Outsourcing to Romania: Clear Guide & Top Tips for US Businesses

Outsource to Romania with confidence. Discover the benefits, costs, and practical steps for US businesses.

Understanding the difference between accounts payable and accounts receivable is crucial.

Balancing your books will be more straightforward if you can stay on top of both accounts. You’ll also be on track for a healthy cash flow if you can strike the balance between money earned and spent.

This post will explore accounts receivable vs payable, and the key differences between them.

Try Wise Business - The easy way

to send money and get paid from abroad

The first step to understanding the difference is to know the definitions:

Accounts receivable - accounts that show claims you have against debtors. In other words, debts that customers owe you. If you have supplied services or goods, and are awaiting due payment, you have accounts receivable.

Accounts payable - accounts that are liabilities to creditors. Accounts payable are debts that you owe to suppliers for services or goods that they have provided to you.

Definitions aside, what is the difference between accounts receivable and accounts payable?

Accounts receivable are assets, and accounts payable are liabilities on a company’s balance sheet. They refer to money that will exchange hands, even if the transactions haven’t yet taken place.

Here are some accounts payable vs receivable examples:

Imagine that you receive a bill from an overseas supplier for payment of Є1500. This sum of money is an account payable. Why? Because it refers to the money you owe the supplier.

If you issue an invoice to a customer for 20 hours of freelance editing work for Є500, this sum of money is an account receivable. You expect to receive that money at a future date.

| Accounts receivable | Accounts payable |

|---|---|

| Money coming in | Money paid out |

| Recorded as a current asset | Recorded as a current liability |

| Owed to the business by the customer | Owed by the business to suppliers/services |

| You can offset receivables with the allowance of doubtful debts | Payables have no offset |

| If the payment is received, it results in cash inflow | The sent payment is a cash outflow |

When it comes to accounts payable vs accounts receivable, there are also several similarities.

For instance, when you balance both types of accounts, you can generate a healthy cash flow. Every business has expenses, but it’s how you offset them with your profits that will determine your bottom line.

Without the information from the accounts, you won’t be able to draw up a clear picture of your company’s financial health, either. While it’s easy to focus on money entering and leaving your account right now, it’s also crucial to look at future payables and receivables.

Both account types are also recorded in a company’s general ledger.

You have to keep a close eye on accounts payable, since if they exceed accounts receivable, your company may start struggling to pay off debts.

One of the best ways to track accounts payable is through accounting or expense management software. With one centralized system, you’ll have an easier time tracking accounts payable.

If you have regular payments to make, such as in the case of a software subscription, you can set up recurring payments. That way, you’ll avoid incurring any late fees, and can save time on setting up the payment each month. Accounts payable automation can help with this, and this is often a feature of accounting software.

|

|---|

⚠️ If you don’t get a handle on your accounts payable, you could lose money due to fraud.

According to the 2020 study by the Association of Certified Fraud Examiners, U.S. businesses lose an average of 5% revenue to fraud each year. There is an average loss of $1,509,000 per case.¹

The study also found that the risk of billing fraud was 2x higher in small businesses compared to large organizations.²

To reduce the risk of errors and fraud with accounts payable, it can be a good idea to have several people sign off on invoices. There should also be an assigned person for authorizing payments.

Clarify that each invoice is legitimate, that the invoice matches the order, and that the service has been fulfilled before you pay.

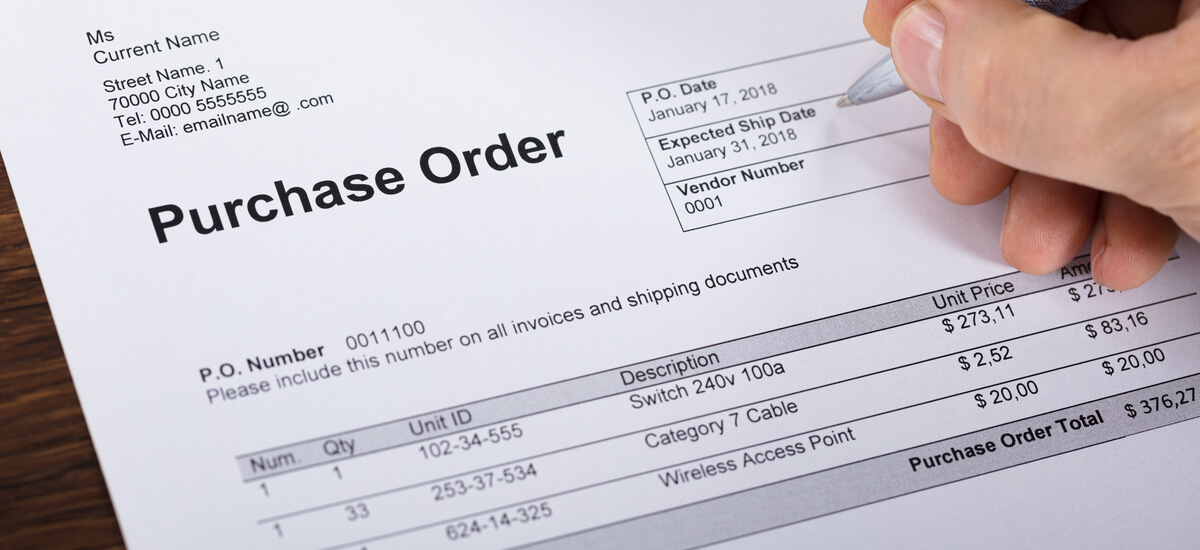

If your business uses purchase orders, you can use these to cross-check the accuracy of incoming invoices. A receiving report can also help, as it records received goods and services, along with payment owed to the respective suppliers.

To manage your accounts receivable, you have to establish clear payment terms.

Let the customer know exactly how much they should pay you, when they should do so, and in what currency. This leaves no room for confusion and minimizes the chance of late payments.

Use a professional invoice that lays out all the necessary information. You can even use the free invoice template from Wise.

Once you have an invoice, send it out the moment you’ve fulfilled the goods or services ordered.

Invoice software can help you streamline the process with timely reminders, lowering the risk of manual errors.

If you do business overseas, it’s essential to set up a system for receiving foreign transactions. If you have a UK-based customer who regularly buys your products, they might be put off by having to pay in USD, which can delay payments.

What can you do in this situation?

Simplify the process for your customers to pay you.

For overseas customers, you can create an account that lets you receive foreign currencies. With a traditional bank, this may cost you a fortune, but there are other solutions.

The Wise Business multi-currency account is an affordable option that grants you up to 10 major foreign account details. That means you can have a UK account number and sort code, for example, even if you’re a US citizen. As a result, your UK-based customer can pay you in GBP without worrying about conversion fees.

You’ll be able to manage, convert, and pay in different currencies all from a single account.

| 💡Accounting software such as Xero and QuickBooks can automate invoices and outgoing payments. This saves admin time for the business to use on other key tasks. |

|---|

If you have customers around the world, then you need an effective way to deal with international transactions.

Wise Business can be just that. Wise offers a safe and easy solution for sending and receiving payments on an international scale.

Send international payments

in one click with Wise

With a Wise Business account, you can manage day-to-day finances. Pay freelancers, staff, and suppliers with ease - even if they’re located abroad.

Sources:

All sources checked November 29, 2021.

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Outsource to Romania with confidence. Discover the benefits, costs, and practical steps for US businesses.

In this US guide to buying commercial property in Singapore, navigate the process, costs, and unlock foreign investment opportunities with expert insights.

Discover the most secure and convenient online payment methods for your business.

Learn the essentials of how to invest in commercial property in the UK as a US investor.

Compare Mollie vs Stripe to find the best payment gateway for your business. Our guide covers fees, features, and integrations to help make the right choice.

Find out how to open an IBAN account with our step-by-step guide. Understand the requirements, benefits, and best practices.