PayPal charges explained: What you need to know about fees in Ireland

What are the PayPal fees for consumers in Ireland? How much do you pay when sending money? Read here.

There’s many reasons why you might be looking to close your Revolut account. Maybe it’s because you don’t really use it, it doesn’t quite fit your needs or you want to change to a different solution that you like better. Whatever the reason, we’re here to help.

This guide will walk you through what you need to do to delete your Irish Revolut account and give you some ideas for alternatives available in Ireland, such as the Wise Account, which allows you to hold and convert +40 currencies.

Discover all the benefits

of the Wise Account 💡

Closing your Revolut account can be relatively simple depending on how many features you’re currently using. Here’s what to do step by step, using the Revolut app¹:

- Check that your Revolut app is the latest version and if not, update it

- Clear your currency accounts, cryptocurrency accounts and vaults

- If relevant, downgrade your account to the Standard plan

- Close your trading account

- Check there’s no pending transactions, active insurance, linked <18 Revolut account or current chargeback requests

- Go to ‘Profile’

- Select ‘Account’

- Choose ‘Close account to begin termination’

Once your request has been processed you’ll get confirmation that your Revolut account has been closed. ✅

Alternatively, you can also close your account by writing to Revolut at their head office or by emailing them at feedback@revolut.com.³

Revolut head office address - Lithuania

Konstitucijos ave. 21B, Vilnius, 08130, the Republic of Lithuania

There’s no fees for closing your Revolut account, but keep in mind that you may run into some during the process of getting your account ready to close.

Here’s some of the actions that could attract fees depending on your Revolut plan and circumstances:

- Withdrawing your euro balance to a bank account, card or in cash

- Converting foreign currencies to euros

- Selling your stocks or ETFs

- Transferring stocks to an alternative broker

- Selling cryptocurrency⁴

| 🔎 Read more: Revolut fees in Ireland |

|---|

Regardless of why you're leaving Revolut, looking forward to the future and knowing what other multi-currency accounts and international transfer services are is a good idea. And the Wise Account is an alternative you should consider.

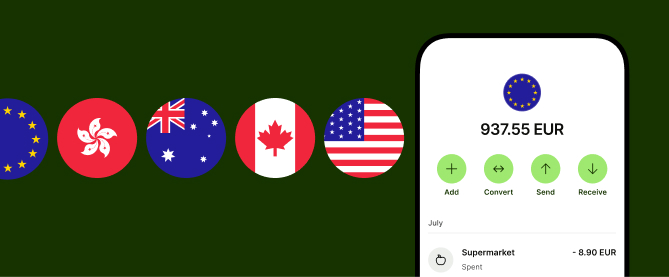

With a Wise account you can manage money in over 40 currencies and gain local account details for 9 of those. There’s no monthly subscriptions to worry about and any currency exchanges are done at the mid-market rate with no hidden fees or markups.

Once you have an account you can order a Wise debit card as well. Using this card you can spend money in 150+ countries with any currency conversions being done automatically.

If you like, you can also use Wise’s virtual cards which can be generated at the press of a button, for free.

Open your Wise Account

for free 🚀

Please see Terms of Use for your region or visit Wise Fees & Pricing for the most up to date pricing and fee information.

There’s no delete button for your Revolut account, but closing it means it no longer functions, and you won’t be able to access it anymore.

Revolut will hold your data for 8 years, but this is because they’re required to by regulatory and anti-money laundering laws.¹

If you’d rather not close your Revolut account using the app you can contact Revolut via email at feedback@revolut.com or writing to their head office.³

Keep in mind you will still want to empty your accounts before closing, otherwise Revolut will hold the funds until you contact them at the same email to organise a transfer.³ That option is only available for the 8 years that Revolut hold your data.

Once you close your Revolut account you’ll no longer have access to it. Here’s a few things you might want to do before closing your account to prevent any inconvenience:

You can only have one personal account at a time for your individual use meaning you can’t open a second Revolut account.

That being said, if you were to completely close your account there’s nothing in the terms to stop you from opening a new Revolut account in future.³

If you can’t close your Revolut account it could be because you haven’t met the Revolut account closure requirements. Here’s what they are¹:

Closing a joint account is actually relatively easy as either account holder can do it without the other's permission. All you need to do is make sure the account balance is zero then follow these steps:

There are alternatives in Ireland that can help you with your financial needs, including other neobanks, high street banks and money transfer services, like Wise. To get you started here’s 5 Revolut alternatives that are available in Ireland.

Sources used:

Sources last checked on date: 5 June 2023

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

What are the PayPal fees for consumers in Ireland? How much do you pay when sending money? Read here.

Discover how Revolut works in Ireland. Explore the mechanics of Revolut's operations tailored specifically for Irish customers.

Can Irish citizens open a Swiss bank account as non-residents? Read all about it in this guide.

Revolut’s IBAN decoded. Is it LT, IE, or another country code? Get a clear, simple breakdown of your account in Ireland.

Wondering if your Revolut card is Visa or Mastercard? Get the lowdown on the differences and how it impacts your spending.

Wondering if Revolut is safe in Ireland? Our comprehensive analysis covers deposit protection, security measures, and more.