How to open a bank account online in Australia: Eligibility, steps, and top providers

Wondering if you can open a bank account online in Australia? Discover the options available and how to open a bank account online.

These days, choosing a bank to open an account with can be quite overwhelming. If you are looking to open an account with one of Australia's "big four" — then National Australia Bank (NAB), might be a great option for you.

Through this guide, we will go through the ins and outs of opening a new bank account with NAB, but also introduce you to another great alternative that can cater to most of your everyday local and international banking needs. Let’s jump right in.

| 💸 Looking for a stress-free international account, with your very own local AUD account details? |

|---|

Learn more about the

Wise Account

There are several different account options you can open with NAB. These include:

You can open an NAB bank account online through their website or by visiting a branch. If you are an existing NAB customer, you can easily open an extra account through the NAB mobile app by¹:

If you aren’t already an NAB customer, keep reading to check out the steps to open a bank account with NAB.

NAB classic banking account is NAB’s everyday transaction account. Opening an account only takes 5 minutes and comes with your own NAB Visa card for easy everyday spending. Below are the steps to open an account online or via the NAB mobile app².

NAB has two account options for those that want to grow their savings, the NAB iSaver and NAB Rewards account. As a new customer, you can open either of these accounts through the NAB website or at a branch. However, before you do this, you need to understand the differences and requirements of holding either account.

An NAB iSaver account allows you to benefit from a 0.30% p.a. introductory rate for the first four months from opening, while allowing you to deposit and withdraw funds anytime³.

To open an NAB iSaver account, you will also be required to open and maintain an eligible NAB transaction account that will be automatically linked. You can either choose to open an NAB iSaver and let NAB open an NAB classic account automatically or choose to add this account type through the NAB classic account application⁴.

The NAB Rewards account is for those who want to accrue interest through regular monthly deposits and no withdrawals. This savings account offers a variable rate of 0.25% p.a. for each month you don’t make any withdrawals and make a deposit before the second last banking day³.

You can open this account online through the NAB website or by visiting a branch. Note that withdrawals from this account can only be made in branch with a suitable ID⁴.

Joint accounts are available for NAB classic banking or both savings accounts and make managing shared expenses easier. It is possible to open a joint account online only if both parties are new customers to NAB or existing customers who already have a joint account at NAB⁵.

The same steps apply as above, but you must click “2” when asked how many people are applying on the first step of the application.

Unfortunately, if only one of you is already a customer but wants to add someone to your account, you must visit a branch to set this up⁵.

NAB also offers the possibility for expats moving to Australia on a valid visa to open an NAB classic bank account from overseas. You can look into opening an account through the NAB Migrant banking channel⁶.

Note that this process takes a tad longer than the standard application done within Australia (3 business days)⁶.

Let's take a look at the fees associated with holding an account with NAB. Now is also the perfect time to introduce you to Wise, an alternative banking option with comparable benefits for much of your banking needs.

| Fees | NAB – Account | Wise Multi-currency account* |

|---|---|---|

| Account monthly fees | No fee² | Free to hold up to $23,000 AUD per month. 0.00437% daily holding fee for any amount over $23,000 AUD |

| International transfer fee (for a sample amount of $1,000 AUD to GBP) | Transfer in foreign currency = $10 (+ any overseas bank charges) Transfer in AUD = $30⁸ | Small payout fee + 0.45% variable conversion fee (e.g. for a transfer of $1,000 AUD to GBP, the total fee charged is $5.14 AUD) You can make a fee calculation here. |

| ATM withdrawals | Free from NAB ATMs Fees may apply other ATM providers within Australia Overseas withdrawals = $5 per withdrawal + 3% AUD of transaction for withdrawals in other currency + $1 (if balance enquiry requested)⁹ | You can take out money for free twice a month — as long as the total amount is under $350 AUD. After that, there is a $1.50 AUD per transaction fixed fee. If you take out over $350 AUD in one month, there is a 1.75% on the amount exceeding that. See card fees here. |

| Card maintenance fees | NAB Visa Debit = None NAB Platinum Visa Debit = $10 per month, per card¹⁰ | None |

*Information last checked on 14 January, 2022

As you can see above, there are some comparable benefits in choosing to bank with Wise. It is especially beneficial if you need to send or receive money from abroad or withdraw funds in an overseas currency while travelling overseas.

Even if you choose to open an NAB account, you can easily transfer funds between your NAB account and Wise AUD account, benefitting from the perks of both account options.

Next, we will go through answers to some common questions regarding other requirements, documents and how to contact NAB directly if any issues arise.

To open an account you will need to have handy either your Passport, drivers licence or Medicare card. You must also be over the age of 16 and an Australian tax resident².

There is no minimum deposit required for an NAB classic banking account or both savings accounts mentioned⁷.

Fortunately, most bank accounts can be opened online through NAB’s website.

If you are currency abroad, you can look into opening an account through the NAB Migrant banking channel⁶.

You can contact NAB by¹²:

If you aren’t convinced that NAB is for you yet, then you can check out the alternative top banks in Australia – CommBank, Westpac or ANZ banking group – to open an account with.

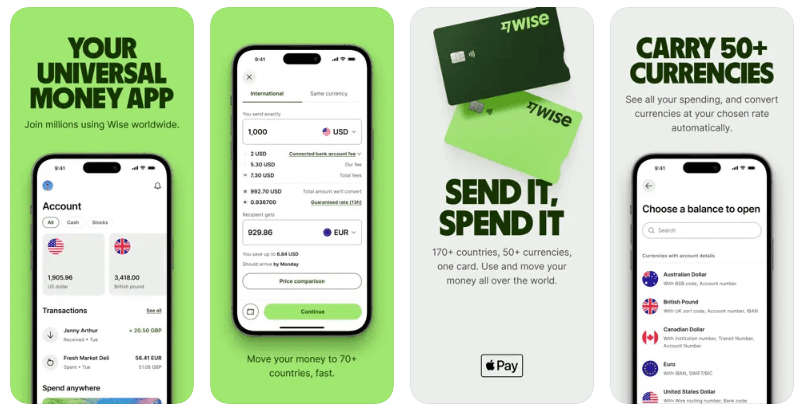

Wise offers international payment services as well as a smart and flexible Multi-Currency account. If you’re looking for an alternative to traditional banks, which also cuts the costs of sending money overseas, Wise is tailor-made for you.

Your multi-currency account can hold 40+ currencies, receive fee free payments using your very own AUD account details, send money to 140+ countries, always using the mid-market rate — with a low and transparent fee. You can also have a debit card to spend with at home and avoid foreign transaction fees while abroad.

If you’re an expat, this could be a great money-saving option for sending money to and from your Australian bank account before the big move.

Register your Wise account in minutes

Please see Terms of Use and product availability for your region or visit Wise Fees & Pricing for the most up to date pricing and fee information.

Sources:

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Wondering if you can open a bank account online in Australia? Discover the options available and how to open a bank account online.

Compare the best high-interest savings accounts in Australia. Our guide breaks down interest rates, and fees to help you find an account to grow your savings.

Looking for how to open a bank account with Virgin Money in Australia? We’ve got you covered. Here’s the process, fees and what you need to know.

Learn how to close your Revolut Australia account. The steps, options and important need-to-knows before your begin.

If you’re a student juggling study alongside work and social commitments, ensuring you have reliable and easy access to your money is essential. Choosing a...

Coming into student life something you might not think to address straight away is your banking. Many Australian banks offer accounts designed for students,...