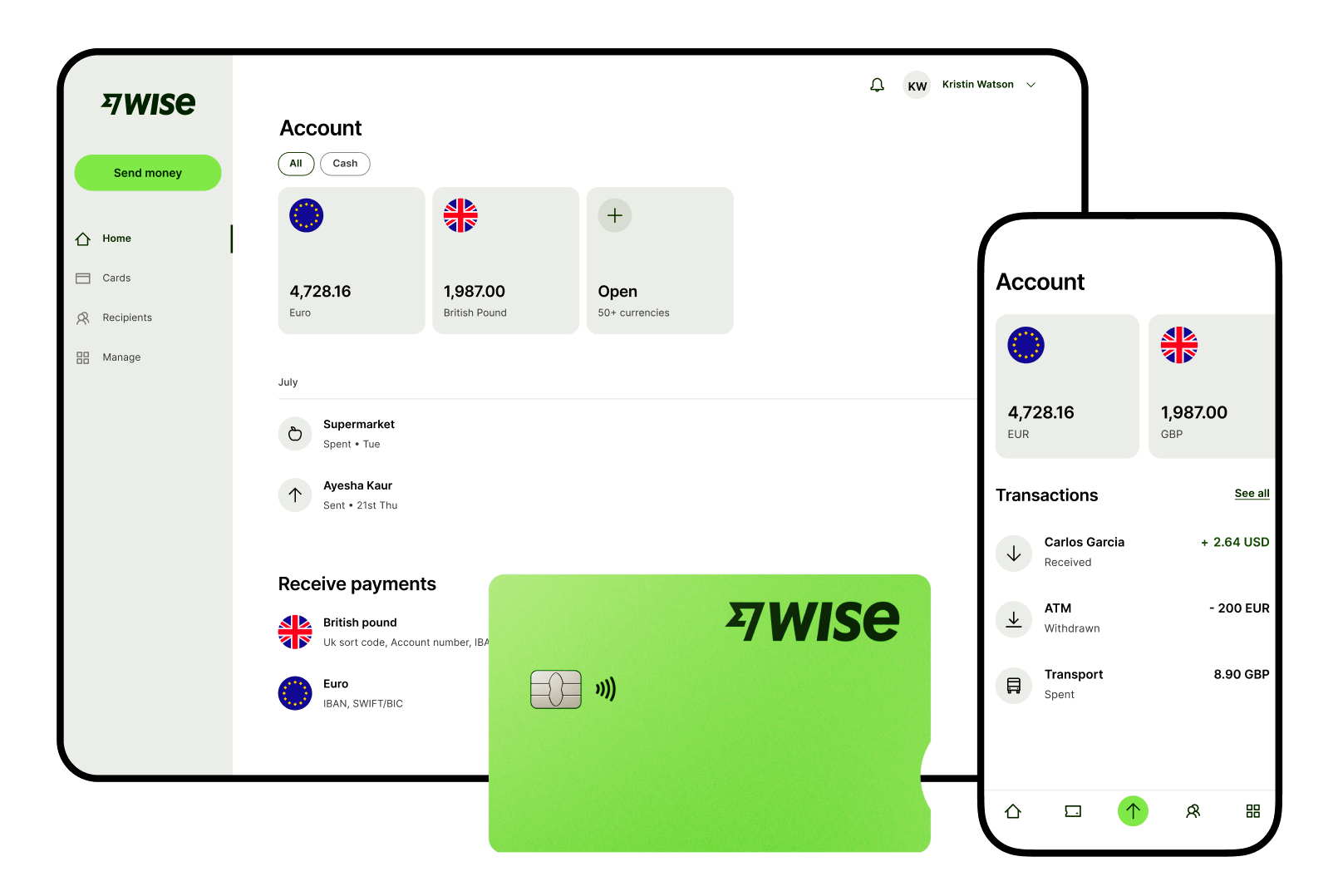

If you’re looking for easy ways to manage your money across currencies, check out the Wise account. You can hold and exchange 40+ currencies, with the mid-market exchange rate every time, and low fees from 0.33%⁷. Plus, you can order an international debit card for convenient spending and withdrawals, and you’ll get local bank details to get paid conveniently to your Wise account in MYR and a selection of other major global currencies.

Need to pay someone based abroad? Wise offers fast, low cost transfers to 160+ countries in 40+ currencies. To send money with Wise,

And that is it! You can track your transfer in your account and your recipient will also be notified when a transfer reaches them.

Join 16 million customers and enjoy a cheaper, faster and transparent way to send money abroad with the mid-market exchange rate.

Send money to 150+ countries with Wise🚀

Pricing/fees: Please see Terms of Use for your region or visit Wise Fees & Pricing for the most up to date pricing and fee information

The AmBank group includes brands which focus on retail and business banking, Islamic banking, insurance and investment. This means a wide range of products and services for AmBank customers.

|

|---|

AmBank has a good range of services for customers, and online and mobile banking which is growing in use and functionality.

OCBC is a long established bank with a significant presence in Malaysia and around the region. As you’d expect, you can get a good range of products and services with strong online and mobile banking options.

|

|---|

OCBC in Malaysia offers consumer, business and investment banking, as well as Islamic banking services under its dedicated subsidiary.

UOB - United Overseas Bank - has over 500 branches in 19 countries, and has been in Malaysia since 1951. You can access banking and Islamic banking products through a network of local branches, and online.

|

|---|

UOB started out in 1935, mainly serving the Fujian community. These days, UOB is represented in 19 countries and is one of the largest banks in the region. As you would expect of a large and well established bank, you can get a broad range of products suited to different customer needs.

We couldn’t feature all the banks in Malaysia in this one guide - but here are a few others that are worth a quick mention.

CIMB11 is one of the largest investment banks in Asia and one of the largest Islamic banks in the world. Regionally, CIMB has over 1,000 branches and locations. CIMB Clicks is the online banking service from CIMB. In Malaysia alone, there are 3.3 million customers using CIMB Clicks accounts.

Public Bank12 has a representation in Malaysia, across South East Asia and beyond. Customers can get a broad range of services including personal and business banking, Islamic banking, investments and insurance products. Public Bank has a full range of products and services including accounts, loans and insurance. Public Bank is also particularly popular for residential property financing, and in the passenger vehicle financing market.

Hong Leong13 has an existing - and ever growing - footprint in the Asian region, with global services and Islamic banking products also available. Banking services are delivered through branches, online, an app, self service terminals and call centres. Hong Leong has a strong regional presence and has been frequently recognised with awards for service and standards. You’ll find a full range of banking products and services available, and a range of smart ways to manage your money online or using your mobile devices.

Bank Rayat14 is one of the biggest Islamic financial institutions in the country offering personal and business banking based on Islamic principles. Bank Rakyat offers a comprehensive range of products and essential services including basic banking in underserved rural areas. You can manage your money via a branch, online and mobile banking, call centre and more.

Finding a bank in Malaysia won’t prove difficult. But getting the right bank and account for your needs requires a little research. Take this guide as a starting point to help you find the bank that best suits you - and don’t forget to check out Wise for multi-currency accounts you can use to hold and exchange 40+ currencies, and low cost international payments to 160+ countries.

Sources:

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Find out which are the best digital banks in Malaysia and how they compare.

Foreigner opening a bank account in Malaysia? Read more what options are available, documents needed to open a bank account and more

Looking to open a bank account online Malaysia? Read more about how to open a bank account or international account online and their requirements.

Looking to open a CIMB current account in Malaysia? Here's how to open an account with CIMB and review of each current account.

Need a local bank account in Singapore? Here’s how to open an account online in Malaysia, without leaving your home.

Looking to open an HSBC Global account in Malaysia? We reviewed the features, currencies, fees and more.