Complete Guide to Sending and Receiving International Money Order Online through India Post [2025]

Learn how India Post's international money orders work with France and UAE, plus discover Wise as a modern alternative for global transfers.

Old money transfer services are moving their operations online, while new fintech companies are bursting with online-only services that deliver straight to local bank accounts around the world. But with so many choices and new features, it is important to do your research and find the international money transfer app that is right for you.

Some apps are only available to residents of certain countries, while others will get your money there faster but at a cost. Some will let you drop off or receive in cash if that is what you need. And a few may have the speed, cost, and convenience you need all in one. To make things easier for you, we have tried to pick out some apps which we think are best suited for your international money transfer needs.

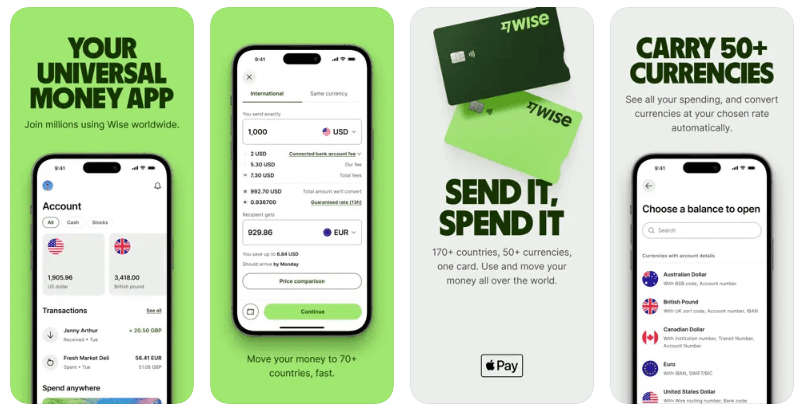

Known for its upfront fees and real exchange rate, Wise lets you send money directly to local bank accounts in India from 59 countries¹.

|

|---|

With over 5 million users, Wise is one of the most popular apps to send money to India. It has an award-winning app that can let you send money on the go to friends, family or merchants. Wise doesn’t always guarantee being the cheapest there is on the market for your particular transfer, but its price comparison tool will let you know that up front.

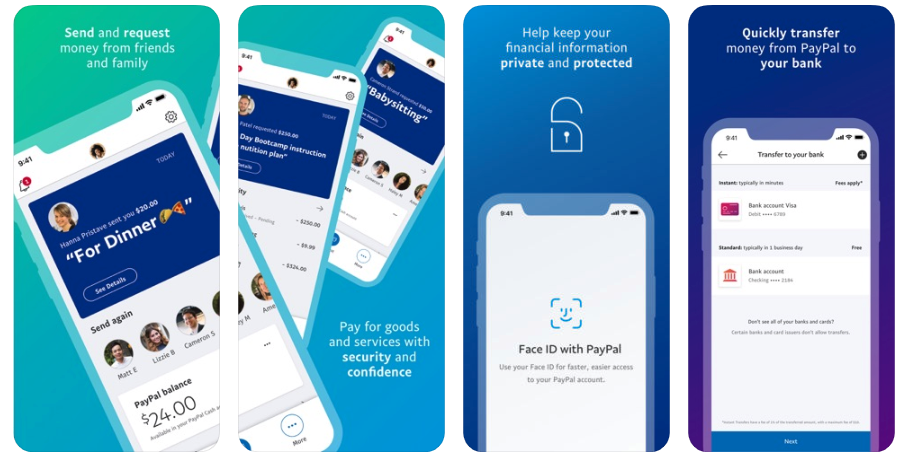

One of the leaders in starting online global e-wallets, PayPal lets you send money instantly if your friends or family have an account too.

|

|---|

Whether you are sending or receiving funds, you would require an account with PayPal. Plus there are transfer fees, like the currency fixed fee for sending money, a funding fee and a transaction fee². PayPal’s wallet system can seem like a long and expensive process when trying to send money quickly. But it can be a secure option, although one with fees, if you and your recipient have PayPal accounts already set up.

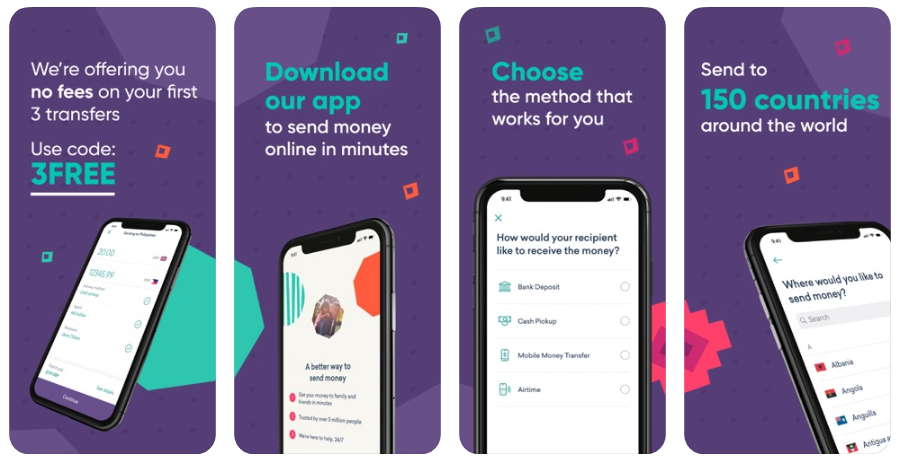

InstaReM is a modern money transfer service that uses the real mid-market exchange rate for transactions. They then charge a percentage of your transfer amount as a fee, instead of a flat fee.

|

|---|

Like Wise, InstaReM provides transparent pricing on all of their transfers. So you get the real mid-market exchange rate and an upfront transfer fee on every transaction. And most transactions arrive within 1-2 days.⁴ You can transfer money to InstaReM through Electronic Funds Transfer (EFT) / Bank Transfers / Wire Transfers in all countries. You can also send money through POLI (in Australia), Debit Card (in EU), FPX (in Malaysia) and ACH Pull or Bank Transfer method (in USA)⁵. InstaReM has differing minimums and maximums you can send depending on the originating country.

Remitly has a strong reputation for offering fast, easy and low-cost transfers directly to Indian bank accounts.

|

|---|

Remitly is an online-only remittance service provider with a large nationwide coverage with over 130 banks across India. There are no transfer fees if you are sending more than $1,000 USD with either option⁶. Remitly also sets their own exchange rate which is less than the mid-market rate- the rate used by the banks themselves. This small difference can really add up with ongoing transfers. However, Remitly remains a strong option to transfer money abroad with their one-time fee and especially for amounts greater than $1,000 USD.

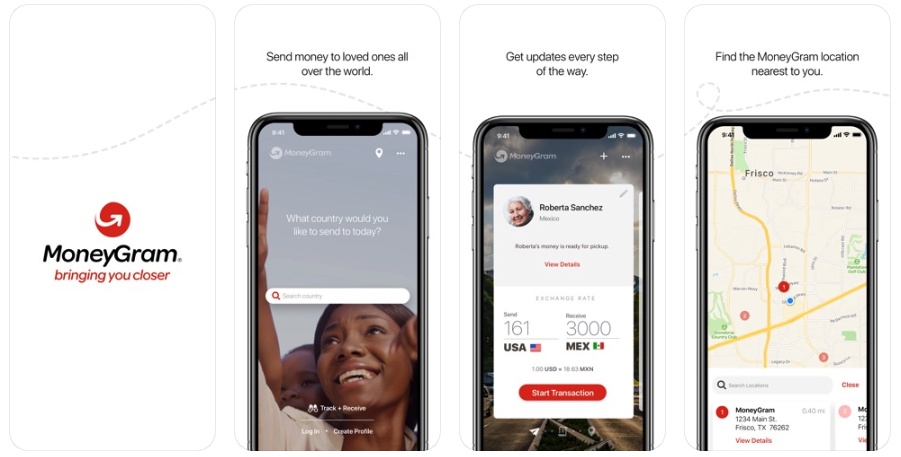

MoneyGram is well known in the money transfer business especially for their cash pick up, but if you are paying by credit or debit card, their fees can be pricey.

|

|---|

MoneyGram provides online and offline money transfers and is found to be fairly quick compared to other service providers. Depending on how the recipient wants to receive the money, it is ready anywhere from 3 hours to 3-4 days if paid by bank account but varies based on destination and currency⁸. They have a transfer fee that varies depending on if you are paying by credit/debit card or online bank account, and if it is a direct to a bank account or cash pick up.

WorldRemit is a fast and secure way to send money to India and is well-reviewed on Apple’s AppStore and Google Play.

|

|---|

With WorldRemit you can transfer money directly to an Indian business or individual bank account or add mobile credit to prepaid phones in India. The sender is charged a transfer fee that you see upfront, as well as a WorldRemit set exchange rate. Make sure to check the amount you might be losing against the exchange rate you see on Google to know what the transfer is really costing you.

Ria has been in the money transfer game since the late 1980s and with their 377,000 locations worldwide¹⁰, Ria has an advantage for cash pickups in India.

|

|---|

It is free to sign up for Ria Money Transfer and your recipient doesn’t need to have an account to either receive the money in their account or pick up the cash. The exact fees charged on your transaction will differ based on the amount you are sending and the payment method and are not clearly listed without signing up. In some cases, Ria may not charge any transaction fees but will still take a cut by marking up the exchange rate.

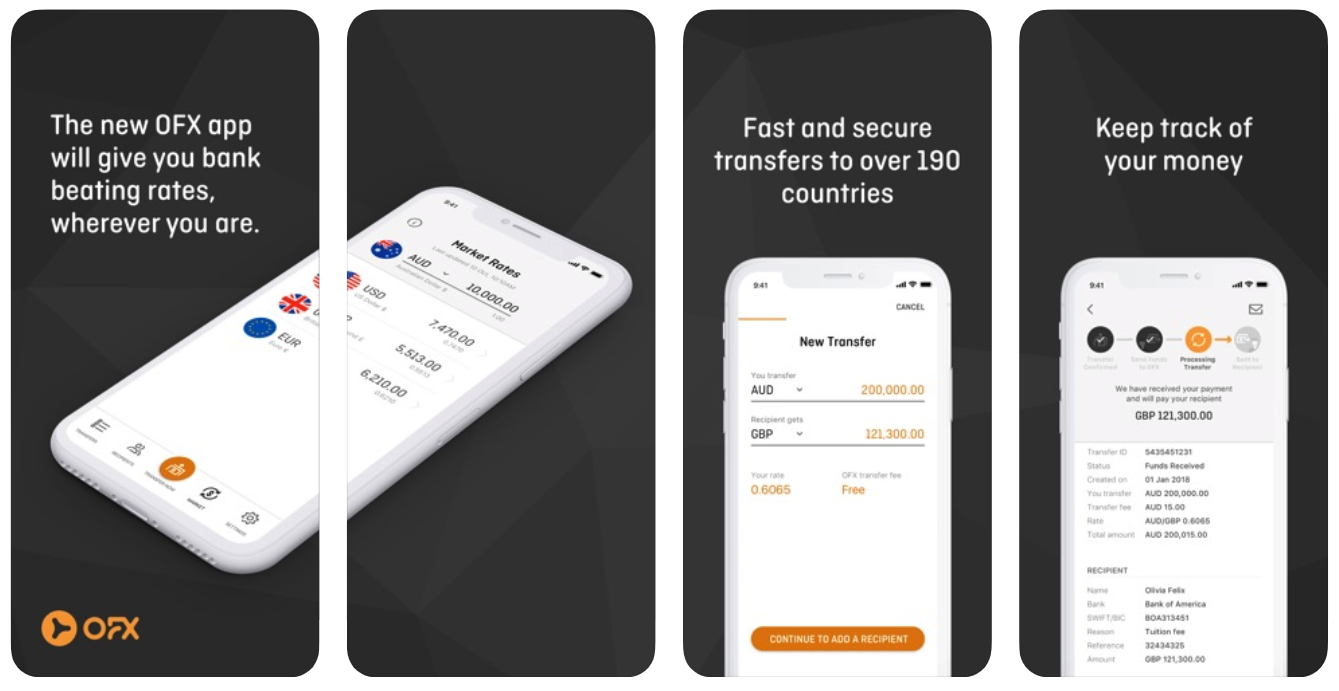

OFX lets you deposit money directly into recipients' bank accounts, and is most attractive when moving amounts larger than $10,000 AUD.

|

|---|

Using OFX, you can send money directly to any bank account in India. The minimum transfer amount is $250 AUD¹³, so if you are looking to send anything smaller than that you may need another option. If you are sending over $10,000 AUD, OFX does waive the transfer fee and it can be an attractive option for sending money.

This PayPal owned company offers international payments to India from Europe, the UK, and the US, but paying by debit/credit card may be costly.

|

|---|

Xoom offers fast and safe international payments directly into bank accounts. You can send bank deposits typically in minutes to HDFC, Axis Bank, Yes Bank, and Punjab National Bank (PNB). Bank account payments are cheaper, but there is a substantial fee when paying by debit or credit card. If you are making transactions that are less than $1,000 USD, you may want to look at options that are low cost and with a transparent exchange rate.

Like many modern money transfer providers, TransferGo uses a local account which you pay into, and then they use their own accounts to pay out in the recipient’s country to make speedy transfers.

|

|---|

Using TransferGo, you can send the money directly to a local Indian bank account. Your recipient does not need to have a TransferGo account to receive money directly into their bank. The time it takes to receive the money depends on the delivery time that the sender chooses. Taking the longest delivery process is free, while the faster payouts have a fixed delivery fee plus a currency conversion percentage.

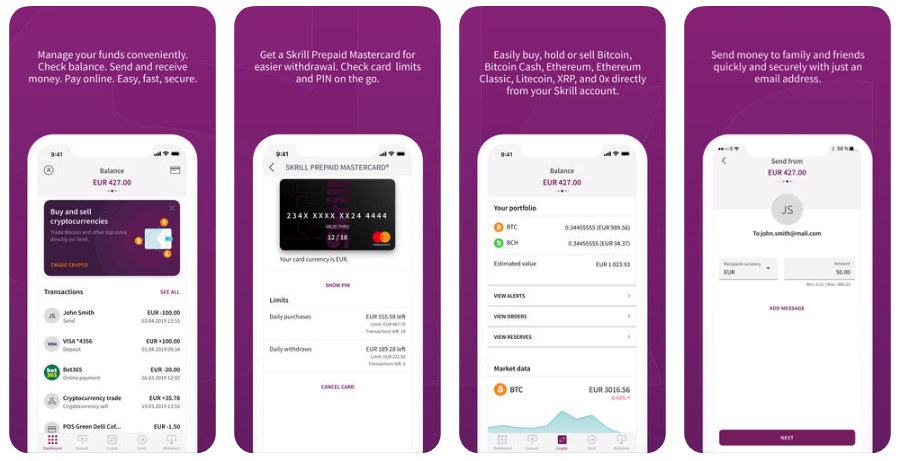

Skrill is a digital wallet platform based in London to help individuals and businesses with e-commerce, money transfers, cryptocurrencies, and gaming or betting.

|

|---|

Skrill is a wide-ranging marketplace and platform that lets you transfer money directly to a bank account from your Skrill digital wallet. There are no fees to receive money into your bank account or to sign up. However, there is a processing fee of 5 EUR (or currency equivalent) to transfer money from your Skrill wallet into your bank account. Plus, Skrill adds a 3.99% fee to the exchange rate for currency conversions. Skrill may not be the fastest or cheapest process, so take it into account when you are making a decision, and see if any purer money-transfer options are better for you.

All the different features and ways to send and receive money can feel dizzying after a while. That is why we have broken down the major components to look at when choosing the right app for you. The how and why you send money will be different per your transaction need, so try to identify the factors that are a priority for you. It could be the speed of transfers, cost, convenience, location or customer support.

Ever felt like you were sending one amount to India, but the recipient got something way less? That’s the cost of hidden fees. These fees are snuck into transfers mainly through the exchange rate, but also depends on which card you use or how you withdraw the money. So make sure you either read the fine print of your money transfer provider or find a money transfer service that shows all their fees upfront. It can save you from any unwanted surprises.

How fast or slow you need to send the money can often determine which one you choose and what your eventual fees will be. And especially for those away from home, speed to transfer money becomes even more crucial in times of emergencies. Some of the older systems of money transfers can take days to land in your recipient’s accounts. But newer companies, like Wise or TransferGo, use local accounts and sophisticated systems to make transfers faster.

Unfortunately, not all apps are available everywhere. Many attractive money transfer services are limited by the regions and countries. So while doing research on which one to go with, always make sure that you find the ones that are appropriate for your residence.

Sometimes, in the search for a good rate and low cost, convenience can be put on the back burner. But the whole point of doing a transfer online is for it to be easy, isn’t it? So make sure you use a service that is easy to use, has a seamless interface, and allows you to transfer money easily. Check the app reviews on the app store too to make sure the app doesn’t have any bugs and current users like how it works.

Last, but definitely not least is customer support. Strong customer support can make all the difference when you are having trouble with a payment or can’t track a transaction. If you feel more comfortable talking to someone over the phone, make sure you choose a provider that provides a real person on the phone at convenient times. Or if you are more likely to shoot an email, ensure your provider has easy to reach email addresses or service request forms online.

Sources used for this article

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Learn how India Post's international money orders work with France and UAE, plus discover Wise as a modern alternative for global transfers.

Complete guide to understanding the limitations of direct ACH transfers from India to USA, and a review of Wise as an alternative that can help.

WhatsApp UPI for India: Can you send or receive money international? Discover limits, safety & Wise as a global transfer alternative.

Complete review of Vance Money Transfer services to India in our guide to that covers their features, fees, and supported countries.

विदेश पैसे भेजने के आसान तरीके सीखें। नकद, बैंक ट्रांसफर, और Wise जैसे ऑनलाइन विकल्पों की जानकारी। फीस और एक्सचेंज रेट समझें।

Complete guide to TCS applicable when remitting from India to cover foreign travel such as for overseas tour packages. We go over the TCS rate and how to claim.