Shopee is one of the largest ecommerce platforms in the region - and a place to buy pretty much anything you can think of, right from your phone or laptop. If you use Shopee regularly you may have noticed ShopeePay as an option. But what is ShopeePay?

This guide has you covered with how to use ShopeePay, the types of transactions you can make, the fees you need to know about, and more. We’ll also introduce Wise as a perfect way to send and spend payments in 40+ currencies, with fees that are often lower than Malaysian banks and alternative providers.

What is ShopeePay?

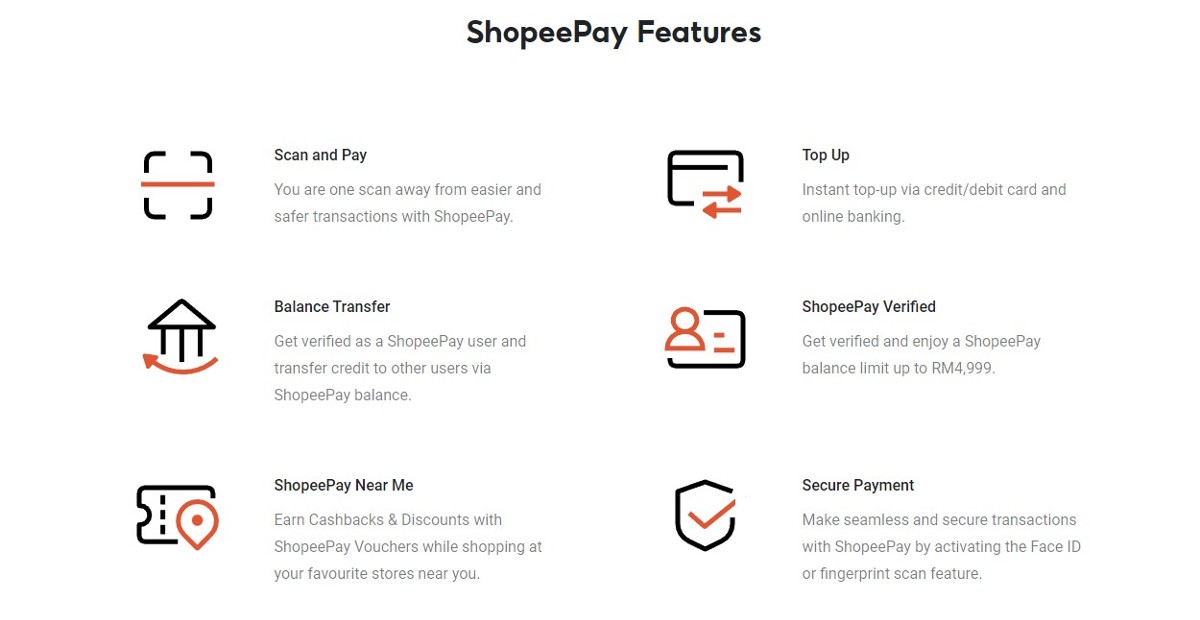

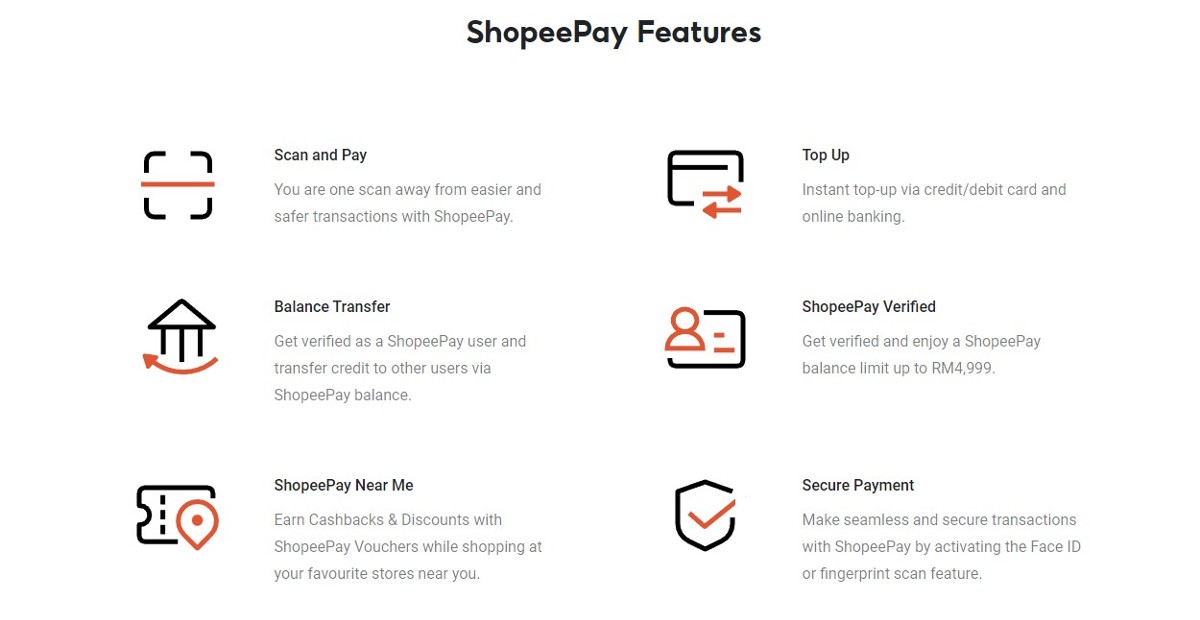

ShopeePay is Shopee’s digital wallet service¹. If you have the Shopee app you can easily activate ShopeePay and link a bank account or card to manually or automatically top up your ShopeePay for purchases and transfers. Use ShopeePay to:

- Pay online when shopping with ecommerce stores

- Pay in person with merchants who accept ShopeePay

- Send money to other ShopeePay users

- Request money from other ShopeePay users²

- Top up or withdraw funds

When you use ShopeePay you may be eligible for deals and rewards, and to earn Shopee coins when you spend. There’s even a handy feature to let you look for live deals near you when you’re out and about, so you could save when you select ShopeePay as the way to pay in person.

Depending on your account type and eligibility, ShopeePay may also be able to offer pay later options and even loans to customers. Check out the full range of options on the ShopeePay app or desktop site.

Is ShopeePay safe?

Before you dive into using a new ewallet, naturally you’ll be concerned about security. You can rest assured ShopeePay is safe, with a thorough account verification process and digital security measures such as your ShopeePay PIN.

ShopeePay is licensed by Bank Negara Malaysia as an e-money issuer³, which means it has to follow the same security steps and regulations as other registered digital wallets. That should mean you can safely use ShopeePay as long as you take normal precautions - such as securing your password and account information, and never sending money to someone you don’t know.

Where can you use ShopeePay in Malaysia to pay?

So, now I know what it is, where can I use ShopeePay to make payments?

You can use ShopeePay when you’re shopping online with Shopee. You can also use it when you’re paying in person at a merchant which accepts ShopeePay - look out for the QR code near the check out, or ask if ShopeePay is available. Finally, you can use ShopeePay to send money to others as long as they also have a ShopeePay account.

Merchants offering ShopeePay in Malaysia include big names like 7-Eleven - and you can also use the Shopee deals near me function to find participating retailers which may have great offers available for you, too.

Limits and fees

ShopeePay doesn’t impose a fee to top up or withdraw funds. However, your own bank or card issuer may have fees you’ll need to check out.

There are ShopeePay limits which may apply depending on the status of your account:

| Account type | Maximum amount in ShopeePay at any one time | Maximum cumulative amount in Shopee per month |

|---|

| Unverified | 2,999 MYR | 4,999 MYR |

| Verified | 4,999 MYR | 4,999 MYR |

Travelling, shopping online, or sending money to a friend abroad? Use the Wise account together with your other eWallets!

ShopeePay is popular here in Malaysia, and also in Singapore, Indonesia and some other regional destinations. However, it’s not available globally just yet - so having another eWallet that work abroad makes sense.

Check out Wise as a perfect addition to ShopeePay when you’re travelling or spending overseas. You’ll be able to hold and exchange 40+ currencies in your Wise Account, to spend with your linked Wise card, online or in person - or send to others in 140+ countries. Wise always uses the mid-market exchange rate (same rate from Google searches) when switching from MYR to any other supported currency - which can mean you cut the costs of transacting overseas significantly.

Wise accounts can be opened easily online or in the Wise app, without needing an existing Malaysian bank account. Just head to the Wise desktop site or download the app to get started.

Get your free Wise account 🚀

Pricing/fees: Please see Terms of Use for your region or visit Wise Fees & Pricing for the most up to date pricing and fee information

How to register and activate your ShopeePay account

Getting started with ShopeePay is easy. Here’s what to do⁴:

- Open the Shopee app and find the ShopeePay icon

- Tap to Activate ShopeePay to sign up

- Enter your name and IC or passport number

- Check over and agree to the terms and conditions

You’ll be able to use your ShopeePay account right away, but there are limits to the amount you can do with an unverified account. To verify your account and increase your ShopeePay limits, you’ll simply need to follow the in-app prompts to add your passport (for non-Malaysians) or IC information.

How to top up your ShopeePay account

You can top up ShopeePay in a few different ways, including:

- Credit or debit card

- Maybank2U

- Using online banking

- In cash at participating convenience stores

To top up using a digital payment method like card or online banking⁵:

- Tap ShopeePay balance and select the option to top up

- Choose the way you want to pay

- Enter the payment details and amount

- Check everything over and follow the onscreen prompts to complete the payment

Your balance should immediately be updated - contact Shopee customer service if the increase isn’t showing after a day.

Topping up is possible in cash, too⁶ - in this case you’ll simply select the option to top up at a 7-Eleven store when you follow the steps above. Then enter the amount to top up, and Shopee will generate a unique barcode to show to the staff in your preferred 7-Eleven branch. Have them scan your code and hand over the money in cash, to be deposited to your ShopeePay account conveniently.

ShopeePay automatic top-ups

To make life even easier, you can set your ShopeePay account to automatically top up when your balance falls. To do this:

- Open the ShopeePay balance tab and select ShopeePay Settings

- Tap the gear icon then Auto Top Up Settings

- Enter the balance amount you want to trigger an automatic top up

- Add the amount you want to top up when this balance is hit

- Confirm the payment method, and tap Submit, then Save

Now you can spend freely with ShopeePay, knowing that your balance will be automatically topped up without you needing to do anything, as soon as it starts to fall.

How to withdraw money from ShopeePay

As long as you’ve added a bank account to ShopeePay, and have verified your identity with the app, you’ll be able to withdraw funds you’ve deposited into your ShopeePay account, money sent to you by other Shopee users, or money refunded to you from merchants⁷.

- Select Withdrawal from in the ShopeePay app

- Tap the bank account you want to withdraw to

- Enter the withdrawal amount and tap Next

- Confirm and enter your ShopeePay PIN for verification

Frequently asked questions

Still unsure about how best to use ShopeePay in Malaysia? Here are a few more tips:

How to use ShopeePay offline for payments?

To use ShopeePay offline you’ll need to scan the merchant’s QR code using the Shopee app QR code scanner, the Duitnow QR code scanner or the ShopeePay QR scanner. Then⁸:

- Enter the payment amount and optional description

- Tap Next the Pay Now

- Enter your ShopeePay PIN and tap OK

How to deactivate ShopeePay?

To delete ShopeePay you’ll have to delete your whole Shopee account. If that’s what you want to do you’ll first need to withdraw any funds you have in your account. After that⁹:

- Open the Shopee app and tap Me

- Select Request account deletion

- Confirm by tapping OK

If all you need to do is temporarily deactivate ShopeePay - when you’ve misplaced your phone for example - you can reach out to the Shopee customer service for help.

How to increase ShopeePay limits?

To increase your ShopeePay limits you’ll need to verify your account. You can do this in the Shopee app¹⁰:

- Open the Shopee app and tap Me

- Select ShopeePay and then the gear icon

- Tap IC verification

- Follow the prompts to upload your IC or passport

Sources:

- ShopeePay FAQ - what is ShopeePay?

- ShopeePay product disclosure

- Bank Negara Malaysia - ShopeePay

- ShopeePay FAQ - how to activate ShopeePay

- ShopeePay FAQ - top up account

- ShopeePat FAQ - top up at 7-Eleven

- ShopeePay FAQ - withdraw funds

- ShopeePay FAQ - paying at merchants

- ShopeePay FAQ - delete ShopeePay

- ShopeePay FAQ - verify account

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.