What do you need to receive money with Western Union?

Receiving money through Western Union? Learn about the process, from cash pick-up to bank transfers, and find out what to expect.

As the world becomes more interconnected with a greater reliance on technology, the needs of people change. This is true in many areas including banking. A need has developed for online banking services that are an alternative to the traditional brick and mortar banks.

This review will focus on what there is to know about Monese in Ireland, including who they are, their plans, fees and exchange rates. We’ll also let you know about Wise as another option for making international transfers.

See how you can save

money with Wise 💶

In short, no, Monese is not your typical bank. Monese is a mobile financial services app used by millions of people across Europe. It was founded in the UK in 2015 and has since spread to other countries across the continent.

The idea behind Monese was to create a service that would allow people to open accounts instantly with minimal documentation, and be easily accessible via mobile.⁷

Monese has three Instant account plans on offer:

- Starter

- Classic

- Premium

Each plan has different monthly account fees and variations in the fees charged for local and international services. See the subscription fees associated with each plan if you were to pay monthly or annually.⁵

| Starter | Classic | Premium |

|---|---|---|

| €0 /month | € 5.96 /month | € 14.95 /month |

| € 0 /year | € 49.95 /year | € 124.95 /year |

Here’s a few of of the local fees that when you use a Monese account in Ireland.⁵

| Fee | Starter | Classic | Premium |

|---|---|---|---|

| Contactless debit card | Free + €4.95 delivery | Free | Free |

| ATMs | €1.50 fee per withdrawal | €900 free 2% fee after allowance | €2,500 free 2% fee after allowance |

| Cash top-ups | 3.5% fee with minimum of €3 | €400 free 3.5% fee after allowance | €1,000 free 3.5% fee after allowance |

These are some of the international transfer, transaction and withdrawal fees that apply to each of the Monese account plans.⁵

| Fee | Starter | Classic | Premium |

|---|---|---|---|

| ATMs | 2% fee for withdrawals in foreign currency | €900 free 2% fee after allowance | €2500 free 2% fee after allowance |

| Foreign currency card spending | 2% fee | Free | Free |

| Foreign currency transfers | Free between Monese accounts on weekdays 1% fee on weekend 2.5% fee to non-Monese accounts | Free between Monese accounts From 0.5% fee to non-Monese accounts | Free |

Keep in mind this table doesn’t include any fees that would be applied by other banks involved in the transfer or transaction.

| Read more: Revolut fees in Ireland |

|---|

Monese converts currency using the wholesale exchange rate. For transfers between Monese accounts in the starter plan, exchanges on the weekend have an additional fee of 1% of transactional value.

For other international transfers, depending on your plan, additional exchange rate fees may apply:

All this can add up, so it’s a good idea to see how much the exchange will cost you before finalising the payment.

If you want to see how the Monese exchange rate compares to another alternative service, you can take a look at the Wise currency convertor calculator. Wise converts your money using the real mid-Market exchange rate, like you see on Google, and doesn’t make money on the exchange rate.

As of early 2022, Monese was available in 31 European countries including Ireland.¹

In Ireland there are three main products available to customers:

Depending on where you live your personal Monese Instant account is opened in Euros (EUR), British pounds (GBP) or Romanian leu (RON).²

With the account you’ll have access to a number of services and features including the following:²

- Access to a contactless debit card that can be used internationally

- Make SEPA payments

- Send money internationally in 19 different currencies

- Access to budgeting tools.

The Monese Joint account is the same as the Monese Instant account, but can be accessed by two people and you’ll get two attached debit cards.³

You can open up to 10 Monese pots within your Monese personal account.⁴ Conceptually, these pots are similar to the savings accounts that traditional banks have.

One interesting feature of the Monese pots is that you can set it up so that your Instant account transactions are automatically rounded up and the difference is sent to your pot automatically.⁴

To open a Monese account you just need to download the app and follow the prompts. The only things you’ll need to sign up are a phone number, ID document (e.g. passport) and email address.¹ Keep in mind that you should be a resident of the country you are applying for.

At the time of publication, Monese stated that customers could send money in 19 different currencies.²

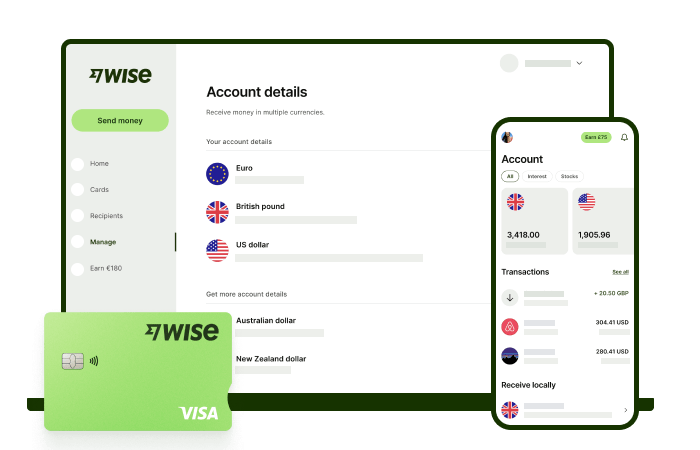

In comparison, with the Wise Account you can hold and convert more than 40 different currencies and send money to 160+ countries. And as a bonus, you can use Wise debit card in over 150+ countries. Check how it's easy to send money abroad with Wise.

Here are some of the Monese account limits that apply to an Irish Euro account.⁶

| Monese limits in Ireland | |

|---|---|

| Maximum Account Balance | €50,000 |

| Incoming/Outgoing SEPA Transfer (per transaction) | €50,000 |

| Incoming/Outgoing SEPA Transfer (per day) | €50,000 |

| Card Purchase (per transaction) | €4,000 |

| Card Purchase (per day) | €7,000 |

| ATM Cash Withdrawal (per day) | €750 |

| ATM Cash Withdrawal (per month) | €7,500 |

While Monese isn’t a traditional bank, it does still have a connection to the financial oversight of the traditional banking system. For EU users, including those in Ireland, Monese is a registered agent of PPS that is authorised and regulated by the Bank of Belgium.⁷

Here’s how you can contact Monese from Ireland:

As we mentioned, Wise is another option for international transfers in Ireland, and their equivalent is the Wise multi-currency account.

Like Monese, the set up is pretty quick with minimal documentation and the option to do it through the app. Unlike Monese, Wise doesn’t have different plans and there’s no subscription fees.

With a Wise multi-currency account you can have access to local account details in 9+ of the world's major currencies, store money in 40+ currencies and can send money to 160+ countries. Your money is exchanged using the real exchange rate and there are no hidden fees.

Your account also gives you access to a Wise debit card, that can be used around the globe and automatically converts currency when needed, making everyday spending simple.

To see how easy it can be, set aside a few minutes and sign up for a Wise Account today.

Register your Wise

account for free 🚀

Sources used:

Here please put all listed sources in the article above in a text link format:

Sources last checked on date: 11 March 2022

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Receiving money through Western Union? Learn about the process, from cash pick-up to bank transfers, and find out what to expect.

Need to get money from abroad? Learn about the ways you can receive international transfers through An Post in Ireland..

Discover the best way to send money from Ireland to the UK for property purchases. Compare costs, timing, and methods for transferring money safely.

Looking to receive a payment through Remitly? Discover all the ways you can get your money in Ireland.

Discover how you can send money abroad with An Post and what fees and rates you'll need to pay.

Here’s our guide to what you need to know to make an international transfer with AIB, including what information you need, and the fees and rates you'll pay.