PayPal charges explained: What you need to know about fees in Ireland

What are the PayPal fees for consumers in Ireland? How much do you pay when sending money? Read here.

If you’re looking for a modern way of banking that prioritises online services then Revolut might be right for you. To help you decide we’re going to take a look at what Revolut is, how to open an account, and what the eligibility requirements are in Ireland.

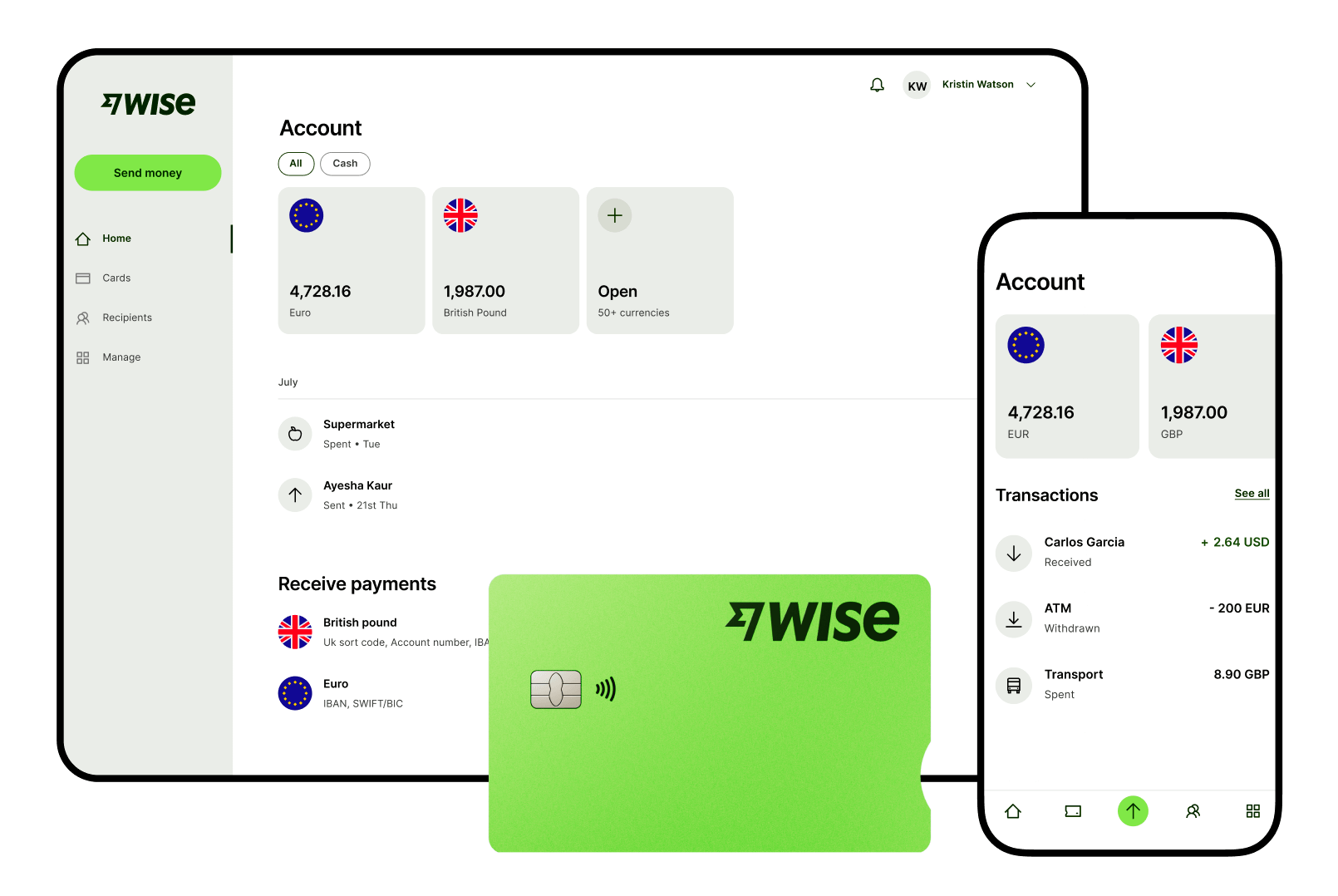

As an alternative we’ll also introduce you to the Wise Account, which allows you to manage 40+ currencies, send money to 140+ countries and receive payments via local account details in 8+ currencies, including in Euro.

Discover all the benefits

of the Wise Account 💡

Revolut is a financial service provider who offer personal, business, company and under 18 online accounts.⁴

Taking a look at the Revolut personal account, it is designed to help you to transfer, store, spend and invest your money. With it you can send and receive money in 29 different currencies including transferring funds to other Revolut account holders free and in an instant.⁴

The account can be attached to a Revolut card for daily spending and comes with budgeting and analytic tools. There’s also options to invest your money to try and grow your balance.

Revolut is a bank that’s incorporated in Lithuania and regulated as a credit institution by the Bank of Lithuania and European Central Bank.¹ It has an office in Dublin enabling it to offer services to Irish customers.

Deposits held with Revolut Bank UAB are insured by the Lithuanian State Company Deposit and Investment Insurance for up to EUR 100,000.⁶

How Revolut operates is a bit different to the traditional high street banks because it’s considered a neobank.

| Neobanks are a new style of banking that operate exclusively online without a network of physical branches. They generally offer an online account, linked debit card and foreign currency exchange facilities. Other examples of neobanks that you might be familiar with are N26 and Tomorrow. And you might have also read about similar money service transmitter providers like Wise. |

|---|

Getting straight into it, here’s how to open a Revolut bank account²:

1️⃣ Download the Revolut mobile app from the Apple App Store or Google Play

2️⃣ Open the app and enter your phone number

3️⃣ Choose a 4-digit passcode for your Revolut account and complete the one time pin (OTP) verification process for your mobile number

4️⃣ Follow the prompts to enter your personal information

5️⃣ Review and accept their terms and agreements

As you can see the process for setting up a Revolut account is pretty simple provided you have access to a smartphone that supports the app.

❌ At this stage you can’t open a Revolut bank account using an internet browser, it’s only possible through the app.²

To open a Revolut account in Ireland you’ll need to provide documentation to prove your identity.⁵ Here’s what you could use:

- A valid Irish passport

- EU national ID card

- An Irish residence card

- A valid Irish visa along with your passport (The Schengen tourist visa isn't accepted)

To submit your ID document you need to take a clear photo of it and submit it when prompted by the Revolut app during the sign up process.⁵

| 🔎 Read more: Revolut fees in Ireland |

|---|

As we mentioned before the Wise Account is another option to the Revolut account.

Once you’ve signed up for a free Wise account you can hold and convert money in 40+ currencies and send it to 140+ countries. You can also get local account details for 8+ currencies including EUR, GBP and USD, making it easier to send and receive money.

If you want, you can order a Wise debit card for your account which makes it possible for you to spend money almost anywhere Visa cards are accepted.

Wise automatically takes care of any required currency conversion using the mid-market exchange rate and there’s no hidden fees to worry about.

Here’s the two ways you can go about registering for a Wise account.

During the registration process you’ll need to provide your full name, phone number, email, home address and a valid form of ID such as a passport or national ID.

Open your Wise Account

today 🚀

Please see Terms of Use for your region or visitWise Fees & Pricing for the most up to date pricing and fee information.

You can open an Irish Revolut account if you legally reside in Ireland and are aged 18 or over.¹

If you don’t reside in Ireland but want to use Revolut while you’re there it may still be possible for you to sign up for an account provided it’s available to residents of your home country.

You might be wondering if you can open a Revolut account for your child or children. While you can’t open a standard Revolut account for them due to their age, you could open a Revolut <18 account.³

The features for the Revolut <18 account are slightly different to the Personal Revolut account, tailoring it more towards the needs of children.

Just like the Wise Account, the process for registering for a Revolut account can be done in minutes.⁴

Keep in mind that you’ll need to have your personal information on hand for verification of the account. It will take some time for a physical card to be delivered if you decide to order one.

Sources used:

Sources last checked on date: 22 April 2023

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

What are the PayPal fees for consumers in Ireland? How much do you pay when sending money? Read here.

Discover how Revolut works in Ireland. Explore the mechanics of Revolut's operations tailored specifically for Irish customers.

Can Irish citizens open a Swiss bank account as non-residents? Read all about it in this guide.

Revolut’s IBAN decoded. Is it LT, IE, or another country code? Get a clear, simple breakdown of your account in Ireland.

Wondering if your Revolut card is Visa or Mastercard? Get the lowdown on the differences and how it impacts your spending.

Wondering if Revolut is safe in Ireland? Our comprehensive analysis covers deposit protection, security measures, and more.