American Express Platinum Travel Card Review: Fees, benefits and is it worth it?

Thinking about getting the Amex Platinum Travel Card? Explore its fees, rewards, perks, lounge access, and overseas charges.

PayPal, one of the leading companies in global money transfers wallets offers its services to Indian residents.

But there are a few things to be aware of before you sign up for PayPal India, as it operates differently domestically.

To understand how PayPal India is unique, check out the breakdown of how PayPal works in India. And how you can open an account.

Sending money to India does not have to be complicated or expensive.

| 📝 Table of contents |

|---|

| With Wise, businesses and freelancers in India can receive money directly to your local Indian bank account from abroad the easy, fast and cheap way 🚀 |

|---|

Open your Wise Business account

PayPal India lets individuals and businesses in India open accounts, but functionality and what you can do with PayPal India is limited.

First, individuals can only use PayPal to shop at the brands and boutiques in the PayPal Shopping home site.

| ⚠️ If you are looking to send money overseas to friends or family, PayPal India does not offer a wallet or money transfers |

|---|

Instead, you have to link your debit or credit card to your account and can make payments for any purchases made with sellers on PayPal. That is it.

If you are a business owner, it is a different story.

You can receive international payments from 200 countries using PayPal. It can also be used for domestic payments as well, but it can be more expensive than native-Indian payment gateways.

As a registered business account, you can also send payments using your PayPal India account. So whether you have suppliers or partners to make payments to, you can use your account to do so.

But with a business account, it is a good idea to keep an eye on your fees. International payments have a fee of 4.4%+ a fixed currency fee. This is in addition to a currency conversion fee and a PayPal-set exchange rate.

This exchange rate is different from the mid-market exchange rate that banks use themselves. The mid-market exchange rate is also the one you see on Google. If you are paying an exchange rate that is different from the mid-market exchange rate, then there is a chance you are paying a markup on your rate.

One more thing to keep in mind is that with a PayPal India business account, your balance is cleared daily into your local bank account.¹

| The Good ✅ | The Bad ❌ | |

|---|---|---|

| Individual | Shop using PayPal | • Cannot send or receive personal payments • Cannot have PayPal Wallet |

| Business | Receive payments or send payments | Cannot keep a PayPal balance more than 24 hours |

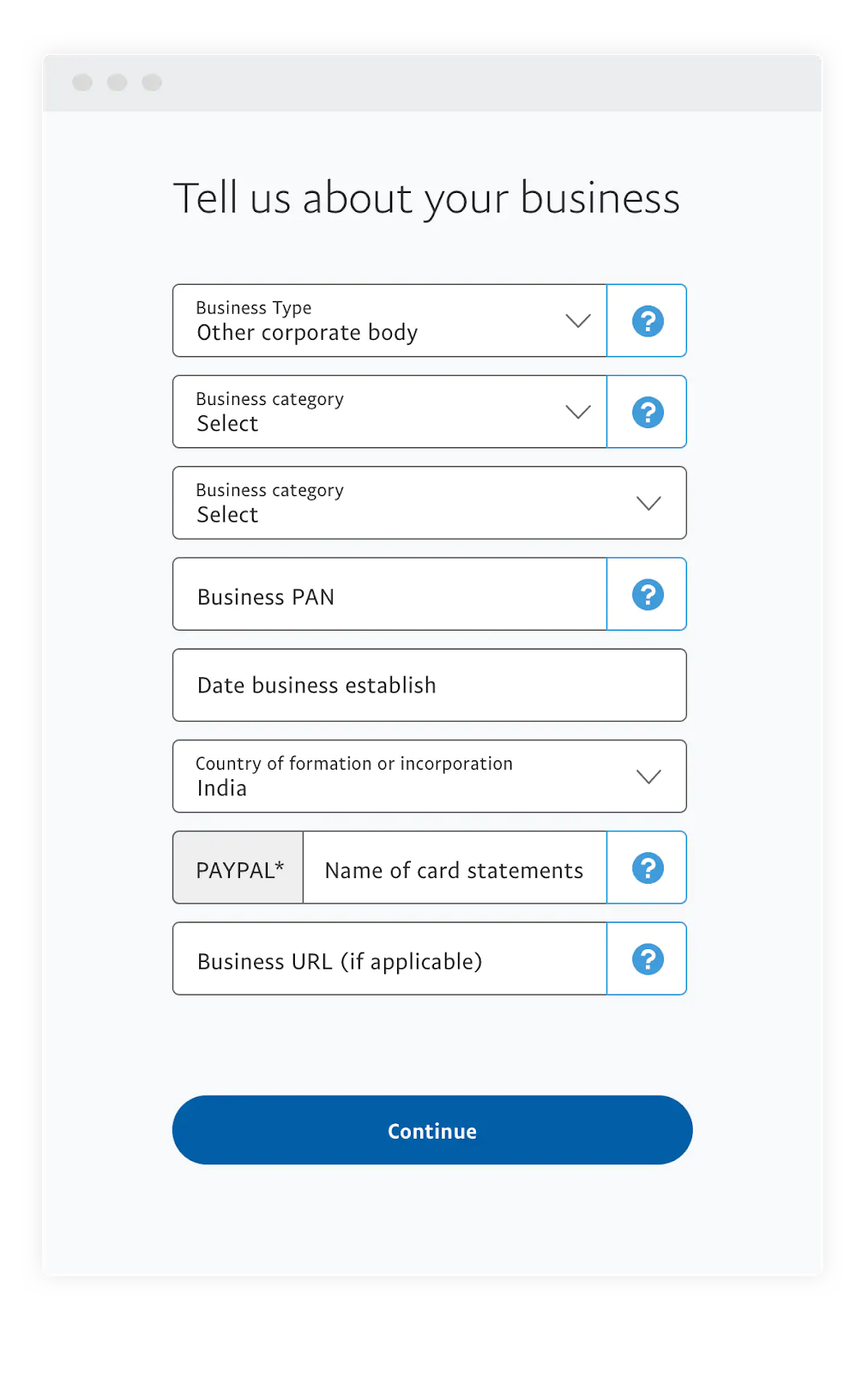

Now if you want to open a PayPal India account, there are different processes for opening an individual account, or a business or freelancer account. Here is a step by step guide on how to setup your PayPal account in India:

To begin using your PayPal India account, you will need to complete the company’s verification process.

You will need to first link your debit or credit card to your PayPal account. You can do that under Payment Methods on the dashboard and by submitting your card details.

You can confirm your debit or credit card with an OTP sent to the registered mobile number. Check out the section below about how to confirm a bank account. ⁴

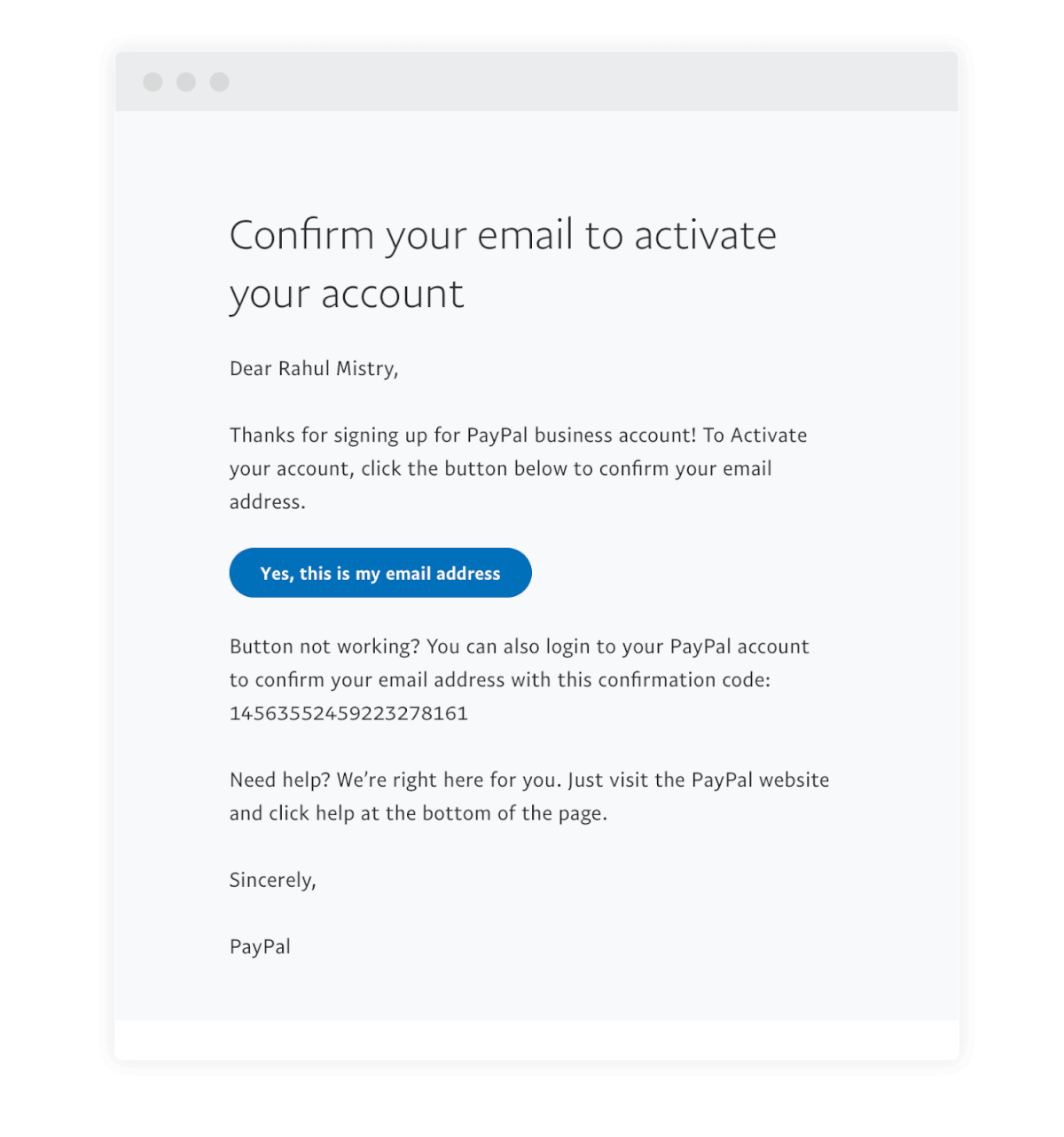

You need to activate and verify your account. Here is how you can do it⁵:

Next, you will have to complete the Know Your Customer (KYC) procedure to verify your business account. Depending on the type of business you do, you may be required to provide additional documents to PayPal.

Link your business bank account to your PayPal account. Make sure your business bank account is valid and matches the PAN information you provided to PayPal.

Be sure to have your Bank name, IFSC code, and Account number ready and on hand.

For both individual and business accounts with PayPal, you will need to verify and confirm your linked bank account through a similar process.

To do this, PayPal will send two small deposits, with amounts between ₹1.01-1.50, to the bank account you have submitted. You can check your bank account or bank communication for the exact amounts that have been deposited. This can take 4-5 business days.

Once you have the unique amounts that were deposited in your account, you can confirm your bank account by entering in the amounts under the Payments Method tab. If the amounts match, your bank account is confirmed.⁶

PayPal can feel confusing at times with what you can and can’t do. So let's recap a few important questions.

To open a personal PayPal account in India, you will need a valid phone number and email address.

Next, to make purchases, you will need to link a debit or credit card, or a bank account to your PayPal account. And make sure your bank account allows for international transactions.

For a business account, you will need to have a valid and registered business and a PAN number to open an account.

You will also need a business bank account that matches your PAN information. Besides these items, you may need to show additional documentation validating your business and line of work.

It is free to open and have a PayPal account. But there are fees when you are using your PayPal account for transactions, especially for businesses.

First, you will be paying PayPal’s exchange rate on any international transactions.

PayPal has an exchange rate that is different from the mid-market exchange rate, and in that difference they are able to sneak in a fee. Even for individuals who are shopping online.

But if you are business, you will be paying additional fees for domestic and international transactions.⁷

| Transactions | Fee |

|---|---|

| Standard India- Domestic | 3% + ₹3 |

| Domestic Debit card through RuPay, UPI, BHIM-UPI, or UPI QR Code | 2.5% +₹3 |

| International Transactions | 4.4% + fixed fee |

The fixed fee for international transactions depends on the currency the payment is coming from. See below for what the fixed fee can look like:

| Currency Home Country | Fixed Fee |

|---|---|

| Australia | .30 AUD |

| Euro | .35 Euro |

| US dollar | .30 USD |

| United Kingdom | .20 GBP |

And in addition, you will be paying a currency conversion fee over and above the exchange rate.

| ⚠️ Currency Conversion Fee: 3% on top of the exchange rate |

|---|

Before making a payment, be sure to check the PayPal fees calculator to know exactly how much you will end up paying. Or use the compare tool to know all your options.

PayPal can feel expensive and take a real bite out of payments from international customers. Make sure you do your research on online global payment providers that could give you a better deal on international payments.

PayPal is absolutely safe to open. As one of the oldest running global payment platforms, PayPal offers 24/7 online fraud monitoring and selling protection, and 180 day buyer protection for refunds. Many well known global brands use PayPal as a payment gateway.

PayPal has a robust customer service with a resolution center, community support and customised help for any issues with your account.⁸

Wise offers Indian businesses and freelancers with account details in 8 different currencies to receive payments from abroad. Your clients pay you with a local transfer in their currency, and you receive rupees in your INR bank account — with eFIRC for every transfer.

Get started with a Wise Business Account, and save with a low-cost transfer fee and mid-market exchange rate - which is the same as the one you see on Google.

| 💸 Deposit money straight into a local bank account with Wise |

|---|

Get started with a Wise Business Account 🚀

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Thinking about getting the Amex Platinum Travel Card? Explore its fees, rewards, perks, lounge access, and overseas charges.

Wondering which Thomas Cook Forex Card is right for your next trip? We break down the benefits and charges of each variant to help you decide.

Considering the Scapia Federal Bank credit card? Get a full review of its zero forex, rewards, and fees. Find out if it’s the right travel card for you.

Thinking about getting an Axis Bank Forex Card? Here’s a breakdown of its benefits, charges, and how it works so you can choose what works best for your trip.

Heading abroad? In our HDFC Regalia ForexPlus Card review, we break down the benefits, charges, and compare with the Wise Travel card to help you choose.

Considering the Orient Exchange Forex Card? Here’s what to know about its features, benefits, and charges, before you decide if it’s worth it.