Stop typing, start uploading — your shortcut for adding new recipients

Paying someone new? Don’t waste time typing out their bank details or double-checking their IBAN. Upload a screenshot or invoice instead. Our new AI feature...

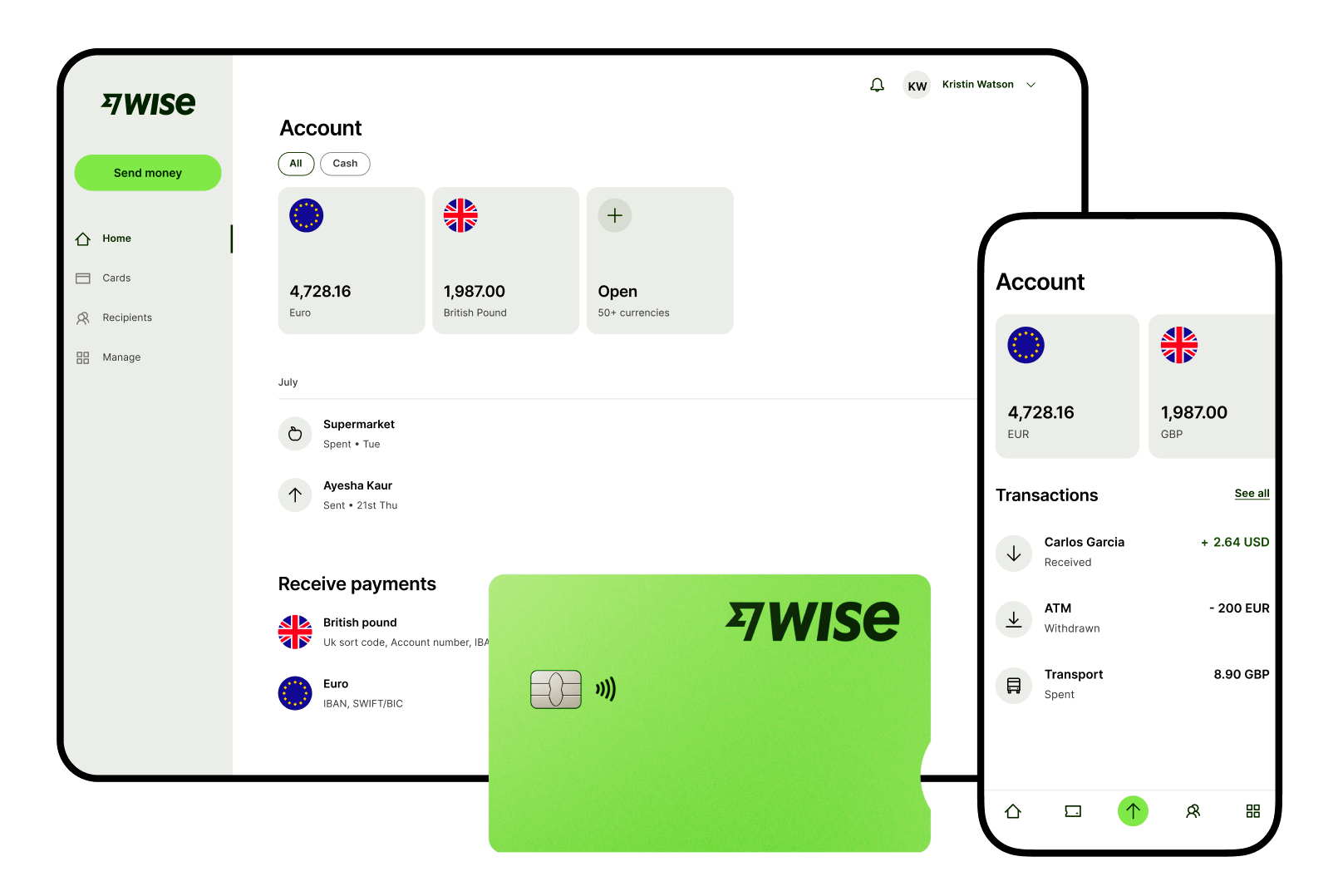

If you shop online, travel, or do business abroad, this little green card will save you money.

We’re excited to announce the launch of our card in Canada — to help customers save on every foreign transaction.

Traditional bank cards weren’t built for cross-border spending. You’re charged foreign transaction fees every time you make an online purchase, or swipe your card abroad — on top of the bad exchange rates your bank might hit you with.

We don’t think that’s fair. So we’re proud to launch the Wise card for people and businesses in Canada. It’s time to say goodbye to foreign transaction fees, and crazy exchange rates, for good.

For people shopping online overseas, travelling internationally, or taking their business global, the Wise multi-currency card is up to 4x cheaper than banks for spending abroad.

You can spend in-person or online in over 200 countries at the real exchange rate, with zero foreign transaction fees and super-low conversion fees.

It’s already helping over 11 million people around the world avoid hidden bank fees when they spend in foreign currencies. And now people in Canada can benefit from it too.

Our card is part of the Wise account — a multi-currency account that lets you send money with the real exchange rate, receive money for free, and convert currencies with low fees.

Both the Wise personal and business accounts let you add, hold, and convert over 40 currencies instantly and on the go. All conversions and card transactions are made with the real exchange rate — like the one you see on Google.

You can get your own bank details for 10 different currencies (including USD, GBP, EUR, and more) to receive money from those places free of charge. Unlike other accounts, there are no monthly charges or minimum balance requirements.

With the Wise card, you get the real exchange rate on every purchase, and free overseas cash withdrawals up to $350 CAD every month. You pay no foreign transaction fees or annual fees.

If you already have a Wise personal or business account, just log in to order your card. If you don’t have an account, it’s free and easy to get started.

Say bye-bye to complicated forms, as you can easily sign up for an account online. And if you need to get in touch, our customer support team is happy to help.

You can manage everything from your phone or computer, and keep track of all your spending with push notifications and emails.

If you leave your card at home and need to make an online payment, you can get your card details on our website or app. And if you leave your card at a cafe or in a taxi, not to worry — you can freeze and unfreeze your card with the click of a button.

Regardless of where you’re going, what you’re doing, or how long you’re doing it, the Wise card is your ticket to stress-free spending across borders. Get your card today.

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Paying someone new? Don’t waste time typing out their bank details or double-checking their IBAN. Upload a screenshot or invoice instead. Our new AI feature...

From time to time, you might make a purchase with your Wise card and run into an issue — maybe something you bought didn’t arrive, wasn’t as described, or you...

Our mission is to lower the cost of moving money across borders. And since we started 13 years ago, we’ve made good progress, particularly over the past...

A dedicated comparison research team in Wise compared Wise to 3 Canadian bank accounts, as well as PayPal, Remitly and Western Union. They found that you can...

Wise has revealed a complete visual makeover, featuring a fresh green palette Our new look and feel features a bold new font, imagery and universal symbols ...

Good news! We have improved the experience of sending US dollars to bank accounts that are denominated in USD outside the US. USD is sent to bank accounts...