Bank Islam transfer limits and step-by-step on how to set, change and increase them

Learn more about Bank Islam transfer limits as well as how to set, increase and change them.

Wondering how to receive money from overseas in Malaysia with CIMB? This guide covers all you need, including the CIMB Bank SWIFT code, the fees involved with receiving money from abroad, and how to contact CIMB customer service.

We'll also introduce Wise and the Wise multi-currency account as a cheaper, easier alternative.

| Table of contents |

|---|

If you’re expecting a payment from overseas into your CIMB account you’ll need to give the sender some key information to make sure your money arrives safely and without delay.

While the exact details needed may vary a little based on your payment type and where the money is coming from, you’ll usually need to provide:

A SWIFT code is a unique identifier issued to banks around the world, and used to make sure international payments arrive where they need to be safely and as fast as possible. You’ll need to give your sender the correct CIMB SWIFT code[1]:

It’s important to provide the sender with your CIMB SWIFT code as providing inaccurate or incomplete details might mean your money is delayed, returned, or sent to the wrong account entirely.

You can also double check whether you got the code right with our SWIFT Code Checker.

Here are the fees charged by CIMB for their inward telegraphic transfer services[2].

| CIMB inward telegraphic transfer service | CIMB fee |

|---|---|

| Receive domestic inward telegraphic transfer/RENTAS to your CIMB account | No fee |

| Receive foreign inward telegraphic transfer/RENTAS to your CIMB account | 5 MYR |

| Receive inward telegraphic transfer for credit to another bank customer’s account by cheque | 5.15 MYR |

| Receive inward telegraphic transfer for credit to another bank customer’s account by RENTAS | 9 MYR |

It’s worth also knowing that when payments are processed through the SWIFT network, other banks - known as intermediaries or correspondent banks - can also charge fees which are deducted as the transfer is processed. This can sometimes mean you get less than you expect in the end.

The length of time it takes for your money to arrive in your CIMB Malaysia account will depend on the sender’s bank, as well as the country and currencies involved.

It’s normal for payments made through the SWIFT network to take 3 - 5 business days to arrive. However, if the payment is sent out of hours, or there are holidays either in Malaysia or in the sender’s country, there may be further delays.

Got questions? Here’s how to connect with CIMB customer service in Malaysi[3]a.

| CIMB customer service phone number | +603 6204 7788 |

| CIMB customer service online | Email: cru@cimb.com - you can also use the online feedback form or send a secure message through your digital banking service |

| CIMB customer service by mail | CIMB Bank Berhad / CIMB Islamic Bank Berhad Customer Resolution Unit (CRU) P.O. Box 10338 GPO Kuala Lumpur 50710 Wilayah Persekutuan |

| CIMB customer service in branch | Use the CIMB Branch Locator to find a suitable place to get in person help |

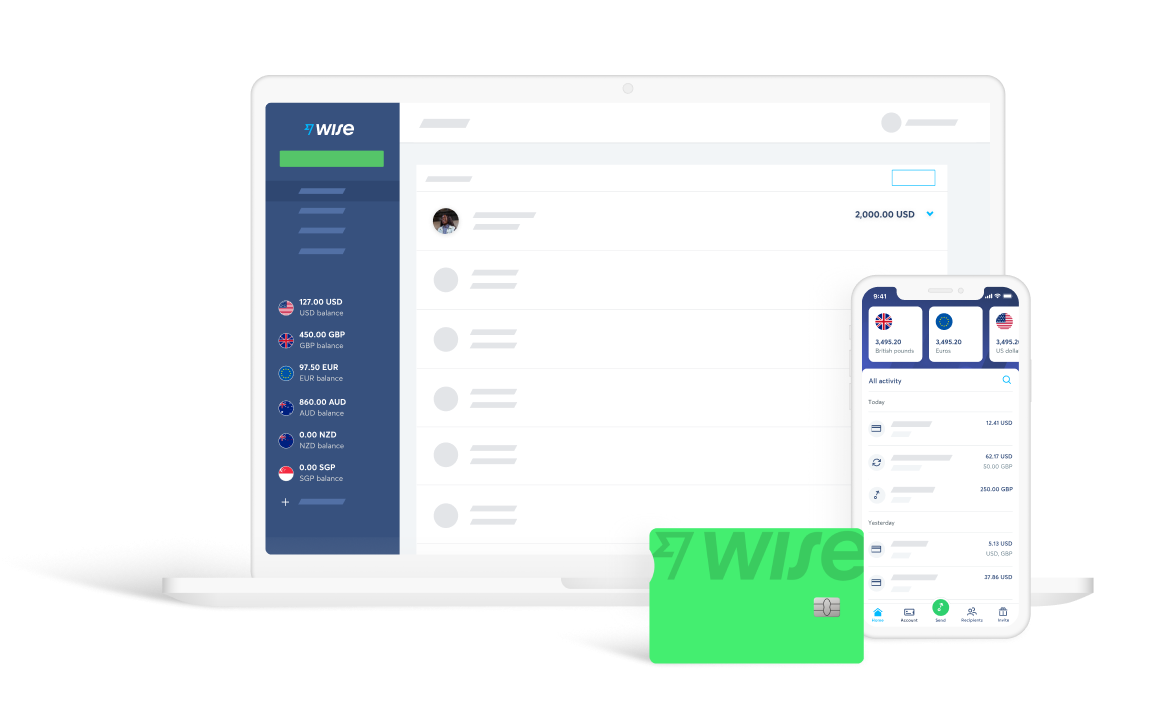

If you’re expecting a payment from overseas, both you and the person sending you money could save with Wise and the Wise multi-currency account.

Open a Wise account online for free and you’ll be able to get paid completely fee free in 10 currencies, including MYR, SGD, USD, GBP and EUR. Just give the person sending the money the bank details you’re provided when you open your account, and they can make the transfer like a domestic payment. That’s usually faster than sending money overseas. It’s completely free for you, and usually free for the sender, too.

If you need to you can also receive SWIFT payments into your account in EUR, USD, and GBP. It’s free for EUR and GBP - but there’s a small fee forreceiving USD via SWIFT.

Once you have your money you can hold or spend your balance in 50+ currencies and switch to a different currency with the real exchange rate and just a low, transparent fee. Overall, the Wise multi-currency account can be 3x cheaper than using your normal bank.

See how much you can save with the Wise multi-currency account today!

Sources:

Sources checked on 01.03.2022

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Learn more about Bank Islam transfer limits as well as how to set, increase and change them.

Learn more about how to change Maybank transfer limits as well as transfer time, fees, and more when making an online transfer.

Learn more about how to make an Bank Islam online transfer including limits, transfer time, and fees.

Learn more about how to make an Affin Bank online transfer including limits, transfer time, and fees.

Learn more about how to use Lulu Money in Malaysia, as well as benefits, fees, and more.

Learn more about making IBG transfers with CIMB, including fees, how long it takes, and relevant timings.