How to ask for work in an email: Your complete guide

Learn how to write compelling emails to your client asking for more work with practical tips and easy templates.

The global online wallet giant, Paypal, offers accounts for Indian businesses. This can be handy, especially if you are a freelancer working with clients abroad.

Let’s take a look at Paypal’s business accounts in India and how it can work for you.

Yes, freelancers in India can have a PayPal business account. PayPal makes it easy for freelancers to get paid from 200 different countries around the world, and also from marketplaces and freelance platforms online.

But if you are a freelancer in India wanting to open a PayPal account, you have to make sure you have the following:

- A registered business

- A business category

- A business PAN

- A business bank account in the same name as the PAN

- Your annual sales volume

| ⚠️ Without these you will not be able to open a PayPal business account |

|---|

Due to the requirements, PayPal can only be a good option for established freelancers with a registered business. Those new to freelancing are likely to have to look at other options to get payments from abroad.¹

There is a large difference between a PayPal individual account and a business account in India. Here is a quick table:

| PayPal Individual Account | PayPal Business Account | |

|---|---|---|

| Receive payments globally | ❌ | ✅ |

| Send payments globally | ❌ | ✅ |

| Shop worldwide with PayPal | ✅ | ❌ |

| Linked to Indian bank account | ❌ | ✅ |

| Linked to a Indian debit/credit card | ✅ | ❌ |

| PAN required | ❌ | |

| Hold money in the PayPal wallet for more than 24 hours | ❌ | ❌ |

PayPal India used to allow individuals to send and receive payments, but it has stopped that feature. So now individual accounts can only link their debit or credit card to the account to shop online. You are not allowed to hold money in a wallet in your PayPal account either.

The PayPal business account in India does allow you to send and receive payments from abroad. It also lets you send invoices, payment links and provide built in buttons to your website. But again, you will need to have a registered business to do so.²

| 💸 Want to get payments from abroad easily in India? Check out Wise Web/Android/ iOS app to get paid directly into your local Indian bank account. |

|---|

Find out more about Wise Business 🚀

If you have your freelance business set up, registered and with monthly sales, you are ready to open your PayPal business account. Here is how to go about it.³

First, go to PayPal’s India site and click on Sign up in the top right hand corner.

You will then be asked if you want to open an Individual account or a Business account. There will be a short description of what you can do with each.

Choose the Business Account and click on Next.

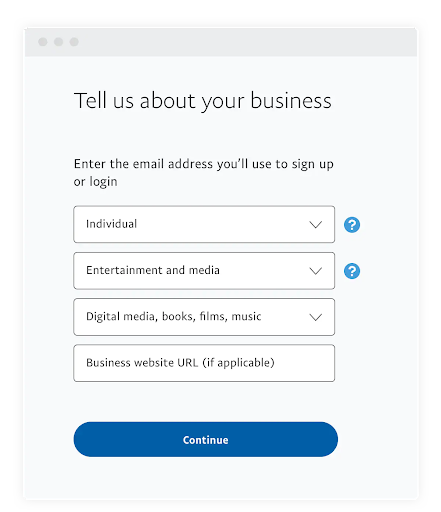

You will then be asked about your business, and asked to enter in the email address you would want associated with the account.

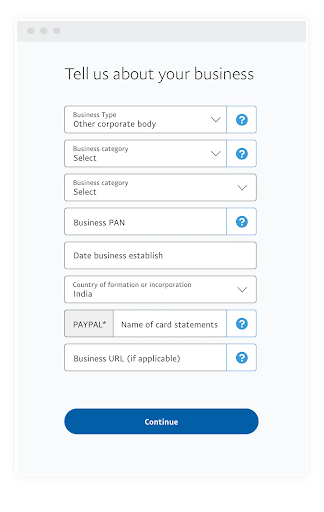

You will then be asked to enter details on your business, such as your business category, date of establishment and PAN:

You will then be asked about your finances, in order to comply with Indian tax laws:

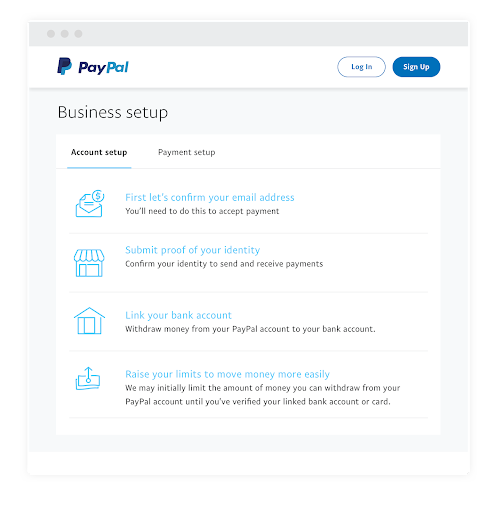

Once you complete these steps, you will be asked to verify and activate your account. You can verify your account with the email address you entered earlier:⁴

Next you will need to activate your account by completing the necessary KYC procedures. This will require uploading identification and documents.

Only once the KYC is complete can you start to receive payments.

After that, you will need to input your bank information so PayPal knows where to send the money in India:

| ⚠️ The name on the account must match the name on the business PAN card |

|---|

You will then need to verify your bank account. PayPal will drop 2 small but unique amounts into the bank account you put down. You will have to check your bank account for the exact amounts and input them in the form to PayPal. This will confirm your bank account on file.

Once you have completed these steps, in most cases you should be ready to go.

| 🔖 Read more: Full guide to How to open a PayPal account |

|---|

Opening an account with PayPal is free, but there are fees for using the account. First there is a fixed fee that is based on the transactions. And then there is a second fee that is hidden in the exchange rate with PayPal. Let’s break them down.⁵

For receiving payments from a client outside of India here is the transaction fee:

| Fee | 4.40% of the transaction + a fixed fee |

The fixed fee is based on the origin country of the sender. Each country has a different fee:

| Client’s country | Fixed fee |

|---|---|

| Australia | 0.30 AUD |

| Euro | 0.35 EUR |

| Hong Kong | 2.35 HKD |

| US | 0.30 USD |

| Great Britain | 0.20 GBP |

| Singapore | 0.50 SGD |

So, for example, if you were getting a payment from the US, this is how it would look:

Fee: 4.40% + .30 USD

Here is how much you would be charged from PayPal for a $100 USD transaction:

| Fees | Amount |

|---|---|

| Flat fee of 4.40% | $4.40 |

| Fixed | $.30 |

| Total fee | $4.70 |

| Amount after fee | $95.30 |

But on top of this, you will get charged a fee on the exchange rate with PayPal.

For most countries and currencies, PayPal charges an extra 4.0% on the exchange rate. So your exchange rate is weaker than the real exchange rate you see on Google or Wise.

With the fees and the exchange rate, how much would you get in the end in Indian rupees when using PayPal?

Let’s take a look, and see how it compares versus when someone sends you $100 on Wise:

| PayPal | Wise | |

|---|---|---|

| Payment amount in USD | $100 | $100 |

| Fee | $4.70 | $5.28 |

| Exchange rate at $1 | ₹72.28 | ₹75.39 |

| Amount you receive in INR | ₹6,888 | ₹7,141 |

So even with a slightly higher fee, Wise is cheaper than PayPal when sending money from the US to India. You get an extra ₹253 every time just by getting paid through Wise, rather than PayPal.

| 💸 Wise Business helps Indian businesses and freelancers receive payments from abroad right into their local bank account |

|---|

Find out more about Wise Business 🚀

Indian businesses and freelancers can sign up with Wise Business Account to get account details in 8 different currencies to receive payments from abroad. Your clients pay you with a local transfer in their currency, and you receive rupees in your INR bank account — with eFIRC for every transfer. That is truly business without borders.

And the best part is that you can get more of your earnings with Wise. With the real exchange rate, you won’t ever be charged extra on every Dollar or Euro converted. That means more money in your wallet.

Sources used for this article:

All sources checked as of 7 December, 2021

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Learn how to write compelling emails to your client asking for more work with practical tips and easy templates.

Find out the best payment methods for freelancers in India, and learn how to choose the right provider for your needs.

Discover the best freelancer developer websites in India, and find the right platform for your unique skills

Discover the best freelancer writer websites in India, and find the right platform for your unique skills

Discover the best freelancer graphic designer websites in India, and find the right platform for your unique skills

Compare Freelancer vs Fiverr on finding work, fees, payments, dispute resolutions, and find out which platform suits your needs best.