How to buy FIFA World Cup 26™ tickets: Step-by-step guide

Guide on how to buy world cup tickets 2026: official sales, signup tips & tricks, resale safety, and key dates to secure seats.

The PayPal Cash Card has recently been rebranded, so is now called the PayPal Debit Card.

It is a real debit card, but is only linked to your PayPal balance account. It’s free to get, although there are some fees to use it.

In this guide, we'll show you how it works. Plus, we’ll even show you a low-fee¹ alternative which you can use for international purchases and payments in lots of different currencies - the Wise Multi-Currency Card.

But more on this later. For now, let’s get back to looking at the PayPal card.

You can apply for the PayPal debit card online, at the PayPal website, or by logging into your account.

You’ll need to have a PayPal Balance account to get the card. ID will be required, but the good news is that no credit checks are involved during application².

The PayPal debit card is free to get, but there are fees involved to use it. You’ll definitely need to watch out for those international fees, if you plan on using it in another country.

Let’s take a look:

| Transaction | PayPal card fee² |

|---|---|

| Transactions within the US | Free |

| Withdrawals at MoneyPass ATMs (up to $400 daily limit) | Free |

| Withdrawals at non-MoneyPass ATMs | $2.50 |

| Foreign transactions and ATM withdrawals | 2.5% |

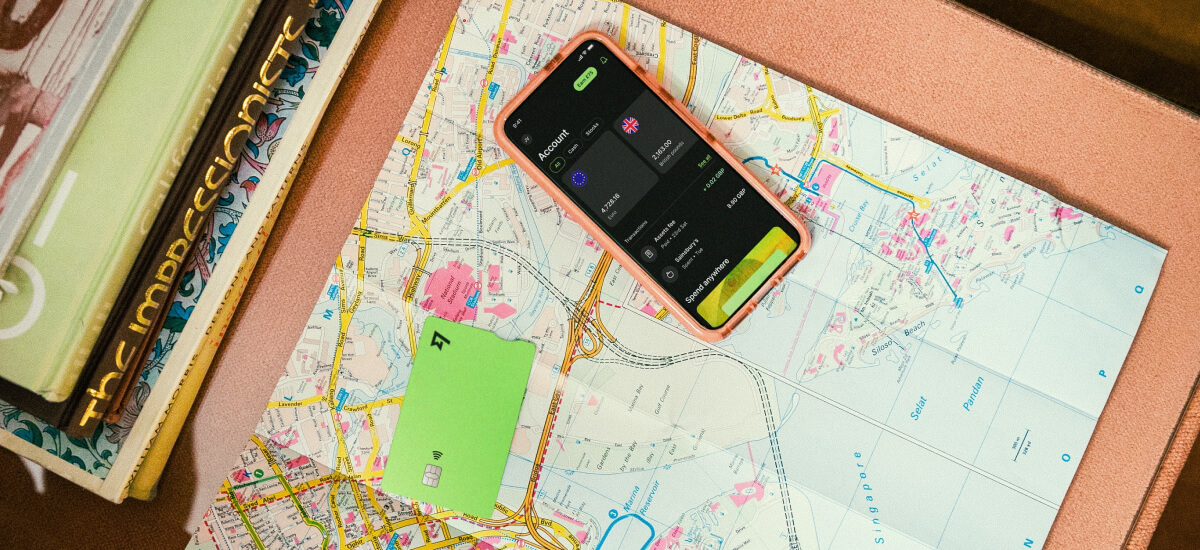

Love the idea of spending abroad without worrying about getting ripped off by poor exchange rates? Take the Wise Multi-Currency Card with you the next time you travel.

The Wise Multi-Currency Card is available for a one-time fee of just $9¹ when you open a Wise account. You can use it to spend and withdraw cash from ATMs in 174 countries. Your USD is automatically converted to the local currency at the mid-market exchange rate, whenever you spend. There’s just a small fee¹ to convert the currency.

Order a Wise Multi-Currency Card today

Is the PayPal debit card right for you? Here are some pros and cons to bear in mind:

| Pros | Cons |

|---|---|

|

|

Now, exactly what is the PayPal cash card, and how does it work? In short, it’s a debit card you can use to spend your PayPal balance. You can use it wherever Mastercard is accepted, which includes stores, restaurants and transport hubs - and online too.

Another thing that many people ask about this particular product is - can you use a PayPal card at an ATM? This is another clever feature of the PayPal Debit Card, that you can in fact use it for ATM withdrawals. This means you can access what is normally an online-only balance and turn it into cold, hard cash.

Your PayPal debit card is linked to your PayPal balance. This means you can spend money that other people send you via PayPal.

Alternatively, you can top up your balance via your linked bank account or debit/credit card.

There’s one more way you can put money on your PayPal debit card. It’s possible to add cash to your PayPal balance at around 90,000 retailers nationwide². All you need is your PayPal card or the app and the cash you’d like to deposit.

This is as simple as managing your PayPal balance. Log into your PayPal account and simply transfer the desired amount to your linked bank account.

Bear in mind though that this will leave you with less or perhaps no money to spend using your PayPal card.

The PayPal debit card is only for spending and cash withdrawals. That means you can’t use it to send money to another person. However, you always can use your PayPal account to send and receive money.

Lastly, how does the PayPal card work in terms of security - is your money safe? According to PayPal, there are lots of reassuring safety features associated with its debit card. These include²:

In this guide, we’ve hopefully answered your question - what is a PayPal debit card? We’ve shown you how it works, how to get one, the fees involved and much more.

If you’re a regular PayPal user, you get some good use out of the PayPal debit card. Just be careful not to use it for transactions where fees can be charged, such as using a non-MoneyPass ATM.

For international spending and cash withdrawals, an alternative like the Wise Multi-Currency Card could be a much better option.

The PayPal debit card offers the following benefits:

If you’re a big PayPal user, and you can steer clear of fee-charging transactions, you could find it useful. It’s especially handy if you want to withdraw your PayPal balance in cash. There’s no fee to get a PayPal card, so you could give it a try.

If you have further questions about the PayPal card, such as how to activate your card or whether you can use it abroad, here’s how to contact customer services⁴:

Sources checked on 21-Oct-2022.

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Guide on how to buy world cup tickets 2026: official sales, signup tips & tricks, resale safety, and key dates to secure seats.

Interested in Remitly Flex? Find out everything you need to know, including key features, costs, and limits.

Read on for everything you need to know about sending and receiving international wire transfers with Abound.

Receiving a large international wire transfer in the US? Here's a guide on the fees, time, and what you should give to your sender overseas.

Read on for everything you need to know about sending and receiving international transfers with GCash.

Read on for everything you need to know about sending and receiving international wire transfers with Remit2Any.