How to buy FIFA World Cup 26™ tickets: Step-by-step guide

Guide on how to buy world cup tickets 2026: official sales, signup tips & tricks, resale safety, and key dates to secure seats.

If you ever need to send money through the mail, money orders are one of the most tried and true ways to do that. They’re also handy if you need to send money to someone without a bank account since they can often be cashed out at the recipient’s location.

However, if you’re sending money abroad, then international money orders definitely have limitations. Cancelling can be a hassle and the price is often a major downside. Especially if you take into account the cost to cash the orders, and the often hidden expense of exchanging money between two currencies. You may be better off using an online money transfer service like Wise. More on that later.

| Opening a Wise account is another option you can benefit from — it’s quick and simple to do it online with just a few clicks. |

|---|

An Amscot money order is pretty similar to any other money order. It’s a lot like a check, except you pay for a money order upfront rather than waiting for it to be cashed or deposited to debit from your account.

Amscot’s money orders are different from many others in that they don’t cost an upfront fee to buy. Although they do still have plenty of costs associated with them. They just aren’t all spelled out upfront. That’s why we did the research, so you don’t have to.

Purchasing either an Amscot domestic or international money order doesn’t carry a fee.¹ However, that doesn’t make the money order free. Many services advertise fee-free upfront, but blindside you with high fees and charges through the rest of the process. So you’ll want to be cautious.

In addition, if you’re sending money internationally, you may run into further problems. Many countries have restrictions or ban cashing checks or certain money orders. So it’s best to double check with your recipient that they even have the ability to cash your money order before you send it off to another nation.

| Service | Amscot money order fee |

|---|---|

| Sender purchases the order | $0¹ |

| Conversion costs (international orders) | May be up to 10% or more — Many money transfer services advertise 0 fees but take an average of 4-6% from customers by giving them poor exchange rates when switching between 2 currencies. Money exchange services, though, often charge even more. So make sure you ask beforehand for exchange rates and compare them with those you find on Google to calculate how much you’re actually losing. |

| Recipient cashes the order | Varies — If issued by Amscot and cashed an an Amscot location, recipient pays 1.5% of the order. If issued by Western Union and cashed at an Amscot location, the recipient will need to pay 9.5% of the total.¹ However, it will be unlikely if you’re sending money to an international recipient that they will be able to cash it at an Amscot location, so likely the fees will be quite large. In addition, there’s a possibility that the recipient may not even be able to cash the order due to country restrictions on checks and money orders. |

| Sender cancels or stops the money order | $12 — You will need your money order receipt stub to do so.² |

| After 1 year, if money order isn’t deposited or cashed | $2 to $144 — “A service charge of $2 for each month or fraction thereof that this money order remains unpaid, up to a maximum of $144.”² |

| Recovering the money from a lost or stolen order | There’s no guarantee that you can recover the money. The process generally takes 6-9 months. You’ll need to file a police report or file an affidavit of forgery/alteration with the bank Amscot uses. |

If you are sending money abroad and both you and your recipient have bank accounts, it may be a less costly and easier process to use Wise online for sending money internationally.

For this example, we’ll use a $500 transfer from the US to Mexico and look at the costs there.

| Service | Wise international transfer fees |

|---|---|

| Sender pays upfront fees | $5.46 — the charge for sending $500 to Mexico and paying by debit card. |

| Conversion costs | $0 — Wise always gives the real mid-market rate, so you don’t lose out. |

| Recipient receives the money | $0 — There should be no charge because Wise deposits directly into bank accounts via local bank transfers. |

| Sender cancels or stops the transfer before it’s sent | $0 — As long as the sender cancels the transfer before it is paid out, it will cost nothing to cancel. |

Sending a money order from Amscot is pretty much the same process as sending any other type of money order.

Before you leave home, though, note that you may need to have several things handy for verfication in order to make your money order purchase. It’s good to bring them, just in case:

Once you have all of that info, the process is fairly simple and straightforward. You just have to:

Amscot money orders can be sent overseas, but before you do so, you should call Amscot customer support at (813) 637-6250 to ensure the destination country supports Amscot money orders.

Alternatively, Amscot offers international wire transfers through a partnership with Western Union. Western Union has locations in many countries, which may make it more convenient. Although it’s still best to double check, because depending on how the money order is issued — for example, as a check — it’s possible that even if there are Western Union locations in your recipient’s country, they may not be able to cash it.

Fees for sending a Western Union money order or wire via an Amscot branch will vary depending on where you’re sending the money, how you’re paying for it, and how the recipient plans to pick it up. It’s also important to note that Amscot discloses on its site that:

Western Union also makes money from currency exchange³

That means your Western Union wire transfer will be sent at a marked-up exchange rate and the recipient will receive less than the value of the money you sent after it’s converted from your currency to theirs.

Luckily, there are ways to avoid this. As noted already, if you use Wise to send money overseas, your money is always sent at the real mid-market rate with no markups or hidden fees. So that rate you see on Google is pretty much the same one you get on Wise. You just have to pay a small, fair transfer fee that’s clearly spelled out up front, which means you know exactly how much your transfer is going to cost before you pay for anything. No surprise fees or tacked on charges.

Wise also offers borderless multi-currency accounts, which allow you to send, receive and manage money in multiple global currencies all at once. If you’re living and receiving payments in the EU, the UK, the US, or Australia, you can get local bank details in those areas that allow you to receive payments into your borderless account for free, just like a local. You can also get the Wise multi-currency debit card, which you can use to pay for goods and services all over the world.

See how Wise works and give it a try today.

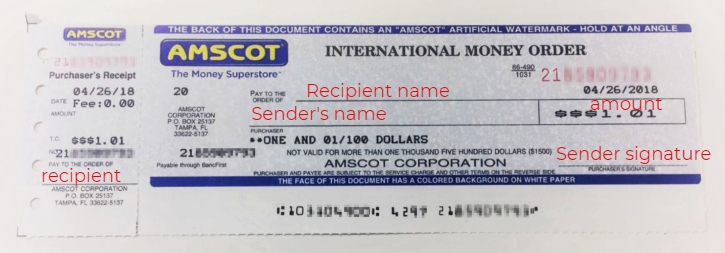

Filling out an Amscot money shouldn’t be too hard.

Here’s everything you need to do to make sure your money order is correct and valid:

![]()

Amscot doesn’t offer online tracking for its money orders, so if you need to find out information about a money order you’ve already sent, you’ll have to call their customer support line at (813) 637-6250. Have your receipt handy so you know you have all the information you need to track your order.

Especially if you’re transferring money overseas, whether by wire, money order or another method, knowing all your options is the best way you can make sure you’re choosing the option that’s best for you and your wallet. You might try Wise today to see how easy and affordable it can be to move money between countries. Good luck!

Sources

1. https://www.amscot.com/resources/check_cashing_rates.pdf (July 23, 2018)

2. https://www.amscot.com/free-money-orders.aspx (July 23, 2018)

3. https://www.amscot.com/western-union.aspx (July 23, 2018)

This publication is provided for general information purposes only and is not intended to cover every aspect of the topics with which it deals. It is not intended to amount to advice on which you should rely. You must obtain professional or specialist advice before taking, or refraining from, any action on the basis of the content in this publication. The information in this publication does not constitute legal, tax or other professional advice from TransferWise Limited or its affiliates. Prior results do not guarantee a similar outcome. We make no representations, warranties or guarantees, whether express or implied, that the content in the publication is accurate, complete or up to date.

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Guide on how to buy world cup tickets 2026: official sales, signup tips & tricks, resale safety, and key dates to secure seats.

Interested in Remitly Flex? Find out everything you need to know, including key features, costs, and limits.

Read on for everything you need to know about sending and receiving international wire transfers with Abound.

Receiving a large international wire transfer in the US? Here's a guide on the fees, time, and what you should give to your sender overseas.

Read on for everything you need to know about sending and receiving international transfers with GCash.

Read on for everything you need to know about sending and receiving international wire transfers with Remit2Any.