Everything you need to know about Revolut IBANs in Ireland

Revolut’s IBAN decoded. Is it LT, IE, or another country code? Get a clear, simple breakdown of your account in Ireland.

Getting ready to start a new course? If you’re heading off to a university in Ireland, a student bank account is a must-have.

With a student bank account, you can receive income from part-time work and your student loan. You’ll also get a debit card for convenient spending on everything from travel to books.

A dedicated student account will also help you make the most of your money, with handy features such as interest-free overdraft facilities, plus freebies and discounts only available to students.

There are many banks offering accounts for students, so you’ll be spoilt for choice. In this guide, we’ll look at what’s on offer with AIB. This includes the features, perks and fees of the AIB student account, plus how to apply.

Before you get started, a word.

Studying in Ireland can be expensive. Classes you have to pay for, books and materials you have to buy - and you also want to enjoy your student life, right? If you need to send and receive money from your home country to cover these costs, Wise is here to help.

Wise uses a smart new technology that connects local bank accounts around the world and skips those hefty international transfer fees. This means you can save up to 8x by using Wise rather than your bank when you send your money abroad - or when you receive it. Wise also gives you the most fair exchange rate out there, the mid-market exchange rate.

Now let’s get back to what you came here to read.

AIB offers a couple of student accounts, each aimed at learners of different ages. Let’s take a look at the features and benefits of each, so you can find the right account for you.

Designed for students aged 12 to 18 in second level education (full or part time), this is a great current account for everyday needs. You can use it to pay in earnings from a part-time job, or just to stash your pocket money.

The AIB Student Account for 2nd Level Students comes with an optional AIB debit card. But if you’re under 16 years old, you’ll need consent from a parent or legal guardian to get it.

The account also offers:

This is a student current account for people enrolled (or in the process of enrolling) in a full-time third level course. As long as your course is a minimum of one year long, you should be eligible to apply.

The AIB Student Plus Account is an everyday banking account which comes with an AIB debit card. It also offers:

If you open either of AIB’s student accounts, you can get an AIB debit card. Remember though, under-16s will need parental or legal guardian consent, and the debit card is optional with the AIB Student Account for 2nd Level Students.

This AIB student debit card is a Visa debit card, accepted in over 35 million places worldwide. You can use it online, and for ATM withdrawals and contactless purchases in shops at home or abroad. The card can also be used for mobile payments with Apple Pay and Google Pay.³

But the big draw of the AIB debit card for students is AIB Everyday Rewards⁴. If you’re over 16, you can receive cashback on your spending in eligible participating stores - these include some of Ireland’s biggest brands.

Once you’ve registered for the scheme, you’ll receive personalised offers each week. Then all you need to do is spend (meeting minimum spend requirements and other terms) and you’ll receive the cashback in your account.

Like many student accounts, AIB offers many banking services fee-free for students. So, this means you won’t pay:⁵

However, there are still some charges and fees you need to be aware of - especially if you plan to use your AIB card abroad, or send and receive money from overseas. Let’s take a look:

| Transaction type | Fee⁶ |

|---|---|

| ATM withdrawals within Ireland - subject to Government Stamp Duty | €0.12 per withdrawal⁵Free for AIB Student Account for 2nd Level Students holders |

| ATM withdrawals outside of Ireland | 2.5% + 1% commission charges |

| Debit card purchases in foreign currency | 1.75% |

| Sending/receiving money within Ireland | Free (for non-urgent payments) |

| Sending money overseas | €15 for online instruction€20 for paper instruction |

| Receiving money from overseas | Free for euro payments and amounts less than €127 in other currencies€6.35 for amounts over €127 in other currencies |

You can open both of AIB’s student accounts in a local AIB branch or using the AIB banking app on your smartphone.

If applying in branch, you can simply pop in to speak to a Student Officer. They’ll guide you through the process of opening your new account. You’ll need to take these original documents in with you¹:

You can also complete the application form online, and print it off to take into branch. If you’re under 16 years old and applying for the AIB Student Account for 2nd Level Students, your application form will need to be signed by a parent or legal guardian. This person will also need to come into branch with you if you’d like a debit card.

If you prefer and you’re over 16, you can apply via the AIB Mobile app from the App Store or Google Play. Once you’ve downloaded the app, you’ll need to provide proof of an EEA passport and that you live in Ireland.

For the AIB Student Plus Account, you’ll also need evidence that you’re enrolled on a third level educational course.²

The AIB Student Plus Account comes with the option to apply for an overdraft of up to €1,000 interest free for first and second year students.

If you’re in your third or fourth year, you can apply for an interest-free overdraft up to €1,500. If you meet the eligibility criteria (being 18 or over and enrolled on a full-time third level education course), you won’t have to pay any fees to access the overdraft facility.

So, that’s pretty much it - all you need to know about AIB student accounts, for learners in both second and third level education. We’ve covered account features, debit cards, fees, overdrafts and how to apply.

Both of these AIB accounts seem like a good option for students looking for an everyday current account. There are no monthly or transaction fees to pay when using your account in Ireland, and even a few perks on offer like the AIB Everyday Rewards scheme on debit card spending.

But just be careful when using your AIB student debit card abroad, as the fees can be expensive for international withdrawals and spending in foreign currencies. There’s also a significant fee for sending money outside of Ireland and for receiving foregin currencies in the amount over €127.

| 🔎 For more details on this provider, you may check our article AIB debit card abroad. |

|---|

If you’re planning to receive money in major currencies other than euro or to travel and spend your money abroad, then you should definitely consider Wise.

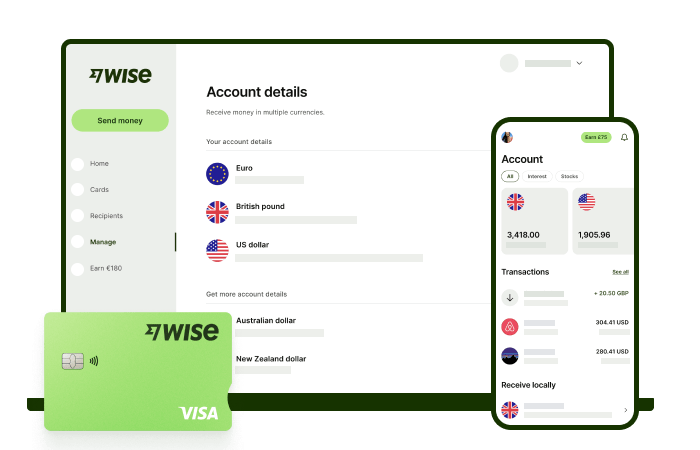

Open a Wise multi-currency account for free and you can order a contactless Wise debit cardfor spending in 150+ countries. There are no transaction fees or commission charges, only a tiny fee for converting the currency. This is done automatically at the mid-market exchange rate - the fairest rate you can get.

The Wise multi-currency account is also a great option for international students, offering a transparent way to send money back home - and of course, to receive money from family to top up your student loan.

Open your Wise Account

for free 🚀

Sources used for this article:

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Revolut’s IBAN decoded. Is it LT, IE, or another country code? Get a clear, simple breakdown of your account in Ireland.

Wondering if your Revolut card is Visa or Mastercard? Get the lowdown on the differences and how it impacts your spending.

Wondering if Revolut is safe in Ireland? Our comprehensive analysis covers deposit protection, security measures, and more.

Can Irish citizens open a Swiss bank account as non-residents? Read all about it in this guide.

If you need a UK bank account, read this article, as it covers the requirements and documents needed.

Discover how you can open a bank account in Australia from Ireland, including the documents and steps.