How to buy FIFA World Cup 26™ tickets: Step-by-step guide

Guide on how to buy world cup tickets 2026: official sales, signup tips & tricks, resale safety, and key dates to secure seats.

In the complex world of credit cards, one of the biggest offerings from leading US bank Chase is known as Sapphire: that’s the name it gives to two types of credit card, Sapphire Preferred and Sapphire Reserve.

Both these credit cards are especially popular with travelers, because of the extra points they offer on travel-related purchases.

If you’re interested in the Chase Sapphire Preferred foreign exchange rate, or the Chase Reserve foreign exchange rate you’re in the right place — learn all you need to know about Chase exchange rates, and Chase Sapphire international fees in this handy guide.

| 📑 Table of Contents |

|---|

The Chase Sapphire Preferred credit card comes with a range of rewards when you spend, and a reasonable annual fee.

Even better, there’s no foreign transaction fee¹ when you use Chase Sapphire Preferred. That means that there’s no special fee to pay when you spend in a foreign currency.

The fact that there’s no foreign transaction fee doesn’t mean you’ll get completely fee free transactions with Chase Sapphire, though. More on that later.

The Chase Sapphire Reserve credit card is a premium version of the Sapphire card, with a higher annual fee. It also has higher earning opportunities — great if you’ll be spending a lot on the card and want to max out the benefits.

Like the Sapphire Preferred card, there’s no Chase Sapphire Reserve foreign transaction fee. However there are other costs you’ll need to take into consideration when you apply for and use your Chase card.

💡 Wondering which Chase Sapphire is the right one for you? Check out our full guide on Chase travel cards

When you spend in a foreign currency using a US issued credit card, the transaction value will be converted back to USD using the card network’s exchange rate.

Chase Sapphire cards are issued on the Visa network, so this will mean that card purchases are converted using the Visa exchange rate before being billed to your account.

Generally, the rates used by major card networks are pretty fair, making this a reasonable way to spend as long as you don’t get hit by foreign transaction fees or other card charges.

You can find the Visa exchange rate online — but it’s worth noting that the rate which will apply is the one that’s live at the point of the transaction being processed.

This may be a day or two after you actually make the purchase. Frustratingly, this means you can’t know the Chase Sapphire exchange rate until after you’ve already committed to the payment.

Foreign transaction fees aren’t the only cost that’s specific to traveling abroad. Often foreign currency transactions also come with a charge that’s been rolled into the exchange rate.

If you send money abroad or get foreign cash from a currency exchanger, it pays to shop around to find an exchange rate as close as possible to the mid-market rate.

That’s what the banks use to trade between themselves — but it’s not often passed on to regular retail customers. With Wise, you can even send money abroad at the mid-market rate itself, with only a simple and clearly stated fee to pay. Wise is not a bank, but an online financial services provider, designed with international transactions in mind.

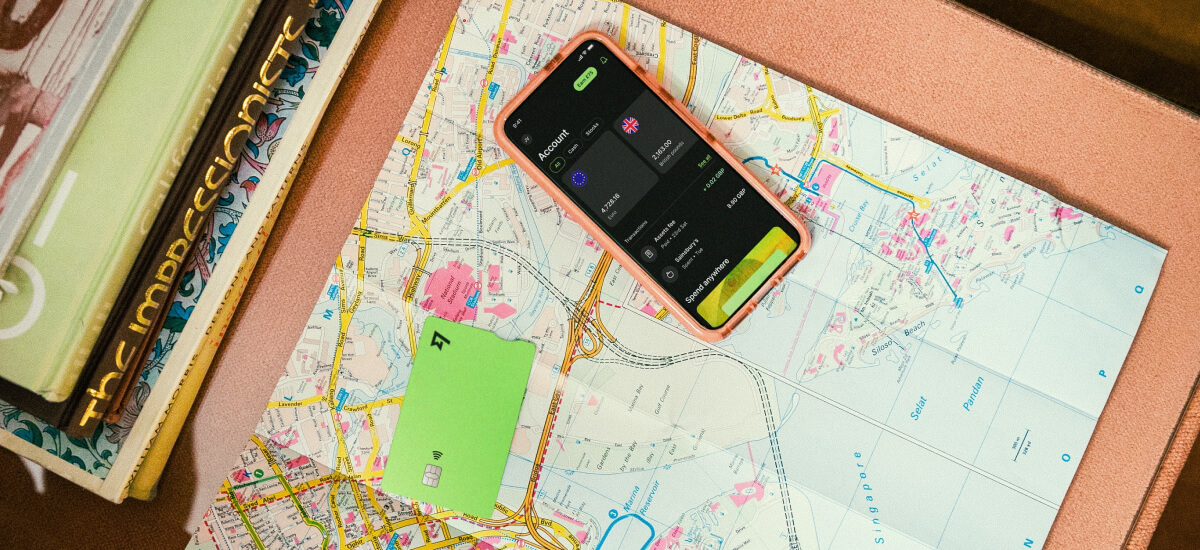

Speaking of the mid-market exchange rate, Wise Multi-Currency Card is a great debit card option for you to send and spend money internationally.

| 🎯 With Wise you can |

|---|

|

Please see Terms of Use for your region or visit Wise Fees & Pricing for the most up to date pricing and fee information.

There may not be a foreign transaction fee, but whether your card is Sapphire Preferred² or Sapphire Reserve³, there are other fees to remember. Here’s an overview:

| Charge type | Chase Sapphire fees |

|---|---|

| Annual fee |

|

| APR |

|

| Balance transfers |

|

| Cash advances |

|

| Late or return payments |

|

What are the benefits of each card, though? For travelers, there are quite a few. Both credit cards come with a high number of bonus points if you spend 4,000 USD in the first 3 months, and those points can translate into rewards and savings in travel costs.

And there are more travel bonuses. Generally, with both cards you earn 1 point per dollar, but you can earn up to 5x or even 10x rewards on certain spend categories, depending on how you use your card.

A quick note about using credit cards abroad. If you’re asked whether you want to make the transaction in the local currency or your home currency, US dollars, choose the local currency every time. This avoids dynamic currency conversion — a huge headache which comes with high fees and poor exchange rates — and nets you the best value every time.

Chase Sapphire credit cards may suit you if you want a credit option with no foreign transaction fees, and opportunities to earn rewards. However, there are fees to pay, including annual charges, interest and some transaction costs.

Alternative options like debit cards might be worth exploring if you want to consider avoiding costly yearly membership fees and avoid high credit costs. Check out the Wise Multi-Currency Card as an especially efficient way for you to use your money abroad.

Happy traveling!

All sources checked 06.03.2022

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Guide on how to buy world cup tickets 2026: official sales, signup tips & tricks, resale safety, and key dates to secure seats.

Interested in Remitly Flex? Find out everything you need to know, including key features, costs, and limits.

Read on for everything you need to know about sending and receiving international wire transfers with Abound.

Receiving a large international wire transfer in the US? Here's a guide on the fees, time, and what you should give to your sender overseas.

Read on for everything you need to know about sending and receiving international transfers with GCash.

Read on for everything you need to know about sending and receiving international wire transfers with Remit2Any.