AIB large transfer: Limits, cut of times and how to do it

Read about how you can do a large transfer with AIB Ireland, including the maximum limits.

Transfer fees can make international transfers frustrating, and traditional banks may not always offer you the best deal. So, if you’re in Ireland, you can consider CurrencyFair Ireland.

In this CurrencyFair review, you will learn everything about this provider. We’ll discuss their exchange rates, fees and other relevant things about them. On top of that, we’ll talk about Wise, an alternative transfer service that can help when making international transfers.

See how you can

save money with Wise 💰

Launched in Ireland in 2010¹, CurrencyFair is a cross-border money transfer service.

With the provider, you can transfer money immediately using their rates. Or you can choose to transfer money with your preferred rate and wait for CurrencyFair to match you with peers, using its peer-to-peer service. However, this feature is currently not available to US customers.³

One of the things you may like about CurrencyFair is their multi-currency account. It allows you to send and receive money transfers from over 150 countries and supports over 20 currencies². Some of the currencies are⁴:

- Australian dollar (AUD)

- Euro (EUR)

- Canadian dollar (CAD)

- Hong Kong dollar (HKD)

- Singaporean dollar (SGD)

- British Pounds (GBP)

- UAE dirham (AED)

These currencies can be limiting when you want to make international transfers in the currency CurrencyFair doesn’t have. So, if you're looking for an alternative money transfer service, you can use Wise multi-currency account.

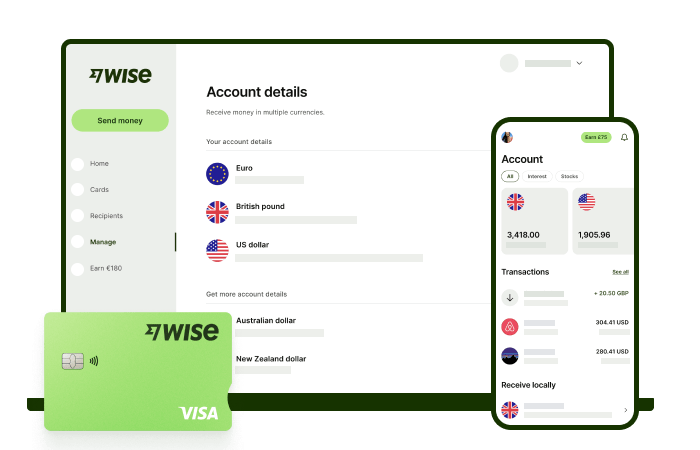

Wise allows you to send money to 160+ countries, hold and convert more than 40 currencies and also helps you to receive payments like a local in 9 currencies. This means you get account details that you can share with others to receive money. These 9 currencies are:

- Great British pound (GBP)

- Euro (EUR)

- US dollar (USD)

- Australian dollar (AUD)

- New Zealand dollar (NZD)

- Singapore dollar (SGD)

- Romanian lei (RON)

- Canadian dollar (CAD)

- Hungarian forint (HUF)

The CurrencyFair fees are lower than most traditional banks. There are no charges involved in setting up your account and no monthly or premium costs. After exchanging your money, you’ll spend a flat fee of €3 (or currency equivalent) for each transfer.⁵

You can use the online CurrencyFair calculator⁶ to get the exchange rate that CurrencyFair uses. However, it’s good to understand that CurrencyFair is a marketplace, so their users set their exchange rates⁷.

On average, their exchange rate at the moment is an additional 0.45% markup to the mid-market rate⁵. So, as a result of this markup, there is a difference between the rate you see on Google and the CurrencyFair rate.

Wise operates on a different exchange rate to CurrencyFair. With Wise, you’ll get the real mid-market exchange rate, the same one you see on online currency converters like Google. Wise doesn’t make money on the exchange rate. It’s fully transparent about the fee it charges so you know exactly what the full cost of your transfer actually is.

🔎 Here's a quick example. Imagine you’re sending €1000 from Ireland to a GBP account in the UK, and look at this table to understand how the cost works for both CurrencyFair and Wise.

| Provider | Fee | Exchange rate | Amount received |

|---|---|---|---|

| CurrencyFair | £2.50/€3⁵ | 0.45% added to the mid-market exchange rate = 0.8364 | £834.50 |

| Wise | €4.58 | The real exchange rate - the same one you find on Google = 0.8403 | £836.60 |

This comparison is based on exchange rates and prices offered at 15:43 GMT on 15th March 2022 on CurrencyFair and on Wise website.

Depending on where you are sending money from/to, there may be additional intermediary and receiving bank fees involved with your transfer. This happens if any of the accounts that you are sending from/to are held in non-local currencies.

Intermediary bank fees are determined by the banks involved in processing the transaction and they can vary.

CurrencyFair transfers United Arab Emirates dirham (AED), Polish Zloty (PLN) and Israeli New Shekel (ILS) from non-local accounts, so you should expect that any non-local currency transfers will arrive with a smaller amount than what was originally sent.

Any transfer you make to brokerage accounts utilises the SWIFT system which is a way traditional banks communicate. Due to this, there is a further fee of 20 USD which the intermediary bank involved will demand you pay.⁸

💡 If you’re looking for something different, Wise has bank accounts all over the world. Local ones. With local currency. Which means you won’t have to use intermediary banks to get your money from one country to another. And you won’t be charged any additional international transfer fees by your bank.

So, if you're looking for a different way to send money abroad, Wise might be the answer. Wise uses the mid-market exchange rate, and there are no intermediary bank charges. You only have to pay a small fee, and your transfer amount determines this fee, which you'll see the exact amount.

As we mentioned, you can take advantage by getting a Wise multi-currency account. It allows you to hold more than 40 different currencies and to receive 9 currencies like a local.

Check how you can send money with Wise:

Open your Wise

account today 🚀

1: To transfer money with CurrencyFair, you need to sign up for a CurrencyFair account.

2: CurrencyFair will then ask regular identification documents to confirm your identity. They do this in compliance with Irish laws. These identification documents are⁹:

- Passport

- Driving licence

- National ID card

3: Create your transaction and fill in the amount you want to transfer and the currency.

4: Fill in the receiver’s details.

5: Choose a transfer method.

6: Transfer in money to your account and CurrencyFair will exchange and transfer out to your recipient.¹⁰

The Central Bank of Ireland regulates CurrencyFair in Europe. CurrencyFair is also regulated by the Australian Securities and Investment Commission in Australia. The Monetary Authority of Singapore (MAS) regulates CurrencyFair in Singapore, and is a licensed Money Service Operator in Hong Kong.¹¹

If you’re sending in money to your CurrencyFair account, transfers usually take 2 business days for Euro payments. For GBP Faster Payments and CHAPS transfers typically get completed on the same business day. Other international transfers can take about 5 days before completion.¹²

CurrencyFair says that many of their international transfers are completed within 24 hours. Deposits and transfers of GBP can occur within one hour using Faster Payments (with participating banks).¹³

The minimum amount you can quote on CurrencyFair is €8 and the maximum amount is €10,000,000.¹⁴

You won’t be able to transfer money to other CurrencyFair accounts. Additionally, CurrencyFair cannot be used to send out money without first completing an exchange.

CurrencyFair address in Dublin: Colm House, 91 Pembroke Rd, Ballsbridge, Dublin, Ireland.

You can email CurrencyFair Support via their contact page or via support@currencyfair.com. However, there are situations where you may need to talk to someone. In these situations, call on +353 (0) 1 526 8411.¹⁶ ¹⁷

| 🔎 Read more: Monese Ireland |

|---|

Sources used:

Sources last checked on date: 15 March 2022

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Read about how you can do a large transfer with AIB Ireland, including the maximum limits.

Read on how you can make large transfers with the Bank of Ireland, including limits and transfer times.

If you need to receive an international transfer with AIB Ireland, read this article to discover all about it.

Learn how to send money on Revolut effortlessly with our step-by-step guide. Send money via phone number, username, or to non-contacts.

Discover Western Union fees in Ireland and understand rates and charges for online and in-person money transfers. Learn how to minimize fees and save money.

All you need to know about AIB exchange rate, including where to find it, the bank mark up and an alternative to avoid that.