Remittances: why they matter to me and millions more around the world

Today, we celebrate the International Day of Family Remittances. Wise was founded by immigrants, built by immigrants, and is used by immigrants. This month in...

Sending money abroad is a big deal for many people living international lives. You might be supporting your family, planning your next adventure, or expanding your business. But did you know that most people are unaware of what they actually pay to send, spend, or receive money internationally?

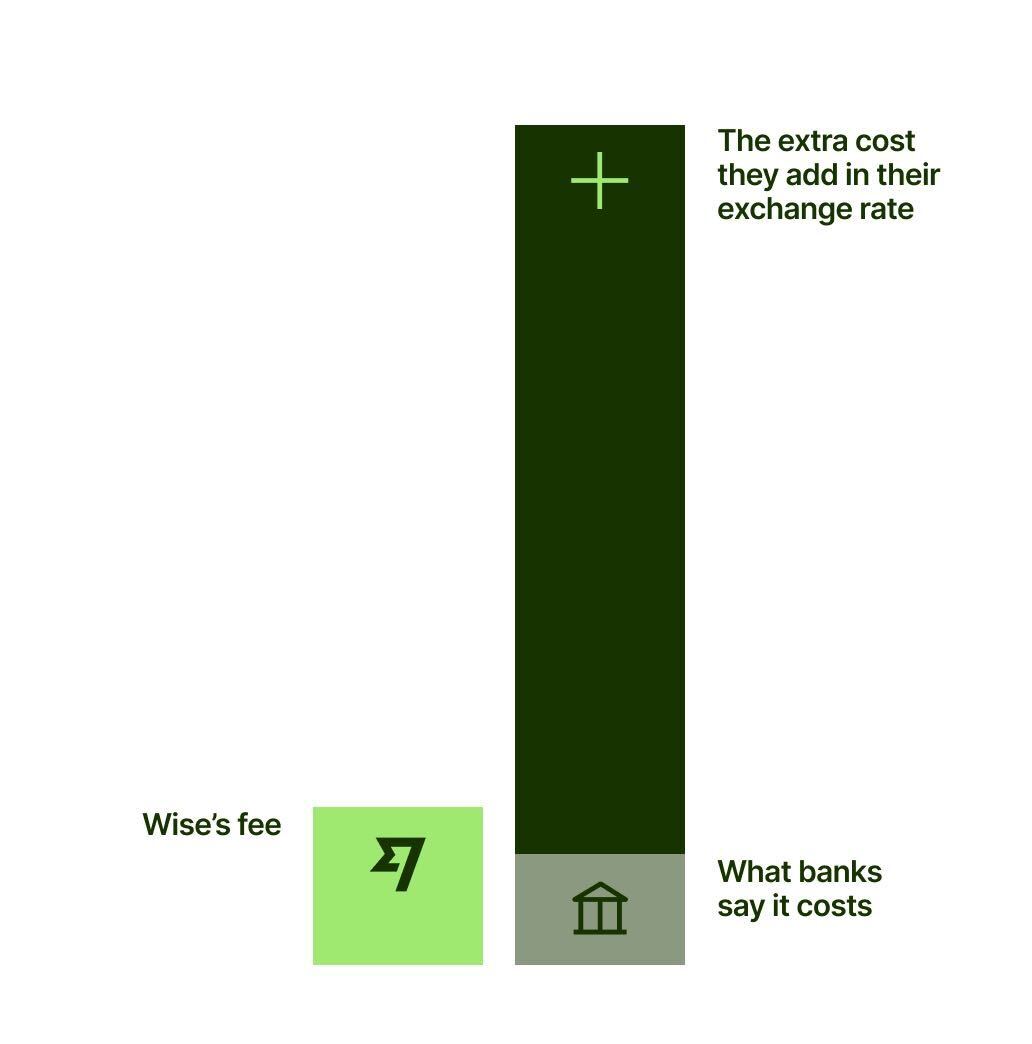

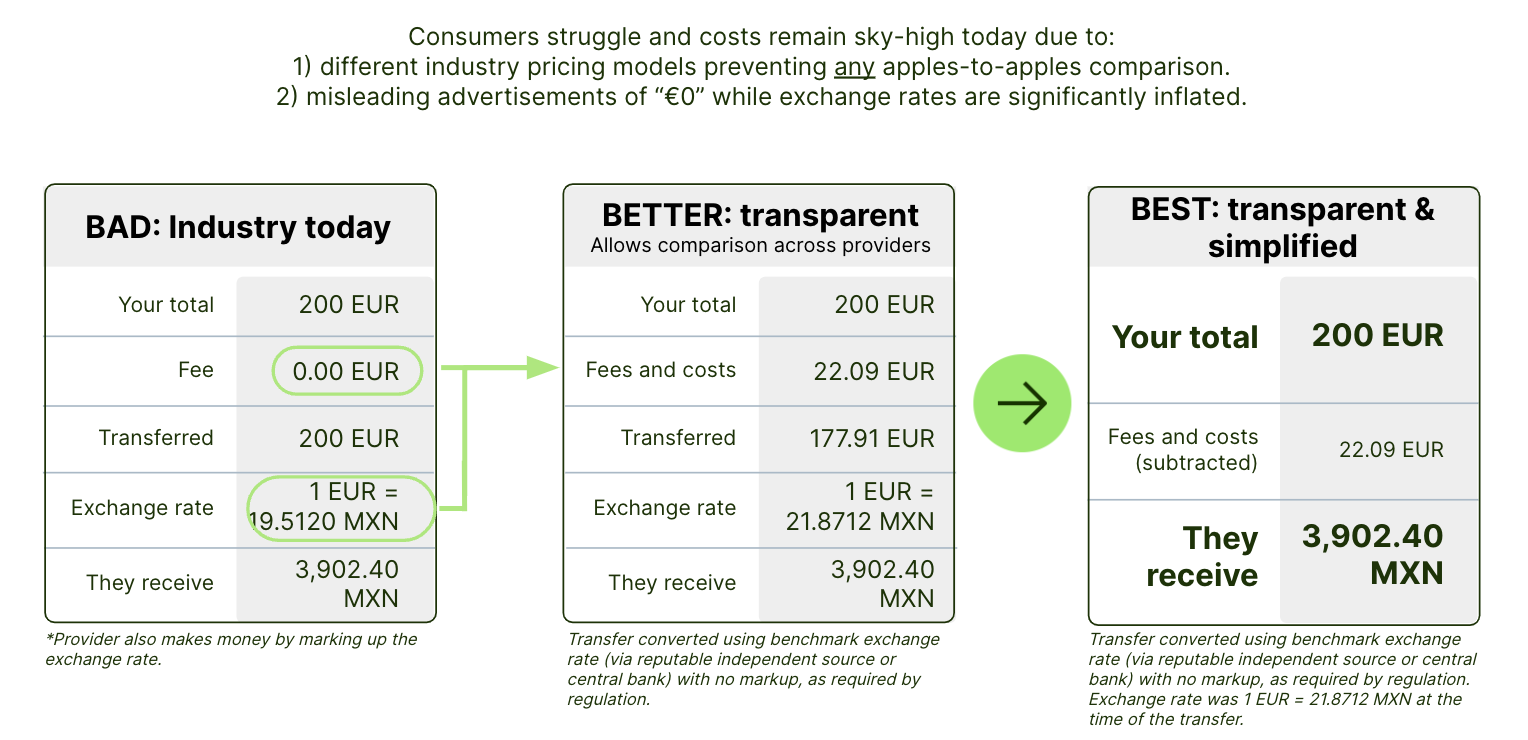

That’s because international money transfer providers often mislead people on the fees they charge. They may say they have low, or even no fees, but they hide extra fees in a marked-up exchange rate. In fact, there's only one that you ever need to care about: the mid-market rate, like the one you see on Google.

Remittances are vital for millions of people worldwide. But today, it’s still expensive to send money cross-border, with the global average at 6.3%. The international community wants to fix this. The United Nations Sustainable Development Goal 10c aims to bring down these costs to less than 3% on average by 2030.

We urge governments to promote transparent pricing in cross-border payments to achieve this goal. People like you deserve to know the total cost of sending money abroad and make informed decisions. Our campaign, "Nothing To Hide," seeks to make hidden fees illegal, ensuring full transparency for consumers everywhere. Join us to fight against hidden fees and make a difference!

The good news is that the second Payment Services Directive (PSD2), designed by the EU, prohibits financial service providers to use non-transparent pricing methods for international payments. The bad news is that these rules are badly enforced and loopholes in the law enable providers to add extra costs hidden in exchange rate mark-ups. Unfortunately, the rules only apply to transfers within the EU.

A law called the Cross Border Payments Regulation, which was adopted by the UK, requires banks and transfer providers to disclose the total cost of international money transfers - including those hidden in exchange rate mark-ups. Sadly, like in the EU these rules are also badly enforced and only apply to transfers from GBP to EUR. Remittance price transparency should be extended to include all money transfers from the UK and EU to any other currency in the world.

The consumer watchdog, the Australian Competition and Consumer Commission (ACCC), has issued guidance that requires international money transfer providers to disclose upfront the amount a recipient will receive. However, the existing rules are too loose, as providers are not required to disclose that they are hiding extra fees in a marked-up exchange rate.

Currently, there’s no rules banning hidden fees in the exchange rate, but the consumer watchdog, the Consumer Financial Protection Bureau (CFPB) wants to make it easier for people to understand the fees charged by international money transfer providers when sending money abroad. The CFPB is considering taking action to improve how fees and exchange rate mark-ups are displayed. This idea has gained support from US Senators, consumer and immigration groups, and an industry trade association. The goal is to provide clearer information to people, helping them make better decisions when sending money abroad.

At the moment there's no rules banning hidden fees in the exchange rate, but the Canadian government has previously made a commitment to lowering the costs associated with transferring money from Canada to other countries. Following in the footsteps of the US, the 2023 budget plan outlines new steps to put money in the pockets of people who need it the most, cracking down on junk fees, except in hidden exchange rate mark-ups. Any plan to end junk fees should include cracking down on hidden fees when Candians send money abroad.

Governments can make simple changes to improve remittance price transparency and reduce costs. If providers use a benchmark exchange rate provided by a trusted source and subtract fees from the amount being sent, it would enable fair price comparisons and eliminate hidden fees. Consumers would be able to compare send amounts, fees, and receive amounts easily. If all banks and providers adopt these practices, the market would become transparent with consistent pricing. It is important for the international community to support these changes, as they would benefit consumers and help achieve the goal of reducing remittance costs to 3% by 2030.

At Wise, we believe in making finance fairer and ending hidden fees. Unlike banks and other providers, we tell you exactly the cost of your payments—no hidden fees, no unpleasant surprises—and offer fair, mid-market exchange rates for converting your money. Whether you're sending money to support your family, planning an exciting adventure, or growing your business, choose Wise. We prioritise transparency and have nothing to hide.

Please see the Terms of Use for your region or visit Wise fees & pricing for the most up-to-date information on pricing and fees.

Sources used:

Sources last checked on date: 26-May-2023

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Today, we celebrate the International Day of Family Remittances. Wise was founded by immigrants, built by immigrants, and is used by immigrants. This month in...