Hiring Independent Contractors in Canada: A Complete Guide for Businesses

Learn how to hire independent contractors in Canada. Understand legal rules, tax responsibilities, and how to avoid misclassification with this guide.

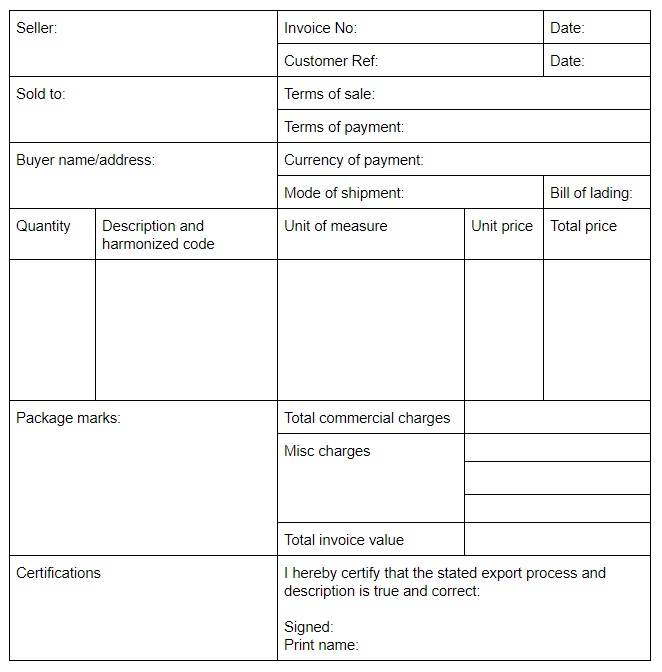

A commercial invoice is one of the documents which will be checked by US Customs and Border Protection, as part of the import process, so getting it right will make sure your goods pass through customs inspections without issue.

There’s no legally mandated format for a US commercial invoice, but there are some key pieces of information to include.

This guide will cover all you need to know, including:

| 💡 If you’re thinking about importing goods to the US, you’ll also want to consider how to manage your overseas payments to avoid high international transfer charges. A great option is to use Wise Business. Wise operates online and has a smart approach to international payments. You can access the mid-market exchange rate for all transfers, and forget excessive cross border charges. Signing up to Wise Business allows access to BatchTransfer which you can use to pay multiple invoices in one go. |

|---|

If you’re importing anything into the US, you’ll need to create a commercial invoice which will be shown to Customs and Border Protection as part of the import process. There is no fixed format for the invoice, although there are certain pieces of information which are always required to avoid customs delays or unnecessary import duties.

You’ll need a commercial invoice for any goods crossing the border, including things with little or no commercial value, like samples and items being sold online. If you’re unsure about what you need to feature on your invoice, it’s smart to get the help of an experienced customs broker or other professional.

Getting the invoice wrong may cause delays to your goods as they pass through customs clearance, or even result in you being asked to pay extra duty charges if the goods are incorrectly declared.

You can find a variety of commercial invoice templates online, and choose the one which suits your needs, or build your own using the commercial invoice sample below.

At the minimum, the invoice should include the following details:¹ ²

You’ll need to include the following information about the product being imported:

A clear description of the product, including the harmonized code, (taken from the HTS — Harmonized Tariff Schedule) — there’s more on this below. The correct harmonized code can be found using the tools available on the US International Trade Commission website

The quantity and value of products being imported. Value should be shown in both dollars and the currency the invoice will be settled in, if different

Where the item was made

Where the item is being sold (if different to its country of origin)

You’ll also need to include details of the invoice number, customer reference, and mode of shipping

| 💡 You can also create and send your invoices by using our downloadable free invoice templates or invoice generator from Wise. |

|---|

The invoice should also include details of the person selling the goods:

Finally, you’ll need to detail who the goods are going to be sent to within the US, and any other parties involved in the import:

One of the key functions of the commercial invoice is to allow customs officers to check that the item you’re shipping into the US is allowable, and ensure that any relevant duties are paid. That means that your invoice must include a clear description of the product, its purpose, and value. In some cases you’ll also need to add details such as the materials used to make the product.

To make this simple, it’s standard to include the HTS code of the country of import, on your invoice. For the US this means you need to look up the correct code from the resources available online from the US International Trade Commission, or ask your local customs service for help to classify your product.

You’ll be able to search the HTS resources to find the HTS codes which might apply to your product. In some cases this is very easy, simply by searching for the name of the item you’re importing. However, you may find several different codes available for items of the type you’re looking at.

For example, if you searched for ‘shoes’, you will find dozens of headers, split by type of shoe — tennis shoe, golf shoe, and so on, and then need to narrow your search accordingly. By looking for the type of item, the material used to construct it, and the purpose, you’ll usually be able to find the right HTS code for you. If you have any queries, you can always contact a customs broker, or the customer service for advice.³

Creating the right commercial invoice is a good way to make sure your import/export business can run smoothly, and ensure you never pay more duty than you need to. However, as with any business, there are other costs you need to think about — and minimise — when setting up your operation.

If you’re looking to import goods into the US on a more regular basis, it’s definitely worth researching your options when it comes to making and receiving cross border payments. Check out the fees you might be charged, as well as the exchange rates used, if you’re invoicing customers based overseas, or paying international suppliers.

International payments can be expensive — but they don’t have to break the bank if you choose a specialist provider like Wise for business. You can open a business account and hold money in any of dozens of different currencies, as well as making and receiving payments overseas using the mid-market exchange rate. That’s the rate you’ll see on Google. You’ll just pay a small transparent fee that you can review before the transfer.

Other business friendly features include the QuickBooks connection for automatic reconcilliation. Signing up to Wise Business allows access to BatchTransfer which you can use to pay multiple invoices in one go. There’s also full support from the service team, to help you every step of the way.

You’ll be able to find samples of different styles of commercial invoice online and choose the one you like, and which suits your situation. There’s also a commercial invoice sample here to get you started.

As you’ll see from this example, invoices typically capture the same core information, although the exact format might vary.

You’ll need to describe:

Setting up your commercial invoices for the US shouldn’t be too tricky, if you follow the pointers given here, and get professional advice when you need it.

You’ll also want to sort out how best to manage your money when making and receiving international payments. This will allow you to focus on growing your business, rather than worrying about high transfer fees. Check out Wise, for a business account that can help your business flourish.

Find out more about Wise Business

| 💡 For all you need to know about invoices, don't forget to read and bookmark the ultimate guide to invoicing from Wise! |

|---|

Sources:

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Learn how to hire independent contractors in Canada. Understand legal rules, tax responsibilities, and how to avoid misclassification with this guide.

Learn how to hire independent contractors in Brazil. Understand tax rules, compliance, contracts, and how to avoid misclassification risks.

Learn how to hire and pay independent contractors in Mexico. This article also includes an FAQ and best practices about working with contractors in Mexico.

Learn how to navigate the overseas worker recruitment. Discover legal requirements, sourcing strategies, visa compliance, and tips for international hiring.

Paying overseas vendors is common, but the hidden costs of B2B cross-border payments aren’t. Learn how to simplify international business payments today.

B2B payment processing doesn’t have to be hard. Learn how growing businesses can simplify cross-border transactions, streamline invoicing and get paid faster.