American Express Platinum Travel Card Review: Fees, benefits and is it worth it?

Thinking about getting the Amex Platinum Travel Card? Explore its fees, rewards, perks, lounge access, and overseas charges.

You may have heard about PayPal in India, but might be asking yourself, how does it actually work?

That is a good question, because it does work differently domestically, and also differs for personal use versus businesses in India.

Let’s break down how you can use PayPal in India.

| ⚠️ PayPal India has stopped their domestic payment transaction operations and will only be providing businesses for cross border transactions. Individual use of PayPal or selling domestically will be closed to focus on providing products for Indian businesses to sell internationally. |

|---|

Want a simple and easy way to receive money in India? Try Wise Business 🚀

Wise offers Indian businesses and freelancers with account details in 8 different currencies to receive payments from abroad. Your clients pay you with a local transfer in their currency, and you receive rupees in your INR bank account — with eFIRC for every transfer.

Get started with a Wise Business Account 🚀

| 📝 Table of contents |

|---|

So let’s get started on how to open a PayPal account in India. Whether you are signing up for personal use to shop on the site, as a freelancer, or as a business, your PayPal account will be free to open.

Here is a step by step guide on how to open a PayPal account¹:

| What you can do ✅ | What you can’t do ❌ | |

|---|---|---|

| Individual Account | Shop 24/7 through PayPal | • Send or receive money personally • Fill up a wallet |

| Business Account | Receive payments from customers or sellers or businesses globally • Send and receive international payments | Can’t maintain a loaded PayPal wallet |

After choosing to open an Individual Account:

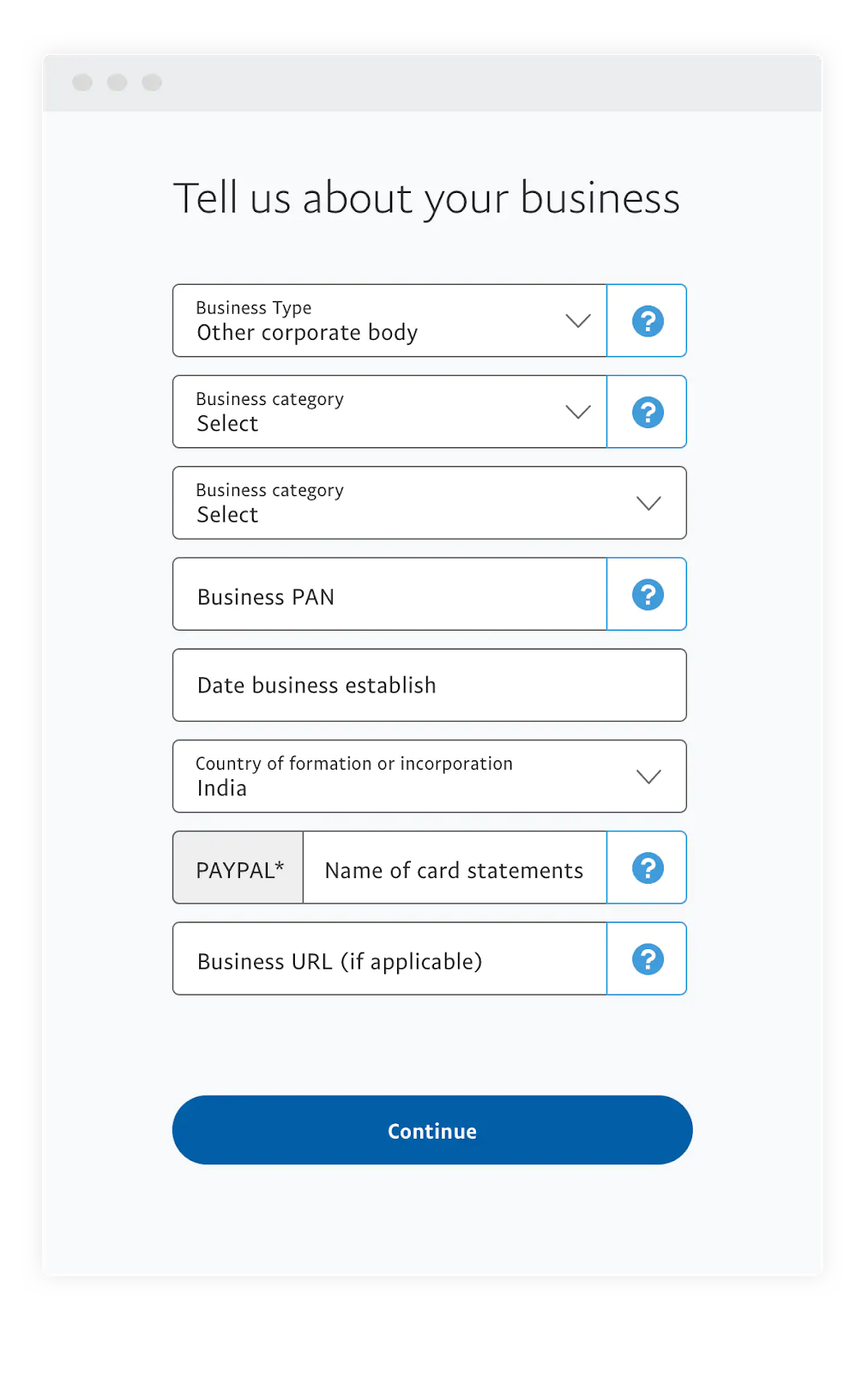

After choosing to open a Business Account:

| ⚠️ To begin using your account to make payments to sellers or suppliers, or to receive money from customers, make sure you link your debit or credit card or bank account to your PayPal account. |

|---|

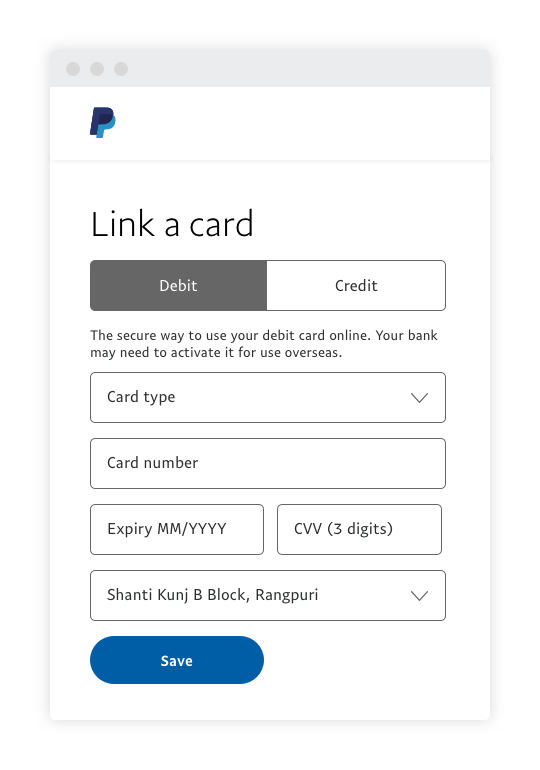

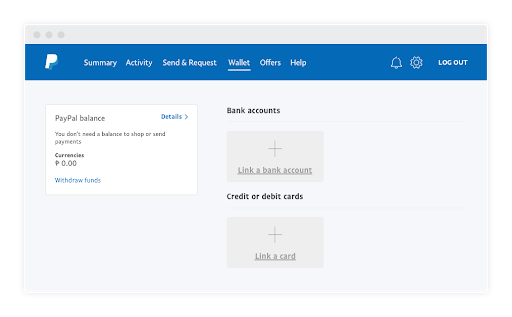

For individuals, you can link your debit or credit card by going to Payment Methods and then Link Debit or Credit Card.

For businesses, you will have to go to Payment Methods too and then link your bank account.

Last but not least, the most important part to finish opening your PayPal account is to verify your card or bank account.

For individuals, you will receive a OTP confirmation on the mobile number associated with your debit or credit card to validate and verify your card.

For bank accounts, like those for a business, you will receive 2 small deposits between ₹1.01-1.50 in your bank account. This may take 4-5 business days to happen. Once the amounts are deposited, you will have to enter in the exact amounts to verify your account in PayPal.

To receive money in your PayPal business account, first make sure your account is open and verified.

Next, you can look at the different PayPal payment solutions that are appropriate for your business to receive funds from international customers²:

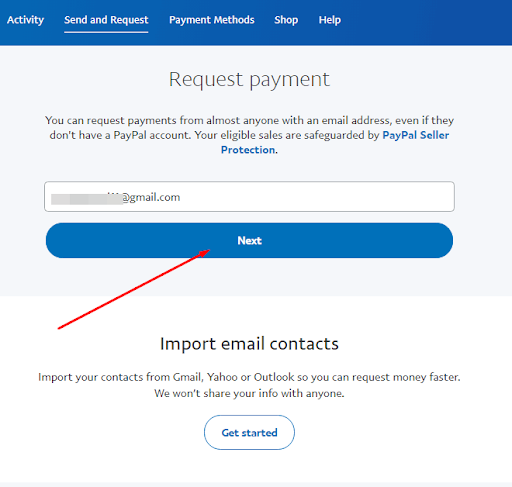

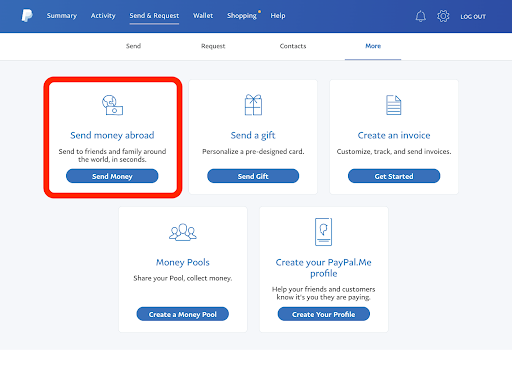

As a seller, you can also use the Request Payment feature on PayPal to get payments by using the clients’ email address.

If you are trying to receive money in a personal PayPal account, you are out of luck here.

| Try other providers to receive money from abroad to your local bank account, like Wise 🚀 |

|---|

You can also read how to receive money with PayPal to know more.

Unfortunately, if you are using PayPal as an individual in India, you will not be able to send money to friends, family or clients. The PayPal wallet feature is not available in India for personal use.

However, as an individual, you can use PayPal to make a purchase with the sellers that use PayPal globally and through the PayPal mall for goods or services.

To make a purchase to a seller or merchant on PayPal, you will first have to link your PayPal account with your debit or credit card, or your bank account. PayPal does not let you fill a digital wallet with their system in India.

You can link your debit or credit card by going to the Payment Method on your dashboard, once you are signed for PayPal. Then click on Link Debit or Credit Card, and input your card details.

You will have to verify your card information to proceed.

If you are a registered business, it is possible and easier to send payments. There are two ways you can pay someone on PayPal³:

You don’t need a bank account for PayPal as an individual making purchases. You will just need a valid debit or credit card.

If you are a business, you will need a bank account to use your PayPal business account. PayPal requires a daily withdrawal from your PayPal balance into your bank account, so it must be connected for you to operate.

You can use PayPal without a card by linking your Indian bank account to your account. You can do this under the Payments Method tab on your dashboard.

For businesses, payments can then be made to your PayPal account, which will be withdrawn to your local bank account daily. And you can also link your bank account to make payments through PayPal to clients or suppliers abroad.

PayPal is free to open and maintain, no matter what kind of account you have.

But the fees are made up for through your activity in your account.

Customers and personal users will not have to pay any fees, but if you are a business you will have to bore the charges.

Here are the major fees for businesses in India operating on PayPal⁴:

PayPal sets their own exchange rate, which means you may be paying a marked up rate on any international transactions that come in. The rate you get from PayPal will likely be different from the mid-market rate. The mid-market rate is the rate that banks use themselves and is the one you see on Google.

By setting their exchange rate to be different from the mid-market rate, they are able to charge you a fee on every unit that is converted to INR.

For every international transaction there is an international transaction fee of 4.4% + a fixed fee depending on the currency of the funds that are coming in.

For payments done in India, there is a standard domestic fee of 3% + ₹3 on every transaction.

If your customer uses UPI or BHIM for their payment, the transaction fee is 2.5% + ₹3.

There is a currency conversion fee of 3% on top of the exchange rate anytime you are converting a paid amount you received into INR. Now with how PayPal operates in India, that means you have to pay the currency conversion fee daily when the funds are withdrawn to your account.

For a more detailed breakdown, head to the PayPal fees article.

Wise makes it simple and easy for you to receive money in your local bank account in India. Wise offers Indian businesses and freelancers with account details in 8 different currencies to receive payments from abroad. Your clients pay you with a local transfer in their currency, and you receive rupees in your INR bank account — with eFIRC for every transfer.

Open your Wise Business Account

All sources checked as of 9th February, 2021

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Thinking about getting the Amex Platinum Travel Card? Explore its fees, rewards, perks, lounge access, and overseas charges.

Wondering which Thomas Cook Forex Card is right for your next trip? We break down the benefits and charges of each variant to help you decide.

Considering the Scapia Federal Bank credit card? Get a full review of its zero forex, rewards, and fees. Find out if it’s the right travel card for you.

Thinking about getting an Axis Bank Forex Card? Here’s a breakdown of its benefits, charges, and how it works so you can choose what works best for your trip.

Heading abroad? In our HDFC Regalia ForexPlus Card review, we break down the benefits, charges, and compare with the Wise Travel card to help you choose.

Considering the Orient Exchange Forex Card? Here’s what to know about its features, benefits, and charges, before you decide if it’s worth it.