Best tax preparation software for small business

Find the best tax preparation software for your small business. Simplify your filing process and ensure accuracy with top-rated tools.

Running a business comes with its challenges, especially as it grows. Maintaining profitability and growth simultaneously is not always easy.

A 2021 analysis of failed startups by CB Insights showed that some of the common reasons for business failure included running out of capital and pricing and cost issues, among others.¹

One of the ways businesses can navigate these issues is through financial monitoring. Regularly looking at financial statements, alongside performing analyses such as break even analysis, is crucial for businesses.

Doing a break even analysis can provide deep insight into financial performance, profitability, and how to grow the business further.

This article will look at what the break even point is, the break even point formula, and how to calculate break even point.

| Table of contents |

|---|

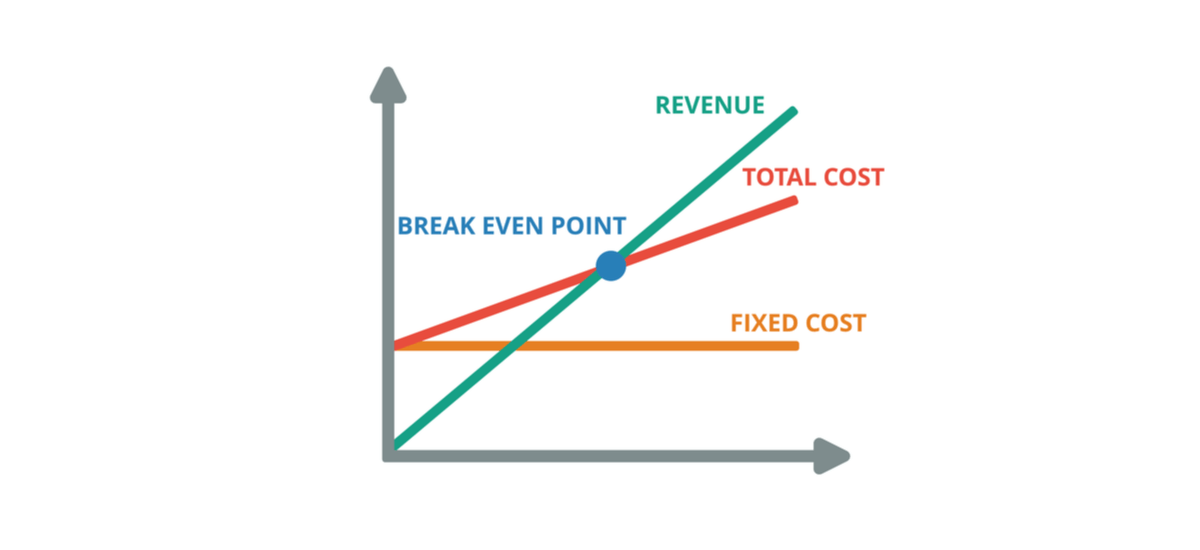

So what is the break even point? It’s defined as the point when total cost and total revenue are equal - so the business has no losses but no gains either.²

A break even analysis is used to understand how much your business needs to cover its total costs without incurring losses or making a profit.

Understanding what's your business’ break even point, can be incredibly beneficial for a variety of reasons, such as:

Break even analysis is a part of financial business planning because it shows the minimum revenue needed for the company to operate without incurring a loss.

However, the break even point is just that - your business breaks even.

It will recoup the investment a company has made into operations, but it is not profitable.

That means the business is making just enough to survive, but it is not generating the additional revenue needed to be successful and grow.

There are two ways to calculate the break-even point: units or sales dollars.²

The method you use to calculate the break even point for your business will largely depend on what you are trying to learn.

Formula for break even point in units:

| Break-even point (units) = fixed costs ÷ (sales price per unit – variable cost per unit) |

|---|

Formula for break even point in sales dollars:

| Break-even point (sales dollars) = fixed costs ÷ contribution margin |

|---|

| Note that the sales dollar formula uses a different metric, the contribution margin. The contribution margin is calculated by subtracting product price from its production cost. |

Analysing both units and sales dollars gives you deeper insight into financial performance.

Here’s how to calculate the break even point for a business:

1. Determine fixed costs

You’ll first need to identify fixed costs for your business - essentially, costs that don’t change even if the business output is high or low.

This can include rent, salaries, equipment payments, internet costs, etc.

2. Determine variable costs

The next step is to identify variable costs for your business. These are costs that change depending on the level of output.

Variable costs can include materials, shipping costs, packaging, transaction fees, etc.

3. Determine sales price per unit

Sales price per unit refers to the price customers pay for a single unit of your product or service. If you plan to do a sales dollar break even analysis, make sure you also have the contribution margin calculated.

4. Organize your costs

Now that you have the three figures organize your costs into a spreadsheet so that you have all the data in one place.

5. Run the break even point formula

Once you have all the numbers in place, you will just need to enter your numbers into the formula for units or sales dollars, depending on which one is most relevant to your business.

To better understand break even analysis, let’s look at an example:

Business X buys hats for $5 and sells them online for $25.The fixed costs of running the business are $2000 a month.

| Break even formula = $2000 / ($25 – $5) = 100 |

|---|

For Business X to break even based on their fixed costs, variable costs, and selling price, they must sell 100 hats.

Going from reaching break even to making a profit can seem daunting, but there are ways to achieve that.

Here are some tips to help your business go from breaking even to becoming profitable

For businesses working with multiple suppliers and overseas staff, using financial tools that help your business is crucial.

The right financial tools can help with identifying and lowering extraneous costs.

| Wise can help you with international money management. |

|---|

Manage international payments

with Wise Business

Whether your business is just established or looking to expand, breaking even is just one part of the process.

To become profitable, it’s incredibly important to keep an eye on financial statements to understand business performance.

Key financial statements to monitor include your cash flow statement, balance sheet, and income statement.

Growth planning and going past the break even point will largely depend on the financial health of your business.

Even profitable businesses can fail, which is why it’s so important to focus on this aspect.

Doing so can help you plan for sustainable growth and work towards profitability to ensure your business sees long-term success.

With Wise, you can save money on international payments, helping reduce your operational costs.

Open your Wise multi-currency account to keep track of all your multi-currency payments, subscriptions and invoices in one place.

Get the mid-market rate for your transfers when paying employees and suppliers abroad.

Plus, you can receive payments like a local with foreign account details (IBAN, routing number, Sort code, and more) in up to 10 currencies, making it easier and cheaper for your overseas customers to pay you on time.

Open your Wise Business account today

Sources:All sources checked on 22 December 2021

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Find the best tax preparation software for your small business. Simplify your filing process and ensure accuracy with top-rated tools.

Unlock Canadian commercial real estate opportunities. A complete guide for US residents on legal compliance, 35% down payment rules, and cross-border tax tips.

Explore the best electronic payment methods for your business. Secure, fast, and convenient ways to accept online payments.

Learn how to buy commercial property in Australia with our expert guide to the process, costs, FIRB, and saving money on international payments.

Ready to diversify? Discover how US investors can navigate the Indian commercial real estate market, from legal compliance to closing the deal. Read more.

US investors: Learn how to buy commercial property in Dubai with our comprehensive guide to the process, costs, and smart money transfers.