How Loveholic cut cross-border costs by 30% to scale its global luxury brand

Learn how faster payments, transparent fees, and multi-currency support helped Loveholic scale its international operations with confidence.

If you’re a freelancer, entrepreneur or business owner, managing and reconciling your accounts may not be your favourite activity. However, using professional invoices is essential to make sure you create the right impression with customers, get paid on time, have a full legal record of transactions, and can file your taxes correctly.

The good news is that with digital invoices, e-invoices and invoice templates, you'll be able to save time on admin, cut down on errors, and get back to caring for your customers and growing your business. This guide covers how to start with e-invoices in Singapore - and how to get paid digitally from all over the world, for lower fees, with Wise business.

An invoice is an itemised listing of goods sold or services provided, sent by a business to the customer. Invoices contain all that’s needed for the customer to review and pay the outstanding amount, including payment terms and banking details. Invoices can also be used by the seller to track and analyse performance, reconcile accounts, and file taxes.

Invoices - whether they’re the old school typed and printed documents, or a newer electronic invoice (e invoice) - are an essential business tool. They’re important practically, as a notification to the customer confirming what payment is due and when. But they can also form a legal record of a transaction, and be used by the seller to reconcile accounts, manage inventory and keep an eye on cash flow.

And if you’re wondering about the difference between purchase order vs invoice, or receipt vs invoice, that’s understandable as all 3 documents can look pretty similar. However, they serve different purposes within a transaction:

An electronic invoice - also called a digital invoice - is a natural progression from old style paper documents which may arrive in the post. Electronic invoices will still contain all the crucial information needed to confirm a transaction and request payment from a customer - but instead of printing and mailing them, they’ll be sent electronically to the buyer.

This might be done by the seller creating an invoice using an invoice template and sending it directly by email, or if it’s one business invoicing another, via a system like Singapore’s InvoiceNow¹.

What is e-invoicing good for? Here are a few of the key benefits:

Ultimately, e-invoicing should mean faster, easier and more accurate payments.

When it comes to doing business internationally, all of these advantages increase even further: international invoices often require more attention from accounting staff because of differing international standards and codes, and the whole process often takes longer. Via e-invoicing, a lot of these problems can disappear, so long as the invoice is correctly formatted.

In Singapore there are a couple of distinct ways you might choose to use e-invoices, depending on your situation and the way you manage your business accounts.

You might choose to generate your own digital invoices and send them directly to your customers - great for freelancers and smaller businesses, or anyone invoicing a customer directly. Or, if you’re a business billing another business, you might consider InvoiceNow, Singapore’s national e-invoicing framework. Let’s take a look at both of them.

In 2019 Singapore’s government launched a nationwide e-invoice framework, which was initially called Peppol and which has since rebranded to InvoiceNow. This is a form of electronic data interchange (EDI) which allows businesses with accounting systems which are Peppol-ready, to automatically generate invoices to be sent to other businesses which also use Peppol-ready financial software.

Under this system, the business which received the invoice doesn’t need to enter the details of the transaction into their own accounting software, as the file can be automatically uploaded.

InvoiceNow is a good solution for businesses which need to bill other businesses directly, where both have suitable finance systems in place². However, it’s not the right thing for everyone. It can’t be used if you’re billing a consumer, for example - and it requires both the seller and the buyer to have compatible accounting systems in place³.

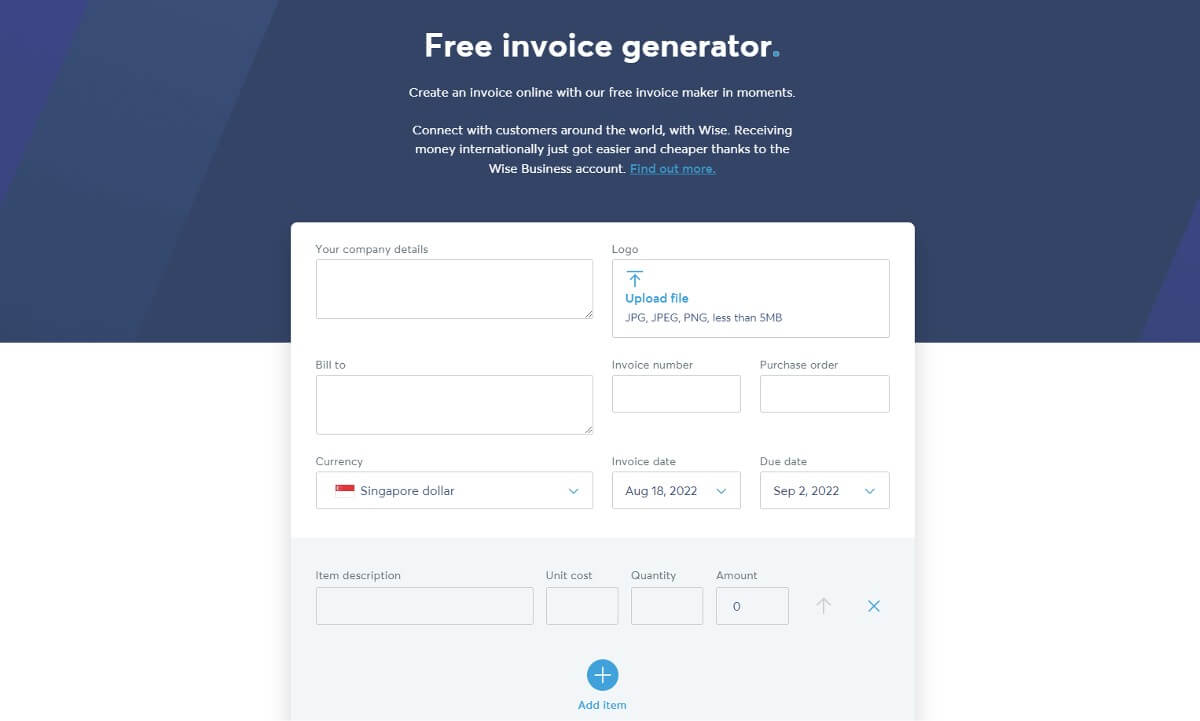

If you’d rather prepare your invoice yourself as a PDF and send it to your client, you can do that easily with the free Wise invoice generator. You’ll be able to create professional PDF invoices which contain all the required information to get paid - and which can be tailored to include your branding and logo for impact.

If you have a Wise business account you can also use this to connect with customers around the world and get paid fee free from 30+ countries - more on that later.

If you’re using InvoiceNow, sending the invoice to your clients can be done directly by following the onscreen prompts. The exact process will depend on the accounting system you use, but most are easy to navigate with comprehensive help and advice on hand if you need it.

If you’re using the free Wise invoice creator, you’ll be generating a PDF version of your invoice. This is the preferred format because it’s compatible with most devices - and secure too. You’ll be able to save the invoice to your own records, and then email it to your client or customer directly in just a couple of clicks. Easy.

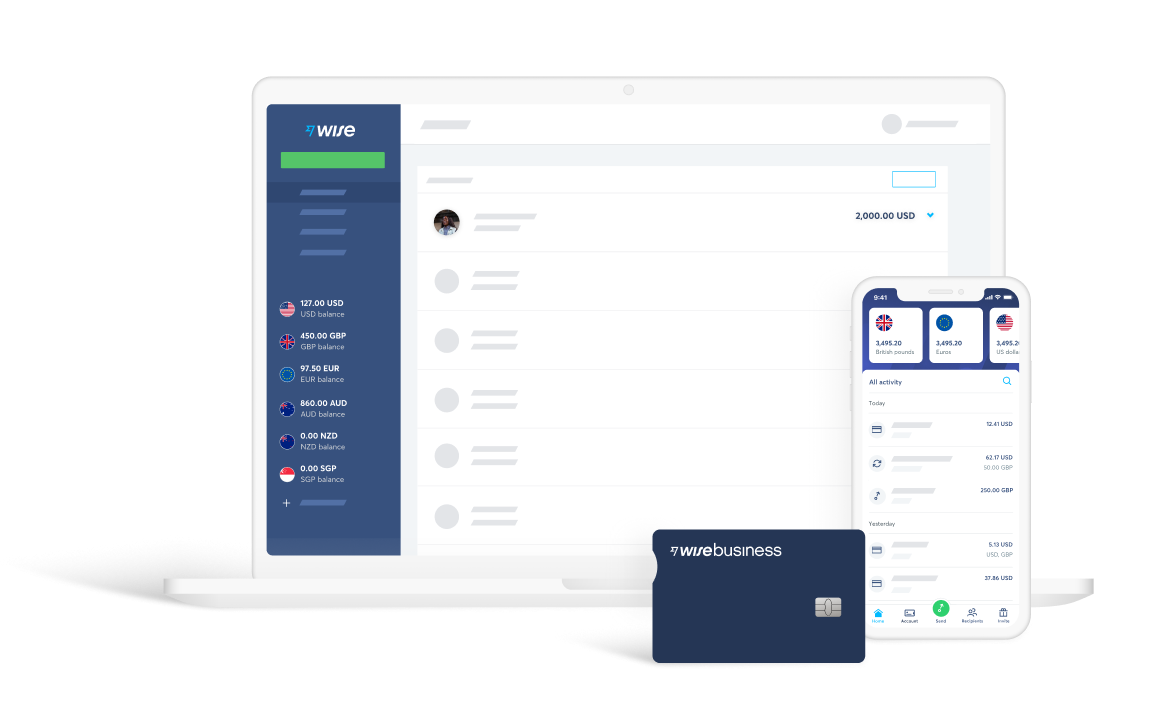

If you’re growing your company and want to connect with customers all around the world you could save money with Wise business.

Open a Wise business account for free online - or pay a one off 99 SGD fee for full account functionality. With the full Wise account you’ll get local bank details for 9 currencies, including USD, EUR, GBP, AUD, SGD and more. Which you can add to your invoices to get paid fee free from 30+ countries locally.

All Wise currency exchange uses the real mid-market exchange rate with low, transparent fees - you can hold your funds in Wise, withdraw to your regular Singapore Dollar account, or use the money to pay contractors and staff based overseas. Hold and exchange 50+ currencies in your account, send payments to 80+ countries and get linked international debit cards for you and your team to spend and make cash withdrawals all over the world.

Wise business accounts have no minimum balance, no monthly fees, and no surprise charges to worry about. See how Wise can help your business grow today.

Learn more about Wise Business

Sources:

Sources checked on 18.08.2022

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Learn how faster payments, transparent fees, and multi-currency support helped Loveholic scale its international operations with confidence.

Learn what a corporate bank account is. Why it’s essential for separating your business finances from personal. How to open one in Singapore. Read here!

Is public liability insurance mandatory in Singapore? Learn what it covers, why SMEs need it, and how to manage your business costs with Wise.

In-depth review of Statrys business account for Singapore, including features, pricing, and alternatives for SMEs with international transaction needs.

Thinking of investing in Singapore properties without having to deal with high ABSD? Read this complete guide to buying commercial property in Singapore.

There are two ways to close a company in Singapore: strike off or wind down. This article guides you through both processes.